Grayscale Investments’ LINK Holdings Hit a New High in November Despite Price Declines

Chainlink’s on-chain strength and renewed institutional interest position LINK for a potential rebound. Declining exchange supply and ETF momentum reinforce the recovery case.

Chainlink (LINK) continued to feel the impact of negative market sentiment in November. The selling pressure pushed its price down 50% from last quarter’s peak. However, Grayscale and several analysts still maintain a bullish outlook.

The three-month decline has also driven LINK back to the most important support level of the past two years. This zone is where traders may find new opportunities.

How Much LINK Is Grayscale Holding?

Grayscale – one of the largest investment firms in the digital asset sector – recently released an extremely optimistic research report on the LINK token. The report highlights Chainlink’s role as a foundational infrastructure layer for decentralized finance (DeFi) and asset tokenization.

The report, titled ‘The LINK Between Worlds,’ describes Chainlink as a middleware module. It enables on-chain applications to use off-chain data securely. It also allows them to interact across blockchains and meet enterprise-level compliance needs.

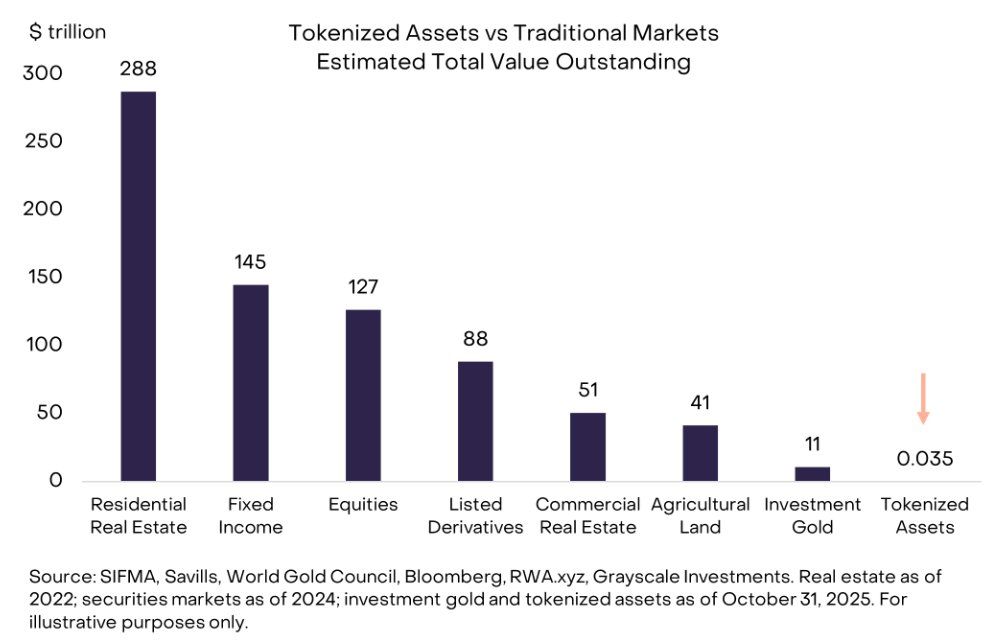

Zach Pandl, Head of Research at Grayscale, noted that tokenized assets remain very small today. They represent only about one basis point (0.01%) of the global equity and bond market capitalization. As a result, the growth potential is enormous.

Tokenized Assets vs. Traditional Markets. Source:

Grayscale.

Tokenized Assets vs. Traditional Markets. Source:

Grayscale.

“Tokenized assets are tiny today: just ~1 basis point (0.01%) of global equity and bond market cap. They will grow enormously over the next decade. In our view there is no project more central to making tokenization a reality than Chainlink,” Zach Pandl said.

The report was released shortly after Grayscale filed an application with the US Securities and Exchange Commission (SEC) for a spot LINK ETF, which would be listed under the ticker GLNK. According to Chainlink’s community liaison Zach Rynes, the application was recently amended and is expected to launch on December 2, 2025.

At the same time, Bitwise’s Chainlink ETF has been listed on the Depository Trust and Clearing Corporation (DTCC) platform under the ticker CLNK.

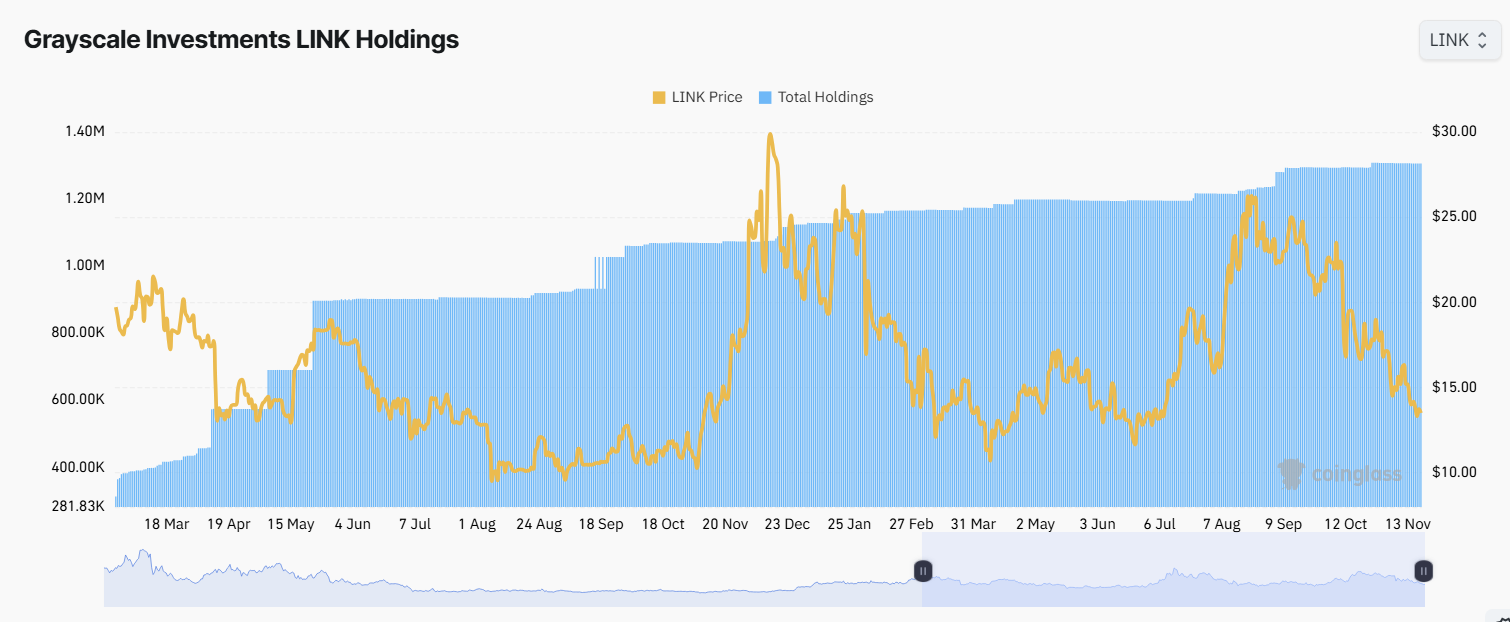

Furthermore, Grayscale Investments’ LINK holdings surpassed 1.3 million tokens in November 2025, according to CoinGlass data. Their holdings have increased more than fourfold over the past two years.

Grayscale Investments LINK Holdings. Source:

Coinglass.

Grayscale Investments LINK Holdings. Source:

Coinglass.

This trend reflects Grayscale’s growing confidence in Chainlink’s long-term potential, particularly as the firm continues to accumulate during periods of lower prices.

Chainlink (LINK) Faces a Recovery Opportunity While Entering Its Best Buying Zone in 2 Years

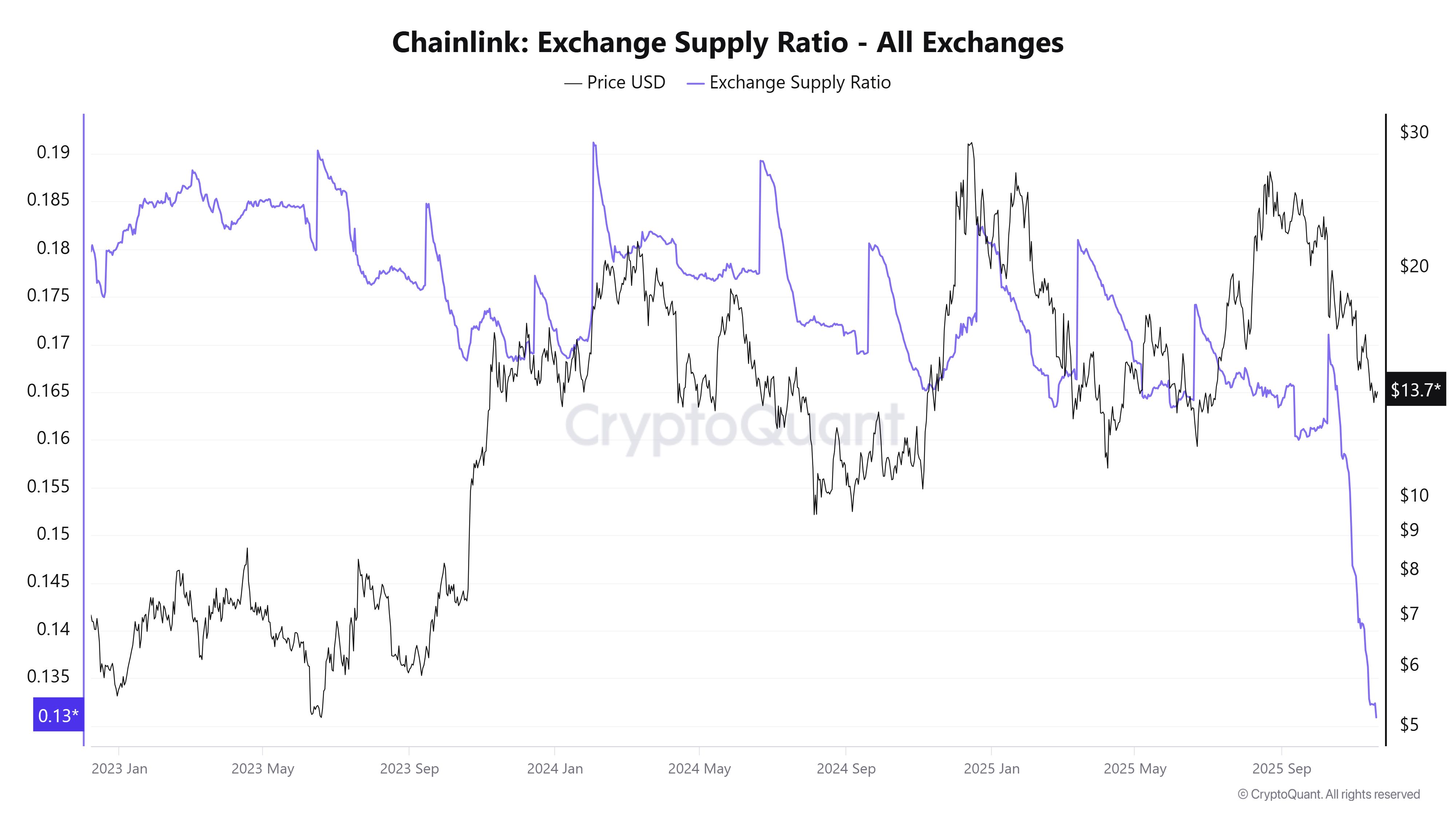

Another key indicator is LINK’s Exchange Supply Ratio, which hit a new low in November. This ratio measures exchange reserves as a percentage of the total supply.

Chainlink Exchange Supply Ratio. Source:

CryptoQuant.

Chainlink Exchange Supply Ratio. Source:

CryptoQuant.

CryptoQuant data shows the supply of LINK on exchanges dropped from 170 million tokens in October to 131 million in November. As a result, the Exchange Supply Ratio fell to its lowest level ever at 0.13.

This signals that fewer LINK tokens are available for trading. It reduces selling pressure, suggesting that investors are withdrawing tokens from exchanges for long-term holding. Such scarcity often precedes a major price rally when demand eventually exceeds supply.

On the technical side, LINK remains inside a large bullish structure and has reached its strongest support level in two years.

Chainlink Price’s Parallel Channel. Source:

CryptoPulse

Chainlink Price’s Parallel Channel. Source:

CryptoPulse

“LINK has been grinding inside a big ascending channel, and price is now right at the bottom of that structure — a spot where it has bounced multiple times before,” analyst CryptoPulse stated.

In summary, with support from Grayscale, upcoming ETFs, record-low exchange supply, and a solid technical position, Chainlink now stands on the edge of a strong recovery.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hayes Focuses on High-Yield DeFi Initiatives Amid Growing Institutional Interest

- Arthur Hayes acquired 2.01M ENA , 218K PENDLE, and 33K ETHFI tokens via Cumberland, totaling $1.42M in DeFi projects focused on yield optimization and automated market-making. - The purchases highlight growing institutional interest in DeFi protocols offering structured products and tokenized derivatives, with ENA and PENDLE leading in governance and yield strategies. - Hayes's strategy aligns with leveraging on-chain data to target undervalued assets, potentially amplifying market sentiment but exposing

Bitcoin Updates: Major Institutions Propel Bitcoin Beyond $90K Amid Expanding ETF Investments

- Institutional investors drove Bitcoin above $90,000 in November 2025 through strategic ETF allocations, including Texas's $10M initiative and Harvard's $443M IBIT stake. - ETF flows showed $238M inflows into spot Bitcoin ETFs despite prior $3.5B outflows, reflecting maturing institutional diversification and crypto-friendly government frameworks. - Texas's planned self-custodied Bitcoin transition and Mubadala's tripled IBIT holdings highlighted growing acceptance of Bitcoin as a strategic reserve asset.

Solana News Update: CHOG Soars by $10M—Meme Coin Frenzy Faces Analyst Cautions Over Market Fluctuations

- CHOG, a Monad ecosystem meme coin, briefly hit $10M market cap on Nov 27, driven by $17.9M 24-hour trading volume. - Monad's mainnet launch (Nov 24) raised $269M via a 1.43x oversubscribed Coinbase ICO, attracting 85,000 participants. - Analysts warn meme coins like CHOG face volatility risks due to social media-driven hype and lack of fundamentals. - Meme coin market reached $47.1B in Q4 2025, with DOGE and SHIB leading despite emerging Solana/Monad projects gaining traction. - Institutional investors r

Vitalik Buterin Backs ZKsync, Igniting Fresh Hopes for Layer 2 Scaling

- ZKsync's Atlas upgrade (Oct 2025) achieved 15,000 TPS and $0.0001 per transfer costs via RISC-V-based zkVM, solving Ethereum's scalability limitations. - Vitalik Buterin's endorsement catalyzed institutional adoption, with Deutsche Bank and Sony leveraging ZKsync for cross-chain settlements and data privacy. - ZK token surged 50% post-endorsement, while ZKsync's TVL reached $3.5B by 2025 through EVM compatibility and liquidity interoperability breakthroughs. - Upcoming Fusaka upgrade (Dec 3, 2025) aims t