How Grayscale Holds XLM as the Price Drops More Than 50%

Stellar faces steep market fear, yet Grayscale’s firm position and rising ecosystem activity signal potential stabilization ahead. The network’s payments push and RWA growth could help buffer continued pressure.

From its 2025 peak, Stellar (XLM) has fallen from $0.52 to $0.26. Grayscale — one of the leading crypto investment funds — has notably managed its XLM holdings during this downturn.

Extreme market fear at the end of the year continues to fuel negative expectations. What does Stellar (XLM) have to face these headwinds?

Grayscale Holds More Than 116 Million XLM

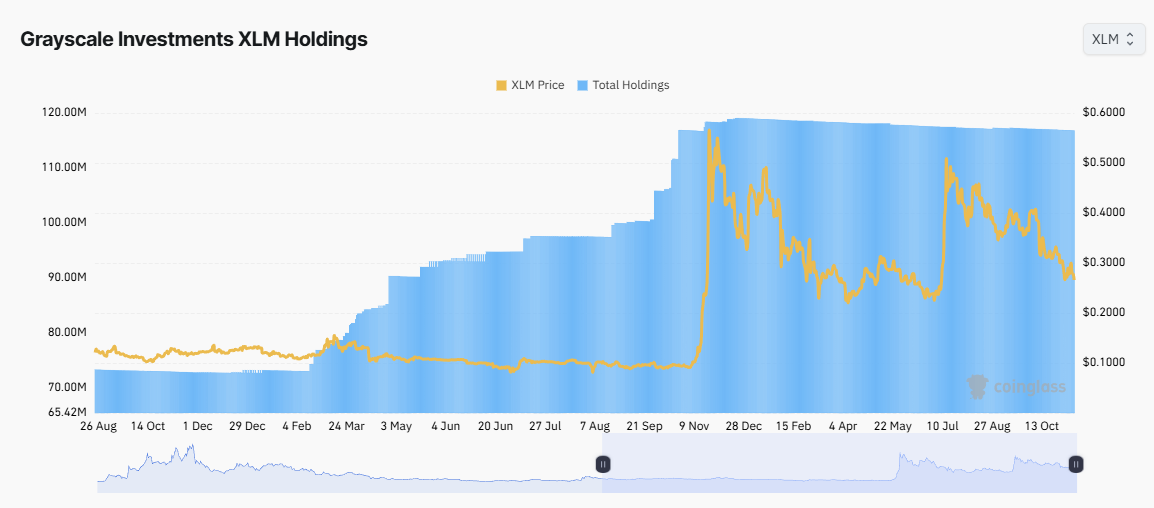

According to the latest data from Coinglass, Grayscale’s XLM holdings increased from last year, before XLM printed a “god candle” in November 2024 with nearly 600% growth.

Grayscale successfully accumulated XLM from 70 million to 119 million ahead of the rally. This move highlights the fund’s effectiveness as a smart-money participant that positioned itself before major market swings.

Grayscale Investments XLM Holdings. Source:

Coinglass

Grayscale Investments XLM Holdings. Source:

Coinglass

However, since early 2025, the fund has stopped accumulating. XLM’s price has stopped setting new highs and entered a downward trend. Compared to the 2025 peak, Grayscale’s XLM holdings slightly decreased to 116.8 million.

The fund’s refusal to sell aggressively reflects its investors’ long-term perspective. They appear to view XLM as a valuable asset in the cross-border payments sector.

More notably, shares of Grayscale Stellar Lumens Trust (GXLM) trade at a premium over its actual Net Asset Value (NAV).

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

GXLM’s market value sits at $24.85, while its NAV per share is $22.29.

The market price is about 10–15% higher than NAV. This premium indicates that investors are willing to pay above the underlying asset value. This condition has dominated most of the trading sessions in 2025.

However, when comparing Grayscale’s XLM holdings to the more than 32 billion XLM circulating supply, the fund only controls about 0.36% of the supply. This share remains too small to create any decisive impact on the market.

What Does Stellar (XLM) Have to Counter Selling Pressure?

November 2025 marked a pivotal moment when seven major crypto players — Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Development Foundation, Mysten Labs, and Monad Foundation — officially launched the Blockchain Payments Consortium (BPC).

This alliance aims to promote blockchain-based payment standards. BPC focuses on cross-chain integration, enabling XLM to reach millions of users across other ecosystems. These developments could boost demand in 2026.

“During Q3, the Stellar network saw 37% growth in full-time developers, 8 times faster than the industry growth rate,” Stellar stated.

In parallel, the Stellar ecosystem continues to see explosive growth in Real-World Assets (RWA). Total RWA value on the network reached a record $654 million in November 2025, up from $300 million at the beginning of the year.

Tokenized Asset Value on Stellar. Source:

RWA

Tokenized Asset Value on Stellar. Source:

RWA

Charts from RWA.xyz show significant contributions from tokenized funds, including Franklin OnChain US Government Fund and WisdomTree Prime.

However, real adoption stories do not always align with market sentiment. Recent analysis indicates that XLM has historically performed poorly in November. With altcoins drowning in extreme fear, XLM may struggle to escape the broader negative trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hayes Focuses on High-Yield DeFi Initiatives Amid Growing Institutional Interest

- Arthur Hayes acquired 2.01M ENA , 218K PENDLE, and 33K ETHFI tokens via Cumberland, totaling $1.42M in DeFi projects focused on yield optimization and automated market-making. - The purchases highlight growing institutional interest in DeFi protocols offering structured products and tokenized derivatives, with ENA and PENDLE leading in governance and yield strategies. - Hayes's strategy aligns with leveraging on-chain data to target undervalued assets, potentially amplifying market sentiment but exposing

Bitcoin Updates: Major Institutions Propel Bitcoin Beyond $90K Amid Expanding ETF Investments

- Institutional investors drove Bitcoin above $90,000 in November 2025 through strategic ETF allocations, including Texas's $10M initiative and Harvard's $443M IBIT stake. - ETF flows showed $238M inflows into spot Bitcoin ETFs despite prior $3.5B outflows, reflecting maturing institutional diversification and crypto-friendly government frameworks. - Texas's planned self-custodied Bitcoin transition and Mubadala's tripled IBIT holdings highlighted growing acceptance of Bitcoin as a strategic reserve asset.

Solana News Update: CHOG Soars by $10M—Meme Coin Frenzy Faces Analyst Cautions Over Market Fluctuations

- CHOG, a Monad ecosystem meme coin, briefly hit $10M market cap on Nov 27, driven by $17.9M 24-hour trading volume. - Monad's mainnet launch (Nov 24) raised $269M via a 1.43x oversubscribed Coinbase ICO, attracting 85,000 participants. - Analysts warn meme coins like CHOG face volatility risks due to social media-driven hype and lack of fundamentals. - Meme coin market reached $47.1B in Q4 2025, with DOGE and SHIB leading despite emerging Solana/Monad projects gaining traction. - Institutional investors r

Vitalik Buterin Backs ZKsync, Igniting Fresh Hopes for Layer 2 Scaling

- ZKsync's Atlas upgrade (Oct 2025) achieved 15,000 TPS and $0.0001 per transfer costs via RISC-V-based zkVM, solving Ethereum's scalability limitations. - Vitalik Buterin's endorsement catalyzed institutional adoption, with Deutsche Bank and Sony leveraging ZKsync for cross-chain settlements and data privacy. - ZK token surged 50% post-endorsement, while ZKsync's TVL reached $3.5B by 2025 through EVM compatibility and liquidity interoperability breakthroughs. - Upcoming Fusaka upgrade (Dec 3, 2025) aims t