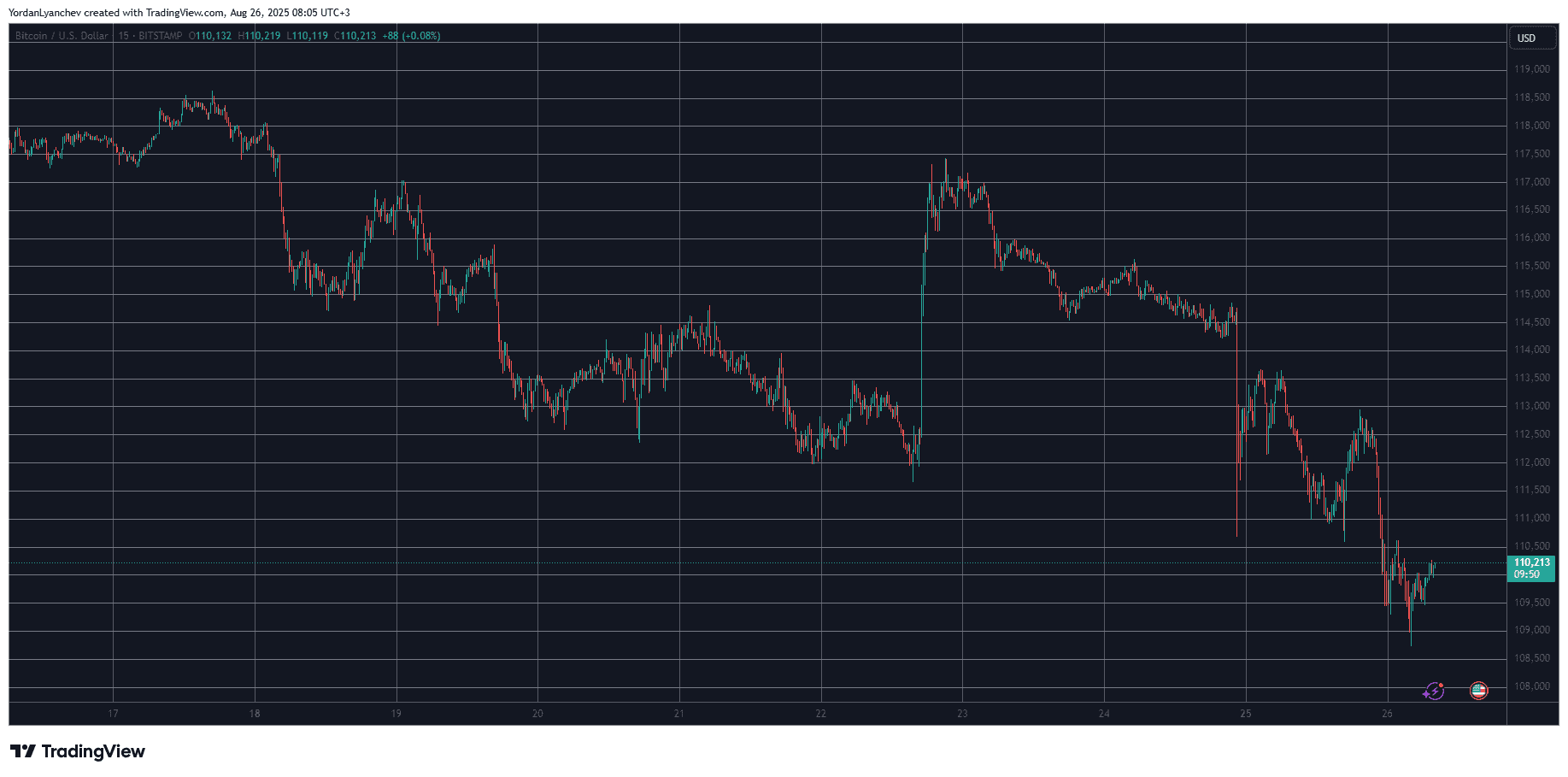

Bitcoin Price Tanks Below $109K After Whale Dump in Brutal Market Flush

Around $205 billion has exited crypto markets over the past 24 hours, sending total market capitalization plummeting back to $3.84 trillion.

It is the lowest level total cap has been since August 6, but it still remains within a six-week sideways channel despite the massive sell-off.

CoinGlass reported that around 205,000 traders were liquidated over the past day, with total liquidations coming in over $930 million as leveraged long Bitcoin positions got flushed. Other analysts were suggesting that exchanges were dumping crypto assets in order to liquidate the long positions.

Today’s painful, but not out of the ordinary, market slump has resulted in a 9% correction for overall crypto markets since their peak on August 14.

Yesterday saw one of the largest #Bitcoin long liquidation events since Dec 2024, with over $150M in longs wiped out as price moved lower. pic.twitter.com/okCNBMWl0j

— glassnode (@glassnode) August 25, 2025

Bitcoin Dragging Markets Down

The big dump has been caused by Bitcoin, which crashed to a seven-week low of under $109,000 in early Asian trading on Tuesday morning on most exchanges.

This was caused by a Bitcoin whale selling an entire batch of 24,000 BTC worth over $2.7 billion, causing the asset to plummet $4,000 a few hours that followed.

According to Glassnode, Bitcoin has dropped below the average cost basis ($110,800) of one to three-month-old investors who accumulated during the May to July rally. “Historically, failure to hold above this level has often led to multi-month market weakness and potential deeper corrections,” it cautioned.

The total BTC correction now stands at 12%, which is still much shallower than the pullbacks in September 2017 and 2021, during the bull market years when the asset retreated by 36% and 24%, respectively.

A retreat between these two levels this September could see Bitcoin prices back at $87,000 before the bull market resumes.

Altcoins Bleed Out

As usual, the altcoins are suffering much more with major losses for Solana dumping over 11% to $186, Dogecoin dropping 10% in a fall to $0.21, Cardano sliding 9% to $0.83, and Chainlink tanking 11% to $23.30.

Other altcoins in pain include Hyperliquid, Sui, Avalanche, and Litecoin. Ethereum has lost 7% on the day, but it remains within its sideways channel and had already started to recover at the time of writing, trading above $4,400 again. However, ETH has lost over 11% since its all-time high just two days ago.

“It never “feels good” when you buy the dip. The dip comes when sentiment drops. Writing the number down can be a good form of discipline,” advised Bitwise CIO Matt Hougan.

When the crypto market rips, everyone says: “I’ll buy bitcoin if it just pulls back to [insert number here].”

Then, when the dip happens, they don’t act because the market doesn’t “feel” good at that point.

One solution: Write the price at which you want to buy on a sticky note…

— Matt Hougan (@Matt_Hougan) August 25, 2025

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.