3 Altcoins To Watch This Weekend | October 4 – 5

SPX, Zcash, and BNB are the top altcoins to watch this weekend. Each faces critical resistance levels that could define their next moves.

With Bitcoin closing in on the ATH, the market seems to be opening up to the altcoins as well. This makes the coming couple of days crucial for crypto tokens as they could be seeing some gains.

BInCrypto has analysed three such altcoins for the investors to watch over this weekend.

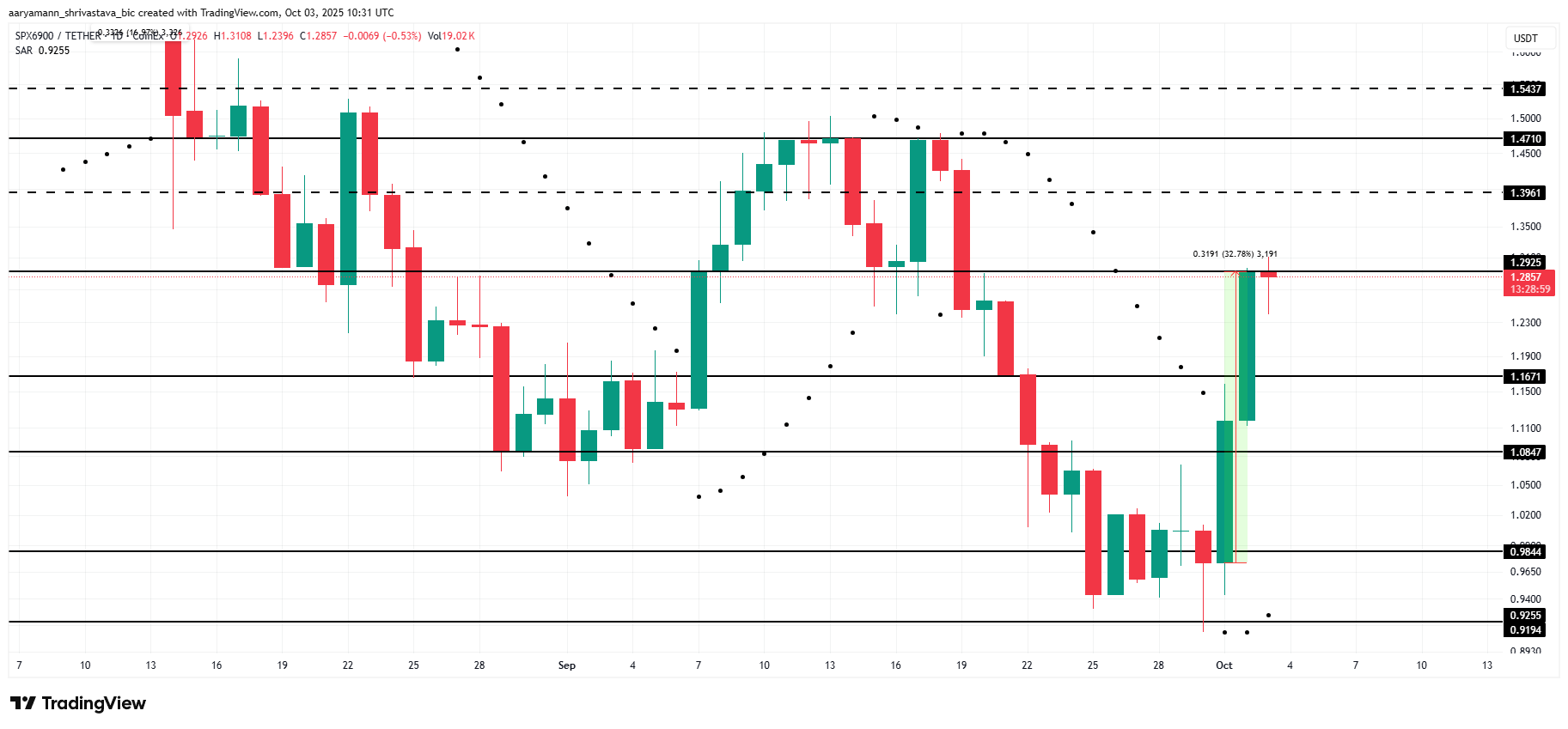

SPX6900 (SPX)

SPX price surged 32.7% in the last 48 hours, making it one of the best-performing meme coins of the week. The token is trading at $1.28, just under the $1.29 resistance level, as investors watch closely for confirmation of a sustained breakout.

Technical indicators suggest bullish momentum is building. The Parabolic SAR is positioned below the candlesticks, signaling an uptrend. If the rally continues, SPX could push past $1.39 and test $1.47, marking a three-week high and erasing recent losses while boosting investor confidence in the token’s recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

SPX Price Analysis. Source:

SPX Price Analysis Source

SPX Price Analysis. Source:

SPX Price Analysis Source

However, downside risks remain. If weekend selling pressure builds, SPX could face a pullback. A decline below the $1.16 support level would weaken the bullish outlook and trigger further caution among traders. Such a drop could undo recent gains.

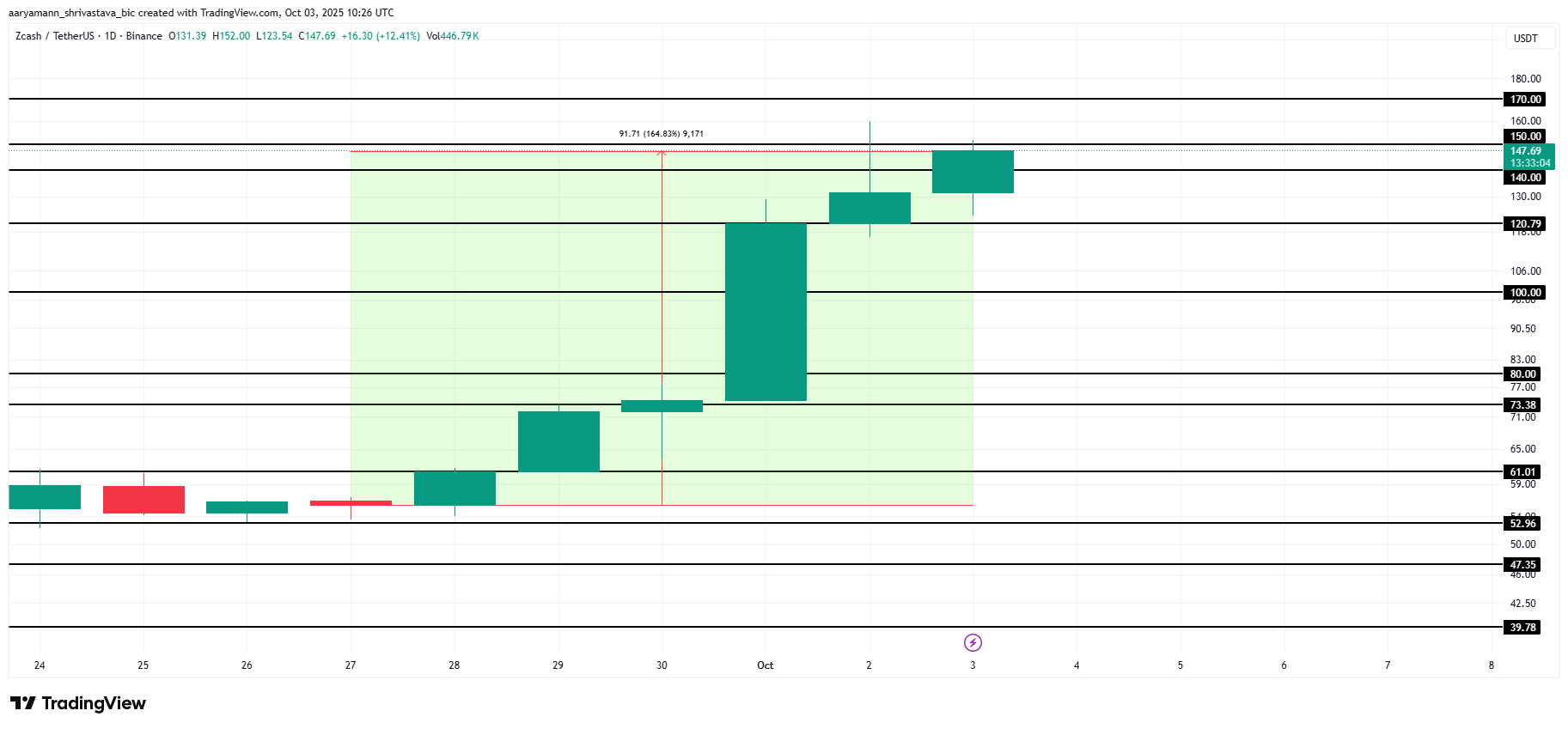

Zcash (ZEC)

Another one of the altcoins to watch this weekend is ZEC, which has emerged as one of the top-performing altcoins in recent days, currently trading at $147. The token surged 164.8% over the past week, marking one of its strongest rallies in years. With momentum building, ZEC is now eyeing the $150 resistance level as its next target.

If ZEC breaches $150, the altcoin could extend its rally toward $170. The surge has already pushed the cryptocurrency to a three-and-a-half-year high, reinforcing bullish sentiment. This milestone positions ZEC for potential further gains, as market optimism grows around its role as a leading privacy-focused digital asset.

ZEC Price Analysis. Source:

ZEC Price Analysis Source

ZEC Price Analysis. Source:

ZEC Price Analysis Source

However, risks of a correction remain. If investors begin taking profits after the recent rally, ZEC could face sharp downside pressure. A drop through $120 would expose the token to further losses, potentially slipping below $100. Such a decline would invalidate the bullish thesis and trigger caution among traders.

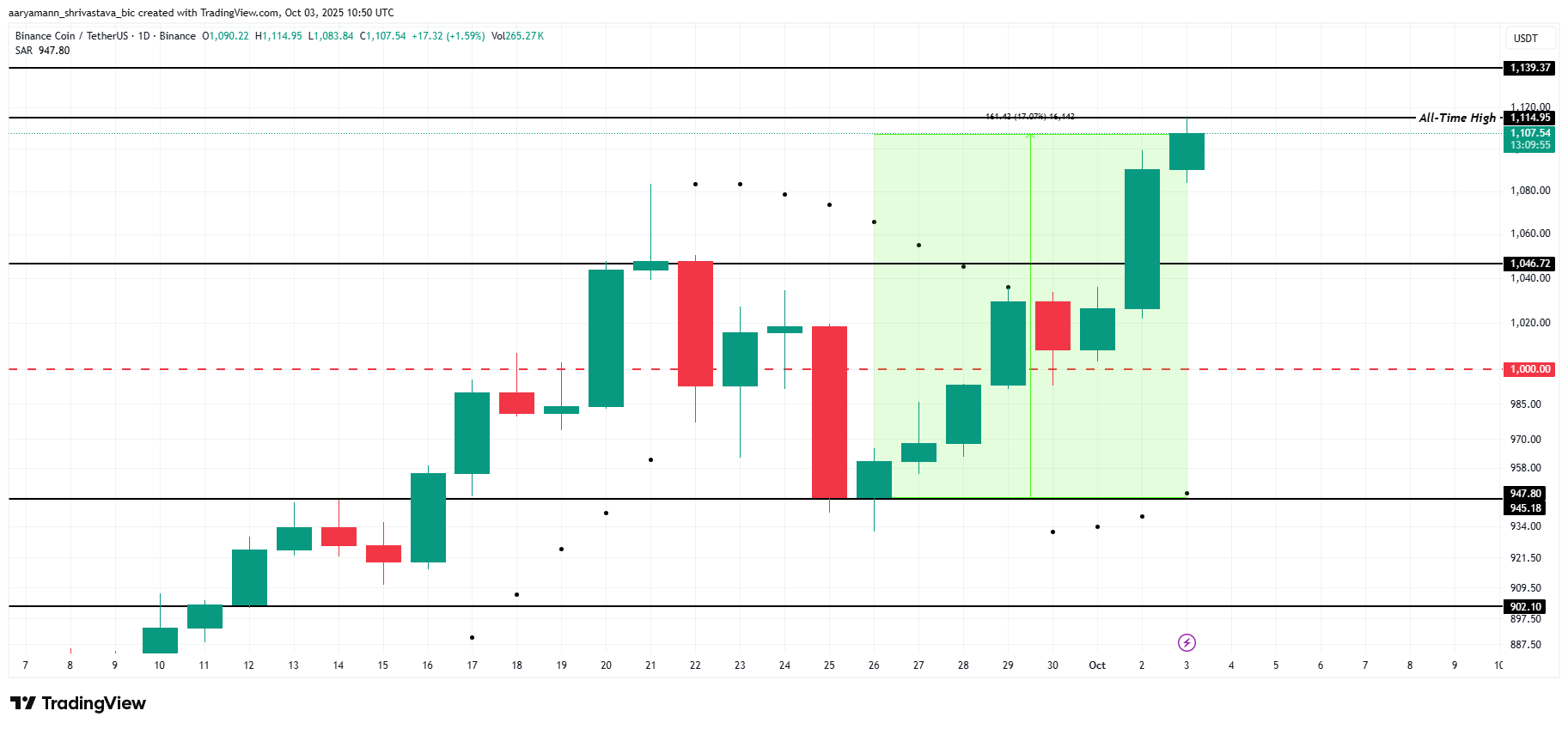

BNB

BNB is among the best-performing top altcoins this week, surging 17% in just seven days. The cryptocurrency is currently trading at $1,107, reflecting strong market demand. This performance reinforces its position as one of the leading assets.

The rally also saw BNB form a new all-time high at $1,114. Technical indicators such as the Parabolic SAR point to an active uptrend. If momentum holds, BNB could breach $1,139 and move even higher, potentially setting another ATH and attracting additional investor interest into the token.

BNB Price Analysis. Source:

BNB Price Analysis Source

BNB Price Analysis. Source:

BNB Price Analysis Source

Still, downside risks remain in play. If profit-taking or bearish market cues emerge, BNB may fall to its $1,046 support level. A breakdown below this floor would open the door to a decline toward $1,000. Any further drop under this level would invalidate the bullish thesis completely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin surges to $90K—Is this a sign of a new cycle or an early warning of another downturn?

- Bitcoin surged past $90,000 amid November's 29% drop from its October $126,000 peak, signaling a tentative recovery. - Ethereum , Solana , and other major cryptos rose 3-5%, while the Crypto Fear & Greed Index improved slightly to 15. - Technical indicators show Bitcoin testing critical levels, with analysts divided on whether $90,000 marks a cyclical bottom or temporary respite. - Institutional flows and on-chain data reveal mixed sentiment, as Fed policy uncertainty and bearish structures persist. - Lo

The Iceberg Phenomenon: Unseen Dangers of AI’s Labor Force Surface Across the Country

- MIT's Iceberg Index reveals AI could replace 11.7% of U.S. jobs ($1.2T in wages), impacting sectors like finance and healthcare beyond tech hubs. - The tool maps 151M workers across 923 occupations, highlighting hidden risks in routine roles (e.g., HR, logistics) versus visible tech layoffs. - States like Tennessee and Utah use the index for reskilling strategies, while C3.ai partners with Microsoft to expand enterprise AI solutions. - Despite C3.ai's market expansion, its stock faces volatility, reflect

Where Saving Animals and Supporting People Come Together: The Gentle Barn's Comprehensive Approach

- The Gentle Barn, a California-Tennessee sanctuary, merges animal rescue with human emotional healing through acupuncture, mobility aids, and therapeutic interactions. - Its volunteer programs and $75 season passes support financial sustainability while fostering compassion between humans and rescued animals like turkeys and hoofless goats. - The nonprofit's holistic model attracts attention as a case study in combining veterinary care with mental health initiatives, despite scalability challenges in nonp

XRP News Today: With Tether and USDC under examination, RLUSD from the UAE stands out as a regulatory-compliant stablecoin option.

- Ripple's RLUSD stablecoin received ADGM approval as a regulated fiat-referenced token in Abu Dhabi, enabling institutional use in payments and treasury management. - Pegged 1:1 to the USD with NYDFS oversight, RLUSD ($1.2B market cap) offers compliance-driven alternatives to USDT/USDC amid global regulatory scrutiny. - UAE's ADGM-DIFC regulatory framework positions the region as a crypto innovation hub, with Ripple expanding partnerships through Zand Bank and Mamo fintech . - The approval aligns with UAE