-

FARTCOIN surged 11% amid a meme coin frenzy fueled by Donald Trump’s Truth Social post about the TRUMP token.

-

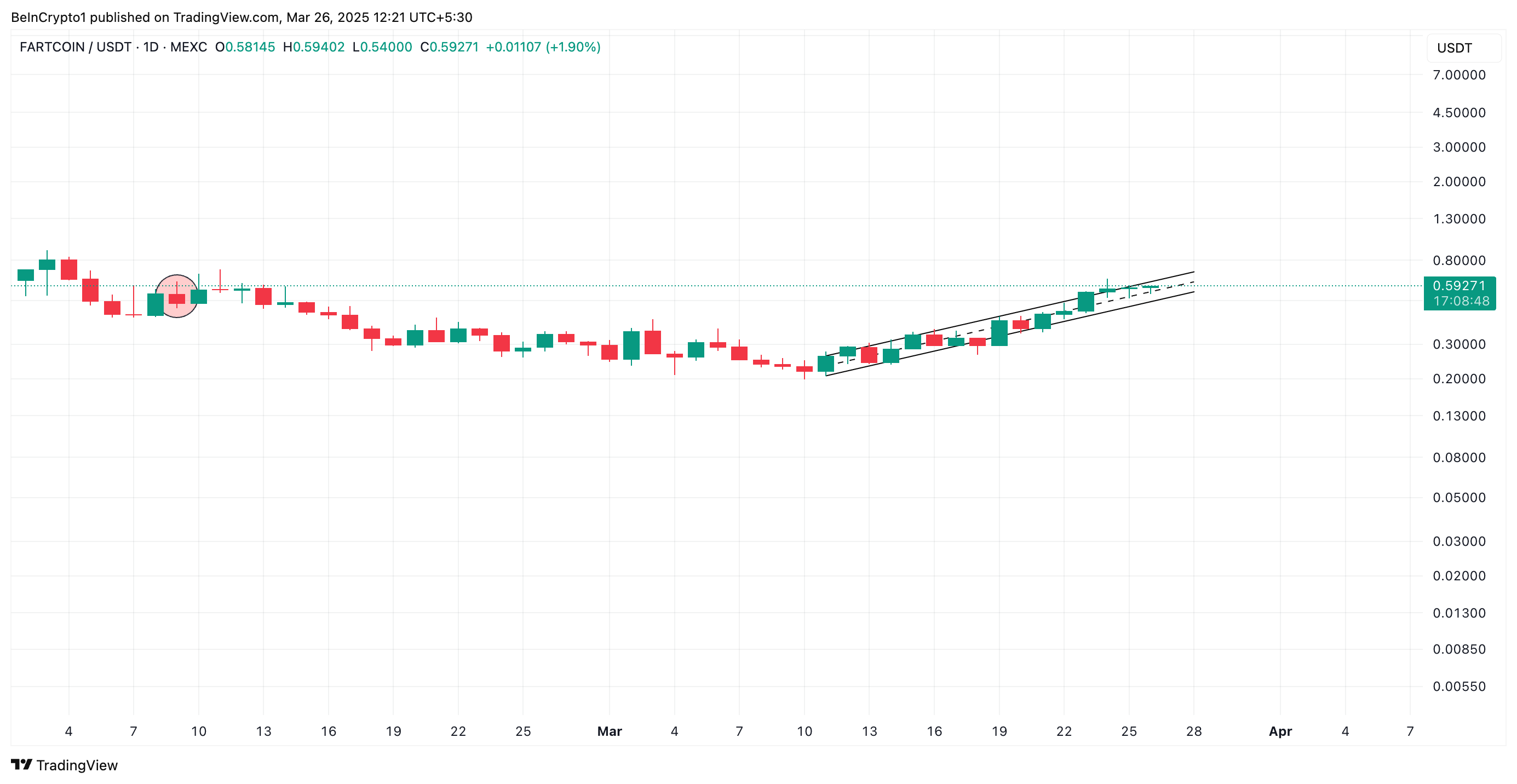

The coin’s price jumped 200% from a March low of $0.19. It is currently trading at $0.59, showing a bullish upward trend.

-

Positive indicators suggest continued buying pressure, with targets of $0.95 if momentum holds, but there is a potential risk of a drop to $0.42.

FARTCOIN experiences a dramatic surge, fueled by interest in meme coins and Donald Trump’s latest endorsement, sparking both excitement and caution among traders.

FARTCOIN Surges with Strong Buying Pressure

FARTCOIN has maintained an upward trend since it plummeted to a year-to-date low of $0.19 on March 10. Currently trading at $0.59, the meme coin’s price has since rocketed 200%, trading with an ascending parallel channel.

This is a bullish pattern formed when an asset’s price moves between two upward-sloping parallel trendlines, indicating a sustained bullish trend. The lower trendline acts as support, preventing the price from falling further, while the upper trendline serves as resistance.

Traders view this pattern as a sign of steady buying pressure and potential price continuation if the asset remains within the channel. This means that the longer FARTCOIN remains within the channel, the stronger its rally becomes.

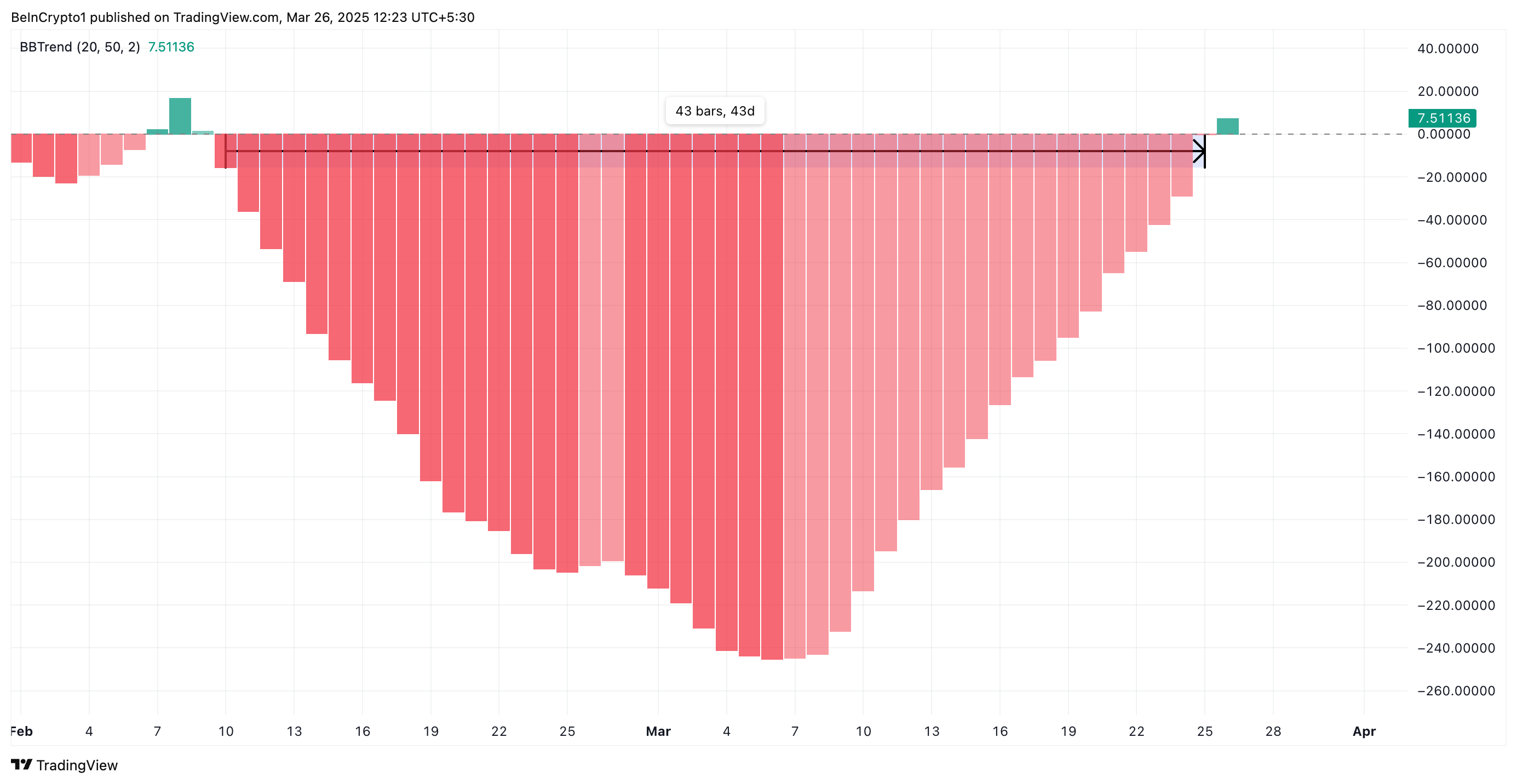

Furthermore, the positive reading from FARTCOIN’s BBTrend reinforces this bullish outlook. At press time, the indicator prints a green histogram bar—the first in 43 days—signaling renewed upward momentum.

The indicator tracks the strength and direction of price trends using Bollinger Bands. When the indicator turns green, it signals increasing bullish momentum, suggesting that buying pressure is growing. If buying activity remains high, this indicates the potential for further FARTCOIN price appreciation.

FARTCOIN Bulls Target $0.95—Will the Rally Hold?

FARTCOIN’s break above the upper trend line of its ascending parallel channel, which forms significant resistance, would strongly confirm its uptrend. In this scenario, the meme coin’s price could climb toward $0.95, a high it last reached in January.

Conversely, if market sentiment turns bearish and profit-taking increases, FARTCOIN’s price could break below the lower trendline of its ascending parallel channel to reach $0.42.

Market Sentiment and Future Outlook

The current market sentiment surrounding FARTCOIN is influenced heavily by social media dynamics and existing crypto trends. With the rise of meme coins, investor awareness and community support play a crucial role in determining price movements. As more traders engage, positive sentiment could drive prices further, but the volatility remains a concern.

In addition, industry analysts are keeping a close watch on developments within the crypto marketplace that could impact FARTCOIN’s trajectory. Regulatory news, technological advancements, and broader market trends in cryptocurrencies should be factored in by investors. Thus, while there is potential for gains, caution is advised.

Conclusion

In summation, FARTCOIN is currently experiencing a significant bull run, largely propelled by renewed interest in meme coins and social media endorsements. With potential price targets of $0.95 in sight, traders should remain vigilant as market conditions fluctuate. The dual paths of possible gains or significant pullbacks highlight the need for strategic trading approaches.