Ripple CEO Sets Bold Target As He Predicts Bitcoin At $180,000 In 2026

Brad Garlinghouse sparks fresh excitement in the crypto market after he projected that Bitcoin could reach $180,000 by the end of 2026. He shared this bold Bitcoin price prediction during Binance Blockchain Week in Dubai, where industry leaders discussed the next phase of global crypto adoption. His statement fired up market conversations because it connects with growing investor confidence and rising institutional activity.

The crypto community follows Garlinghouse closely since he leads one of the most influential companies in the blockchain ecosystem. His long-term optimism connects with many traders who expect major price expansion over the next two years. This new Bitcoin price prediction adds more weight to the bullish sentiment that grows across the market. Many investors already anticipate a strong price cycle and welcome his direct and upbeat outlook.

LATEST: 📈 Ripple CEO Brad Garlinghouse says Bitcoin price will hit $180,000 by the end of 2026, making the prediction during Binance Blockchain Week in Dubai. pic.twitter.com/Wvu75bzxfb

— CoinMarketCap (@CoinMarketCap) December 6, 2025

Why Brad Garlinghouse Believes Bitcoin Will Hit $180,000

Garlinghouse shared his view with strong confidence. He feels the market enters a phase of structural strength. He sees a more mature sector where major investors enter with larger capital and longer horizons. This shift supports his Bitcoin price prediction because demand grows while supply stays fixed.

He mentioned how stronger regulation brings clarity for both retail and institutions. Clear rules attract more buyers, and this increases market depth. He believes these conditions support a long and steady Bitcoin bull cycle.

He also pointed to global economic instability. Many investors embrace Bitcoin as a hedge. As more people treat Bitcoin like digital gold, its long-term value strengthens. He expects this trend to accelerate through 2026.

How Institutional Growth Supports His Bullish Target

Institutional growth shapes the new crypto market outlook. More large funds add Bitcoin to their portfolios. Banks continue to integrate blockchain services. Payment companies explore digital asset rails. These changes increase legitimacy and adoption.

Garlinghouse sees these moves as powerful drivers. Institutions bring stability through large and predictable flows. This steady demand supports any Bitcoin bull cycle. His Bitcoin price prediction aligns with the long-term trend that shapes financial markets.

He also highlighted how Bitcoin ETFs attract strong inflows. Investors who avoid direct storage now access Bitcoin through regulated products. The growing activity in ETFs helps strengthen the market structure and improve liquidity.

Why 2026 Could Become A Landmark Year For Bitcoin

He believes 2026 lines up with multiple major triggers. The latest Bitcoin halving already tightened the supply. Its real impact often appears one or two years later. This matches his timeline for major upside.

He sees rapid adoption across Asia, Europe, and the Middle East. Many governments test blockchain-based infrastructure. This wider momentum strengthens the crypto market outlook. When adoption spreads, trust rises. When trust rises, value rises.

He also expects major technology upgrades across the blockchain ecosystem. Better scalability, faster networks, and stronger security will support long-term growth. These improvements create a strong base for a large Bitcoin bull cycle.

Final Thoughts

Brad Garlinghouse’s fresh Bitcoin price prediction creates momentum across the global crypto community. His view reflects confidence in adoption, regulation, and institutional expansion. He believes 2026 will unlock a major valuation shift. Investors see his projection as a strong signal that Bitcoin still stands at the center of financial innovation. The next two years may shape one of the most influential cycles in crypto history.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

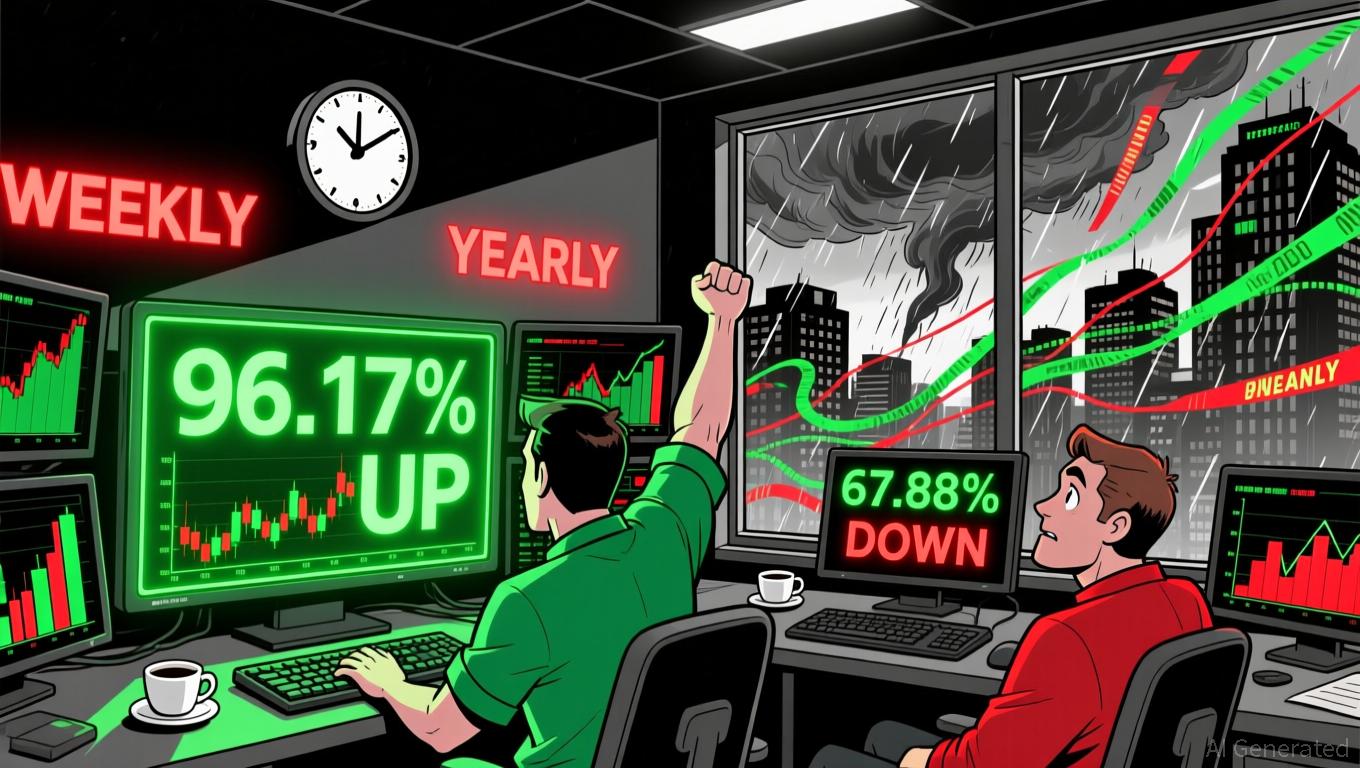

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to

Bitcoin’s Latest Price Swings: Causes, Impacts, and Tactical Prospects

- Bitcoin's 2023-2025 volatility stemmed from macroeconomic uncertainty, delayed Fed rate cuts, and AI-driven credit strains, with prices swinging from $109,000 to $70,000 amid Bybit's security breach. - Regulatory shifts like U.S. Strategic Bitcoin Reserve and custody rules, plus offshore stablecoin risks, exacerbated systemic fragility as crypto financialized through ETFs and derivatives. - Growing equity correlations (e.g., Nasdaq 100) and institutional adoption (MicroStrategy, ETF inflows) highlight Bi

Dogecoin Could Reboot Soon: Rising Wallets Signal Accumulation Around Key Zones