Is Crypto in a Bear Market Now? A Full Market Structure Assessment

Bitcoin’s breakdown below its long-term support has raised fears of a new bear market. On-chain and sentiment data show stress, but the cycle remains unconfirmed.

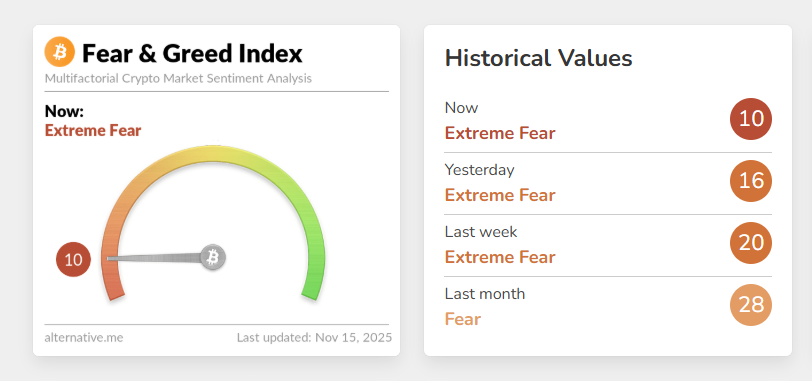

Bitcoin has dropped below $100,000 for the second time in a week, losing 12% in a month. The overall crypto market has lost over $700 billion in the past month, as the Fear and Greed Index has fallen to ‘extreme fear’.

So, do all of these market indicators signal a bear market? Let’s analyze the technical and historical data.

Sentiment Signals Are at Bear-Market Levels

The Fear & Greed Index at 10 reflects extreme fear comparable to early 2022 and June 2022, both confirmed bear-market phases.

- Yesterday: 16

- Last week: 20

- Last month: 28

The trend shows accelerating fear, not stabilizing sentiment. Bear runs usually begin with this kind of persistent fear compression.

However, sentiment alone does not confirm a bear market — it only signals capitulation or exhaustion.

Crypto Fear & Greed Index. Source:

Crypto Fear & Greed Index. Source:

Bitcoin Has Broken Its Most Important Bull-Market Support

The 365-day moving average is the long-term structural pivot.

Current situation:

- The 365-day MA is near $102,000.

- Bitcoin is trading below it.

- The breakdown mirrors December 2021, when price lost the same MA and the bear market started.

Historically:

| Cycle | MA Lost? | Outcome |

| 2018 | Yes | Full bear market |

| 2021 | Yes | Full bear market |

| 2025 | Yes (now) | Bear-phase risk rising |

Failing to reclaim this level quickly often confirms a cycle regime shift. This is one of the strongest technical arguments for a bear-market transition.

Bitcoin "Death Cross" Just Flashed!The Death Cross (An ironically BULLISH indicator) has just triggered, EXACTLY timed with BTC tagging the lower boundary of the megaphone pattern it's in.Several weeks ago we predicted this would happen around mid-November. Well, here we are.…

— 𝙲𝚘𝚕𝚒𝚗 𝚃𝚊𝚕𝚔𝚜 𝙲𝚛𝚢𝚙𝚝𝚘 🪙 November 15, 2025

On-Chain Cost Basis Shows Early Capitulation, Not Distribution Top

The 6–12 month UTXO (Unspent Transaction Output) realized price now sits around $94,600. Bitcoin price currently stands slightly above this level.

This matters because:

- These holders bought during the ETF rally.

- They represent “bull-cycle conviction buyers.”

- When their position enters loss, market structure weakens.

In 2021, Bitcoin price falling below this cohort’s cost basis was one of the final signals before the extended downtrend. This is the first time that cost-basis stress has reappeared since 2022.

This supports the idea of a mid-cycle break, not yet a full macro bear trend.

BULL MARKETS DON’T END LIKE THIS!I’ve been around for multiple bull/bear markets,2001 dotcom, 2008 housing, 2017 crypto , 2021 crypto etc etc.When bull markets end , either something breaks or belief in the asset/ market crumbles.In 2001, people really doubted the…

— Ran Neuner November 15, 2025

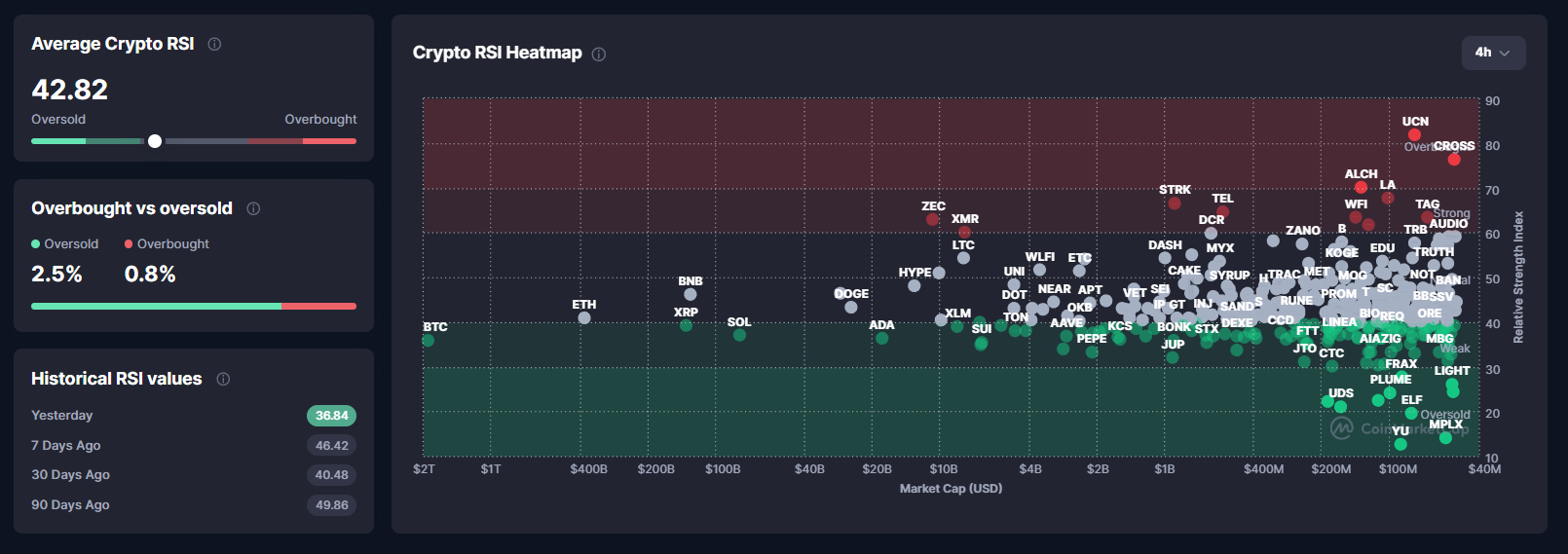

RSI Shows Oversold Conditions, Typical of Mid-Cycle Crashes

Market-wide RSI readings:

- Average crypto RSI: 43.09

- BTC RSI is among the lowest in large caps

- Only 2.5% of assets are overbought

- Most are in oversold territory

Crypto Market Average RSI. Source:

Crypto Market Average RSI. Source:

This resembles May–July 2021, August 2023, and August 2024. Each was a mid-cycle correction, not an end-of-cycle bear. When RSI stays deeply oversold for weeks, bearish momentum confirms.

Right now, RSI shows stress but not yet trend reversal.

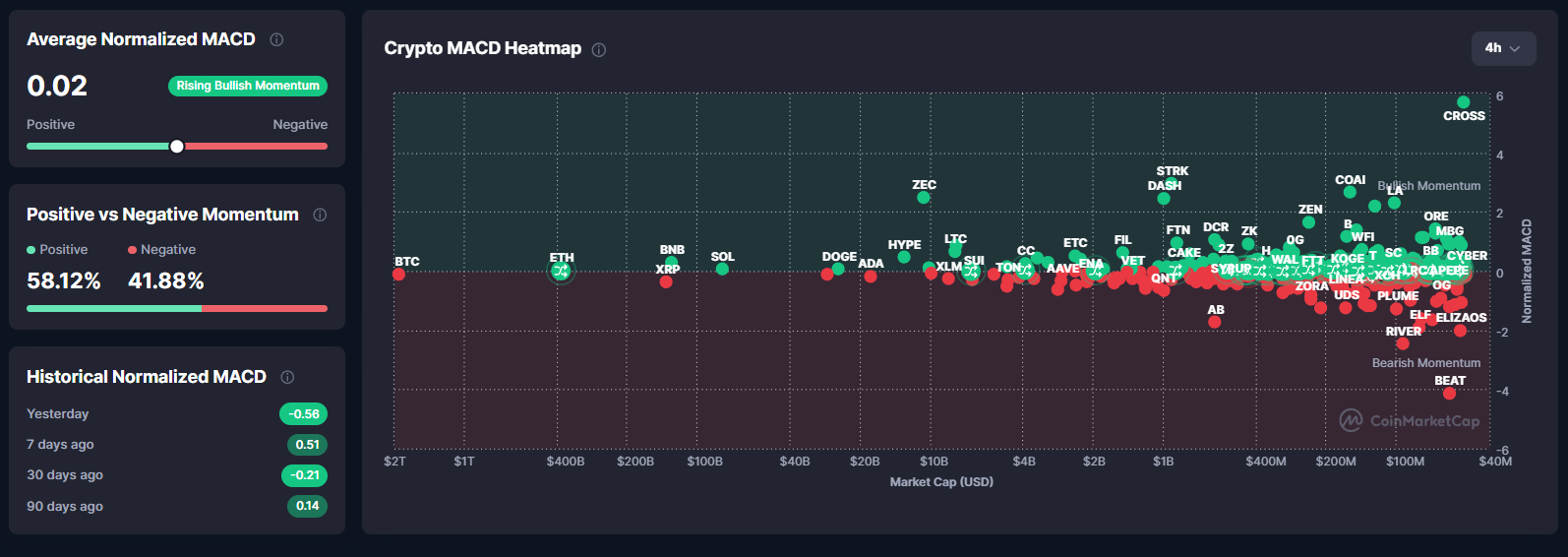

MACD Shows Strong Divergence Across the Market

The average normalized MACD is currently 0.02. This indicates weak bullish momentum returning. Also, 58% of the market assets have positive momentum.

Bitcoin, however, sits deep in the negative zone while altcoins are mixed.

Crypto Market Average MACD (Moving Average Convergence Divergence). Source:

Crypto Market Average MACD (Moving Average Convergence Divergence). Source:

When BTC has negative MACD but the market still has 50%+ positive momentum, the market is in a transition phase rather than a full bear trend.

In full bear markets, 90%+ of assets show negative MACD simultaneously. Right now, that is not the case.

So, Is This a Bear Market?

The crypto market is not in a confirmed bear market — it is in a mid-cycle breakdown with a rising probability of becoming a bear market if two conditions are met.

These are the three conditions that would confirm a bear run:

- Bitcoin remains below the 365-day MA for 4–6 weeks. This triggered every bear market in 2014, 2018, and 2022.

- Long-term holders continue heavy distribution. If LTH (long-term holder) selling exceeds 1M BTC over 60 days, the cycle top is in.

- MACD flips fully negative across the entire market. We are not there yet.

TBH this is the easiest bear market I've ever seen.Seems like most of you have forgotten what 2022 was like. Luna collapsing, then 3AC, then FTX, then Genesis, BlockFi, Axie, NFTs–pretty much everything felt like a house of cards.And then after all that stuff collapsed, the…

— Haseeb >|< November 14, 2025

Overall, crypto is not yet in a bear market, but the current breakdown puts the market in a high-risk zone where a bear market could form if Bitcoin fails to reclaim long-term support soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Driving Institutional Embrace Amid the Blockchain Scalability Competition

- ZKsync's Atlas Upgrade solves throughput bottlenecks with Airbender RISC-V zkVM, enabling 15,000+ TPS at $0.0001 per transaction. - Modular ZKsync OS reduces gas fees by 70% since 2023, enabling real-time financial applications while maintaining regulatory compliance. - Deutsche Bank and UBS test ZKsync for asset tokenization, highlighting its institutional appeal through privacy-preserving ZK features and sub-second finality. - Upcoming Fusaka upgrade aims to push TPS to 30,000 by December 2025, but reg

Bitcoin Updates: Bitcoin Receives Major-Cap Status as Nasdaq Increases Options Limits Fourfold

- Nasdaq seeks SEC approval to quadruple IBIT options limits from 250,000 to 1 million contracts, aligning Bitcoin ETF with high-liquidity assets like EEM and GLD . - The proposal cites IBIT's $86.2B market cap, 44.6M daily shares traded, and industry support for addressing institutional demand amid Bitcoin's rapid financial instrument maturation. - Experts argue higher limits will reduce spreads, enable sophisticated hedging, and treat Bitcoin as a "mega-cap asset," while Nasdaq also seeks unlimited FLEX

XRP Update: ADGM's Green Light for RLUSD Strengthens UAE's Pursuit of Digital Financial Growth

- Ripple's RLUSD stablecoin secured ADGM approval as an institutional fiat-backed token in November 2025, following DIFC's June 2025 greenlight. - The UAE's dual regulatory endorsements position RLUSD for cross-border settlements, with $1.2B market cap driven by institutional demand for collateral and treasury tools. - ADGM's stringent oversight framework requires full reserve backing and AML compliance, aligning RLUSD with global standards under NYDFS charter . - XRP prices surged 24% in late 2025 amid $1

Bitcoin Updates: SpaceX Strengthens Bitcoin Holdings as Institutions Adjust Portfolios

- SpaceX transfers 1,163 BTC ($105M) to new wallets, increasing total holdings to 6,095 BTC ($556.7M) amid Bitcoin's rebound above $91,300. - Institutional Bitcoin interest grows as ETFs see $2.6B outflows, contrasting with SpaceX's secure custody strategy mirroring Tesla's $1.05B BTC treasury management. - Analysts view the activity as routine security adjustments rather than liquidation, highlighting corporate Bitcoin adoption focused on treasury diversification over speculation. - Market debates persist