November 4th Market Key Intelligence, How Much Did You Miss?

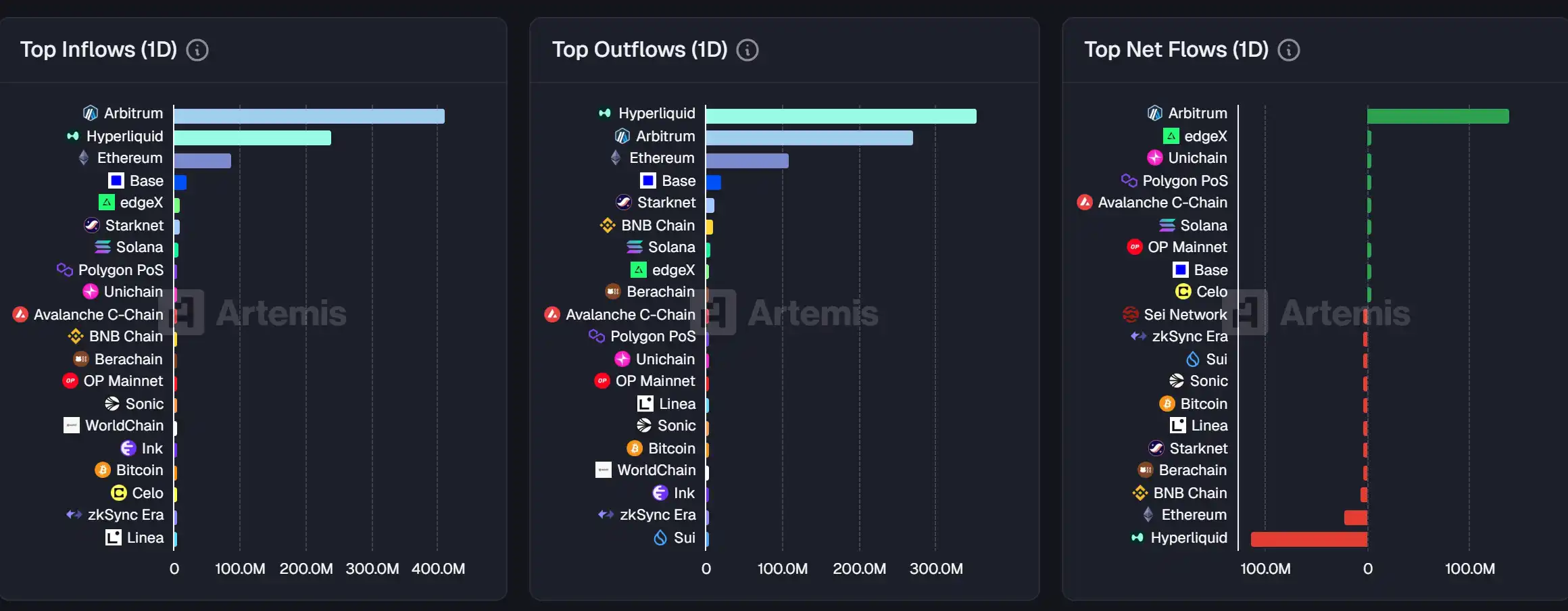

1. On-chain Funds: $139.8M USD inflow to Arbitrum today; $113.8M USD outflow from Hyperliquid 2. Largest Price Swings: $DCR, $XUSD 3. Top News: WILD experiences cascading liquidations leading to flash crash, Arthur Hayes posts encouraging bottom-fishing orders

Featured News

1. WILD Experiences Flash Crash Due to Cascade Liquidations, Arthur Hayes Posts Long Calls for Bottom Fishing

2. JELLY Surges 130% in 24 Hours, Market Cap Peaks Above $2.2 Billion

3. ASTER Skyrockets Over 7.7% in a Short Time, Market Cap Reaches $16.75 Billion

4. Pre-market Crypto Concept Stocks in the U.S. Experience a General Decline, MSTR Drops by 3.30%

5. Multiple New Meme Coins on the BSC Chain See Price Drops Exceeding 40%, GIGGLE's Market Cap Falls Below $50 Million

Trending Topics

Source: Kaito

Below is the Chinese translation of the original content:

[BAL]

Today's core discussion around BAL revolves around a major exploit suffered by Balancer V2 pools, resulting in a multi-chain loss of over $110 million. The hacker targeted Balancer V2's treasury and liquidity pools, exploiting a vulnerability in smart contract interactions to carry out the attack. The Balancer team is actively collaborating with security experts to investigate the incident and recover the stolen funds. This event has led to the temporary suspension of the Berachain network and prompted several platforms to take preventive measures. Despite this setback, the DeFi community continues to show support for Balancer, with most expressing confidence in the protocol's recovery.

[FLIPSTER]

FLIPSTER has garnered significant attention today due to its ongoing trading competition and reward activities. Participants are eagerly looking forward to earning generous USDT rewards by climbing the ranks. The competition is conducted in multiple stages with weekly rewards. Additionally, the platform has launched social activities to provide additional incentives. Community users actively engage in platform interactions, sharing experiences and strategies for climbing the leaderboard.

[BERA]

Today's BERA discussion focused on Berachain network's emergency response to a major vulnerability in Balancer V2 — a coordinated validator-led network pause. This action aims to prevent further losses and address the vulnerability through a hard fork (especially impacting the BEX platform). The community widely supported this decision, emphasizing security over strict decentralization principles. This event has highlighted the security maintenance challenges in the DeFi ecosystem and triggered discussions about the role of validators in crisis management.

[BINANCE]

Today's Binance discussion mainly revolved around various initiatives and controversies the exchange has been involved in. Binance supported the Giggle Fund through donation of trading fees and listed new tokens like Momentum (MMT) and Intuition (TRUST). Additionally, there are rumors that Wintermute may sue Binance over a recent liquidation crisis, sparking debates on the impact of this event on the cryptocurrency market. Binance founder Changpeng Zhao's (CZ) involvement in multiple projects and partnerships (including the controversial event of being pardoned by Donald Trump) has also been a focus of attention.

[METAWIN]

Today's METAWIN core discussion centered around its potential as a preferred cryptocurrency investment target, with users highlighting its gaming features such as Plinko and blackjack. The market sentiment is generally positive, with many users regretting not investing in METAWIN earlier. The discussion also touched on the platform's gaming and prediction features, which are gaining increasing user acceptance.

Featured Articles

1.《Robotics Trending: Overview of Robot Concept Projects on Virtuals》

Virtuals Protocol gained more attention recently due to the surge in the x402 protocol. Last Saturday, Virtuals' token price experienced a 35% single-day increase, although it retraced much of the gains in the following days due to overall market conditions. This "AI Agent Hub" based on the Base is still worth watching. Another hot topic lately is the robotics track, and Virtuals has maintained high interest in this area, announcing "Virtuals Robotics" on October 21st. So, what actions has Virtuals taken, and what are the robotics-related projects within its ecosystem?

2. "The Butterfly Effect of Balancer Hack: Why Did XUSD Break Its Peg?"

After the multi-chain platform fell victim to a hack, causing widespread uncertainty in the DeFi sector for several hours, swiftly carried out a hard fork, and froze the attacker's wallet. Subsequently, the price of Stream Finance's xUSD stablecoin deviated significantly from its target range, exhibiting a clear peg break.

On-chain Data

November 4th On-chain Fund Flow

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su

Bitcoin Updates: Crypto ETPs Signal Market Growth as Leverage Shares Debuts on SIX

- Leverage Shares launched the world's first 3x leveraged and -3x inverse Bitcoin/Ethereum ETPs on SIX Swiss Exchange, expanding its crypto product range to 452 offerings. - The EUR/USD-traded ETPs target sophisticated investors seeking directional exposure, aligning with SIX's 19% YoY crypto ETP turnover growth to CHF 3.83 billion. - Market timing raises concerns as Bitcoin/Ethereum fell 21%/26% in November 2025, with experts warning leveraged products could amplify losses during volatility. - SIX's regul

Ethereum Updates Today: Buterin Moves ETH to Safeguard Privacy Against Major Financial Players and Quantum Threats

- Ethereum co-founder Vitalik Buterin donated 128 ETH ($760,000) to privacy-focused apps Session and SimpleX Chat, emphasizing decentralized metadata protection and user-friendly access. - Recent 1,009 ETH transfer to Railgun protocol sparked speculation about asset reallocation, though control remains with Buterin amid mixed Ethereum price trends. - Buterin warns of existential risks: 10.4% institutional Ether ownership and quantum computing threats by 2028, advocating layered security for Ethereum's desi