Billions on the Move: October’s Winners and Losers in the Stablecoin Market

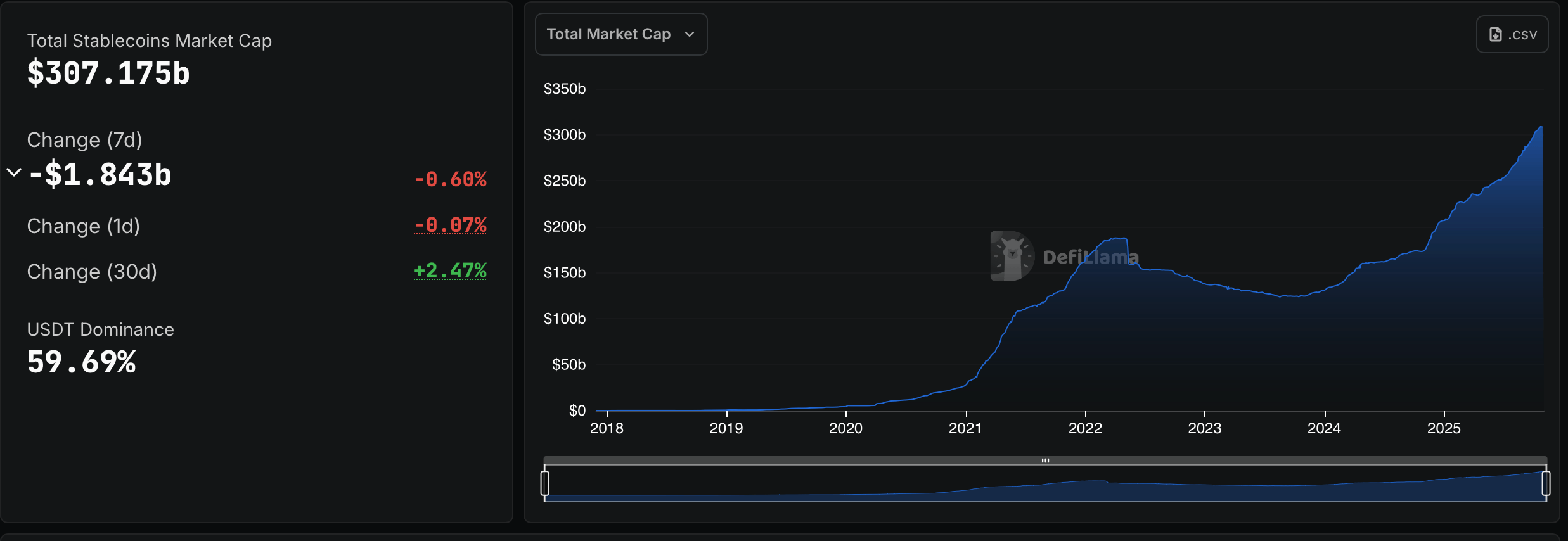

The latest data from defillama.com shows the stablecoin market didn’t skip a beat in October, climbing 2.47% even after trimming $1.84 billion in the past week. Tether ( USDT) was the main heavyweight, swelling its market cap by roughly $7.78 billion during the monthlong stretch.

October’s Stablecoin Snapshot: Who Rose, Who Fell, and Who’s Still Dominant

USDT continues to reign supreme, Defillama figures show it flexing a 4.43% monthly climb to a hefty $183.35 billion market cap. It currently commands 59.69% of the stablecoin sector’s $307.175 billion total value.

Circle’s USDC had its own moment in the spotlight this week, finally breaking past the $75 billion milestone. The runner-up stablecoin tacked on $1.744 billion, marking a 2.36% gain and landing at a tidy $75.51 billion cap.

Ethena’s USDe took a nosedive in October, tumbling 36.57% to settle at $9.36 billion after losing a hefty $5.39 billion in just a month. Sky Dollar (USDS) had a brighter story, leaping 21.67% to hit $5.19 billion, while DAI barely budged—up a modest 0.61% to $5.10 billion.

World Liberty Financial’s USD1 added some flair with an 11.08% lift to $2.98 billion, and Paypal’s PYUSD joined the climb, popping 14.82% to reach $2.81 billion. According to Defillama, Blackrock’s BUIDL inched up 2%, bringing its total to $2.59 billion.

Falcon USD (USDf) took flight with a 24.35% jump to $2.02 billion, while Ethena’s USDtb barely moved, ticking up 0.17% to $1.83 billion. Global Dollar (USDG) rocketed 37.84% to $991.35 million, and rounding out the top 12, Ripple’s RLUSD kept pace with a 21.97% climb to $963.09 million.

Overall, the stablecoin sector showed a mix of steady gains and sharp dips in October, with USDT and USDC tightening their grip on dominance. While Ethena’s USDe stumbled, several competitors like USDG and RLUSD posted eye-catching growth.

The month’s movements highlight how capital keeps flowing across the stablecoin spectrum, even amid the shifting market tides we’ve seen in recent times.

FAQ ❓

- What is the total value of the stablecoin market?

The global stablecoin market is valued at about $307.175 billion as of Oct. 2025. - Which stablecoin holds the largest market share?

Tether ( USDT) leads the pack with 59.69% of the total stablecoin market. - How much is Circle’s USDC worth now?

USDC recently crossed the $75 billion mark in market capitalization. - Which stablecoin saw the biggest decline in October?

Ethena’s USDe dropped 36.57%, losing more than $5 billion in value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli

The Federal Reserve's Policy Change and Its Effects on Solana (SOL): How Infrastructure Funding and Clearer Regulations Are Speeding Up Blockchain Adoption in 2025

- Fed's 2025 policy clarity and liquidity injections accelerated Solana's institutional adoption in blockchain finance. - Regulatory frameworks like OCC Letter 1186 and GENIUS Act enabled banks to engage with Solana's stablecoin and DeFi infrastructure. - Solana's Alpenglow upgrades (100ms finality) and $508M funding fueled partnerships with Visa , Western Union , and Coinbase . - $2B ETF inflows and $1T DEX volume highlight Solana's role in reshaping cross-border payments and DeFi ecosystems.