Date: Mon, Nov 17, 2025 | 10:00 AM GMT

The broader market continues to show downside volatility as Ethereum (ETH) has declined more than 17% over the past 30 days, adding significant pressure on several major memecoins, including Fartcoin (FARTCOIN).

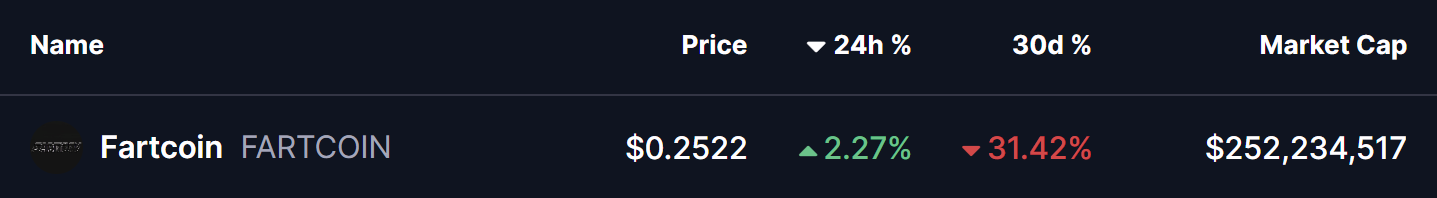

FARTCOIN has recorded a steep 31% dip during this period, but something far more important is developing beneath the surface. Its latest technical structure is beginning to show signs of a potential bullish recovery.

Source: Coinmarketcap

Source: Coinmarketcap

Double Bottom Pattern in Play?

On the daily chart, FARTCOIN appears to be forming a classic double-bottom pattern after a sharp downtrend that began when the token failed to break the $0.3475 neckline resistance in early November. From that point, the price entered a heavy correction phase, dropping more than 30% and revisiting the $0.24 support zone — the region now acting as the second bottom of the pattern.

The chart shows FARTCOIN respecting this support with multiple touches before bouncing back to $0.2521. This suggests early signs of a potential shift in momentum as buyers begin stepping in near the critical demand region.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

With the price rebounding from the highlighted support box and heading back toward the broader consolidation range, the structure is starting to resemble a textbook double-bottom formation.

What’s Next for FARTCOIN?

The key focus remains on the $0.24 support area. Holding above this level is crucial for keeping the bullish pattern intact. If momentum continues to build from this zone, FARTCOIN’s next major test lies at the 30-day moving average, currently hovering near $0.3143. This level also aligns with the upper boundary of the previous consolidation region, making it an important resistance to watch.

A strong breakout above the 30-day MA could trigger a much broader recovery, with the double-bottom breakout target sitting around $0.4550 — nearly 79% higher than the current price.

However, if the token fails to defend the $0.22–$0.24 support range, the bullish structure would be invalidated, leaving room for deeper downside pressure. Traders will need to monitor how price behaves as it approaches the neckline zone in the coming days.