Trader Says Bitcoin Primed for More Downside Before ‘Up-Only Mode,’ Updates Outlook on Ethereum

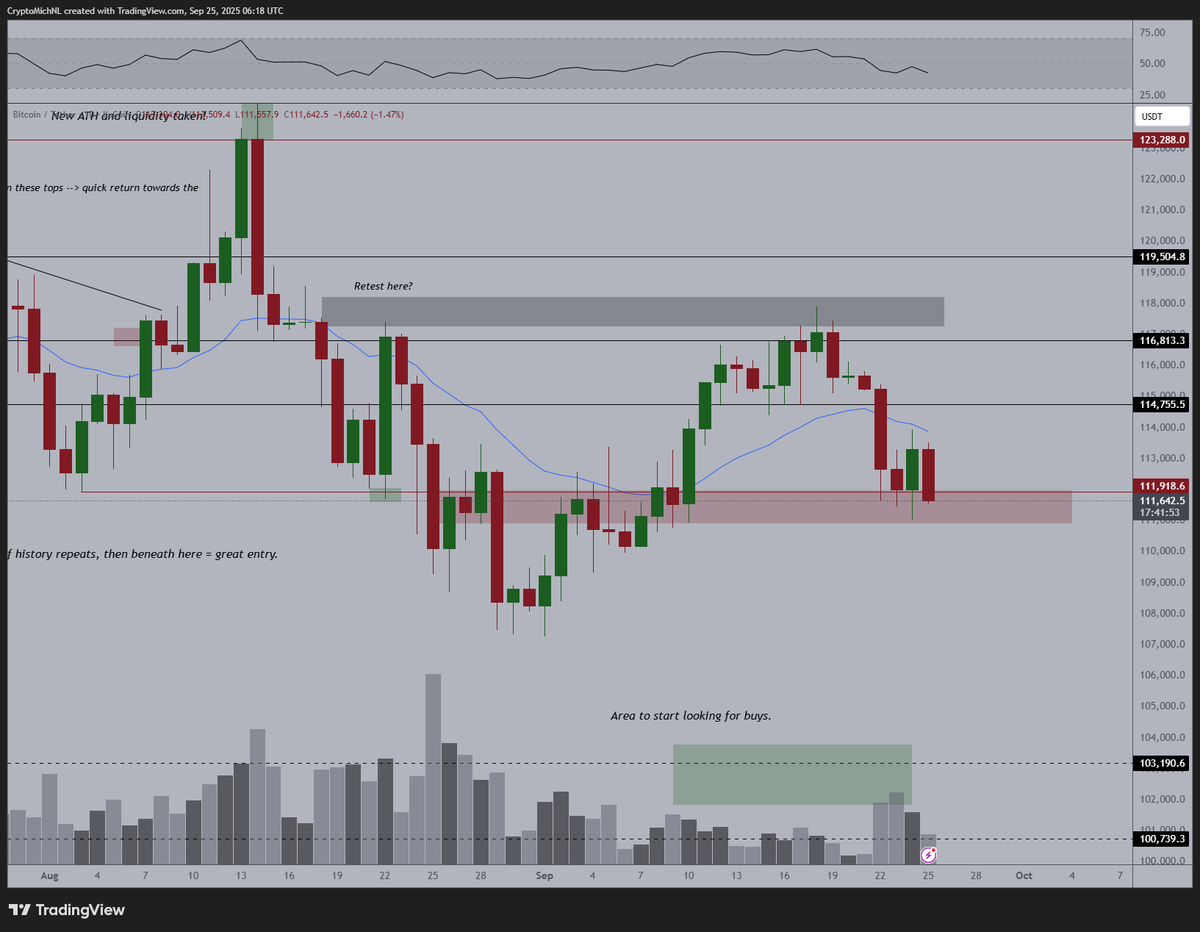

Crypto trader Michaël van de Poppe says that Bitcoin ( BTC ) may have a deeper correction before an explosive move to the upside.

Van de Poppe tells his 808,600 followers on X that Bitcoin may decline below its current $111,000 range before entering a period of bullish momentum.

“I would assume that we’ll be going to get some more downside and then we’re done for the current period, meaning that we’ll be in up-only mode.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at his chart, the trader suggests Bitcoin may retest the level around $108,000 similar to late August.

Bitcoin is trading for $111,075 at time of writing, down 2.3% in the last 24 hours.

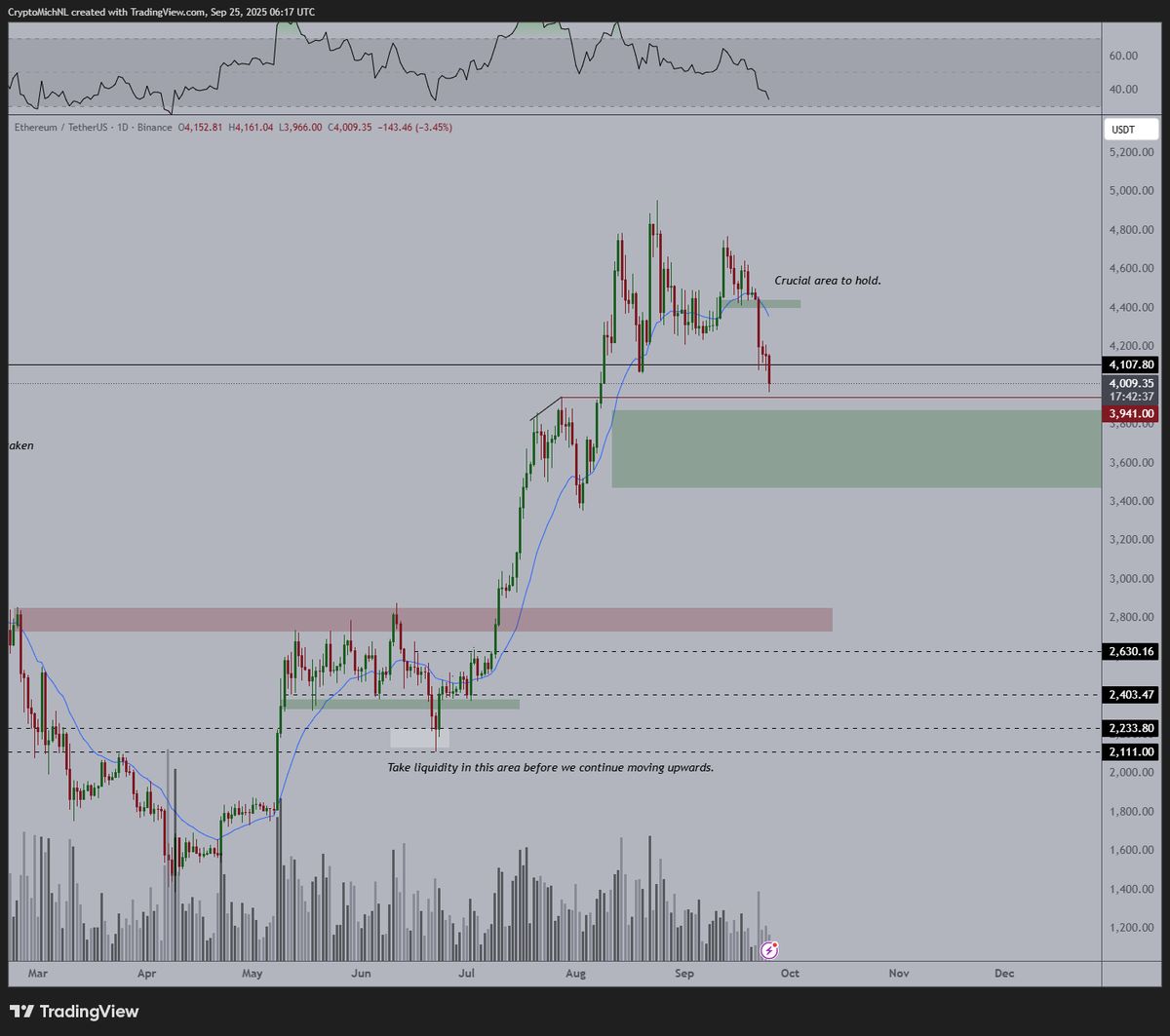

Next up, the analyst says that Ethereum ( ETH ) may form a local market bottom around the $3,800 level.

“I don’t think there’s much more downside to come. Would suggest that the green zone is where we’ll be bottoming out. Perhaps another 5% drop on ETH and that should be it.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

The analyst also predicts that ETH will hit five-figures this cycle and other altcoins may increase 400% from their current values.

“It’s near the bottom on altcoins and ETH. What’s next? ETH at $10,000. Altcoins to go 3-5x. It’s not the end of the bull market, it’s the start of the bull market and recent listings have shown proof of this.”

ETH is trading for $4,002 at time of writing, down 4.5% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Law Firms Take Action Against Corporations Amid Rising Investor Lawsuits

- U.S. law firms like Schall and Gross are leading class-action lawsuits against corporations for alleged investor misrepresentations across sectors. - Cases involve DexCom , MoonLake , Beyond Meat , and Stride , accusing them of concealing risks, overstating drug efficacy, and inflating enrollment figures. - Legal actions highlight SEC's intensified focus on biotech disclosures and edtech compliance, with deadlines set for investor claims by late 2025-2026. - These lawsuits emphasize corporate accountabil

Solana News Update: Solana ETFs Attract $476M While Death Cross and $120 Support Level Approach

- Solana ETFs attract $476M in 19 days, driven by Bitwise's 0.20% fee BSOL ETF with $424M inflows. - Technical indicators show a death cross and $120-$123 support test, with RSI at oversold 33 amid stagnant price action. - Institutional confidence grows via Franklin Templeton's fee-waiver strategy, contrasting Bitcoin/Ethereum ETF outflows of $5.34B. - Whale accumulation and on-chain growth hint at long-term buying, but $140 resistance remains unbroken despite ETF inflows.

XRP News Today: ADGM's Authorization of RLUSD Establishes International Standard for Institutional Stablecoin Compliance

- Ripple's RLUSD stablecoin gains FSRA approval for institutional use in Abu Dhabi's ADGM, effective November 27, 2025. - The $1.2B market-cap stablecoin features 1:1 USD reserves, third-party audits, and compliance with ADGM's transparency standards. - ADGM's approval aligns with its strategy to position Abu Dhabi as a global digital asset hub through regulated fiat-referenced tokens. - Ripple's Middle East expansion includes partnerships with UAE banks and regulatory licenses in Dubai, Bahrain, and Afric

Pi Network Boosts Web3 Gaming Innovation Through New Strategic Partnership