Appian Q4 Earnings Surpass Estimates, Revenues Rise Y/Y, Shares Up

Appian APPN reported fourth-quarter 2025 non-GAAP earnings of 15 cents per share, surpassing the Zacks Consensus Estimate by 59.57% and decreasing 16.7% year over year.

Revenues of $202.9 million increased 22% year over year and beat the consensus mark by 7.28%.

Appian shares were up 2% at the time of writing this article. APPN shares have dropped 29.2% in the trailing 12 months, underperforming the Zacks Computer & Technology sector's 19% return.

Appian’s Q4 Top-Line Details

Subscriptions revenues (80% of total revenues) totaled $162.3 million, up 19% year over year. Professional Services revenues (20% of total revenues) increased 36% year over year to $40.6 million.

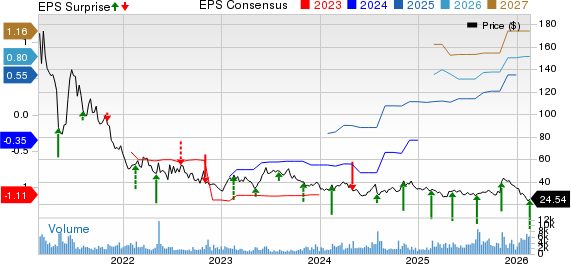

Appian Corporation Price, Consensus and EPS Surprise

Appian Corporation price-consensus-eps-surprise-chart | Appian Corporation Quote

Appian’s Q4 Operating Details

In the fourth quarter of 2025, Appian reported a non-GAAP gross margin of 73.4%, down 370 bps year over year.

In the reported quarter, non-GAAP research and development expenses were $42.1 million, up 16.1% year over year. Non-GAAP sales and marketing expenses increased 21.5% year over year to $66.9 million. Non-GAAP general and administrative expenses soared 22% year over year to $22.5 million.

The company reported a non-GAAP operating margin of 8.6%, down 260 bps year over year.

Appian Balance Sheet & Cash Flow

As of Dec. 31, 2025, APPN had cash, cash equivalents and short-term investments of $187.2 million compared with $191.6 million as of Sept. 30.

Cash generated by operating activities was $1.1 million in the reported quarter compared with $18.7 million in the previous quarter.

Appian Initiates 1Q26 and FY26 Guidance

For the first quarter of 2026, Appian expects cloud subscriptions revenues between $119 million and $121 million, indicating year-over-year growth of 19% to 21%. The company anticipates total revenues between $189 million and $193 million, indicating a year-over-year increase of 14-16%.

Adjusted EBITDA is expected to be between $19 million and $22 million.

Adjusted earnings is expected to be between 16 cents and 20 cents per share.

For 2026, Appian expects cloud subscriptions revenues between $502 million and $510 million, indicating year-over-year growth of 15-17%. The company anticipates total revenues between $801 million and $817 million, indicating a year-over-year increase of 10% to 12%.

Adjusted EBITDA is expected to be between $89 million and $99 million.

Adjusted earnings is expected to be between 82 cents and 96 cents per share.

Zacks Rank & Stocks to Consider

Appian currently carries a Zacks Rank #3 (Hold).

Micron Technology MU, MongoDB MDB and Credo Technology Group CRDO are some better-ranked stocks that investors can consider in the broader Zacks Computer and Technology sector.

Micron Technology shares have gained 309.6% in the past 12-month period. This Zacks Rank #1 (Strong Buy) company is scheduled to release second-quarter 2026 results on March 19. You can see the complete list of today’s Zacks #1 Rank stocks here.

MongoDB shares have returned 21.5% in the past 12-month period. MDB is scheduled to release its fourth-quarter 2026 results on March 2. The company currently sports a Zacks Rank #1.

Credo Technology Group shares have gained 83.8% in the past 12-month period. CRDO is set to report its third-quarter fiscal 2026 results on March 2. The company currently sports a Zacks Rank #1.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 Price Prediction: Rally Builds After Tariffs Fall

iPower Reports Fiscal Q2 2026 Results and Completes Strategic Operating Reset

Why Okta (OKTA) Stock Is Falling Today