Fidelity Bitcoin: CEO Calls It the “Gold Standard” for Savings

Abigail Johnson, the CEO of Fidelity Investments, has revealed that she personally owns Bitcoin. Fidelity manages over $16.4 trillion in assets, making it one of the largest financial institutions in the world. Johnson called Bitcoin the “Gold Standard” for modern savings. She said it is a long-term store of value that can help people preserve wealth.

Her comments come at a time when many investors are cautious about cryptocurrencies. By sharing her own ownership, Johnson is sending a strong signal that she believes in Bitcoin’s long-term potential.

Bitcoin as a Store of Value

Johnson compared Bitcoin to gold, which people have trusted for centuries. She said Bitcoin’s limited supply and decentralized nature make it a safe way to store money. Unlike traditional currencies, Bitcoin cannot be printed or devalued by a single government.

“Bitcoin is a modern way to save,” Johnson said. “It is secure, scarce, and can hold its value over time.” She emphasized that Bitcoin is not just for trading or short-term gains. Instead, it is meant for people who want to keep their money safe for the future.

Fidelity’s Role in Crypto

Fidelity has been active in cryptocurrencies for several years. The company offers Fidelity Digital Assets, which provides Bitcoin trading and custody for institutional clients. Johnson’s personal endorsement reflects the firm’s commitment to digital currencies.

Other big financial companies, like BlackRock and Morgan Stanley, have also started offering crypto-related services. Johnson’s ownership shows that even top executives in traditional finance see value in Bitcoin.

What This Means for Investors

Johnson’s public support can influence both individual and institutional investors. Her long experience in finance adds credibility to the idea that Bitcoin can be a safe, long-term investment.

She encourages a careful approach. Instead of chasing quick profits, Johnson focuses on Bitcoin’s ability to preserve wealth. Her view may inspire more investors to consider adding Bitcoin to their portfolios for long-term growth.

Bitcoin and the Future of Finance

By owning Bitcoin, Johnson shows that cryptocurrencies are becoming part of mainstream finance. Major financial institutions are increasingly exploring ways to integrate Bitcoin.

While prices may rise and fall, Johnson believes Bitcoin can hold value over time. Her personal endorsement helps reinforce Bitcoin’s reputation as a serious investment for those planning for the long term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

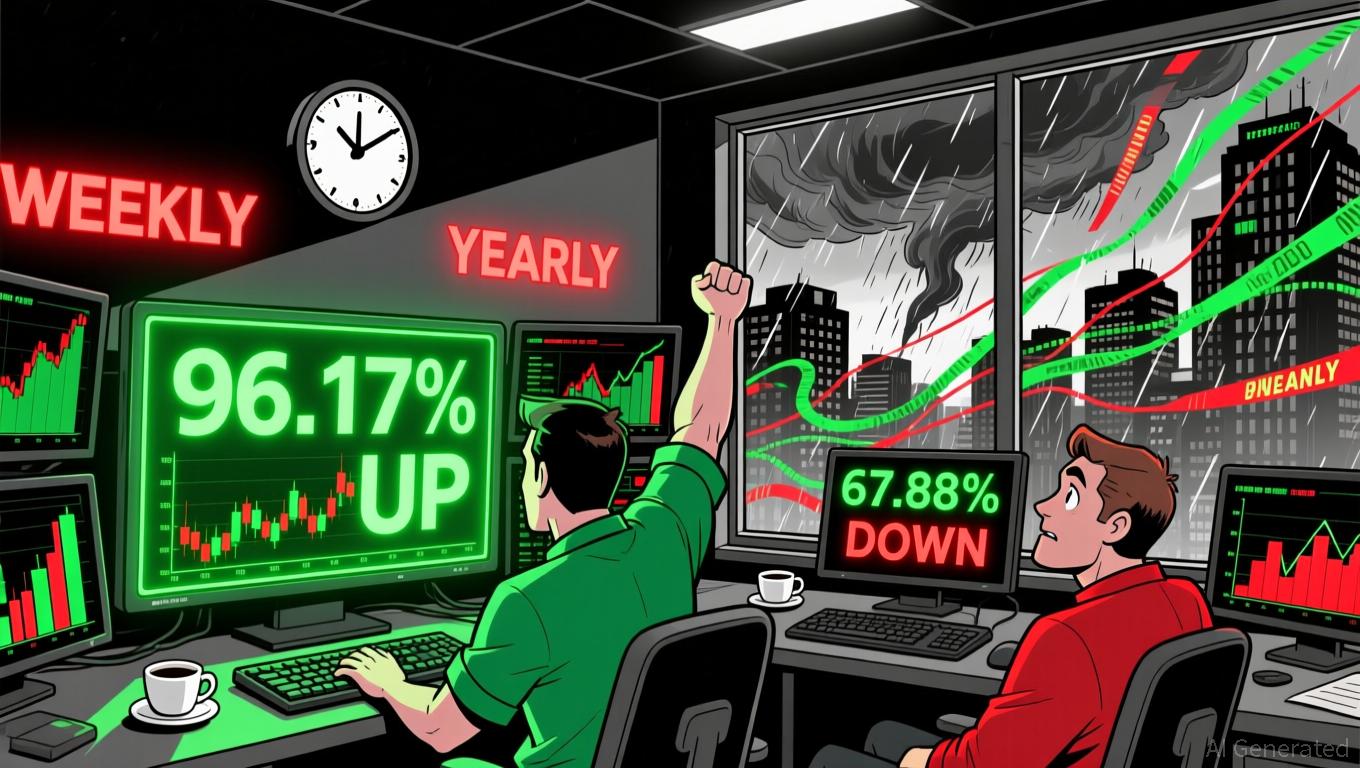

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to

Bitcoin’s Latest Price Swings: Causes, Impacts, and Tactical Prospects

- Bitcoin's 2023-2025 volatility stemmed from macroeconomic uncertainty, delayed Fed rate cuts, and AI-driven credit strains, with prices swinging from $109,000 to $70,000 amid Bybit's security breach. - Regulatory shifts like U.S. Strategic Bitcoin Reserve and custody rules, plus offshore stablecoin risks, exacerbated systemic fragility as crypto financialized through ETFs and derivatives. - Growing equity correlations (e.g., Nasdaq 100) and institutional adoption (MicroStrategy, ETF inflows) highlight Bi

Dogecoin Could Reboot Soon: Rising Wallets Signal Accumulation Around Key Zones