5 Crypto Coins to Add to Your Watchlist in December 2025

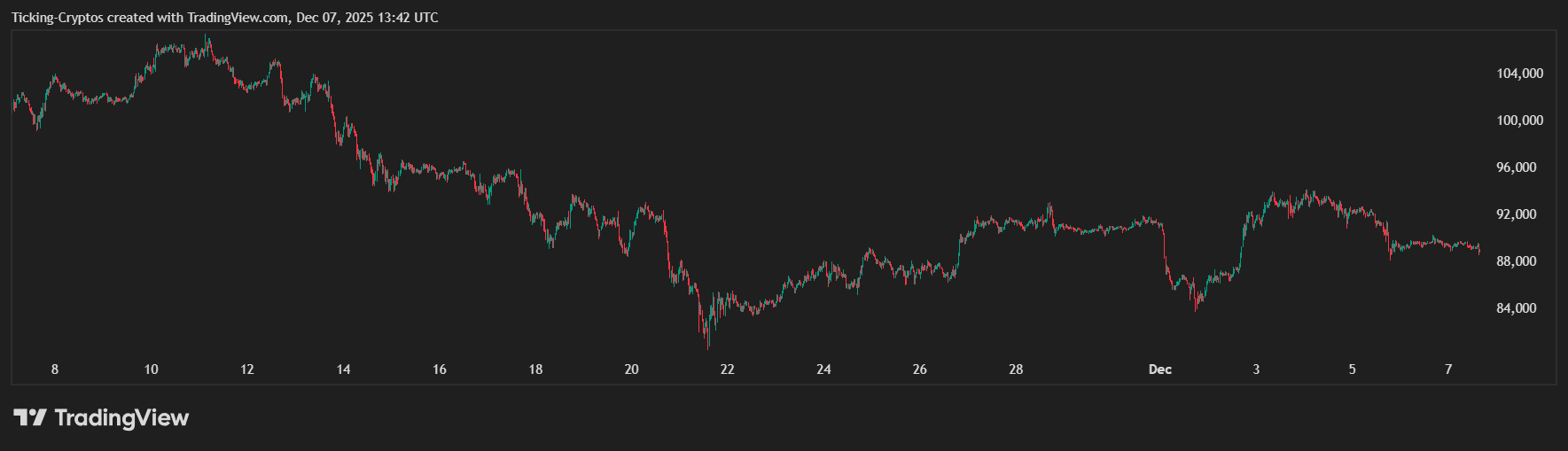

As we enter the final month of 2025, Bitcoin is consolidating tightly between $85,000 and $90,000, creating one of the calmest yet most critical ranges of the year. Historically, such compressions have preceded major market moves — either a breakout to new highs or another sharp correction.

But here’s the key: if $Bitcoin breaks upward, several mid-cap altcoins are positioned for outsized gains due to strong fundamentals, active ecosystems, and rising on-chain activity.

BTC/USD chart in the past month - TradingView

Below are 5 must-watch crypto projects for December 2025, each selected from current market performance and supported by real stats from today’s data.

Why This Market Structure Matters

Bitcoin’s consolidation above $85K shows that buyers continue defending a strong macro support, while sellers struggle to push BTC lower. This equilibrium often precedes a volatility expansion — and altcoins typically move harder than BTC once the direction is set.

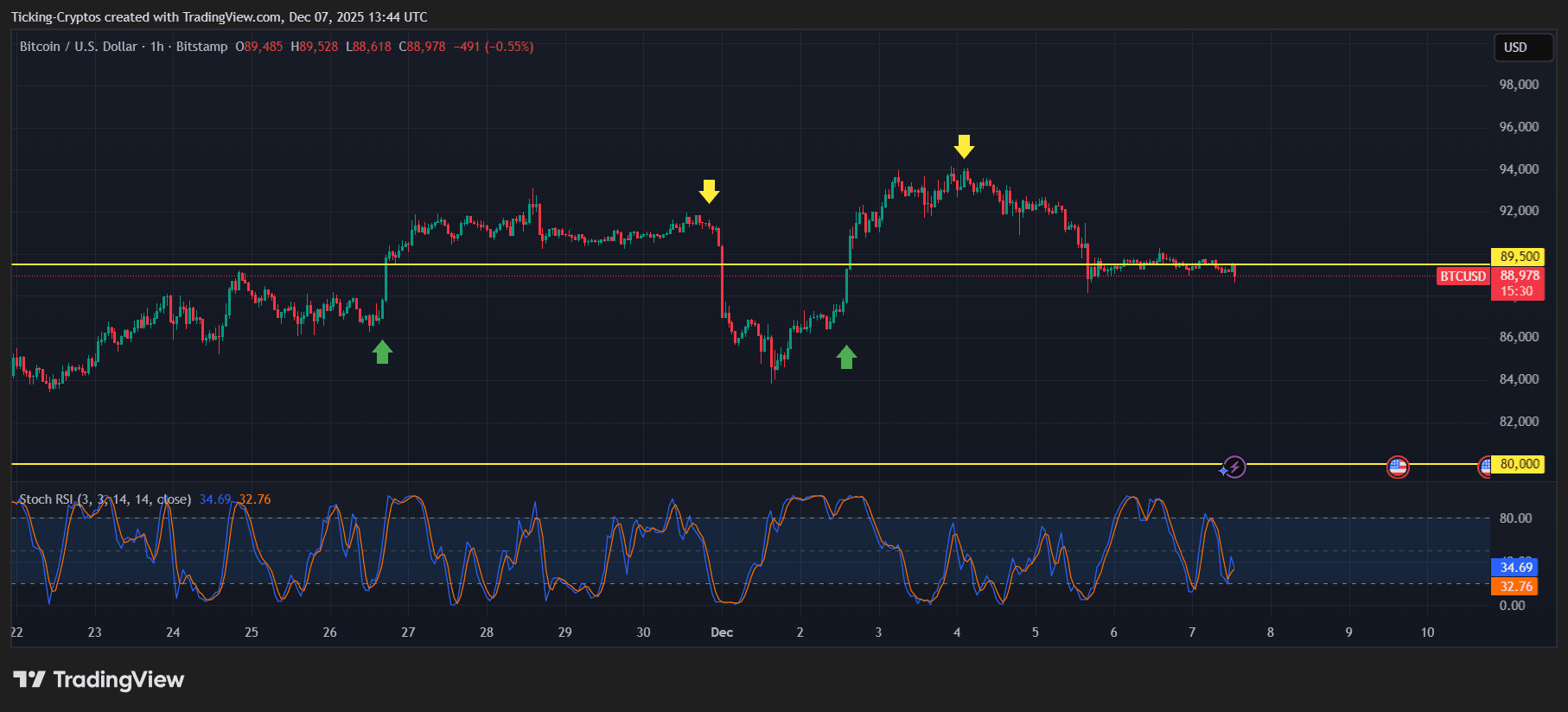

BTC/USD 1-hour chart - TradingView

If $BTC breaks above $90K with momentum, liquidity tends to rotate into mid-caps, rewarding early watchers.

Here are the top 5 altcoins to monitor right now.

Top 5 Cryptos to WATCH

1. Hyperliquid (HYPE)

- Price: $29.45

- Market Cap: $9.918B

- Volume (24h): $209.6M

- Circulating Supply: 336.68M HYPE

Hyperliquid has become one of the strongest narratives of 2025 — a VC-free, on-chain derivatives ecosystem that is now competing directly with centralized exchanges thanks to its ultra-fast execution and deep liquidity.

Its growth is organic, community-driven, and fueled by real traders — not hype. With a nearly $10B market cap, strong volumes, and rising institutional interest in on-chain derivatives, $HYPE remains one of the most compelling large-cap plays going into 2026.

Why watch it in December?

- Strong derivatives volume signals high user activity

- Institutions quietly route capital through Hyperliquid’s on-chain settlement

- A BTC breakout typically increases leverage demand → bullish for HYPE

2. Flare (FLR)

- Price: $0.01311

- Market Cap: $1.053B

- Volume (24h): $3.8M

- Circulating Supply: 80.28B FLR

Flare’s momentum continues as more ecosystem partners adopt its data-powered smart contract architecture, especially for bridging and real-world data protocols.

$FLR offers:

- Oracle-level data directly at the protocol layer

- Expanding integrations with DeFi protocols

- Growing interest from developers seeking scalable data feeds

At just over $1B in market cap, any ecosystem expansion or new integration could accelerate FLR significantly if the market turns bullish.

3. Render (RNDR)

- Price: $1.58

- Market Cap: $820.2M

- Volume (24h): $21.9M

- Circulating Supply: 518.58M RNDR

Render stays one of the strongest AI-crypto crossover projects, supplying a decentralized GPU network for rendering, AI workloads, and 3D graphics.

Key reasons it's a watchlist essential:

- AI demand is exploding

- GPU compute shortages push developers to decentralized alternatives

- Render remains one of the few crypto tokens tied to real hardware usage

If the AI narrative heats up again — which many analysts expect for 2026 — $RNDR could be one of the best mid-cap movers.

4. Uniswap (UNI)

- Price: $5.53

- Market Cap: $3.486B

- Volume (24h): $164.85M

- Circulating Supply: 630.33M UNI

Uniswap is still the dominant decentralized exchange, controlling massive liquidity across Ethereum and multiple L2 ecosystems.

Why $UNI matters right now:

- Trading activity rises sharply when volatility returns

- Fee revenue improves during fast market movements

- The upcoming protocol upgrades are expected to strengthen UNI’s role in governance and rewards

With Bitcoin consolidating and volatility brewing, DEX volumes could spike, putting UNI in a strong position.

5. Virtuals Protocol (VIRTUAL)

- Price: $0.8390

- Market Cap: $550.47M

- Volume (24h): $67.49M

- Circulating Supply: 656.1M VIRTUAL

Virtuals is one of the newer entrants in the AI-native agent economy, enabling autonomous AI entities that interact with blockchain environments.

Why $VIRTUAL is gaining traction:

- Rapidly growing ecosystem of autonomous agents

- High trading volume relative to market cap

- Strong positioning in the emerging “AI + crypto infrastructure” narrative

As AI-powered crypto projects gain steam, VIRTUAL is one of the undervalued mid-caps that traders are starting to accumulate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Mirrors 2017 and 2020 Patterns as 2,605-Day Setup Nears Apex

Altcoin Market at Critical Support: TOTAL2 Defends Key Bull-Market Level — 5 Coins Primed for Major Upside

PEPE Poised for Momentum Gains at $0.0545 Amid Tight Market Range

Hindsight Will Be Brutal: The Market Is Offering Rare Altcoin Discounts — 5 Top Picks to Hold Long-Term