Crypto Whales Bought These Altcoins in the Second Week of September 2025

This week saw a resurgence in new demand across the cryptocurrency market, with multiple assets recording notable gains.

The 5% uptick in the total global cryptocurrency market capitalization reflects this renewed appetite for digital assets. Riding on this momentum, large investors, referred to as whales, have taken advantage of the surge to increase their holdings in select altcoins.

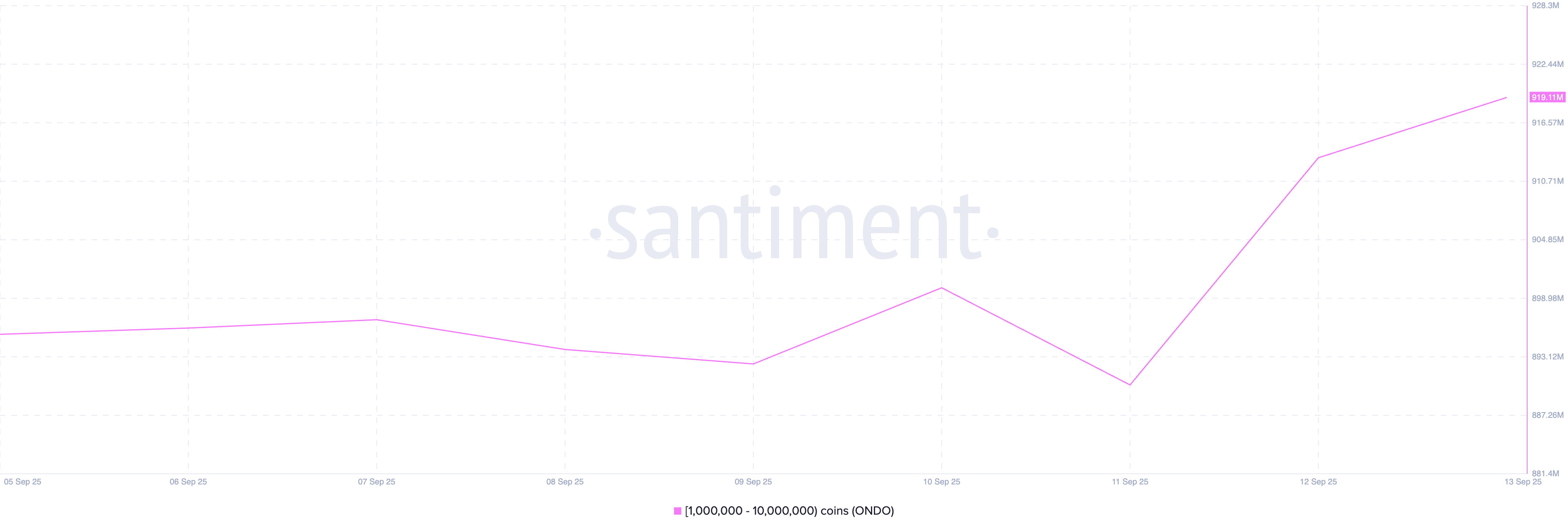

ONDO

Ondo DAO’s native token, ONDO, is one of the top picks among crypto whales this week. On-chain data reveals that since September 5, large holders with wallets containing between 1 million and 10 million ONDO have accumulated 23.73 million tokens.

This surge in whale demand, combined with broader market bullishness, has pushed ONDO’s value up by 21% over the past week.

If this buying momentum continues, ONDO could climb toward $1.135, reflecting renewed investor confidence and market strength.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Conversely, if demand stalls, the token may retrace some of its recent gains, potentially falling back to $1.014.

Official Melania Meme (MELANIA)

Meme coin MELANIA is another asset that has enjoyed some attention from crypto whales this week.

According to Nansen data, whale holdings of MELANIA have risen by nearly 4% over the past week, reflecting growing confidence among large investors.

This surge in whale activity has already contributed to MELANIA’s recent performance, helping the token climb nearly 10% in the past seven days.

Should buy-side pressure persist, MELANIA could extend its gains and rally toward $0.2237.

On the other hand, if whale demand falters and buying activity slows, the token could face a pullback toward $0.19.

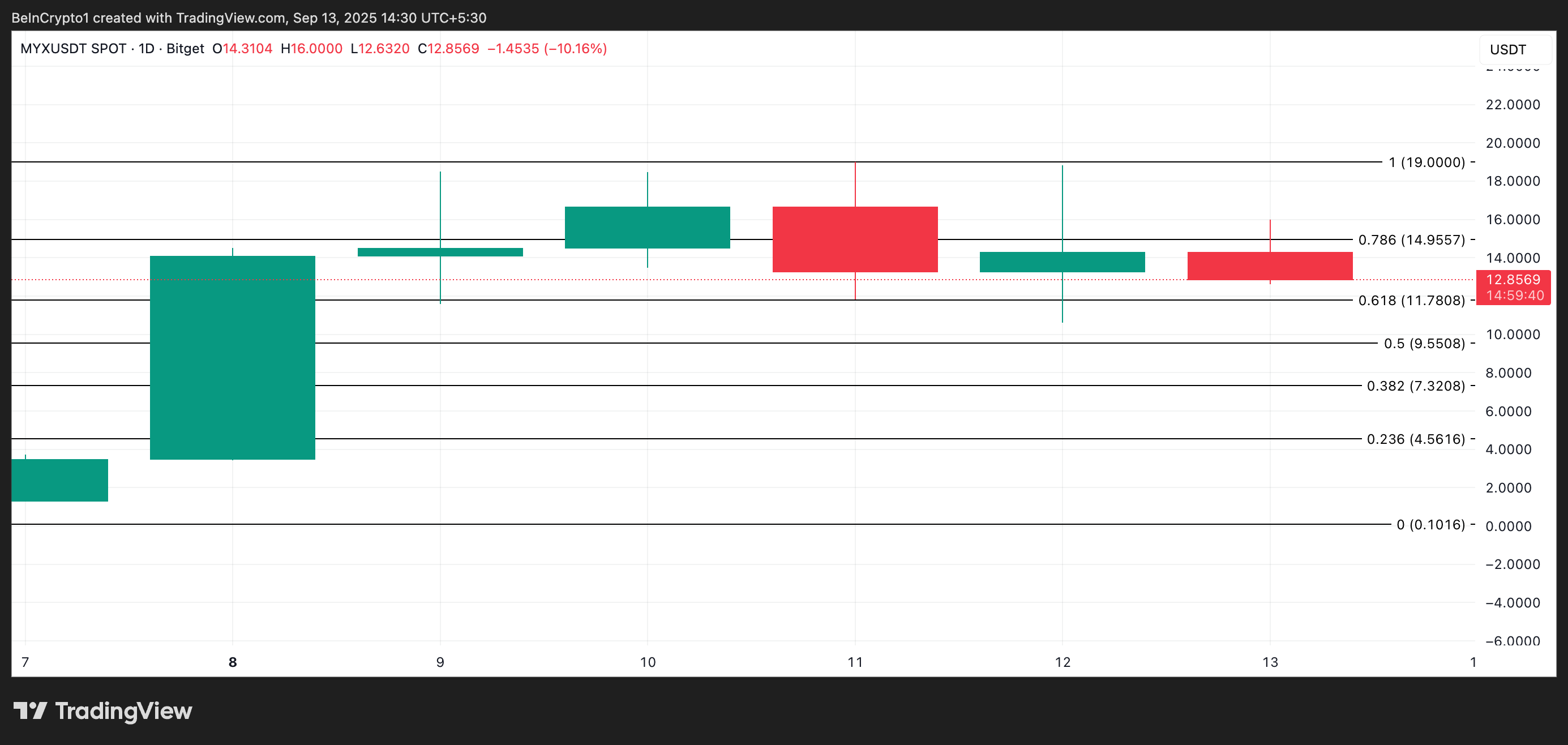

MYX Finance (MYX)

MYX has surged nearly 1,000% over the past week, fueled in part by growing whale activity. During this period, holders with wallets containing more than $1 million in MYX have increased their positions by 17%.44, bringing their total holdings to 855,419 tokens.

If these investors continue their accumulation, MYX could see its price climb above $14.95.

Conversely, if demand softens and buying activity slows, the token could face a pullback, with its price potentially dipping to $11.78.

The post Crypto Whales Bought These Altcoins in the Second Week of September 2025 appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.