TRUMP Token Explodes as $2,000 “Dividend” Promise Fuels Hype

The Official Trump (TRUMP) token has rallied sharply in response to renewed attention around Donald Trump’s proposed “tariff dividend” — a plan to send $2,000 checks to low- and middle-income Americans funded by import taxes. While the plan faces significant fiscal scrutiny, the market reaction suggests traders are pricing in the populist appeal and potential momentum such announcements bring to the Trump-themed digital asset space.

What Sparked the Surge

Trump’s weekend post promising a “$2,000 dividend” per American drew instant headlines and controversy. The proposal claims import tariffs would generate enough revenue to fund these payments while paying down national debt — a figure economists have quickly challenged.

According to the Tax Foundation, tariffs have raised about $120 billion so far, while the proposed payouts would cost an estimated $300 billion. Treasury Secretary Scott Bessent later walked back the comment, framing the “dividend” as a reflection of upcoming tax cuts rather than new checks. Still, in the world of meme and political tokens, perception drives price faster than policy. Traders saw the news as another round of populist fuel for TRUMP — a token whose price often mirrors the former president’s media exposure and campaign rhetoric.

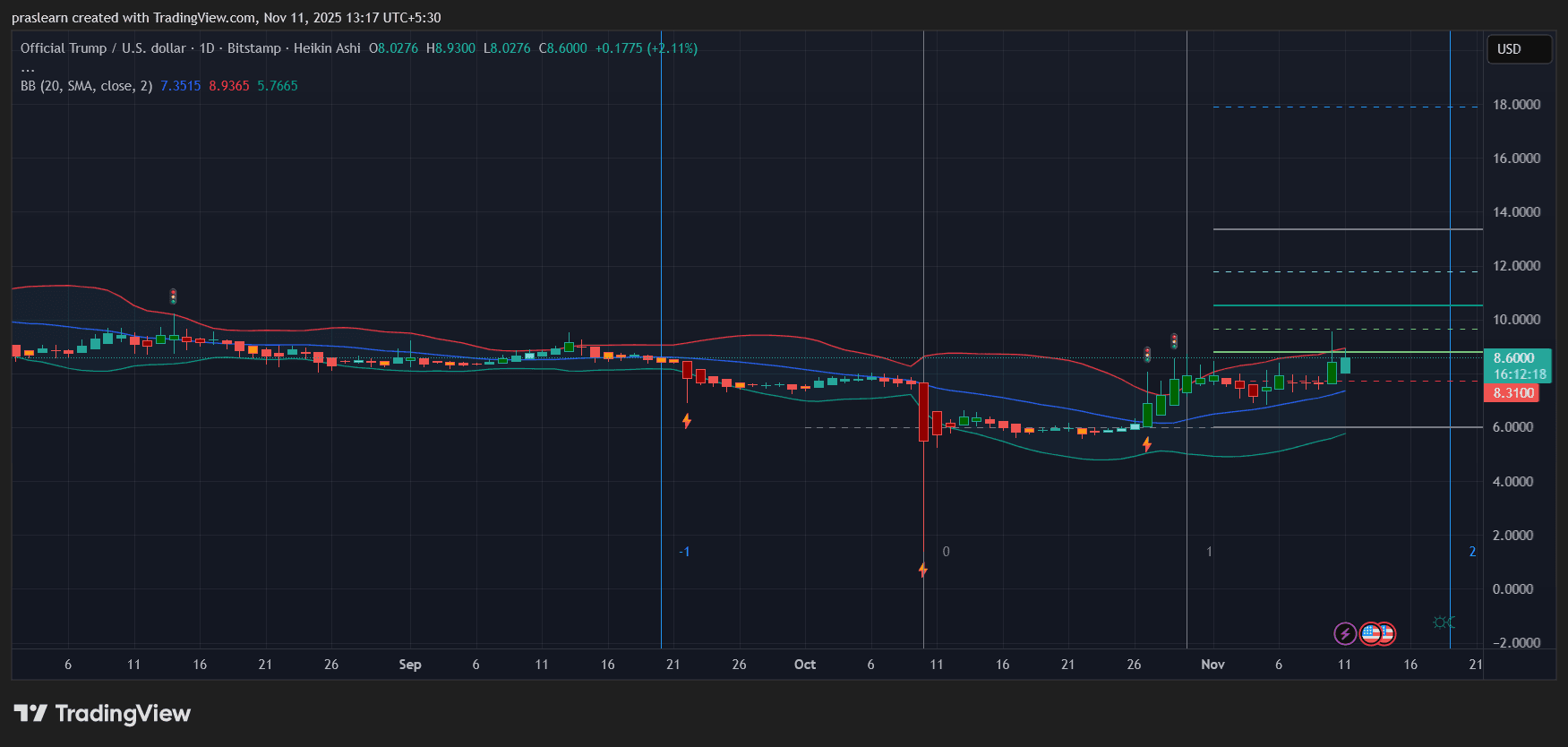

OFFICIAL TRUMP Chart Analysis: TRUMP Breaks Out from Consolidation

TRUMP/USD daily Chart- TradingView

TRUMP/USD daily Chart- TradingView

On the TradingView daily chart, TRUMP price is showing clear signs of renewed bullish strength. The Heikin Ashi candles reveal a decisive breakout above the $8 resistance zone, closing around $8.6 with a 2.11% daily gain. This move follows several weeks of sideways consolidation between $6 and $8.

The Bollinger Bands (20, 2) show widening volatility, with price now testing the upper band near $8.9. The middle band around $7.3 is acting as dynamic support, suggesting buyers are regaining control. The next resistance levels lie around $10, $12, and $14 — all Fibonacci extension targets that could come into play if momentum sustains.

Conversely, the lower band near $5.7 remains a key support level; a daily close below that would invalidate the short-term uptrend.

Momentum and Volume Patterns

The uptick in green candles since late October signals strong buying volume entering the market. The shift from low volatility to expanding Bollinger width often precedes trend acceleration. OFFICIAL TRUMP (TRUMP) price has also reclaimed its 20-day moving average, a critical reversal signal after a multi-month decline from August to October.

Momentum traders are likely eyeing a breakout confirmation above $9 for continuation. If the move holds above $8.5, the next leg could target the $10–$12 zone, while a failure to hold that range could trigger a retest of $7.2.

Political Narrative Meets Speculative Demand

The correlation between Trump’s political statements and the TRUMP token’s market activity remains strong. Each major social post or media appearance tends to trigger short bursts of speculative buying, followed by consolidation. The $2,000 dividend proposal, while economically dubious, taps into the populist narrative that fuels the project’s community.

With the 2025 political season intensifying and debates over tariffs, tax cuts, and economic populism back in the spotlight, the TRUMP token sits at the intersection of politics and speculation — a potent mix for volatility.

TRUMP Price Prediction: Can TRUMP Price Break $10?

If bullish sentiment continues and Bitcoin holds its broader uptrend, $TRUMP could challenge $10–$12 within the next two weeks. The psychological resistance at $10 is likely to see short-term profit-taking, but a close above that level could trigger a rapid move toward $14–$16 based on technical extensions.

However, traders should be cautious. The rally is sentiment-driven and not supported by fundamentals. Any retraction of Trump’s claims or a shift in media focus could pull $TRUMP back toward its $6–$7 base. The probability of a short squeeze remains high given recent low liquidity conditions.

Bottom Line

TRUMP price latest breakout reflects how political narratives continue to move the token more than economics. Whether or not Americans ever see a “tariff dividend,” the announcement has already paid dividends to traders who anticipated a volatility spike.

If the market holds above $8.3 support, momentum could carry TRUMP token toward double digits in the near term. But given its sensitivity to headlines, traders should keep stops tight — because in the TRUMP market, policy promises can fade faster than a campaign tweet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH drops 7.15% in a day as several top executives offload shares through scheduled selling plans

- DoorDash (DASH) fell 7.15% on Nov 26, 2025, but rose 71.59% year-to-date amid insider sales by executives via Rule 10b5-1 plans. - CFO Ravi Inukonda and President Prabir Adarkar sold $2.7M and $4.6M of shares respectively, while analysts raised price targets to $260. - Institutional buyers like XTX Topco Ltd and Summit Global Investments added shares, reflecting ongoing confidence in DoorDash's international expansion and DashPass strategy. - Upcoming Q4 2025 earnings on Feb 10, 2026, will test market se

XRP News Update: XRP ETFs See Inflows Soar While Prices Drop: The $628 Million Inflow Mystery

- XRP ETF inflows hit $164M daily as Bitwise, Grayscale, and Franklin Templeton drive institutional adoption, surpassing $628M total assets. - Ripple's 2025 SEC settlement and RLUSD stablecoin boosted confidence, but XRP's price fell below $2 amid whale sales of 200M tokens. - CME's XRP futures and NYSE Arca's ETF approvals signal growing institutional infrastructure, though 41.5% of XRP supply remains in loss positions. - XRP outperformed Bitcoin (+89% vs 3.6%) due to DeFi upgrades and cross-border utilit

India’s legal framework poses significant obstacles to the enforcement of U.S. court judgments.

- U.S. courts face enforcement challenges in India as Byju Raveendran's $1.07B default judgment clashes with India's strict foreign judgment recognition rules under Section 13. - TCS must appeal a $194M trade secrets ruling from the U.S. Fifth Circuit, highlighting cross-border IP disputes' complexity in the global IT sector . - Binance refunds Alpha Points after a technical error in a token airdrop, emphasizing operational risks in blockchain-based reward systems. - Amber International reports 69.8% YoY a

Bitcoin News Update: Bitcoin's Divergence from MAG7 Highlights a Shift Toward Scarcity-Focused Identity

- Bitcoin’s recent price drop and volatility warnings highlight market fragility amid diverging MAG7 correlations. - A historic $19B liquidation on October 10 marked Bitcoin’s decoupling from MAG7 tech stocks, reclassifying it as a scarcity-based hedge. - Low institutional adoption and 5% odds for MAG7 firms to hold Bitcoin in 2025 underscore limited macro support. - Trump’s growth forecasts lack Bitcoin tailwinds; CleanSpark’s AI pivot highlights crypto diversification. - Bitcoin’s future hinges on macroe