美股異動|貝殼(BEKE.US)漲逾3%,2025年上半年淨收入同比增加24.1%

According to Jinse Finance APP, on Tuesday, KE Holdings (BEKE.US) rose over 3%, closing at $18.16. The financial report shows that in the first half of 2025, KE Holdings achieved a total transaction volume of 1.7224 trillions yuan, an increase of 17.3% year-on-year. On this basis, KE Holdings achieved a net income of 49.3 billions yuan, an increase of 24.1% year-on-year; net profit was 2.162 billions yuan, compared with 2.333 billions yuan in the same period last year.

KE Holdings' operating performance in the first half of 2025 is based on two backgrounds: at the macro level, the total housing transaction volume in China's real estate market remained stable, but the market entered an adjustment period in the second quarter; at the micro level, KE Holdings welcomed the addition of several national and local large and medium-sized real estate brokerage brands. By the end of the first half of the year, the number of active stores on the company's platform reached 58,664, a year-on-year increase of over 32%, and the number of active brokers reached 491,573, a year-on-year increase of over 19%.

免責聲明:文章中的所有內容僅代表作者的觀點,與本平台無關。用戶不應以本文作為投資決策的參考。

您也可能喜歡

Pectra之後,Fusaka來了:以太坊邁向「無限擴展」的最關鍵一步

Fusaka硬分叉是Ethereum於2025年的重大升級,聚焦於擴容、安全性及執行效率,將引入PeerDAS等9項核心EIP,以提升數據可用性與網絡效能。摘要由Mars AI生成。本摘要由Mars AI模型生成,其內容的準確性與完整性仍處於持續優化階段。

ETH行情暴跌背後的隱患:高槓桿與安全風險引發劇烈波動

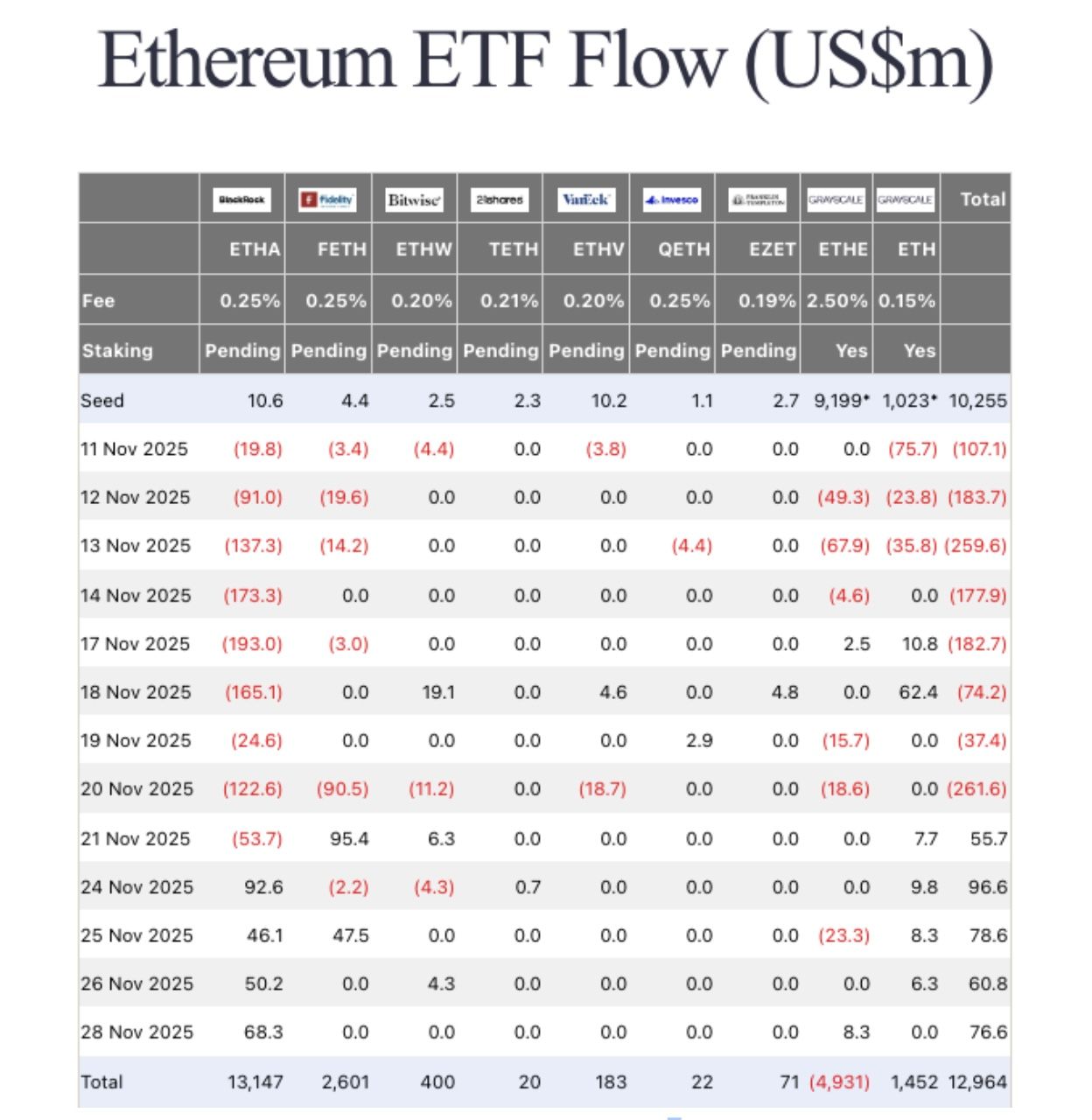

以太坊價格下滑至3,030美元,ETF資金流出與巨鯨去槓桿主導十一月

Ethereum價格在11月下跌21%,但衍生品市場的持倉情況以及巨鯨需求的回升,預示著12月有望迎來積極開局。

CoinShares撤回XRP、Solana和Litecoin美國現貨ETF申請,Nasdaq上市前夕

歐洲資產管理公司CoinShares已撤回其計劃中的XRP、Solana(含質押)及Litecoin ETF的SEC註冊申請。該資產管理公司還將結束其槓桿比特幣期貨ETF。此次撤回是在該公司準備通過與Vine Hill Capital進行價值12億美元的SPAC合併,以實現美國上市之際進行的。執行長Jean-Marie Mognetti在解釋戰略調整時表示,這是因為美國加密ETF市場由傳統金融巨頭主導。