Exclusive Interview with HelloTrade: The "On-Chain Wall Street" Backed by BlackRock

After creating the largest bitcoin ETF in history, BlackRock executives are now reconstructing Wall Street on MegaETH.

In 2025, the biggest trend in crypto will no longer be crypto itself, but its integration with traditional finance.

On one hand, crypto investors no longer believe in hollow narratives and technology, nor do they buy altcoins. Instead, they are turning their attention to US stocks with clear business models and real revenue.

On the other hand, there are still many regions around the world where investing in US stocks is not easy. Investors can only participate through certain brokers, but face issues such as difficult KYC processes, hard-to-use products, and high fees.

A new track has emerged as a result.

Robinhood is building its own chain for US stock tokenization, and crypto giants like Binance Wallet and Coinbase have entered the market one after another. HyperLiquid launched perpetual contracts for US stocks, with trading volume exceeding $2 billion in just 10 days.

SEC Chairman Paul Atkins predicts that all US stocks will be on-chain within the next two years.

Kevin Tang and Wyatt Raich, two "regulars" from the world's largest asset management company BlackRock, have also joined this "on-chain Wall Street" competition.

Kevin and Wyatt

Kevin was a Senior Director on BlackRock's Digital Assets team, personally building IBIT, ETHA, and BUIDL and overseeing their commercialization. Wyatt was the technical lead of the crypto division, writing every line of code that supports IBIT, ETHA, and BUIDL.

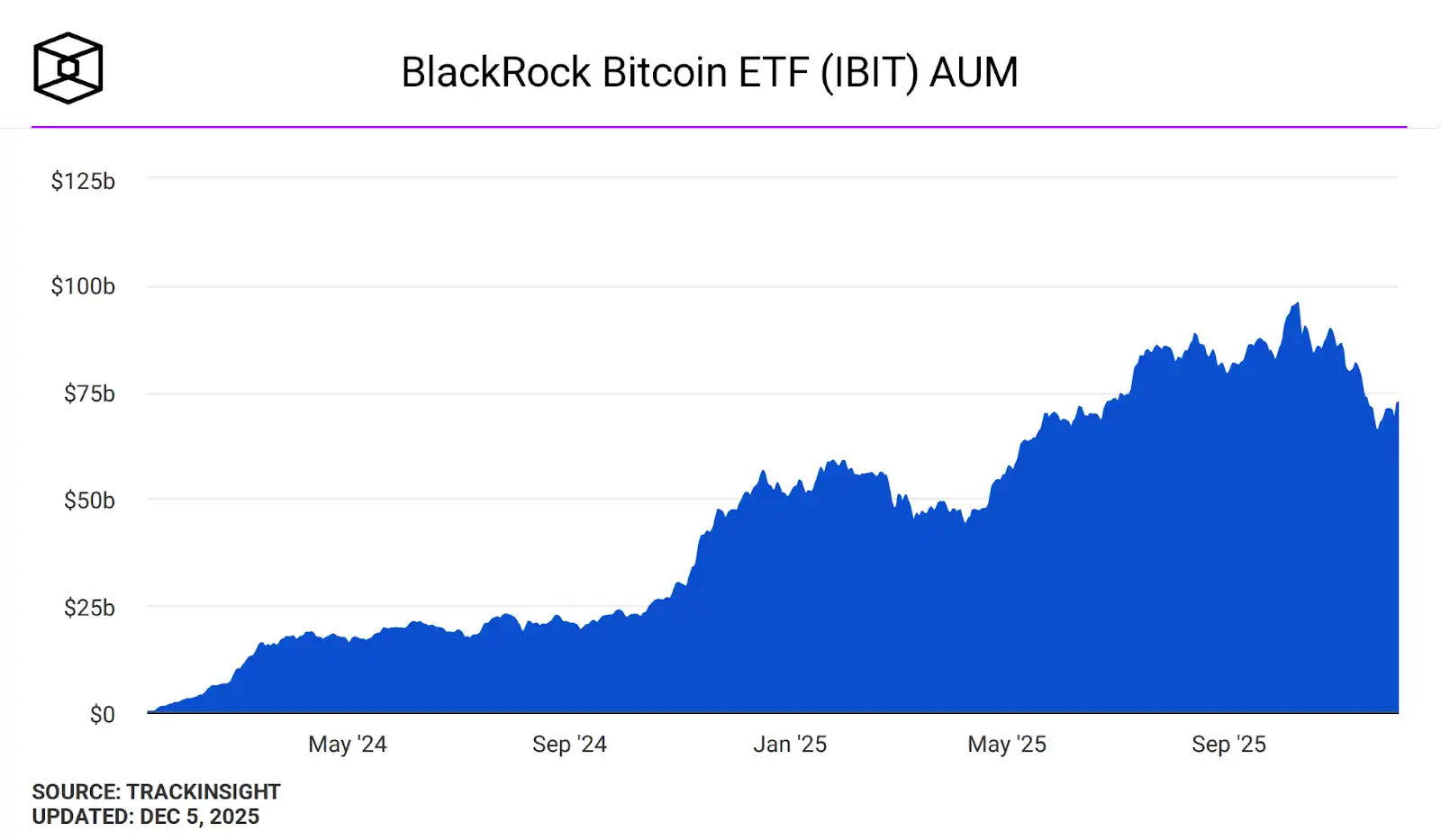

The IBIT they built became the largest bitcoin ETF and set the record for the fastest ETF in history to surpass $100 billion in scale. Currently, bitcoin ETFs have become BlackRock's primary source of revenue.

In May this year, at the peak of IBIT's success, the two chose to leave and founded HelloTrade, an on-chain trading platform for US stock perpetual contracts and RWA.

This may seem like a big gamble, but Kevin has his own judgment. To solve the gaps in traditional markets after hours and on weekends, and to achieve 24-hour on-chain trading of US stocks, one must be proficient in both traditional finance and crypto technology—precisely the strengths of him and Wyatt.

The compliance intuition and risk control experience accumulated at BlackRock are the confidence for HelloTrade to enter this track.

"The real competitors of decentralized exchanges are not each other, but Web2 traditional brokers." Kevin said bluntly in an exclusive interview with BlockBeats, "What we want to build is not just another crypto product, but to reproduce the Web2 user experience on a Web3 foundation."

But Kevin's ambition goes far beyond US stock perpetual contracts. What he wants to build with HelloTrade is an on-chain trading platform that can rival the experience of traditional brokers and centralized exchanges, attracting millions of users who have never traded on-chain before.

In this exclusive interview with BlockBeats, Kevin shared why IBIT became the most successful ETF in history, and why he firmly believes that on-chain US stocks and RWA are the next battleground for mass blockchain adoption.

The following is the interview content.

Leaving BlackRock

BlockBeats: Before joining BlackRock, what were your and Wyatt's career paths?

Kevin: I worked at BlackRock for more than ten years. After graduating from college, I spent a year at State Street, then joined BlackRock. I started in the research group, then moved to the innovation products group, where I helped launch many hedge funds, private equity strategies, and mutual funds.

In 2017, a colleague introduced me to bitcoin and ethereum. I was immediately attracted. At that time, many of our clients were already worried about inflation, and bitcoin as a potential store of value caught my attention.

The emergence of ethereum brought a whole new possibility—it could build decentralized infrastructure and next-generation financial applications.

At BlackRock, I saw long-standing pain points in traditional finance and realized that blockchain technology could solve these problems. So before joining the digital assets department, I kept a close eye on the crypto market in my spare time.

Eventually, I joined BlackRock's digital assets department as the third employee in the business group. Over the next four and a half years, I was mainly responsible for building and commercializing IBIT and ETHA, working with clients, partners, and internal teams to bring these products to market.

Wyatt's career path was a bit different from mine. He started at Lockheed Martin working on AI and robotics. Later, a friend introduced him to digital assets, and he quickly got hooked, starting to write smart contracts, test various protocols, and build applications himself.

He later joined BlackRock as one of the first smart contract engineers on the digital assets team, then led the technical development behind IBIT, ETHA, and BUIDL, and helped build the smart contract system supporting billions of dollars in funds.

We come from different backgrounds, but ultimately served as directors on the same team, both believing in one thing: the next generation of capital markets will be built on-chain.

BlockBeats: The IBIT you built at BlackRock became the world's largest bitcoin ETF, a huge success. Can you share the story behind this?

Kevin: The success of IBIT and ETHA shows that investors can quickly accept investing in spot bitcoin and ethereum through the convenient and secure method of ETFs.

For a long time, individuals and institutions faced high barriers to directly investing in crypto assets. ETFs use a familiar and trusted investment tool to solve many problems.

IBIT's growth rate | Source: Trackinsight

But even though IBIT grew rapidly, launching crypto products at BlackRock was not easy. Before IBIT, BlackRock had a private bitcoin trust fund, which grew much slower than IBIT.

Many clients needed a lot of education: what is the digital asset ecosystem, and why should bitcoin and ethereum be included in investment portfolios. The entire BlackRock team played a crucial role in this educational effort.

Another point I want to make is that, from a macro perspective, bitcoin and ethereum ETFs are still in the early stages. Most wealth management institutions and institutional investors are just beginning to pay attention to crypto assets. In the traditional asset management industry, true mainstream large-scale adoption has not yet begun.

BlockBeats: Since your work at BlackRock was so successful, what made you ultimately decide to leave, and why do you believe a product like HelloTrade must be built on-chain rather than within BlackRock?

Kevin: I have always firmly believed that the next big wave of blockchain adoption is moving traditional markets—stocks, commodities, fixed income—on-chain. This is also why I ultimately decided to leave BlackRock.

Although more Americans hold crypto assets than before, globally, less than 1% of people actually trade on-chain. I think we are still in the very early stages.

HelloTrade's ambitions go far beyond stock perpetual contracts. To quickly realize all our ideas, we must rebuild the infrastructure from scratch, without being limited by the frameworks of traditional finance or big tech companies.

When settlement, custody, transparency, and access thresholds are all redesigned around blockchain, we have to rethink how such a global on-chain market would operate from the ground up.

The second reason is speed. To achieve our vision, we need the fast pace and focus of a small startup, rapid iteration, releasing new products every few weeks, and constantly testing with real users in different markets. This kind of agility is hard to achieve in a company with tens of thousands of employees.

That said, we are still very grateful for our experience at BlackRock. The training, discipline, and customer-centric mindset it gave us are the foundation for building HelloTrade today.

The Global "On-Chain Wall Street"

BlockBeats: Let's talk about the product itself. What type of users is HelloTrade targeting, and which countries are your main target markets?

Kevin: Let's talk about user profiles first. Our long-term goal is to attract two types of people on-chain: one is less experienced crypto users, and the other is traditional finance investors.

By "less experienced crypto users," I mean those who basically only trade on centralized exchanges and rarely use decentralized products directly on-chain. Currently, the number of CEX traders far exceeds that of DEX.

These people are not professional traders. To attract them, we must provide interfaces similar to traditional internet apps that they are familiar with, along with clear risk warnings and reliable security guarantees. Only then will they feel comfortable trading on-chain, and that's what we aim to provide.

In the longer term, we also want to attract an even larger group—ordinary investors who currently only use traditional broker platforms.

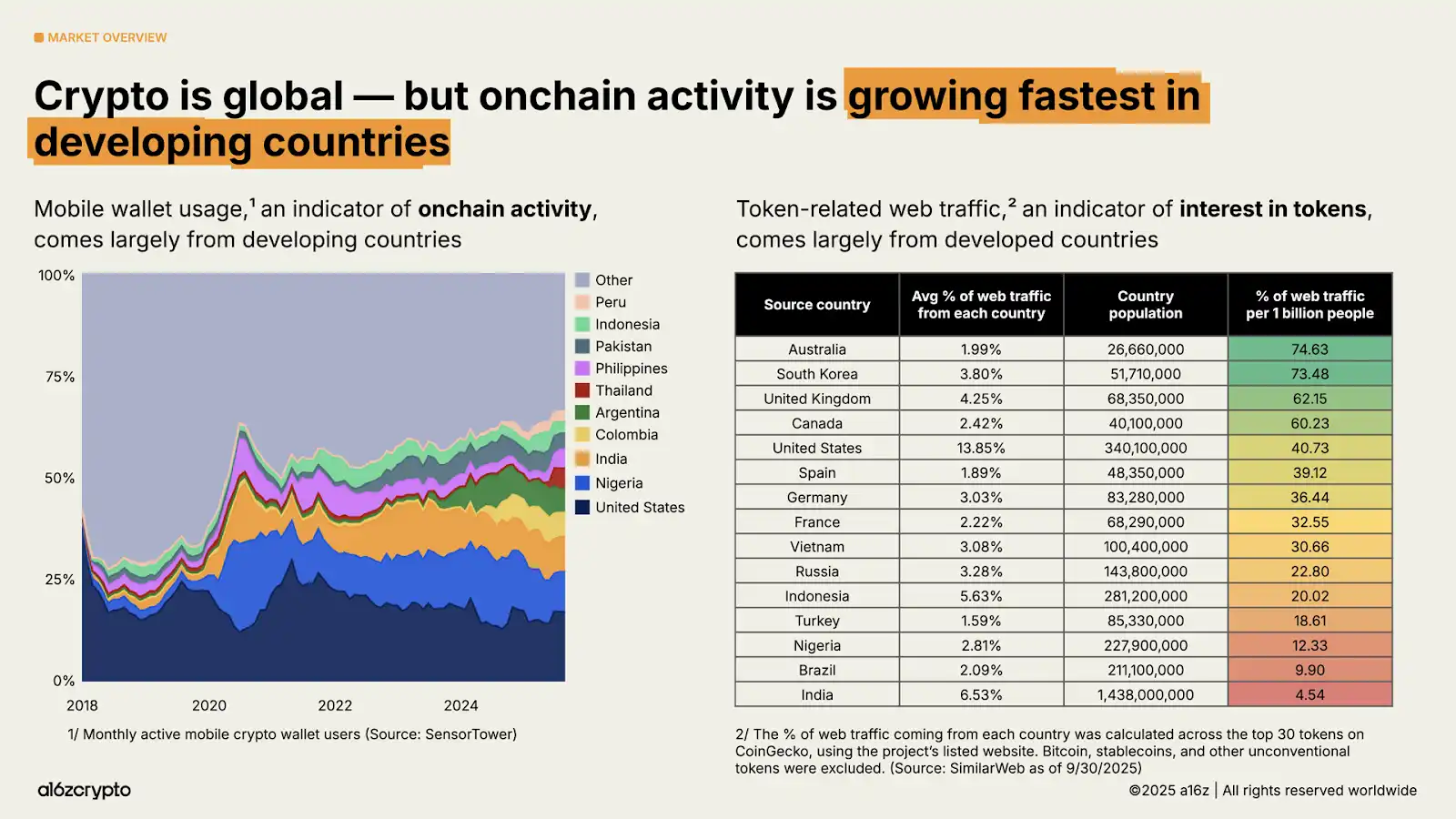

So, in terms of target markets, we will focus on regions where access to global capital markets is restricted or costly.

In emerging markets such as Southeast Asia, Latin America, and Central Asia, people often face many obstacles when trying to invest, such as high fees, fragmented channels, and many financial products they simply cannot access. An open, global, blockchain-based trading platform can bring the greatest value to these users.

The growth of on-chain users in emerging markets is very rapid | Source: a16zcrypto

BlockBeats: That's interesting. When I recommend on-chain DEXs to friends who are used to Binance and Coinbase, they often ask: "Since I can trade anytime on my phone, why bother opening a website?" How does HelloTrade plan to respond to this?

Kevin: That's a great question. Most people are now used to trading on their phones rather than websites, which is why we are focusing on building HelloTrade's mobile app.

The reality is that many crypto apps' interface design, user experience, and reliability still don't match those Web2 apps everyone is used to.

We want HelloTrade to feel just like any top mobile trading app, while also allowing users to enjoy the advantages brought by blockchain technology. We will also have a web version, but the mobile app will be our flagship product and the main way users trade on HelloTrade.

In addition to product experience, we also want to provide real-time customer service. If you encounter problems, don't know how to use a certain feature, or feel anxious about on-chain trading, you should be able to contact real customer service via email, SMS, or phone.

Of course, this is a big plan and may not be fully realized at launch, but it's the direction we're working toward.

BlockBeats: One of your core products is perpetual contracts, which is a crypto-native invention. As professionals from traditional finance, what do you think of it?

Kevin: In my view, perpetual contracts are the preferred tool for short-term directional leveraged exposure. If you want to bet on the short-term trend of a particular underlying asset, I think perpetual contracts are one of the most effective tools.

For most non-professional traders, the pricing models, time decay, and volatility mechanisms of options may be too complex. Perpetual contracts are much simpler—they remove these complexities, are more linear, easier to understand, and more convenient to manage.

So in many cases, for traders who just want to use leverage simply and efficiently, perpetual contracts are a better tool.

BlockBeats: So, compared to crypto-native perpetual contract products or internet financial apps like Robinhood and Revolut, what is HelloTrade's biggest advantage?

Kevin: Actually, I think our biggest competitors are not other crypto-native Perp DEXs, but traditional brokers and neobanks like Robinhood and Revolut, which everyone is already very familiar with and trusts.

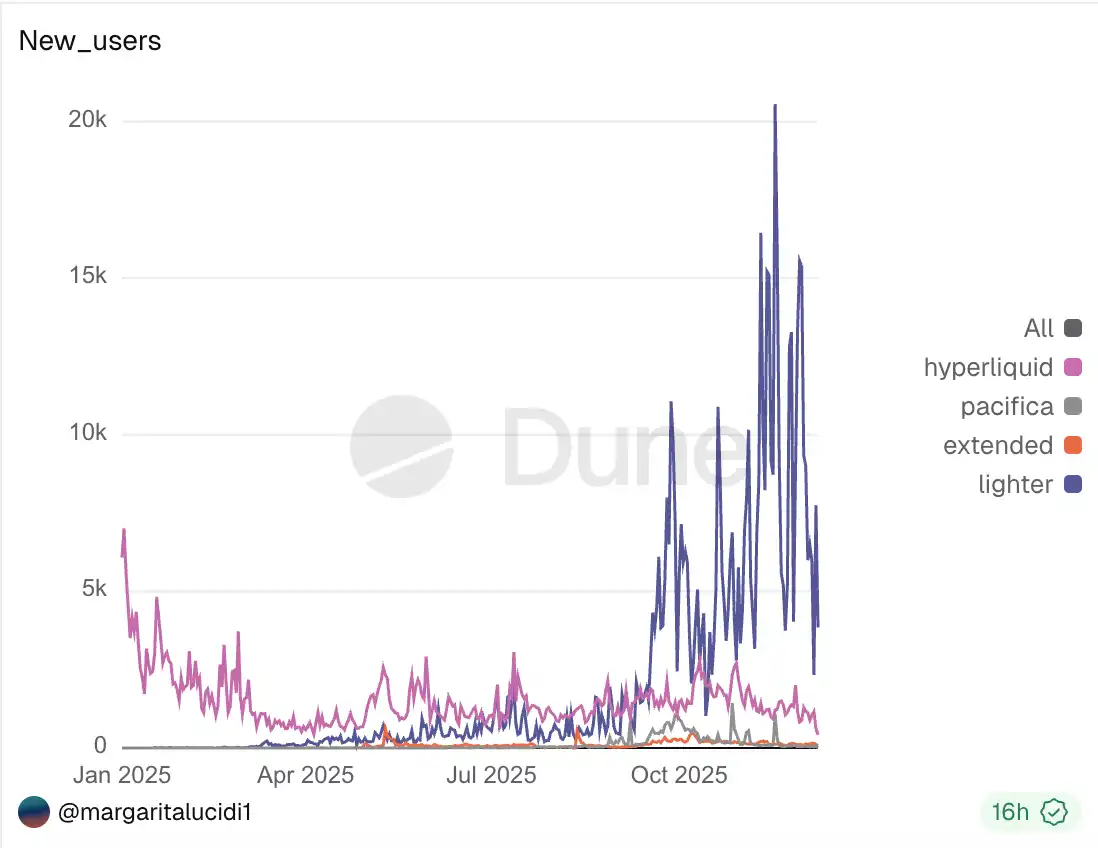

Some Perp DEXs now have large trading volume data, but many analyses show that the number of truly active traders on these platforms is actually not large—only a few thousand to tens of thousands of active users.

Source: Dune Analytics

Our core advantage is providing a product experience on Web3 infrastructure that truly rivals Web2 apps. This means users can enjoy the same level of design, customer service, and technical support as Robinhood and Revolut, all powered by decentralized blockchain technology.

On HelloTrade, users no longer have to go through the cumbersome settlement processes of traditional financial systems, and assets are fully under their own control.

In the future, we will also provide functions that are impossible to achieve in Web2, such as non-custodial margin trading, approval-free lending markets, and on-chain collateral that can be freely allocated among DeFi protocols.

In the long run, this will open up a whole new financial world that traditional brokers simply cannot reach. If we can achieve Web2 product quality while realizing the powerful functions of Web3, I believe HelloTrade can bring millions of users who have never touched blockchain onto the chain.

The second advantage is our team. The stock capital market and the crypto market are very different. The stock market has corporate actions (such as dividends, splits, mergers, etc.) and market closures—these complex situations do not exist in the crypto world.

Handling these differences requires strong technical capabilities. The three early engineers we hired were all former founders of crypto DEXs.

Usually, a team either understands crypto or traditional finance, but rarely both. Our team has years of practical experience in both fields, and we believe this is also our unique advantage.

BlockBeats: You were very successful at BlackRock. For HelloTrade, what scale do you hope to achieve? What do you think is the key KPI for HelloTrade's success?

Kevin: That's a good question. I think our KPIs will evolve over time.

Currently, we are more focused on daily active users (DAU). Trading volume and open interest—these traditional KPIs—are also important. We will set specific goals and monitor them closely as we progress.

But as I said before, we want to be more than just a perpetual contract exchange. We want to be the app that users habitually open every morning. Not only can they trade on our app, but they can also read news, receive price alerts, track FOMC meetings, inflation data, PCE, interest rate changes, and other important events.

For me, the truly critical metrics are daily active users, user time spent in the app, and which features users are using.

These metrics may not all directly generate revenue, but they reflect user engagement. The more time users spend on the app and the more frequently they interact, the deeper our relationship with customers becomes. In the long run, this relationship is our most valuable asset.

Web3 Technology Foundation, Web2 Product Experience

BlockBeats: After talking about the product, let's talk about technical implementation. Why did you choose MegaETH as the underlying layer, instead of more mature ecosystems like Solana, Base, or Arbitrum at the time?

Kevin: There are three core reasons.

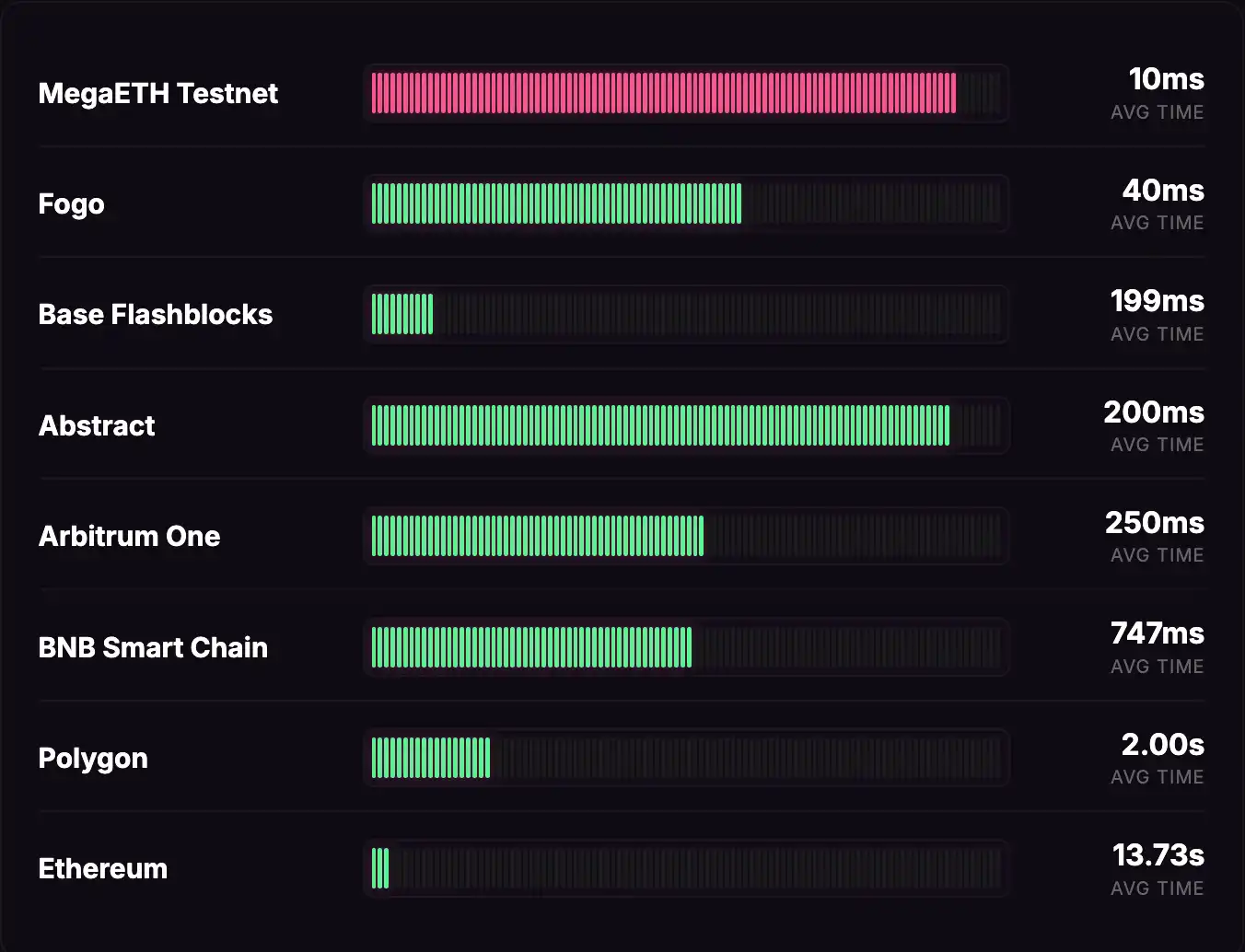

The first is performance. We want to build a trading system that can rival top traditional brokers—fast and with a great experience. This requires a highly performant and reliable chain. Our team carefully studied many Layer 1 and Layer 2 solutions and did extensive testing. MegaETH was the highest-performing choice. We plan to launch some features in the future that were previously impossible on blockchain, all of which will rely on MegaETH's throughput.

MegaETH generates a new mini-block every 10 milliseconds, the fastest among mainstream public chains | Source: https://miniblocks.io/

The second is my belief in ethereum and its network effects. I have always believed that ethereum's security, neutrality, and ecosystem richness are unmatched. The future global financial and DeFi ecosystem will still be built around ethereum, and MegaETH is a "high-speed processing layer" on top of this core.

For us, this combination makes a lot of sense. It inherits ethereum's security while providing an extremely fast execution environment.

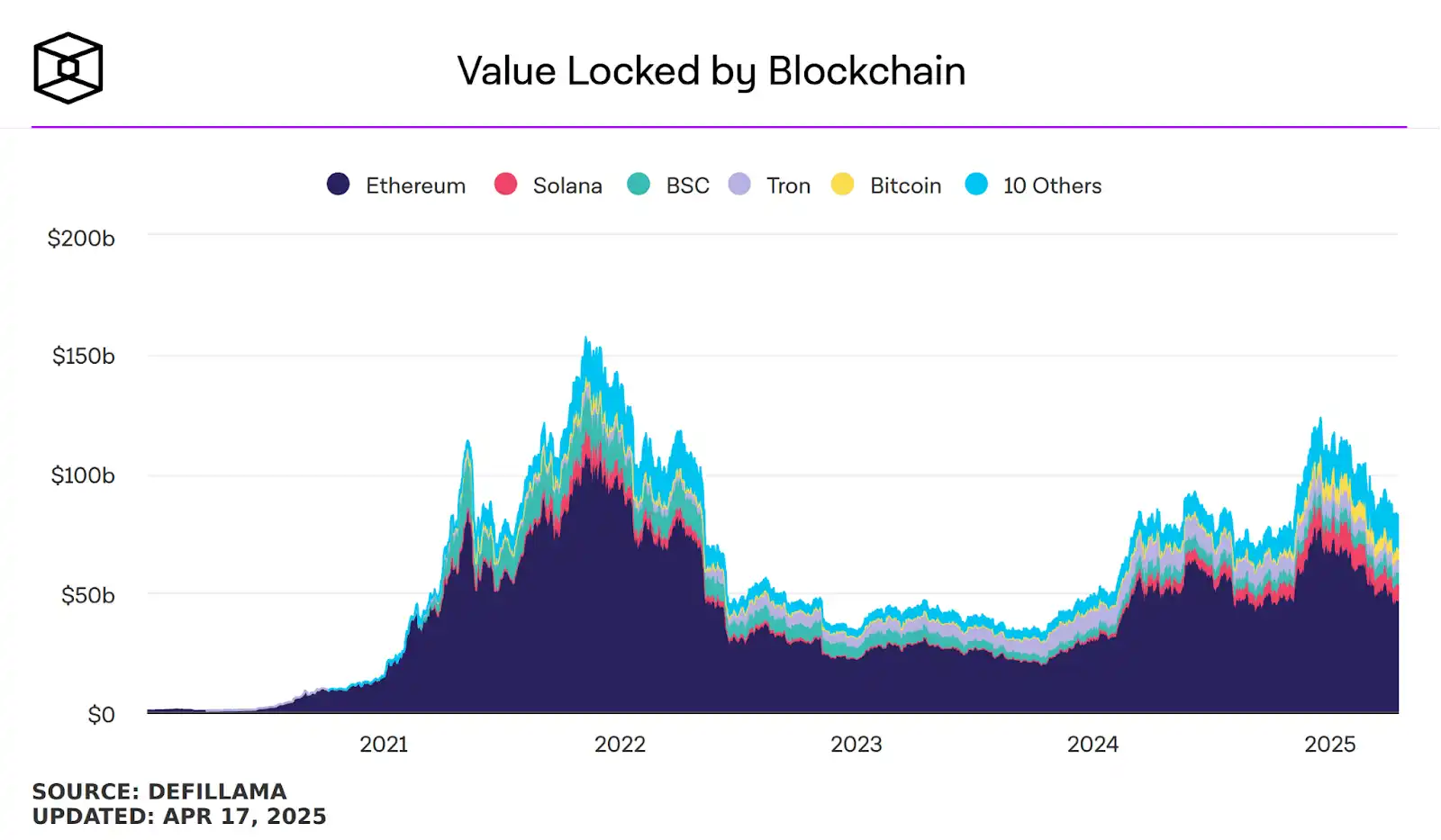

TVL of ethereum compared to other public chains | Source: DeFi Llama

Finally, the MegaETH team is also an important factor. Many blockchain projects start with ambitious plans but ultimately fail to deliver. The MegaETH team are true builders—they have long-term vision and the ability to execute.

BlockBeats: To achieve a Web2-like experience, your mobile app is described as having no wallet setup, no gas fees, and no technical jargon. How is this achieved technically?

Kevin: For crypto apps to achieve mass adoption and a Web2-like experience, several hurdles must be overcome: wallet setup, gas payments, and fiat on/off ramps. We will address these issues step by step.

First, we will eliminate the need for gas payments—users won't have to worry about transaction fees.

Second, for customers less familiar with Web3, we will partner with embedded wallet providers so users can create wallets directly with their email. For more advanced users, we will also support connecting their own self-custody wallets.

The final challenge is how to bring funds onto the platform. We are actively integrating fiat on/off ramps to make the entire experience as familiar and smooth as using a traditional broker app.

BlockBeats: A good trading platform can't do without liquidity. How do you plan to attract market makers?

Kevin: The first key to attracting market makers is to build a strong product. If your product really has a lot of users trading on it, liquidity will naturally follow. Market makers go where trading is active, so our primary task is to provide a product that generates real demand.

The second factor is weekend and after-hours liquidity when traditional markets are closed. This is an area where blockchain can bring something new.

Liquidity is lower during these times. We are developing unique incentive systems—by adjusting leverage, funding rates, fees, etc.—to make it more profitable for market makers to provide liquidity during non-trading hours, ensuring our market remains deep, stable, and reliable 24/7.

Blockbeats: What do you think is the biggest challenge in building stock or ETF perpetual contract products? Is it compliance, the technical details you mentioned, or user growth and education?

Kevin: The biggest challenge is solving the "24/7 trading" problem—how to make the structurally different stock capital market adapt to the non-stop operation of crypto systems.

Specifically, after-hours and weekend pricing is a technical challenge. We will combine external price sources, Friday closing prices, and the weekend order book data itself. At the same time, we will also cooperate with traditional financial participants on weekends to make mark prices more accurate and predictive.

Frankly, until Nasdaq and NYSE truly achieve 24/7 trading, there is no perfect solution.

But what I find very interesting is that as these 24/7 stock perpetual contract platforms mature, they will become the main venues for weekend price discovery, and liquidity will be deeper. At that point, many traditional financial institutions will have to trade on these platforms on weekends due to fiduciary duties.

The second challenge is user experience. We won't just do perpetual contracts—they may not be suitable for everyone. We plan to gradually launch lower-risk products, which may still offer leverage but will penalize users much less when prices move against them.

BlockBeats: Finally, let's talk about risk. At BlackRock, there's a saying: "It takes decades to build trust, but only a few minutes to lose it." At HelloTrade, what "few minutes scenario" are you most wary of?

Kevin: What we value most is the safety of customer assets and unexpected market situations.

First is the security of customer assets. We've all seen what happened at FTX and some other platforms.

Protecting users through proper asset segregation, strong risk control, and secure DeFi infrastructure is our top priority. This is the cornerstone of trust and what we take most seriously.

Second, we must be prepared for extreme situations. We are confident in HelloTrade's core trading model under normal circumstances, but what really keeps us alert are "black swan" events with a 1% probability, like what happened on October 10.

We are simulating and backtesting these extreme scenarios, embedding contingency plans and protective measures to ensure our system remains stable and reliable even under extreme stress.

In traditional finance, price limits and circuit breakers have existed for years for a reason—they prevent the market from completely collapsing in extreme situations. We are also doing our best to prepare for these extremes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.

Interpretation of ZAMA Dutch Auction Public Sale: How to Seize the Last Interaction Opportunity?

ZAMA will launch a sealed-bid Dutch auction based on fully homomorphic encryption on January 12, selling 10% of its tokens to achieve fair distribution, with no front-running and no bots.

Standard Chartered Bank lowers its 2025 Bitcoin price forecast to $100,000.