Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

Despite the positive developments on a macro front, such as the US government reopening, BTC’s quite unfavorable price actions continued in the past 12 hours or so as the asset plunged to a new multi-month low.

The cryptocurrency stood above $107,000 just three days ago after Trump promised to send tariff checks of at least $2,000 to some Americans and hinted that the government shutdown might end soon. However, bitcoin failed to capitalize on this momentum and quickly dipped back to $103,000.

Nevertheless, it rebounded to $105,000 on Wednesday before the bears took complete control of the market, especially on Thursday. The POTUS signed legislation to reopen the government, which was first followed by an immediate bounce, but the landscape changed for the worse shortly after.

In less than a day, bitcoin dumped by more than eight grand and currently struggles below $97,000, which is the lowest it has been since early May.

Doctor Profit, who has been bearish on the asset for weeks, believes the worst is yet to come by predicting another nosedive to somewhere around $90,000 and $94,000.

#Bitcoin: First promised target of 90-94k region is about to be hit. Important to note that I wont take any profits from the short at 90-94k region! https://t.co/p6qQqxsaor pic.twitter.com/Rhamwixvct

— Doctor Profit 🇨🇭 (@DrProfitCrypto) November 14, 2025

The altcoins have followed suit with multiple double-digit price declines. AAVE, ENA, RENDER, SUI, PEPE, and LINK are also down by more than 12%. Even the largest of the bunch has plunged by over 11% and now struggles well below $3,200.

You may also like:

- Bitcoin’s Price Jumps as Trump Signs Bill to End Record US Govt Shutdown

- Bitcoin Tumbles Below $100K Again, Liquidations Approach $700 Million

- BTC Steadies Over $100K: Sign of Maturity While ‘Moonvember’ Buzz Builds

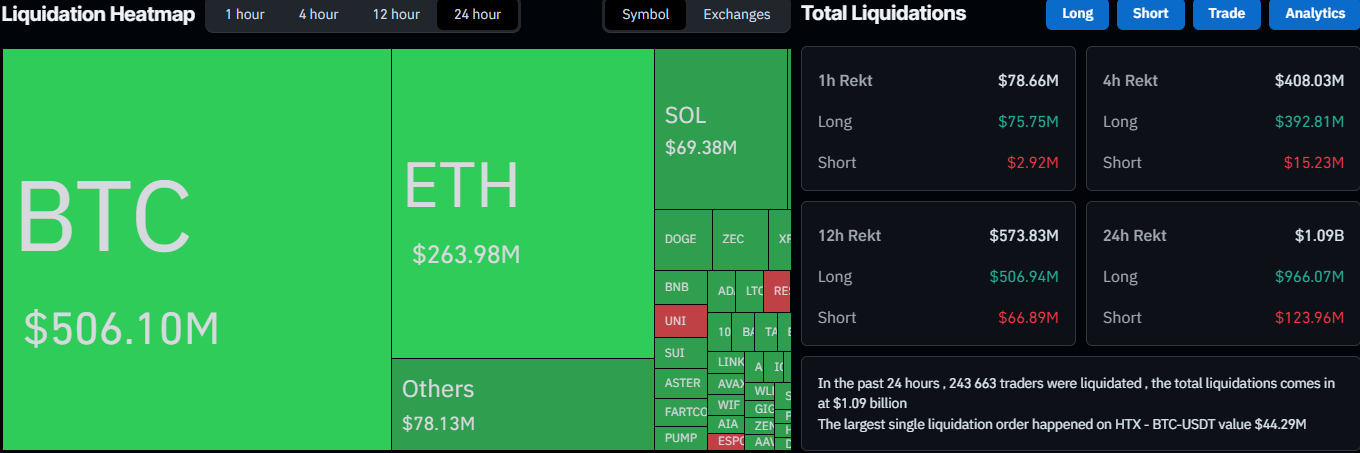

The total value of wrecked positions has skyrocketed to almost $1.1 billion on a daily basis. The single-largest liquidated position, according to CoinGlass, took place on HTX and was worth a whopping $44.29 million. The number of wrecked traders is above 240,000.

Naturally, longs represent the lion’s share, with $966 million. Short liquidations are worth $124 million as of press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hayes Focuses on High-Yield DeFi Initiatives Amid Growing Institutional Interest

- Arthur Hayes acquired 2.01M ENA , 218K PENDLE, and 33K ETHFI tokens via Cumberland, totaling $1.42M in DeFi projects focused on yield optimization and automated market-making. - The purchases highlight growing institutional interest in DeFi protocols offering structured products and tokenized derivatives, with ENA and PENDLE leading in governance and yield strategies. - Hayes's strategy aligns with leveraging on-chain data to target undervalued assets, potentially amplifying market sentiment but exposing

Bitcoin Updates: Major Institutions Propel Bitcoin Beyond $90K Amid Expanding ETF Investments

- Institutional investors drove Bitcoin above $90,000 in November 2025 through strategic ETF allocations, including Texas's $10M initiative and Harvard's $443M IBIT stake. - ETF flows showed $238M inflows into spot Bitcoin ETFs despite prior $3.5B outflows, reflecting maturing institutional diversification and crypto-friendly government frameworks. - Texas's planned self-custodied Bitcoin transition and Mubadala's tripled IBIT holdings highlighted growing acceptance of Bitcoin as a strategic reserve asset.

Solana News Update: CHOG Soars by $10M—Meme Coin Frenzy Faces Analyst Cautions Over Market Fluctuations

- CHOG, a Monad ecosystem meme coin, briefly hit $10M market cap on Nov 27, driven by $17.9M 24-hour trading volume. - Monad's mainnet launch (Nov 24) raised $269M via a 1.43x oversubscribed Coinbase ICO, attracting 85,000 participants. - Analysts warn meme coins like CHOG face volatility risks due to social media-driven hype and lack of fundamentals. - Meme coin market reached $47.1B in Q4 2025, with DOGE and SHIB leading despite emerging Solana/Monad projects gaining traction. - Institutional investors r

Vitalik Buterin Backs ZKsync, Igniting Fresh Hopes for Layer 2 Scaling

- ZKsync's Atlas upgrade (Oct 2025) achieved 15,000 TPS and $0.0001 per transfer costs via RISC-V-based zkVM, solving Ethereum's scalability limitations. - Vitalik Buterin's endorsement catalyzed institutional adoption, with Deutsche Bank and Sony leveraging ZKsync for cross-chain settlements and data privacy. - ZK token surged 50% post-endorsement, while ZKsync's TVL reached $3.5B by 2025 through EVM compatibility and liquidity interoperability breakthroughs. - Upcoming Fusaka upgrade (Dec 3, 2025) aims t