Pi Coin Investors’ Support Remains Weak, Price To Suffer The Consequences

Pi Coin shows minimal transactional activity and rising bearish pressure, keeping the price trapped between $0.234 and $0.217. A break above resistance is needed to revive momentum.

Pi Coin is struggling to regain momentum after days of stagnant price movement. The token has failed to register meaningful growth as investor support remains weak and broader market sentiment stays bearish.

Despite attempts to stabilize, Pi Coin continues to face pressure from declining participation and unfavorable technical indicators.

Pi Coin Holders Are Not Doing Enough

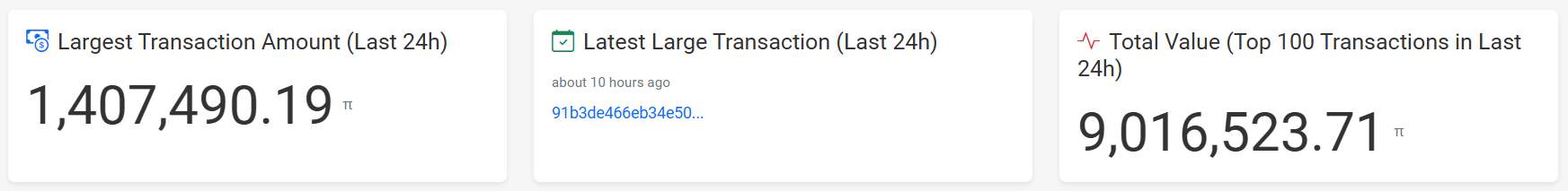

The lack of investor engagement is becoming increasingly evident on-chain. Data from the top 100 transactions in the past 24 hours shows that only slightly more than 9 million PI moved across the network. This activity is valued at under $2.45 million, highlighting the minimal transactional volume supporting the asset.

Among these, the largest transaction involved PI worth less than $319,000, revealing limited interest from major holders. Such low-value movements signal that investors are not actively contributing to liquidity or momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin Transactions. Source:

Pi Coin Transactions. Source:

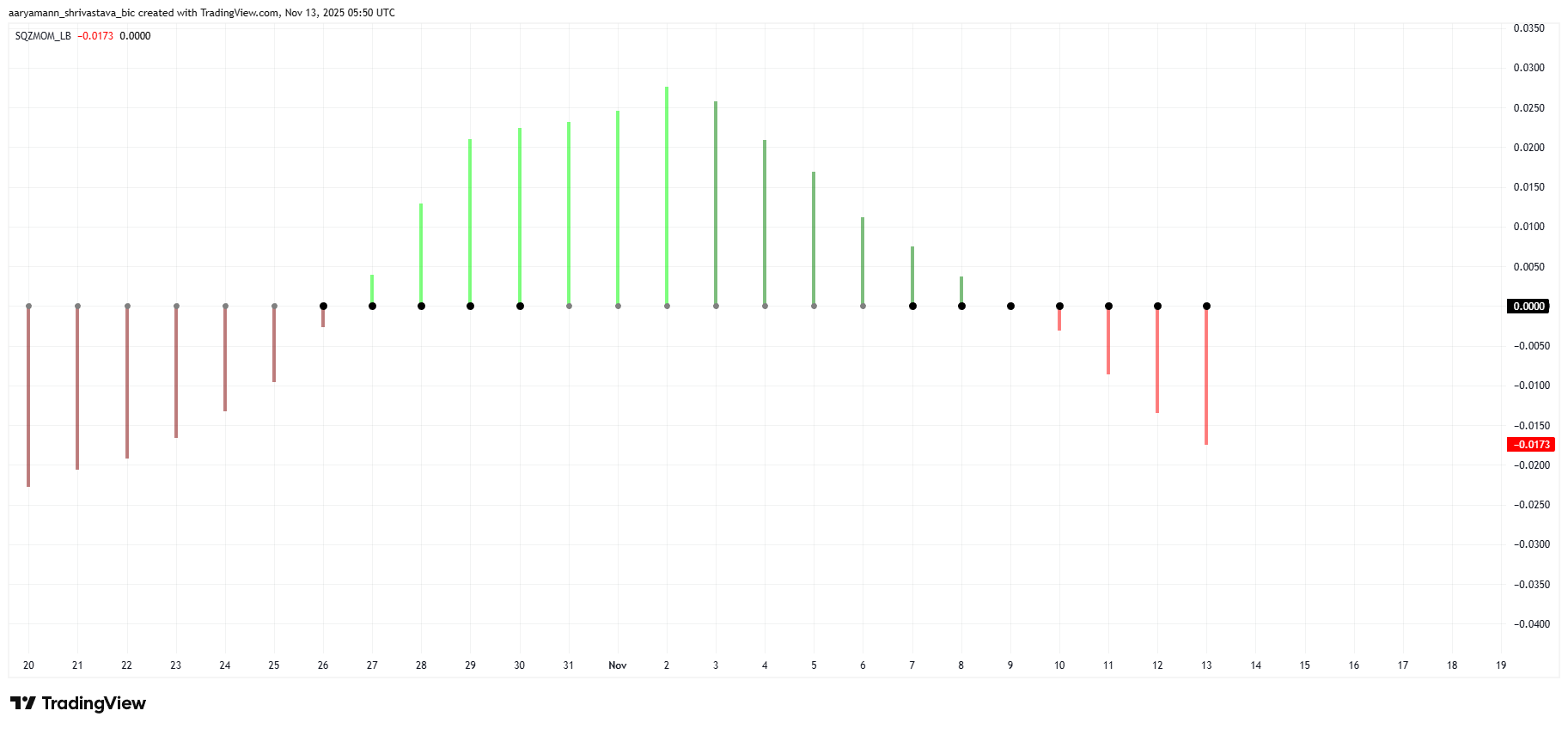

Pi Coin’s broader outlook is further challenged by bearish macro indicators. The Squeeze Momentum Indicator shows a squeeze forming, marked by extending red bars. This pattern reflects strengthening bearish pressure, suggesting that market sentiment may deteriorate further before finding relief.

When the squeeze eventually releases, Pi Coin is likely to face heightened volatility. Given the current bias toward downward momentum, this volatility could trigger a sharper price drop. The ongoing buildup in bearish energy signals that Pi Coin may struggle to maintain its current range.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

PI Price Remains Consolidated

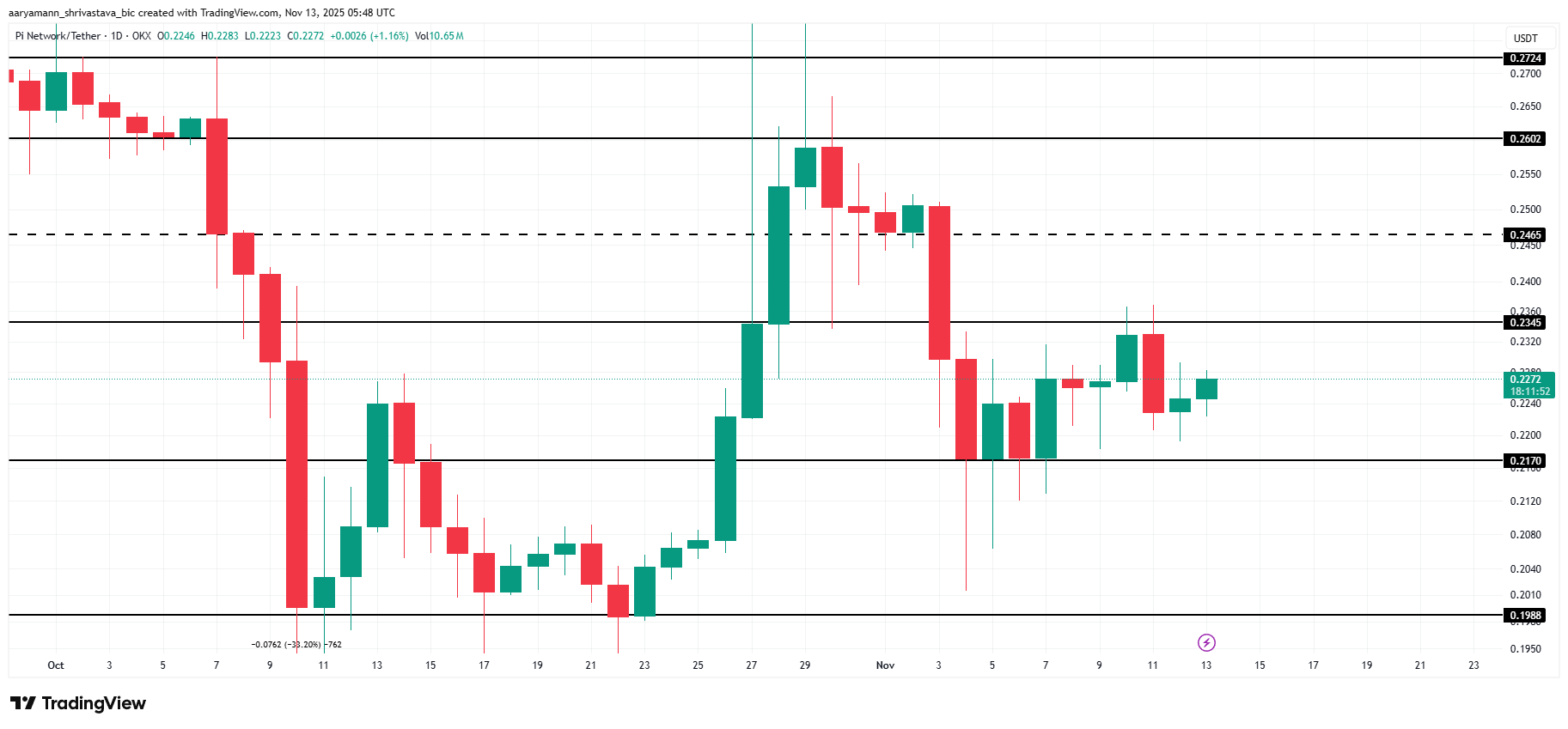

Pi Coin is trading at $0.227 at the time of writing and continues to consolidate between $0.234 and $0.217. The token lacks the strength needed to break above the $0.234 resistance level, reflecting the effects of investor apathy and weak market conditions.

Given the indicators mentioned above, Pi Coin is likely to remain rangebound. If pressures intensify, the price may slip below $0.217, extending the ongoing decline and weakening recovery prospects. Without a shift in sentiment, consolidation may persist.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if investors step in to support the asset, Pi Coin could regain upward momentum. A break above the $0.234 resistance would open the path to $0.246. This would invalidate the current bearish thesis and offer the first signs of stabilization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia Turns to Stablecoins to Address Inflation and Currency Instability

- Bolivia legalizes stablecoin integration into banking , allowing crypto-based accounts and loans to combat inflation and currency devaluation. - Crypto transaction volumes surged 530% in 2025, driven by $15B in stablecoin use as businesses adopt USDT for cross-border payments. - Policy mirrors regional trends, with stablecoins recognized as legal tender to stabilize the boliviano amid 22% annual inflation and dollar shortages. - Challenges include AML safeguards, tax frameworks, and public trust, as regu

Bitcoin Updates: Bitcoin's Decline Sparks Altcoin Battle: ADA's $0.43 Support Faces Pressure

- ADA holds $0.43 support as Bitcoin’s seven-month low of $80,000 pressures altcoin market volatility. - Altcoin fragility stems from Fed’s high-rate signals, reduced institutional inflows, and technical breakdowns in key resistance levels. - Bitcoin’s $90,000 support breach triggered cascading liquidations, while ADA’s $0.43 level shows increased on-chain accumulation. - Infrastructure innovations like GeekStake’s staking protocol aim to stabilize networks during volatility without price forecasts. - Mark

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u