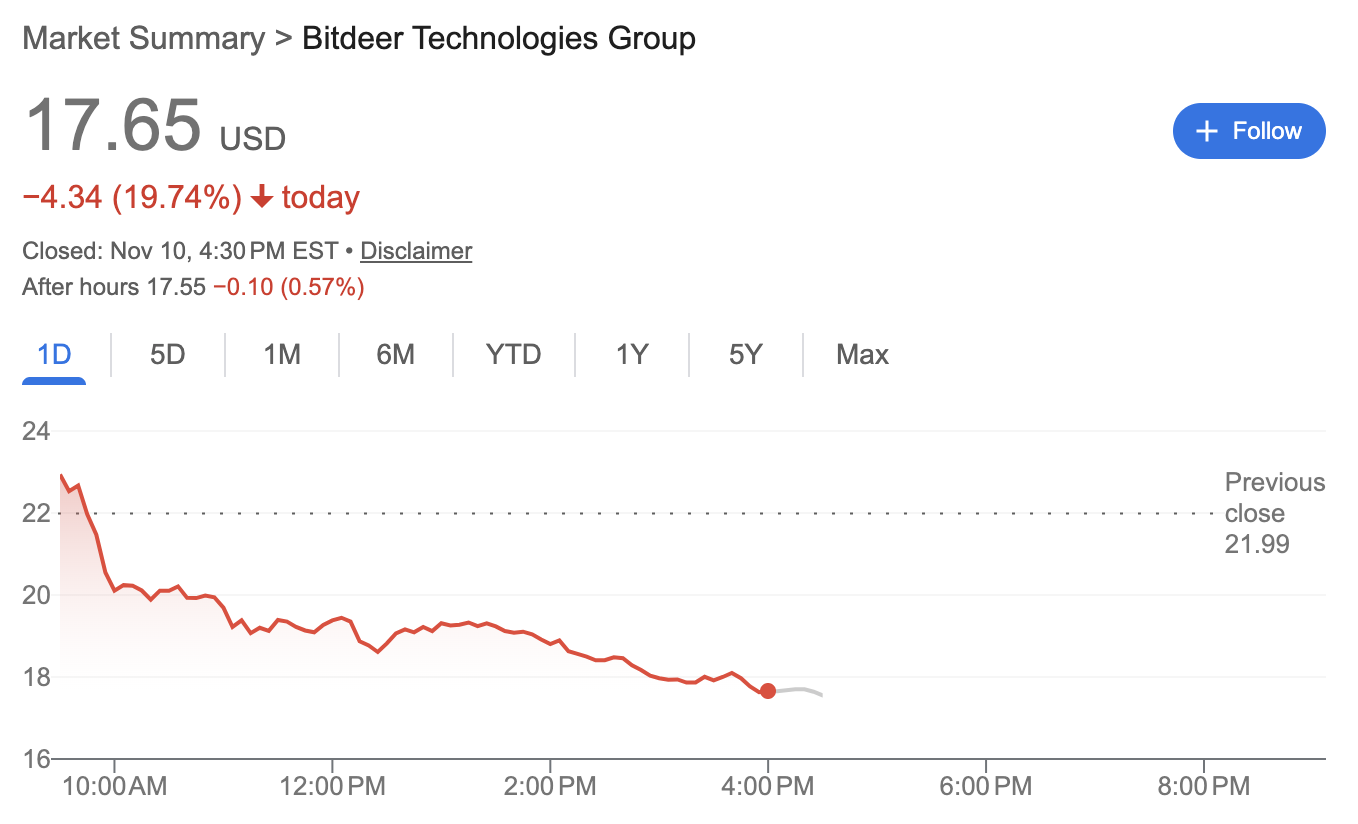

Bitdeer shares drop 20% after posting $266M quarterly loss

Shares of Singapore-based Bitcoin miner Bitdeer Technologies fell nearly 20% on Monday after the company reported a jump in quarterly losses.

Bitdeer recorded a net loss of $266.7 million for the third quarter of 2025, compared with a net loss of $50.1 million for the same period a year ago, largely due to non-cash losses resulting from the revaluation of its convertible debt.

Revenue climbed to $169.7 million, up 174% from the previous year, driven by the expansion of its self-mining operations, according to the company.

Bitdeer also reported gains in its operating performance, with adjusted EBITDA rising to $43 million from a $7.9 million loss in the same period in 2024. The company also doubled its Bitcoin production, mining 1,109 BTC during the quarter.

Bitdeer reported its first revenue from high-performance and AI cloud services, bringing in $1.8 million in Q3 as it began shifting part of its computing power toward artificial intelligence.

Matt Kong, chief business officer at Bitdeer, said the company was “uniquely positioned to capitalize” on AI and the surge in demand for computing power. He added that allocating “200 MW of power capacity to AI cloud services could generate an annualized revenue run-rate exceeding $2 billion by the end of 2026.”

Bitdeer ended the quarter holding 2,029 BTC, up from 258 BTC a year earlier, and managed 241,000 mining rigs, compared with 165,000 at the same time last year.

Related: EToro stock jumps on Q3 results, $150M buyback plan

Bitcoin miners turn to AI

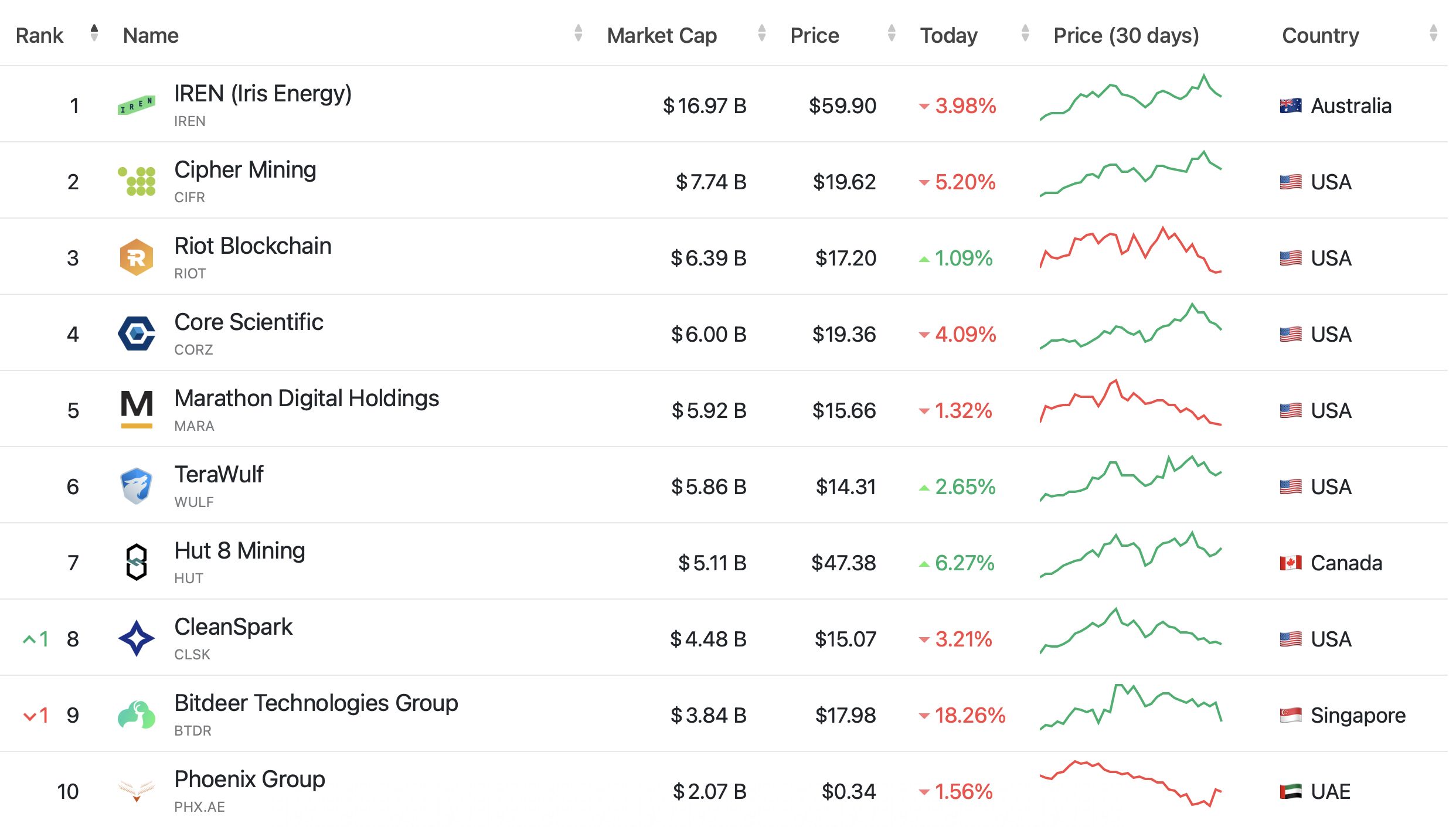

An increasing number of Bitcoin mining companies are pivoting to AI and high-performance computing (HPC), repurposing a portion of their power capacity to meet the fast-growing demand for computing power.

In August, MARA Holdings announced a $168 million deal to acquire a 64% stake in Exaion, a subsidiary of France’s EDF, to expand into low-carbon AI infrastructure, while TeraWulf signed 10-year colocation agreements with AI company Fluidstack worth $3.7 billion in contract revenue.

On Nov. 3, Bitcoin miner IREN announced a five-year, $9.7 billion GPU cloud services deal with Microsoft, giving the tech giant access to Nvidia GB300 chips hosted in IREN’s data centers.

While the pivot by Bitcoin miners into AI and HPC has been picking up momentum this year, it isn’t entirely new.

In July 2023, HIVE Blockchain Technologies rebranded as HIVE Digital Technologies, reflecting its shift to an HPC strategy, alongside its traditional cryptocurrency mining operations.

In March 2024, Core Scientific signed a multi-year, $100 million deal with GPU cloud firm CoreWeave to host HPC workloads at its Texas data center.

Magazine: How Chinese traders and miners get around China’s crypto ban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin's Unstable Holiday Periods Hide Average Gains of 6%

- Bitcoin's Thanksgiving-to-Christmas performance shows equal odds of rising or falling, with a 6% average seasonal return despite volatility. - Historical extremes include a 50% 2020 rally and 2022's 3.62% drop post-FTX collapse, amid a $2.49-to-$91,600 long-term surge since 2011. - 2025's $91,600 price reflects ongoing recovery from 2024's $95,531 peak, with institutional crypto adoption and macroeconomic factors shaping future trajectories. - Analysts advise dollar-cost averaging for retail investors, w

Australia Strikes a Balance Between Fostering Crypto Innovation and Safeguarding Investors with Updated Regulations

- Australia introduces 2025 Digital Assets Framework Bill to regulate crypto platforms under ASIC, creating "digital asset platform" and "tokenized custody platform" licenses. - The framework mandates custody standards, transparency requirements, and lighter regulations for small operators (<$5k per customer) to balance innovation with investor protection. - Global alignment with UAE and EU crypto regulations is emphasized, while addressing risks from past failures like FTX through stricter enforcement and

PENGU Token's Latest Price Fluctuations and Blockchain Indicators: An Analytical Perspective on Technical Factors and Institutional Activity

- PENGU token's recent volatility and on-chain activity spark debate over institutional involvement in the crypto market. - Technical indicators show conflicting signals: overbought RSI vs. positive MACD/OBV momentum since November 2025. - Whale accumulation and Solana integration suggest strategic buying, while team wallet outflows highlight market uncertainty. - Social media sentiment drives short-term price swings, but structural risks like tokenomics and regulatory ambiguity persist. - Institutional ad

GameStop's Profit Strategy: Short Sellers, Brick-and-Mortar Stores, and Interest Rate Expectations Intersect

- GameStop (GME) shares rose near 52-week lows amid high short interest and retail-driven speculation, with a potential short squeeze looming as open options activity surged. - Institutional investors cut $5.4B in MicroStrategy (MSTR) holdings, linking crypto-focused MSTR to GME's 2021 meme stock dynamics amid MSCI index exclusion risks. - A December Fed rate cut (85% probability) could boost retail spending and speculative appetite, countering bearish positioning despite GME's 21.8% Q3 revenue growth. - A