Bitcoin Slides Toward $95,000, Long-Term Metrics Say ‘Undervalued’

Bitcoin nears a decisive point as bearish divergence forms and valuation metrics turn undervalued. BTC prepares for either breakdown or reversal.

Bitcoin is trading near $95,000 after a steady decline that erased recent gains and pushed the crypto king toward a crucial psychological level.

The market now waits for investors to make the next decisive move, one that could determine whether BTC rebounds or extends its downward trajectory in the coming days.

Bitcoin Faces Bearish Divergence

Bitcoin’s dominance has been falling for weeks, creating a clear bearish divergence with the Stochastic RSI. Dominance now sits at 59.37%, down from 65.71% in June. At the same time, the Stoch RSI recorded a bearish crossover as the D line moved above the K line, signaling a shift in market strength.

This divergence, paired with RSI entering overbought territory earlier, signals weakening bullish momentum. Historically, such conditions often precede price reversals or notable corrections. With dominance slipping and momentum softening, traders face increased uncertainty about Bitcoin’s ability to hold support at current levels.

Bitcoin Dominance. Source:

TradingView

Bitcoin Dominance. Source:

TradingView

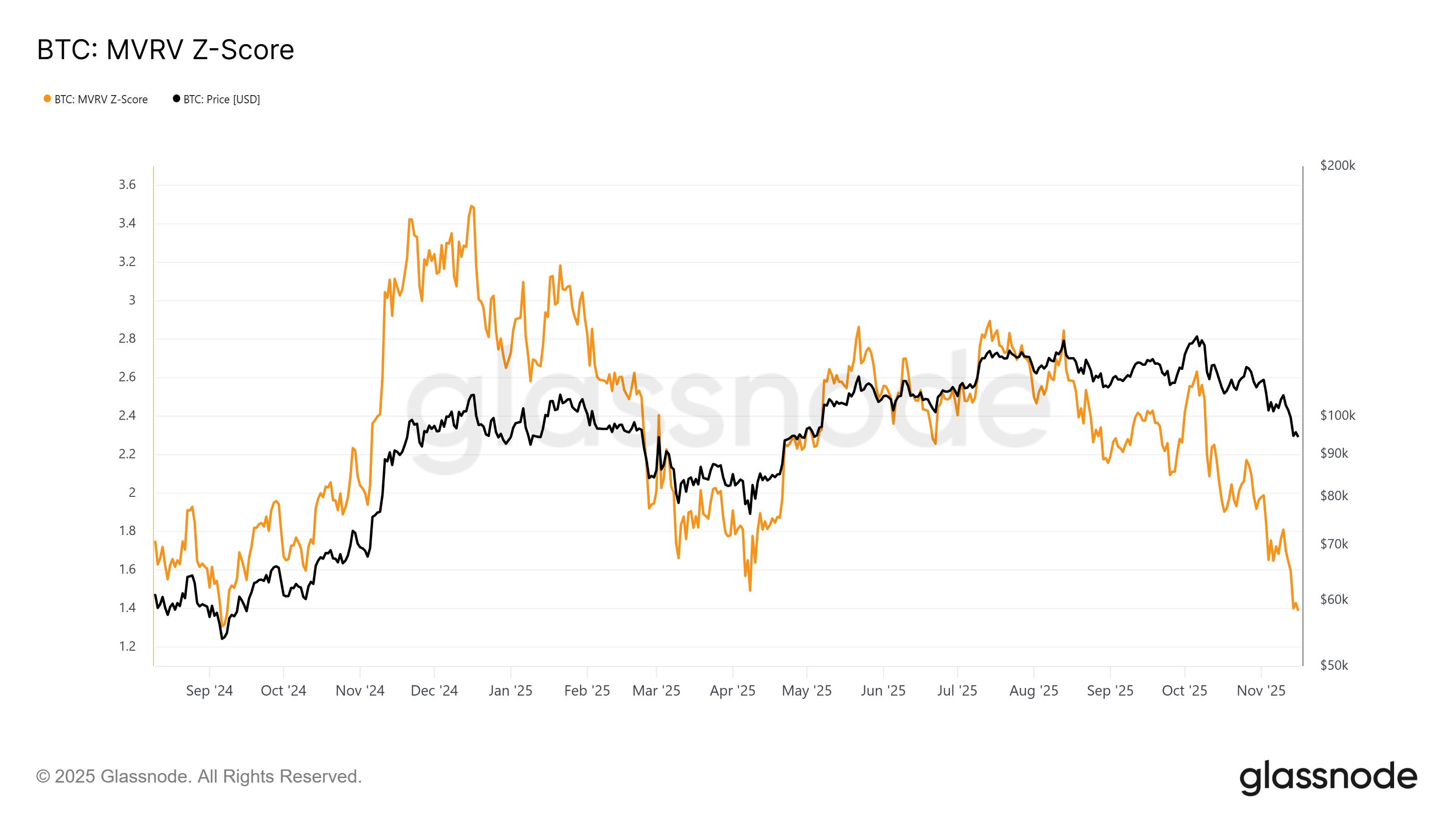

Bitcoin’s MVRV Z-Score has dropped to a 14-month low, indicating the asset is undervalued relative to historical norms. This metric evaluates when Bitcoin is trading above or below its fair value. At present, the indicator suggests BTC is firmly in undervalued territory, which has often marked major accumulation phases.

When the MVRV Z-Score hits similar lows, long-term investors typically begin accumulating. This behavior supports price recovery as fresh demand enters the market. If accumulation increases at current levels, Bitcoin could gain the momentum needed to stabilize and reverse its recent downtrend.

Bitcoin MVRV Z-Score. Source:

Glassnode

Bitcoin MVRV Z-Score. Source:

Glassnode

Can Bitcoin Price Make a Reversal?

Bitcoin trades at $95,040, hovering around a crucial psychological level. The decline intensified after BTC broke below a head and shoulders pattern last week. This breakdown has fueled bearish expectations.

The head and shoulders pattern points to a 13.6% decline, placing the target at $89,407. If investors remain bearish, Bitcoin could slip toward $90,000 and eventually reach the projected target. The combination of falling dominance and bearish crossovers strengthens the case for this downside move.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if investors step in and accumulate at undervalued levels, Bitcoin could rebound toward $100,000. A successful recovery would invalidate the bearish thesis and result in a reversal, pushing the price closer to $105,000. This move would also invalidate the head and shoulders pattern.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Technance’s modular platform accelerates the integration of conventional and Web3 technologies

- Technance launched a modular tech stack for crypto exchanges and Web3 platforms, bridging traditional finance and digital assets. - The Dubai-based infrastructure offers high-performance trading, liquidity aggregation, and blockchain integration. - CEO Haghshenas emphasized modular infrastructure to accelerate development while ensuring institutional-grade security. - Analysts highlight growing demand for scalable solutions as digital asset markets expand and regulations evolve. - Technance's interoperab

Infrastructure-Led Renewal: Harnessing Sustainable Value in Redeveloped Industrial Properties

- Post-industrial towns in the U.S. and Europe are revitalizing through infrastructure-driven real estate redevelopment, transforming abandoned sites into tech hubs and mixed-use spaces. - Strategic projects like Pennsylvania’s tech hubs and Poland’s Zabrze 2030 plan demonstrate how industrial tourism and innovation attract talent, boosting local economies and property values. - U.S. infrastructure investments have driven $13.1T in real estate value growth since 2018, with 7.3% annual job growth in infrast

The ICP Token Jumps 30%: Is This a Turning Point for AI Infrastructure?

- ICP token surged 30% in 2025, driven by Caffeine AI platform launch and strategic partnerships with Microsoft and Google Cloud. - Chain Fusion protocol enhanced cross-chain interoperability, aligning ICP with AI's demand for diverse data sources and decentralized infrastructure growth. - Market trends show AI compute demand reaching $1.81 trillion by 2030, with ICP positioned to address scalability challenges through distributed cloud solutions. - Energy constraints and regulatory risks remain challenges

Australia's approach to cryptocurrency regulation promotes innovation and protects investors

- Australia introduces 2025 Digital Assets Framework Bill to regulate crypto exchanges and custody platforms under AFSL licensing and ASIC oversight. - The law creates two platform categories (transactional and custody) with exemptions for small operators and strict compliance penalties to prevent fraud. - Projected $24B annual economic gains aim to balance innovation with investor protection, aligning with global crypto regulatory trends like the U.S. GENIUS Act. - Industry welcomes safeguards but seeks s