Elon Musk Triggers Another Meme Coin Rally

Elon Musk’s Grok video starring Floki reignited the FLOKI token’s momentum with a 30% surge, reversing losses from crypto’s recent crash and drawing new investor focus.

Elon Musk caused FLOKI to rally after posting a new video on social media. Demonstrating Grok’s video generation capabilities, Musk employed Floki as an unofficial mascot.

Although FLOKI recently rallied after a European ETP listing, the Black Friday crash erased all these gains. The 30% growth after Elon’s post has done a lot to help the token rebound.

Elon Causes FLOKI Rally

Elon Musk has had an explosive impact on the meme coin sector, with his business decisions and social media posts alike spurring huge token movements.

Today has been no different, as Elon posted a new video starring Floki the mascot, causing the related asset to rise dramatically:

Flōki is back on the job as 𝕏 CEO!

— Elon Musk (@elonmusk)

Specifically, Elon posted this Floki video to demonstrate Grok’s AI-generated video capabilities. He has also caused meme coin rallies by teasing these features in development, but it looks like X won’t be splitting Grok videos into a separate app for the moment.

Chaotic Price Fluctuations

In any event, Elon’s post was a huge boon for FLOKI, the meme coin. The token crashed hard after crypto’s Black Friday earlier this month, and it has been stagnant until today.

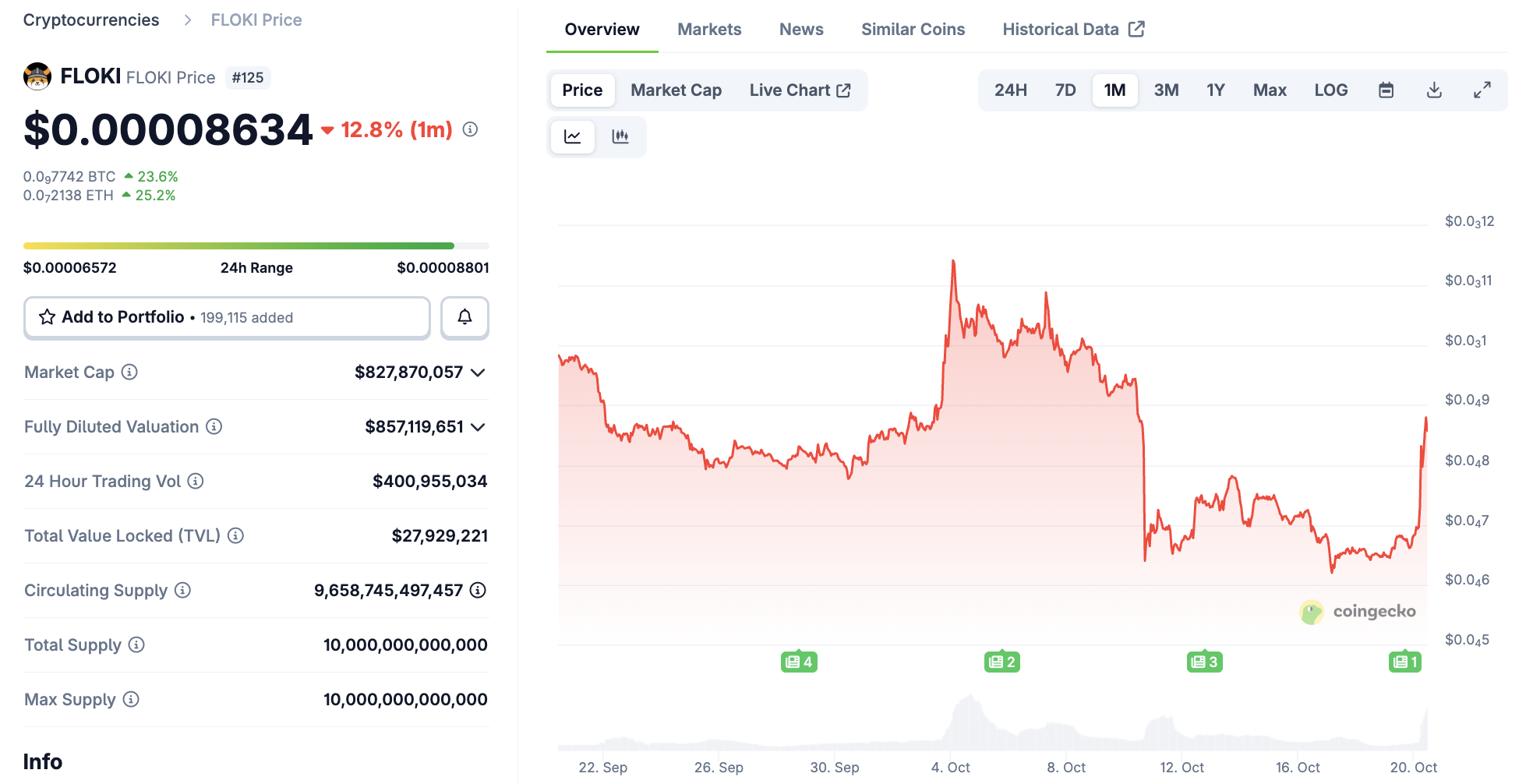

With this new post, however, FLOKI rallied around 30%, recovering much of the lost gains from the crash:

FLOKI Price Performance. Source:

FLOKI Price Performance. Source:

In other words, if Elon Musk keeps demonstrating interest in Floki like this, it could cause a wider recovery. Earlier this month, a FLOKI ETP launched in Europe, providing a big boost to the token. The Black Friday crash erased all these gains, however, and Elon seems like the best prospect to reverse it.

Of course, Elon’s social media posts might not be a reliable boost for FLOKI in the long run. It’s impossible to predict which token he’ll fixate on; although CZ shows persistent support for several projects, Musk’s endorsements are often momentary.

Whatever happens next, this has been a big boost for FLOKI. Hopefully, the project will continue capitalizing on its moment in the spotlight.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia Turns to Stablecoins to Address Inflation and Currency Instability

- Bolivia legalizes stablecoin integration into banking , allowing crypto-based accounts and loans to combat inflation and currency devaluation. - Crypto transaction volumes surged 530% in 2025, driven by $15B in stablecoin use as businesses adopt USDT for cross-border payments. - Policy mirrors regional trends, with stablecoins recognized as legal tender to stabilize the boliviano amid 22% annual inflation and dollar shortages. - Challenges include AML safeguards, tax frameworks, and public trust, as regu

Bitcoin Updates: Bitcoin's Decline Sparks Altcoin Battle: ADA's $0.43 Support Faces Pressure

- ADA holds $0.43 support as Bitcoin’s seven-month low of $80,000 pressures altcoin market volatility. - Altcoin fragility stems from Fed’s high-rate signals, reduced institutional inflows, and technical breakdowns in key resistance levels. - Bitcoin’s $90,000 support breach triggered cascading liquidations, while ADA’s $0.43 level shows increased on-chain accumulation. - Infrastructure innovations like GeekStake’s staking protocol aim to stabilize networks during volatility without price forecasts. - Mark

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u