How a Trader Turned $3,000 Into $2 Million On BNB Within a Week

A crypto trader made $2 million from just $3,000 by sniping the “4” token seconds after launch on BNB Chain — a masterclass in timing and risk.

A crypto trader on the BNB Chain recently turned a modest $3,060 investment into nearly $2 million in less than a week.

On-chain data shows that the wallet 0x872a…e6b8 made a series of early buys in a new meme coin called 4, using automation tools to capture explosive gains before the wider market caught on.

A New Meme Born from a Hack

The 4 token emerged from a viral incident. In late September, a hacker exploited a BNB Chain wallet and stole around $4,000.

The event became a meme, and within hours, the community launched “4” ($4) as a playful tribute.

The coin gained traction after BNB founder Changpeng Zhao (CZ) shared posts about the hack, unintentionally fueling interest. Traders piled in, and within days, $4’s price skyrocketed more than 600×.

Liquidity on PancakeSwap jumped from less than $100,000 to over $2.6 million, turning it into one of BNB’s most traded meme assets of the week.

The Perfectly Timed Entry

The trader’s first purchase was logged at 04:23 UTC on October 1 — within minutes of the token’s deployment. He bought 11.58 million $4 tokens for 2 BNB ($2,052), then followed up with another 5.28 million $4 tokens for 1 BNB ($1,026).

This placed his total entry at 16.86 million $4 tokens for 3 BNB, at an average price near $0.00000018 per token. At the time, the market had only a few dozen holders.

He used the Telegram trading bot Maestro, which allows traders to snipe tokens automatically when liquidity is added to PancakeSwap.

This automation gave him a millisecond-level advantage, letting him buy before most retail traders even noticed the token.

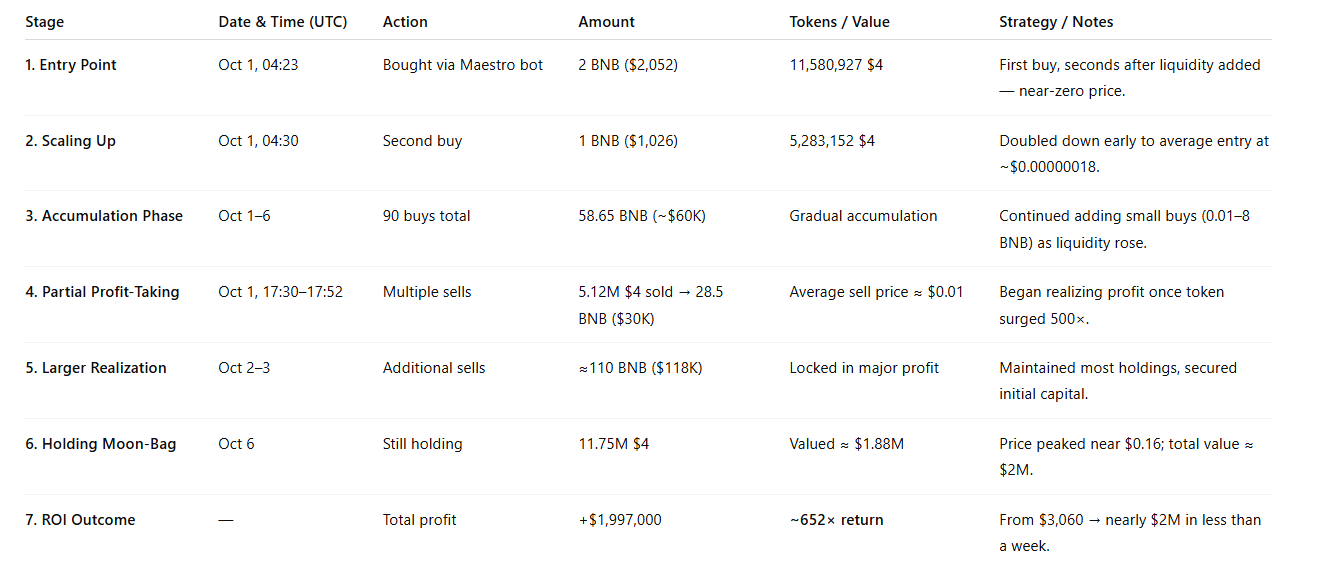

Quick Summary of How the Trader Made $2 Million in Less Than a Week

Quick Summary of How the Trader Made $2 Million in Less Than a Week

How the Strategy Worked

The wallet began accumulating heavily through the first week of October.

Between October 1 and 6, it executed over 90 swap transactions, spending a total of 58.65 BNB (~$60,000) as the token gained traction.

On October 1 alone, he made dozens of micro-purchases ranging from 0.01 to 1 BNB, averaging down his cost and increasing exposure as liquidity deepened.

When prices spiked later that day, he started selling small batches. Six key transactions between 17:33 and 17:52 UTC show him offloading 5.12 million $4 tokens for about 28.5 BNB ($30,000).

Over the next few hours, he gradually sold 110 BNB in total, locking in about $118,000.

By this point, the coin’s price had risen more than 500× from his entry. Yet he still held 11.75 million $4, valued around $1.88 million at the October 6 market price of $0.160.

His total haul stood near $2 million, representing a 652× return.

Why It Worked

Several factors aligned for this outcome:

- Speed: Using Maestro, he entered seconds after liquidity was added — before bots and retail could compete.

- Low Cost: Buying at the launch price gave him an extremely low cost basis.

- Viral Catalyst: CZ’s repost of the meme incident sent traders flocking to the token.

- Liquidity Growth: Rapidly expanding liquidity prevented slippage during his large sells.

- Discipline: He sold early enough to recover costs but kept most holdings to ride the surge.

This combination — fast entry, low cost, and controlled profit-taking — made his position nearly risk-free after early gains.

Can Others Replicate This?

In theory, yes. Traders can use tools like Maestro or BananaGun to monitor token deployments, buy in early, and automate partial exits.

The idea is to capture small, early positions in high-risk launches while cutting exposure once liquidity rises.

However, this strategy requires skill, capital discipline, and awareness of extreme risks.

The Risks Behind the Hype

- Rug Pulls: Many new tokens vanish or disable sells after attracting buyers.

- Slippage and Gas: In volatile launches, fees can exceed profits.

- Liquidity Traps: Early buyers can get stuck if the token never lists or loses hype.

- Timing Risk: A delay of even a few seconds can mean buying 100× higher.

For every successful trade like this, there are hundreds that end in total loss.

What It Means for the Market

The “4” story highlights both sides of today’s meme coin culture — fast profits fueled by automation, but also huge risk.

As tools like Maestro democratize bot-speed trading, early liquidity events have become the new battleground for retail and professional traders alike.

This trader’s success wasn’t luck alone. It was timing, automation, and discipline — executed perfectly at the start of a viral wave. But for most, chasing the next “4”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia Turns to Stablecoins to Address Inflation and Currency Instability

- Bolivia legalizes stablecoin integration into banking , allowing crypto-based accounts and loans to combat inflation and currency devaluation. - Crypto transaction volumes surged 530% in 2025, driven by $15B in stablecoin use as businesses adopt USDT for cross-border payments. - Policy mirrors regional trends, with stablecoins recognized as legal tender to stabilize the boliviano amid 22% annual inflation and dollar shortages. - Challenges include AML safeguards, tax frameworks, and public trust, as regu

Bitcoin Updates: Bitcoin's Decline Sparks Altcoin Battle: ADA's $0.43 Support Faces Pressure

- ADA holds $0.43 support as Bitcoin’s seven-month low of $80,000 pressures altcoin market volatility. - Altcoin fragility stems from Fed’s high-rate signals, reduced institutional inflows, and technical breakdowns in key resistance levels. - Bitcoin’s $90,000 support breach triggered cascading liquidations, while ADA’s $0.43 level shows increased on-chain accumulation. - Infrastructure innovations like GeekStake’s staking protocol aim to stabilize networks during volatility without price forecasts. - Mark

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u