Ethereum Tests Support: Holder Conviction Sets Stage for a Rebound to $4,775

Ethereum price slipped below $4,500, but nearly $8 billion in maturing ETH supply signals strong investor conviction. If ETH reclaims support, a rally toward $4,775 and new highs could follow.

Ethereum has seen a 4% decline in recent days, pulling the altcoin king just under $4,500.

While this short-term dip may concern some traders, the long-term outlook remains bullish as strong fundamentals and investor behavior suggest resilience ahead.

Ethereum Supply Is Maturing

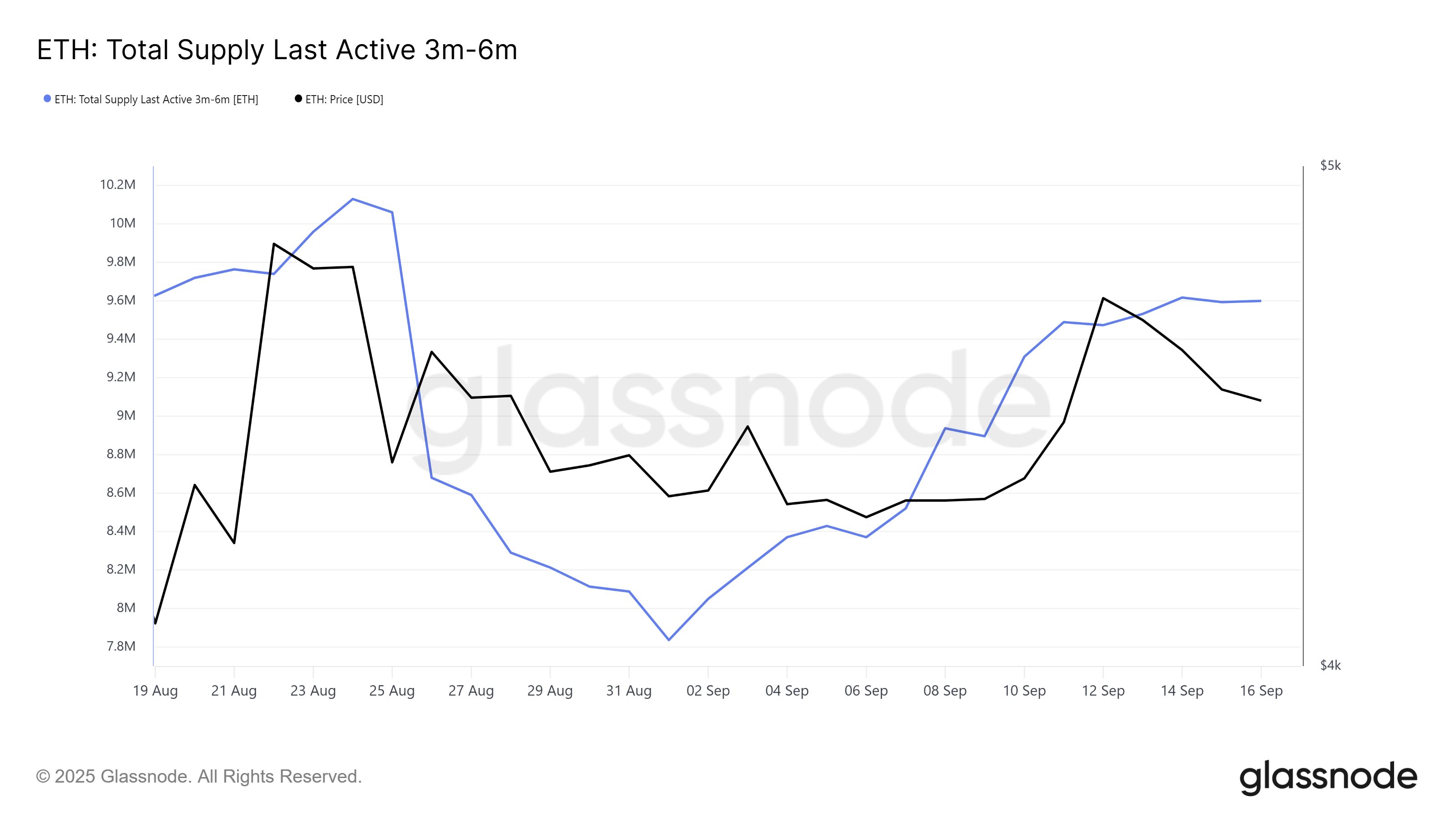

Ethereum supply has matured significantly, reinforcing investor confidence in the asset’s long-term strength. Since the beginning of the month, the 3-6 month-old supply has grown by 1.76 million ETH, now valued at nearly $8 billion. This indicates that holders refrained from liquidating even during market volatility.

Such conviction suggests that investors anticipate higher prices and are willing to ride out short-term declines. By keeping ETH locked, these holders are reducing the circulating supply, which can create favorable conditions for upward price momentum when demand returns. This behavior is a bullish foundation for Ethereum’s growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

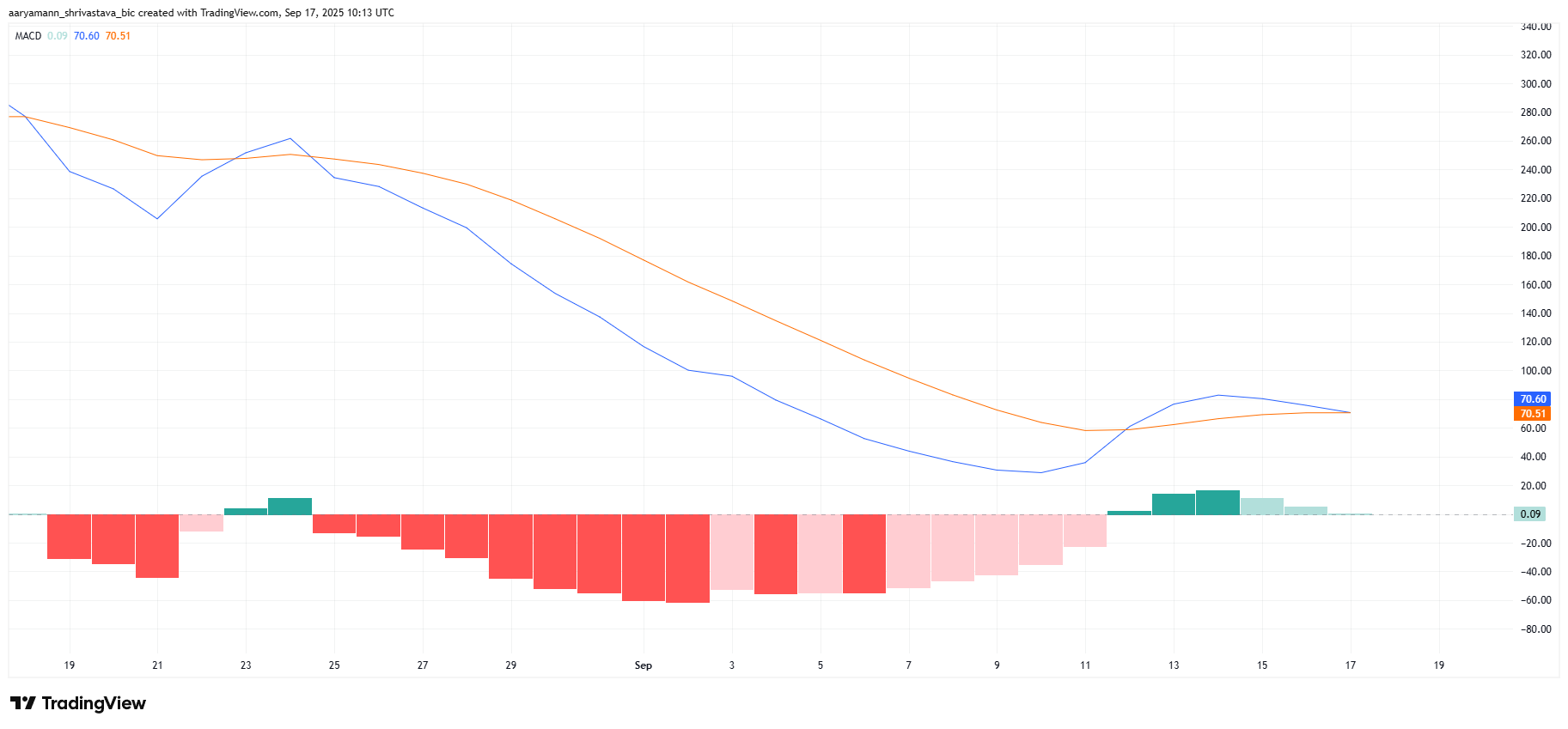

On the technical side, Ethereum’s momentum appears mixed in the near term. The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover, signaling the possibility of short-lived downside pressure. This aligns with ETH’s recent price slip below the $4,500 level.

However, the broader market cues remain constructive. Even if the MACD confirms a bearish crossover, investor sentiment and maturing supply could support a quick recovery. Such dynamics highlight that any decline would likely be temporary, with ETH primed for a strong rebound soon after.

ETH MACD. Source:

TradingView

ETH MACD. Source:

TradingView

ETH Price Could Bounce Back

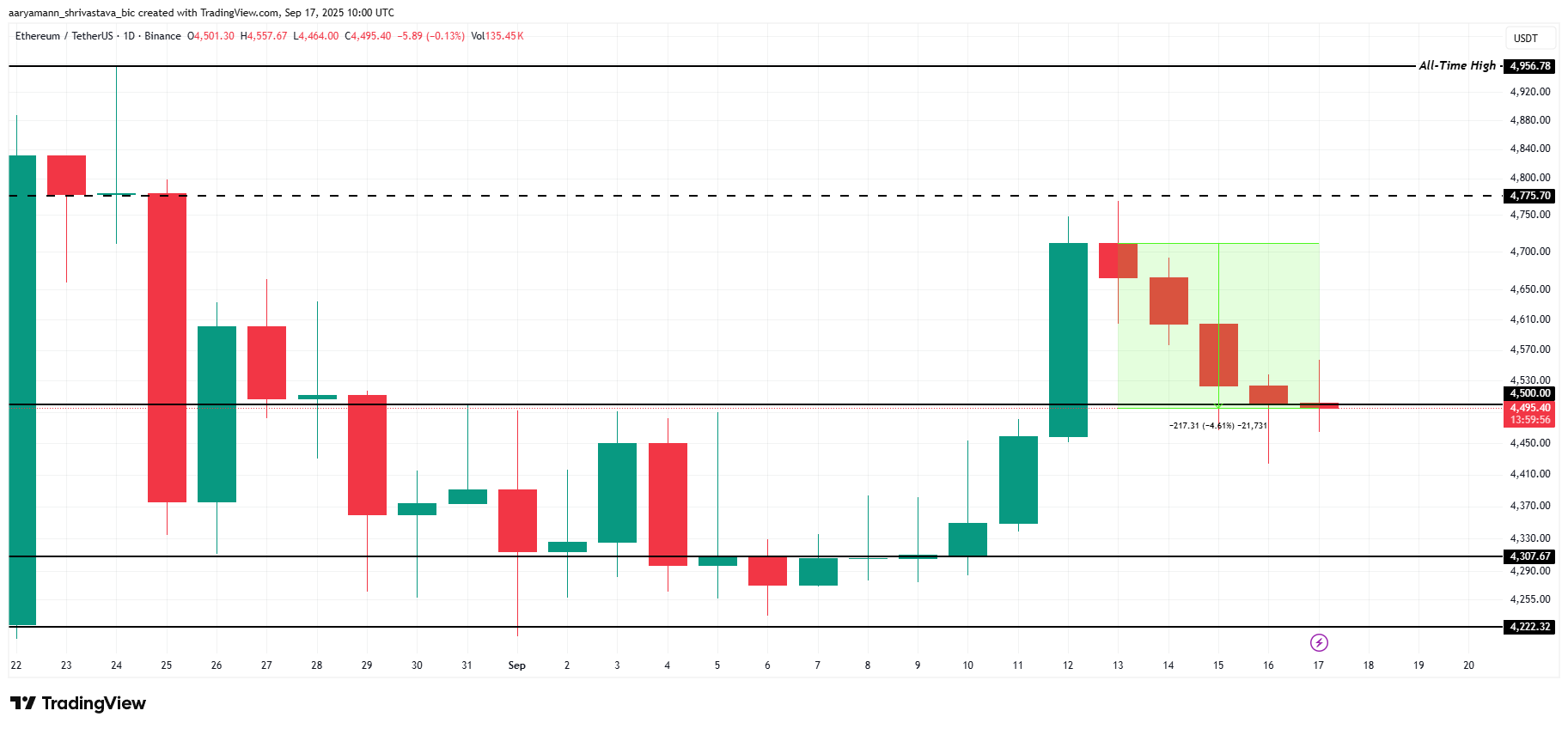

Ethereum is currently trading at $4,495, just below the $4,500 support line. It has not yet closed below $4,500, so the support is still valid.

The maturing supply and bullish long-term outlook indicate that Ethereum could bounce from the support. With fewer coins entering circulation, the altcoin has structural support for renewed upward momentum to $4,775 despite short-term volatility.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if the price closes below the support, ETH may slip toward $4,307, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know