Firo (FIRO) Hits a 3-Year High — What Risks and Opportunities Are Emerging?

FIRO’s rally highlights its maturing tech and strong sector momentum, but heavy whale supply and regulatory risks challenge its stability.

Firo (FIRO), a privacy coin with Bitcoin-like tokenomics, surged more than 300% in November and returned to its 3-year high. With a market cap still below $100 million, many investors expect its rally to extend further.

However, this explosive growth also comes with hidden risks tied to on-chain data and market volatility. This article examines FIRO’s opportunities and challenges in light of recent developments.

What Opportunities Come With FIRO’s Rally in November?

Firo, previously known as Zcoin, launched in 2016 and became a pioneer in privacy-focused cryptocurrencies. Its nine-year lifespan demonstrates resilience across multiple market cycles, which serves as an initial advantage attracting investors.

“Old names can shine again, but only the ones that kept building deserve to. And I genuinely believe this Dino Coin wave will pull fresh liquidity into the market, reviving momentum and setting the stage for the next Altcoin Season,” investor Tanaka predicted.

Firo was the first coin to deploy Zero-Knowledge (ZK) proofs on mainnet, even before Zcash (ZEC). This technology offers users a superior layer of privacy protection.

ZEC’s recent rally pushed many privacy-themed altcoins upward. As a result, the privacy coin sector became one of the best-performing categories, recording an average gain of 320%, according to Artemis.

As a result, many investors compare FIRO’s trajectory with that of ZEC. They believe FIRO still has room to accelerate and break out of its low-cap status.

“Buying FIRO at $5.3 is like buying ZEC at $5.3,” investor 𝐙𝐞𝐫𝐞𝐛𝐮𝐬 predicted.

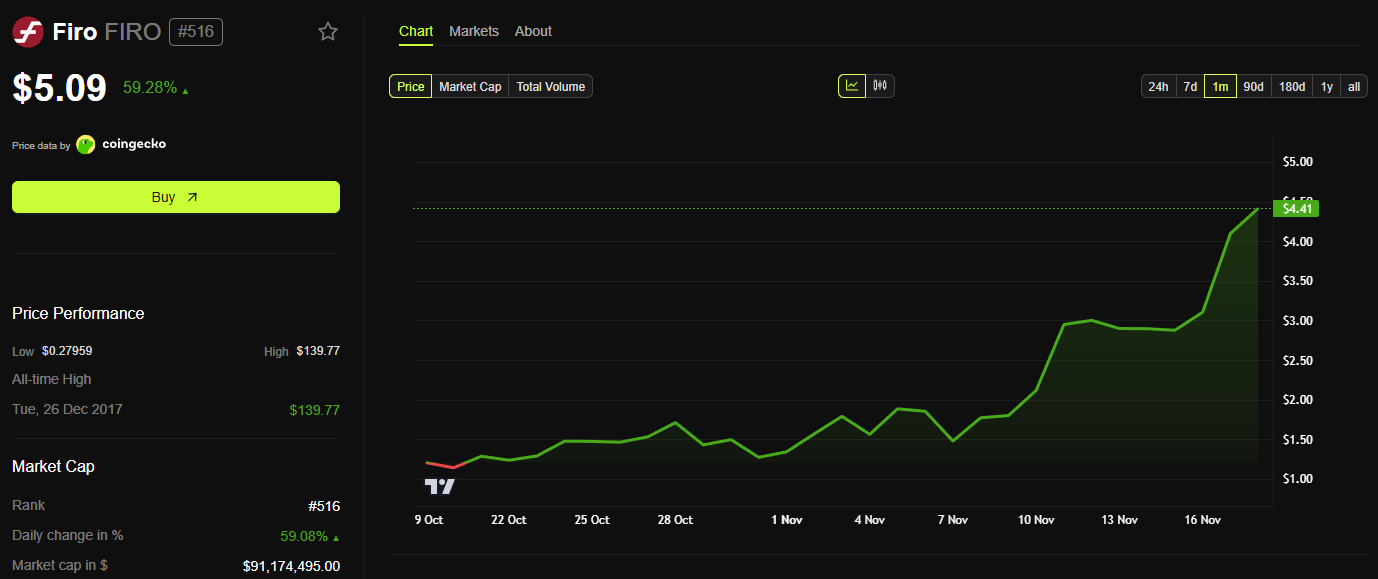

FIRO Price Performance. Source:

FIRO Price Performance. Source:

FIRO Price Performance. Source:

FIRO Price Performance. Source:

BeInCrypto data shows FIRO has surpassed the $5 mark, reaching its highest price since August 2022. The altcoin has ranked as the #1 trending asset on CoinGecko and remained in the top 3 for an entire week.

The biggest highlight at the moment is the upcoming hard fork. Expected to arrive in just two days at block 1,205,100 (November 19, 2025), Firo will upgrade to version 0.14.15.0. The standout feature is the ability to transfer Spark names — digital domains within the Firo ecosystem.

🚨The next hard fork is just around the corner, estimated in about 2 days at block 1,205,100. 🎉This upgrade introduces:✅Spark Name Transfers✅Lower GPU VRAM requirements for miningSpark Names creates privacy-preserving decentralized digital identities where people can pay…

— Firo $FIRO (@firoorg) November 16, 2025

Previously, Spark names were only used for wallet identification. They will now become freely tradable assets, creating an internal “domain economy.” According to Firo’s official blog, this upgrade increases liquidity and encourages community participation. The hard fork is expected to boost demand for FIRO.

What About the Risks?

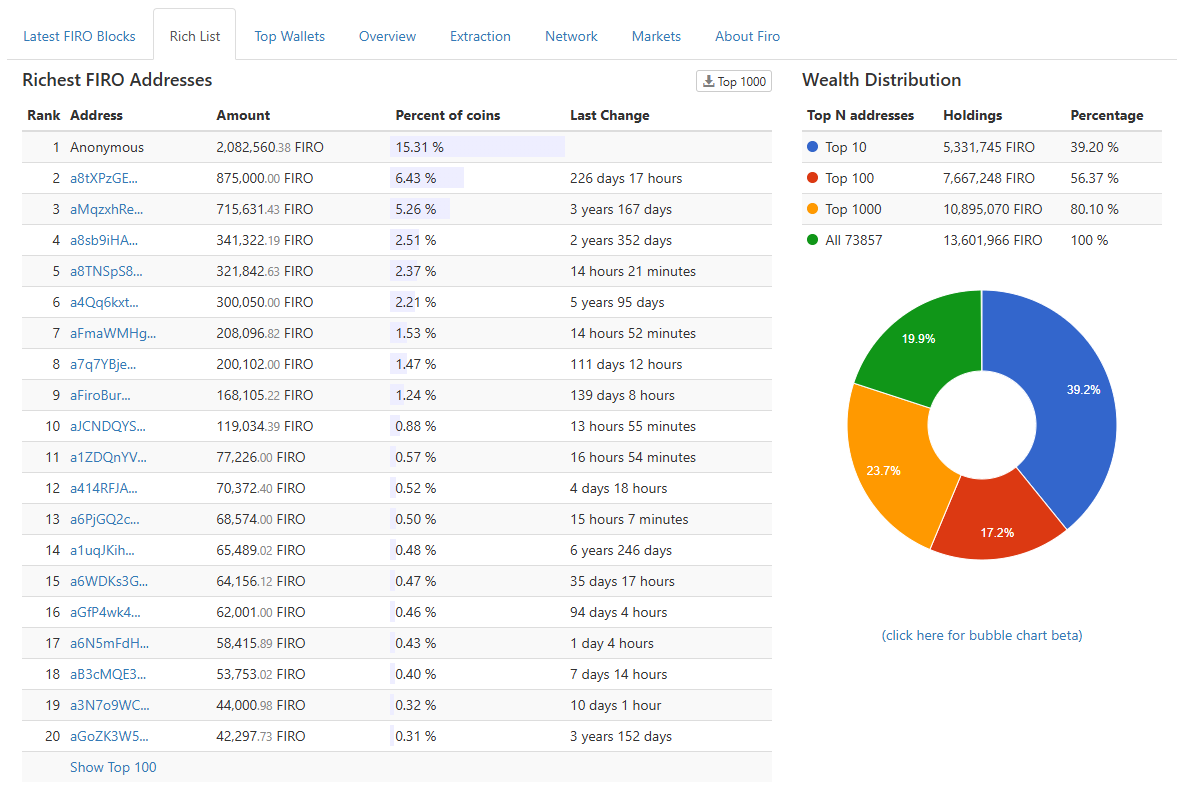

Opportunities come with risks. On-chain data shows the top 10 richest wallets control more than 39% of FIRO’s total supply — an alarmingly concentrated distribution.

Richest FIRO Addresses. Source:

Richest FIRO Addresses. Source:

Richest FIRO Addresses. Source:

Richest FIRO Addresses. Source:

These wallets have remained dormant for years and accumulated FIRO at low prices between 2018 and 2024. With the current price above $5, these holders are nearing break-even or sitting on profits. This situation could trigger large-scale selling if they decide to realize gains.

Privacy coins have historically exhibited strong volatility due to regulatory pressure from governments. FIRO faces the same vulnerability.

Additionally, FIRO and other privacy coins depend heavily on ZEC’s trend. Meanwhile, many analysts warn that ZEC may be forming a new bubble pattern.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin surges to $90K—Is this a sign of a new cycle or an early warning of another downturn?

- Bitcoin surged past $90,000 amid November's 29% drop from its October $126,000 peak, signaling a tentative recovery. - Ethereum , Solana , and other major cryptos rose 3-5%, while the Crypto Fear & Greed Index improved slightly to 15. - Technical indicators show Bitcoin testing critical levels, with analysts divided on whether $90,000 marks a cyclical bottom or temporary respite. - Institutional flows and on-chain data reveal mixed sentiment, as Fed policy uncertainty and bearish structures persist. - Lo

The Iceberg Phenomenon: Unseen Dangers of AI’s Labor Force Surface Across the Country

- MIT's Iceberg Index reveals AI could replace 11.7% of U.S. jobs ($1.2T in wages), impacting sectors like finance and healthcare beyond tech hubs. - The tool maps 151M workers across 923 occupations, highlighting hidden risks in routine roles (e.g., HR, logistics) versus visible tech layoffs. - States like Tennessee and Utah use the index for reskilling strategies, while C3.ai partners with Microsoft to expand enterprise AI solutions. - Despite C3.ai's market expansion, its stock faces volatility, reflect

Where Saving Animals and Supporting People Come Together: The Gentle Barn's Comprehensive Approach

- The Gentle Barn, a California-Tennessee sanctuary, merges animal rescue with human emotional healing through acupuncture, mobility aids, and therapeutic interactions. - Its volunteer programs and $75 season passes support financial sustainability while fostering compassion between humans and rescued animals like turkeys and hoofless goats. - The nonprofit's holistic model attracts attention as a case study in combining veterinary care with mental health initiatives, despite scalability challenges in nonp

XRP News Today: With Tether and USDC under examination, RLUSD from the UAE stands out as a regulatory-compliant stablecoin option.

- Ripple's RLUSD stablecoin received ADGM approval as a regulated fiat-referenced token in Abu Dhabi, enabling institutional use in payments and treasury management. - Pegged 1:1 to the USD with NYDFS oversight, RLUSD ($1.2B market cap) offers compliance-driven alternatives to USDT/USDC amid global regulatory scrutiny. - UAE's ADGM-DIFC regulatory framework positions the region as a crypto innovation hub, with Ripple expanding partnerships through Zand Bank and Mamo fintech . - The approval aligns with UAE