US Govt and Mt. Gox Shift Millions in Hidden Crypto Transfers

New blockchain movements from the US government and Mt. Gox are drawing trader scrutiny, with delayed creditor payouts helping calm market fears.

Blockchain tool Arkham detected small but impactful moves that could have lasting effects for months.

The US government and Mt. Gox, the defunct Japanese exchange, made significant transfers that have traders watching closely.

US Government Moves Seized Crypto

Blockchain intelligence firm Arkham revealed that the US government recently moved $23,000 worth of WIN tokens on Tron. These assets were seized from Alameda Research nearly two years ago.

ARKHAM ALERT: US GOVERNMENT MOVING FUNDSThe US Government moved $23K of WIN on Tron seized from Alameda Research 2 years ago. pic.twitter.com/98goLfxUrd

— Arkham (@arkham) November 18, 2025

While small in dollar terms, the move signals that authorities are still actively managing high-profile crypto seizures.

Such transfers can precede auctions, compliance actions, or other administrative steps, with minor movements, just like major ones, capable of influencing market sentiment for linked tokens.

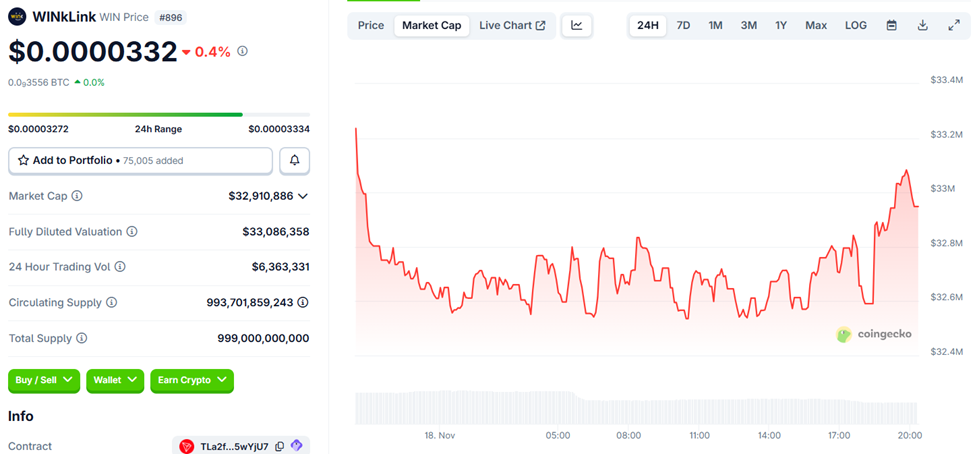

WINkLink (WIN) Price Performance. Source:

WINkLink (WIN) Price Performance. Source:

Data on CoinGecko shows the WINkLink token on Tron was trading for $0.0000332 as of this writing, down by 0.4% in the last 24 hours.

Mt. Gox Transfers $16.8 Million in Bitcoin

More attention is focused on Mt. Gox, which transferred 185 BTC, valued at approximately $16.8 million, to the following a test transaction. An additional $936 million in Bitcoin was shifted to another Mt. Gox wallet, according to Arkham.

MT GOX JUST TRANSFERRED $16.8M OF $BTC TO KRAKENMt Gox just transferred 185 BTC ($16.8M) to Kraken after a test transaction. $936M of change BTC has been moved to another Mt. Gox wallet.Mt. Gox made their last major movement 8 months ago, depositing $77.4M worth of Bitcoin to… pic.twitter.com/5YQYJqqxBw

— Arkham (@arkham) November 18, 2025

This follows the exchange’s last major transfer, eight months ago, when $77.4 million in Bitcoin was sent to Kraken for creditor distributions.

On October 27, Mt. Gox announced that Bitcoin repayments will now occur by October 31, 2026. This locks 34,689 BTC, approximately $4 billion, and temporarily removes a significant source of potential selling pressure.

“It has become desirable to make the repayments to such rehabilitation creditors to the extent reasonably practicable,” rehabilitation trustee Nobuaki Kobayashi stated in the letter, citing court approval for the one-year extension.

Analysts say the delay calms Mt. Gox FUD and provides near-term market clarity. By pushing the next major liquidity event out by a year, investors gain stability and confidence amid delayed selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH drops 7.15% in a day as several top executives offload shares through scheduled selling plans

- DoorDash (DASH) fell 7.15% on Nov 26, 2025, but rose 71.59% year-to-date amid insider sales by executives via Rule 10b5-1 plans. - CFO Ravi Inukonda and President Prabir Adarkar sold $2.7M and $4.6M of shares respectively, while analysts raised price targets to $260. - Institutional buyers like XTX Topco Ltd and Summit Global Investments added shares, reflecting ongoing confidence in DoorDash's international expansion and DashPass strategy. - Upcoming Q4 2025 earnings on Feb 10, 2026, will test market se

XRP News Update: XRP ETFs See Inflows Soar While Prices Drop: The $628 Million Inflow Mystery

- XRP ETF inflows hit $164M daily as Bitwise, Grayscale, and Franklin Templeton drive institutional adoption, surpassing $628M total assets. - Ripple's 2025 SEC settlement and RLUSD stablecoin boosted confidence, but XRP's price fell below $2 amid whale sales of 200M tokens. - CME's XRP futures and NYSE Arca's ETF approvals signal growing institutional infrastructure, though 41.5% of XRP supply remains in loss positions. - XRP outperformed Bitcoin (+89% vs 3.6%) due to DeFi upgrades and cross-border utilit

India’s legal framework poses significant obstacles to the enforcement of U.S. court judgments.

- U.S. courts face enforcement challenges in India as Byju Raveendran's $1.07B default judgment clashes with India's strict foreign judgment recognition rules under Section 13. - TCS must appeal a $194M trade secrets ruling from the U.S. Fifth Circuit, highlighting cross-border IP disputes' complexity in the global IT sector . - Binance refunds Alpha Points after a technical error in a token airdrop, emphasizing operational risks in blockchain-based reward systems. - Amber International reports 69.8% YoY a

Bitcoin News Update: Bitcoin's Divergence from MAG7 Highlights a Shift Toward Scarcity-Focused Identity

- Bitcoin’s recent price drop and volatility warnings highlight market fragility amid diverging MAG7 correlations. - A historic $19B liquidation on October 10 marked Bitcoin’s decoupling from MAG7 tech stocks, reclassifying it as a scarcity-based hedge. - Low institutional adoption and 5% odds for MAG7 firms to hold Bitcoin in 2025 underscore limited macro support. - Trump’s growth forecasts lack Bitcoin tailwinds; CleanSpark’s AI pivot highlights crypto diversification. - Bitcoin’s future hinges on macroe