-

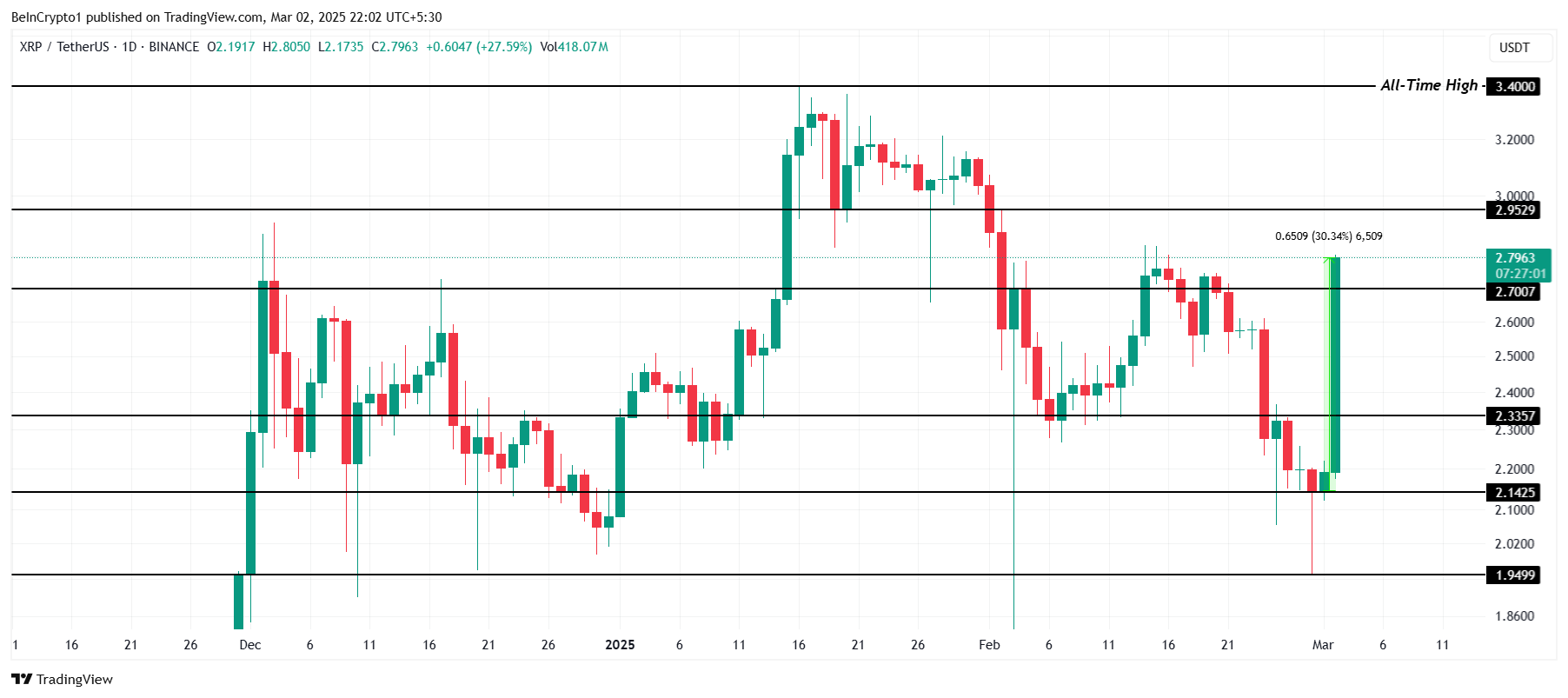

XRP surges 30% after Trump announces a “US Crypto Reserve,” boosting investor confidence and market participation.

-

The Chaikin Money Flow (CMF) shows rising inflows, signaling strong demand and potential for continued price gains.

-

XRP eyes a breakout above $2.95, with a push toward its all-time high of $3.40, but profit-taking could cause consolidation.

XRP has experienced a significant price increase fueled by Donald Trump’s “US Crypto Reserve” announcement, indicating strong market optimism.

XRP Investors Are Suddenly Optimistic

The Price DAA Divergence (PDA) is currently signaling a buy for XRP, as both the price and participation from investors have risen. The uptick in active addresses indicates that more individuals are entering the market, increasing interest in the token. This is a positive sign for XRP’s price, as growing participation typically signals confidence from investors, further driving the price upward.

This increase in participation comes alongside a surge in market activity, which is often a precursor to a longer-term price rise. The inclusion of XRP in Trump’s proposed reserve has undoubtedly added a sense of legitimacy, helping to build investor confidence.

The Chaikin Money Flow (CMF) indicator is also confirming the positive market sentiment surrounding XRP. The CMF is showing a sharp increase, which suggests that investors are loading up on XRP. This rise is likely due to Trump’s announcement, which has given the altcoin a significant boost in inflows. As the CMF continues to rise, it reinforces the bullish trend, suggesting that the price of XRP could continue to see upward movement.

The uptick in CMF indicates growing demand for XRP, with increased buying activity likely pushing the price higher. The continued support of investors, driven by both the announcement and the improving market sentiment, suggests that XRP is well-positioned for further growth.

XRP Rises Sharply

At the time of writing, XRP is trading at $2.79, marking a 30% increase over the past 24 hours. The bullish factors driving this rally are bringing XRP close to breaching the $2.95 resistance. Should this level be broken, XRP could make its way upwards to $3.00, setting the stage for further gains.

If the price continues to push through this resistance, XRP might test its all-time high (ATH) of $3.40. A breach of this level would mark a new ATH, signaling further upward movement for the altcoin. Such a development could lead to even greater investor interest and possibly new records for XRP.

However, if the rally slows and investors begin to take profits following the recent surge, XRP may face difficulties breaching the $2.95 resistance. In this case, the altcoin could fall back below $2.70, potentially halting the bullish momentum for now. This would signify a short-term consolidation before any further price movements occur.

Conclusion

The surge in XRP’s price following Trump’s announcement reflects a crucial shift in market sentiment, with potential implications for future growth. Investors are optimistic, but cautious profit-taking could lead to temporary consolidation. The altcoin’s capacity to break past resistance levels will be closely monitored in the coming days as market dynamics continue to evolve.