Pi Coin’s Rare Green Streak Could Last If The Altcoin Clears One Key Level

The Pi Coin price is flashing a rare multi-timeframe green streak even while the broader market struggles. A breakout from a symmetrical triangle, a CMF surge, and improving OBV all point to growing strength. But the entire move depends on one level: $0.229. A close above it could unlock more upside.

Pi Coin just printed something unusual. Three major timeframes are green at the same time. The one-month chart is up 9.5%, the seven-day chart is up 2.1%, and the last 24 hours are up 3.5%.

This is rare because the Pi Coin price is still down almost 40% in the three-month window. The token is showing early strength while most of the market is still stuck in a slow bleed. The question now is simple: is this just a brief bounce, or the start of a larger move?

Symmetrical Triangle Breakout Surfaces As Money Flow Turns Positive

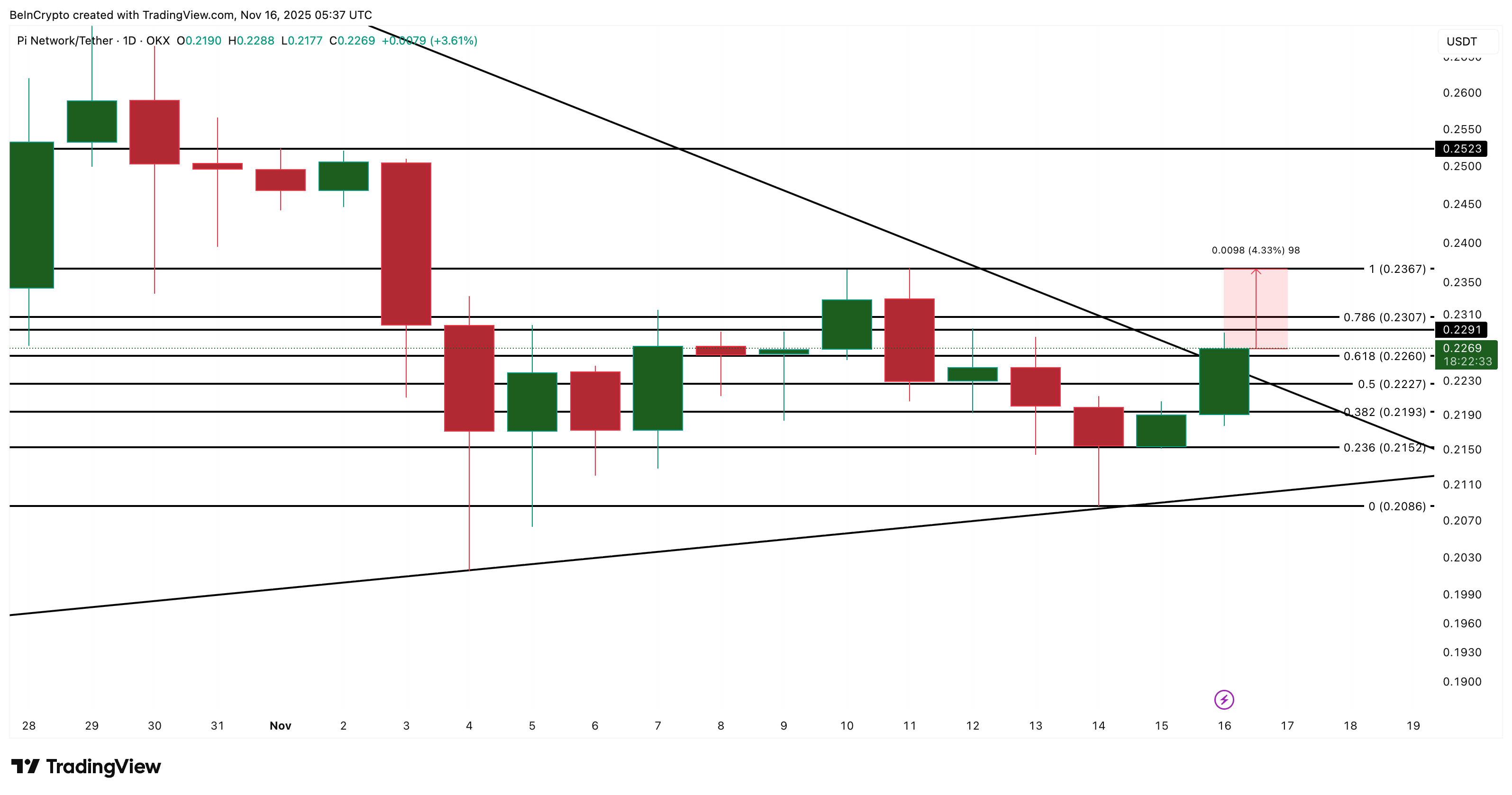

PI has been stuck inside a symmetrical triangle for weeks. This pattern typically indicates indecision, rather than a trend direction.

However, yesterday, the Pi Coin price broke through the upper boundary and is now testing the confirmation level near $0.229, a key level. A clean candle close above that line is the first sign that buyers are finally taking control.

Pi Coin Breaks Out:

TradingView

Pi Coin Breaks Out:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

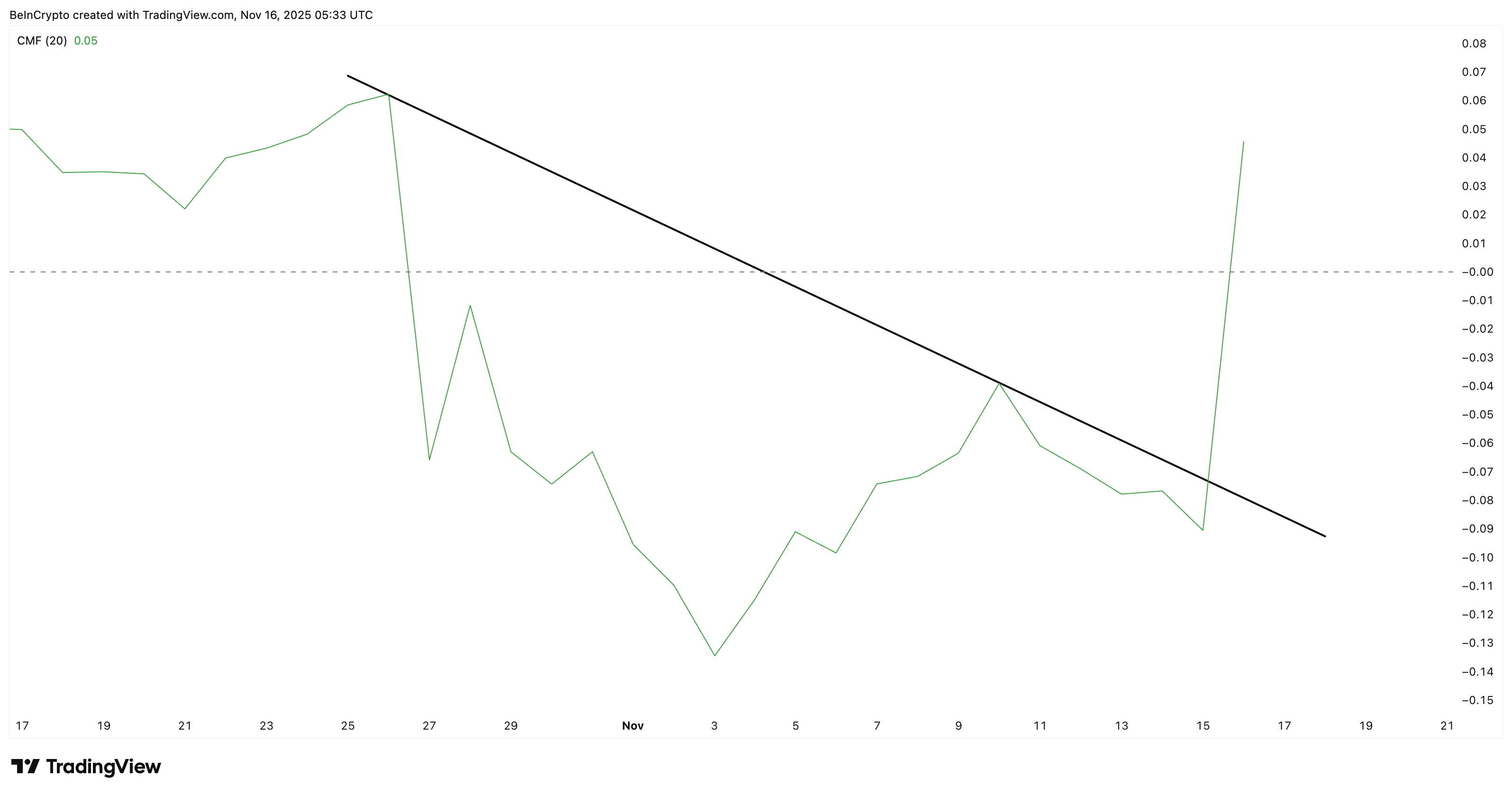

The next clue comes from the Chaikin Money Flow (CMF). CMF measures whether money is moving into or out of an asset. Two days ago, CMF broke out of its descending trend line, rising sharply from –0.09 to +0.05.

This jump shows that the breakout is not random. Bigger Pi Coin wallets may be stepping in as the pattern flips bullish.

Big Money Flows In:

TradingView

Big Money Flows In:

TradingView

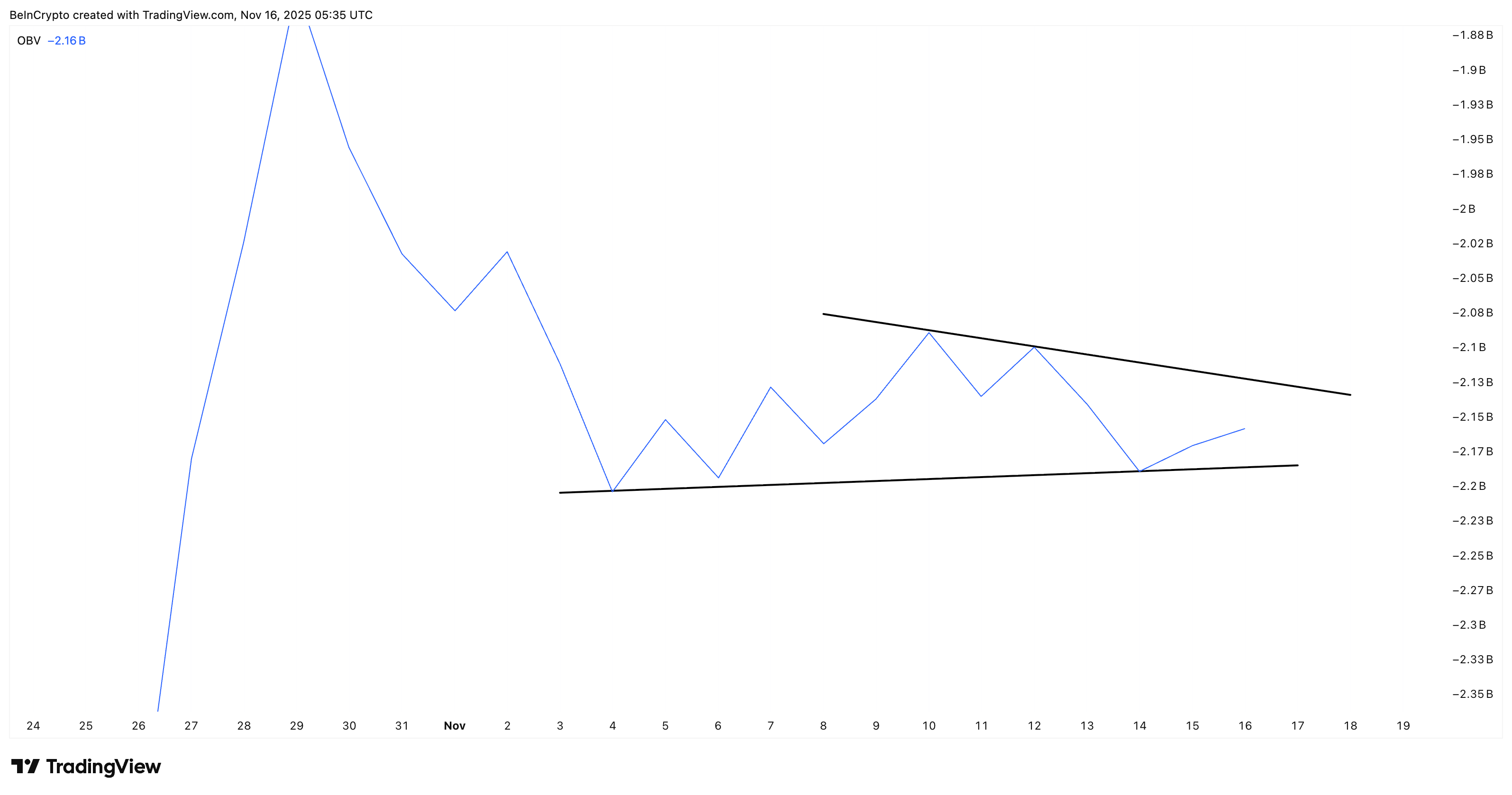

The On-Balance Volume (OBV) tells the other half of the story. OBV tracks buying and selling volume to show whether traders support the move. OBV touched lower, back to its rising trend line on November 12–13, hinting that retail volume wasn’t ready.

However, since November 14, OBV has begun to curl upward again. If OBV breaks its upper trend line, it confirms that retail Pi Coin buyers are now joining the move sparked by the CMF breakout.

Retail Volume Coming Back:

TradingView

Retail Volume Coming Back:

TradingView

The combination of a technical breakout, rising money flow, and recovering OBV gives Pi Coin its strongest setup in weeks.

Pi Coin Price Levels To Watch As Momentum Builds

If the Pi Coin price closes above $0.229, the move could extend to $0.236, representing a gain of approximately 4.2% from current levels. If momentum holds, the next target is near $0.252, which has previously acted as strong resistance.

However, the bullish setup can fail if the OBV rolls over again or the CMF slips back into negative territory. A drop below $0.215 weakens the structure and exposes a slide toward $0.208.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Currently, the Pi Coin price is exhibiting rare strength across multiple timeframes. Whether that strength lasts comes down to one line: $0.229. If the bulls defend it, PI’s green streak may have more room to run.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia Turns to Stablecoins to Address Inflation and Currency Instability

- Bolivia legalizes stablecoin integration into banking , allowing crypto-based accounts and loans to combat inflation and currency devaluation. - Crypto transaction volumes surged 530% in 2025, driven by $15B in stablecoin use as businesses adopt USDT for cross-border payments. - Policy mirrors regional trends, with stablecoins recognized as legal tender to stabilize the boliviano amid 22% annual inflation and dollar shortages. - Challenges include AML safeguards, tax frameworks, and public trust, as regu

Bitcoin Updates: Bitcoin's Decline Sparks Altcoin Battle: ADA's $0.43 Support Faces Pressure

- ADA holds $0.43 support as Bitcoin’s seven-month low of $80,000 pressures altcoin market volatility. - Altcoin fragility stems from Fed’s high-rate signals, reduced institutional inflows, and technical breakdowns in key resistance levels. - Bitcoin’s $90,000 support breach triggered cascading liquidations, while ADA’s $0.43 level shows increased on-chain accumulation. - Infrastructure innovations like GeekStake’s staking protocol aim to stabilize networks during volatility without price forecasts. - Mark

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u