Pi Coin Price Rises 10% As Capital Inflows Jump to 6-Week High

Pi Coin rallies 10% as inflows spike sharply, RSI rises, and investors push the asset toward a potential breakout above key support.

Pi Coin is gaining strong traction after a sharp 10% price increase that lifted the token to a weekly high. The recent rise reflects renewed investor confidence and improving market conditions.

Strengthening demand and accelerating inflows continue to support Pi Coin’s upward movement, signaling momentum that could extend in the near term.

Pi Coin Is Picking Up Capital

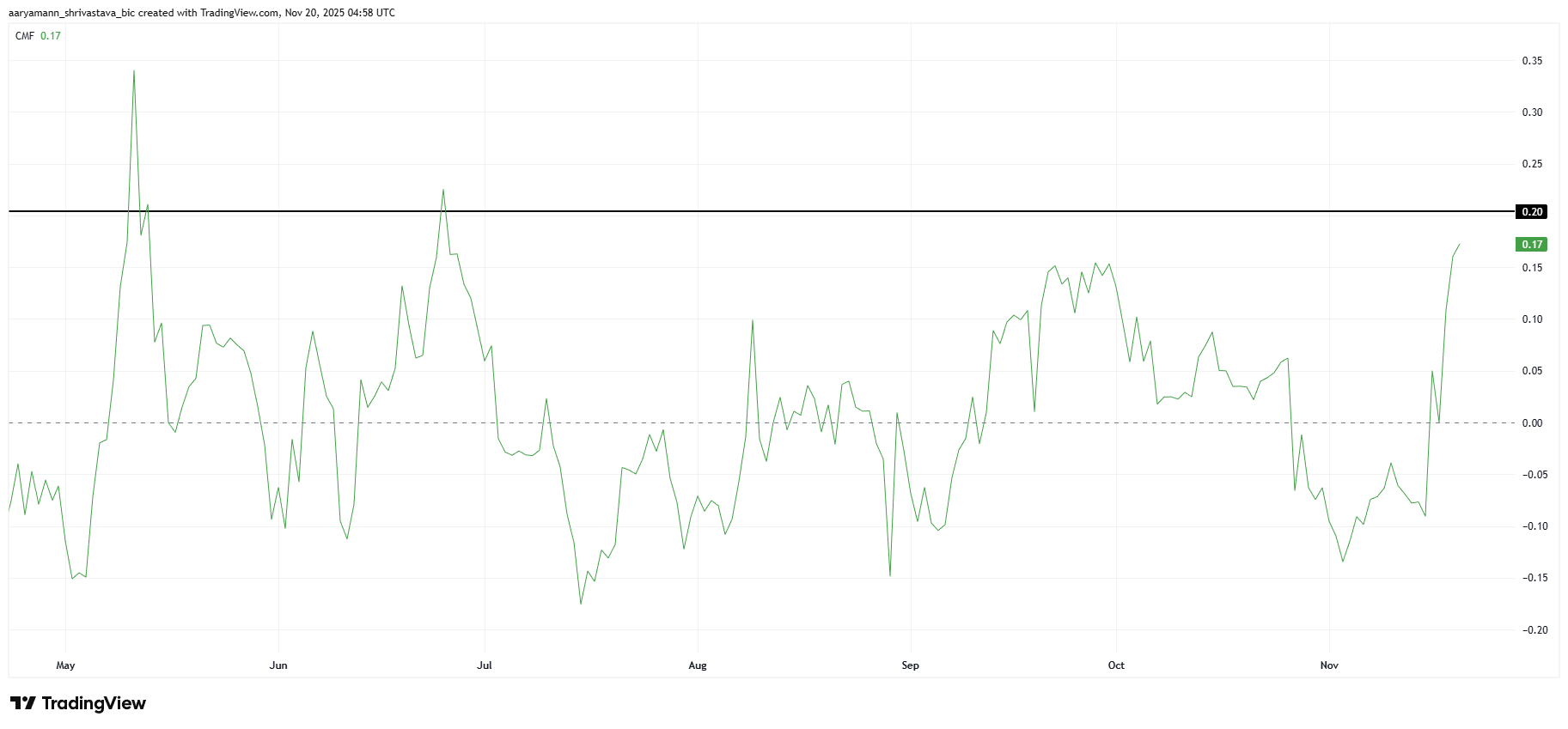

Market sentiment has strengthened notably, with the Chaikin Money Flow showing a sharp rise over the past few days. CMF measures capital flows, and a move into positive territory signals increasing inflows. Pi Coin’s CMF is climbing quickly, suggesting that investors are actively adding liquidity to the asset.

This uptick reflects growing confidence in Pi Coin’s short-term outlook. As inflows increase, the buying pressure strengthens. Investors appear motivated by improving conditions and are positioning themselves for continued gains.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

Macro momentum indicators are also aligning with Pi Coin’s bullish trend. The Relative Strength Index is observing a steady uptick, showing rising demand and stronger upward momentum. A rising RSI often suggests that buyers are gaining control and driving sustained appreciation.

This strengthening momentum is crucial for supporting ongoing growth. As broader market sentiment improves, Pi Coin may continue benefiting from increased risk appetite across altcoins.

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

PI Price Could See Continued Rise

Pi Coin trades at $0.250 after rising 9.5% in the past 24 hours. The altcoin is preparing to flip $0.246 into a confirmed support level. Holding this range will be essential for maintaining upward momentum and preventing short-term pullbacks.

If Pi Coin secures the support, it could rise toward $0.260 and higher, recovering losses from late October. Such movement may attract new investors looking for momentum-driven opportunities, further sustaining the ongoing rally. Strengthening fundamentals and improving sentiment add to the bullish outlook.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, if Pi Coin faces selling pressure, the price could slip below $0.246 and weaken current support. A decline may push the altcoin toward $0.234 or even $0.224, signaling a deeper retracement. This scenario would invalidate the bullish thesis and reflect fading confidence among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su

Bitcoin Updates: Crypto ETPs Signal Market Growth as Leverage Shares Debuts on SIX

- Leverage Shares launched the world's first 3x leveraged and -3x inverse Bitcoin/Ethereum ETPs on SIX Swiss Exchange, expanding its crypto product range to 452 offerings. - The EUR/USD-traded ETPs target sophisticated investors seeking directional exposure, aligning with SIX's 19% YoY crypto ETP turnover growth to CHF 3.83 billion. - Market timing raises concerns as Bitcoin/Ethereum fell 21%/26% in November 2025, with experts warning leveraged products could amplify losses during volatility. - SIX's regul

Ethereum Updates Today: Buterin Moves ETH to Safeguard Privacy Against Major Financial Players and Quantum Threats

- Ethereum co-founder Vitalik Buterin donated 128 ETH ($760,000) to privacy-focused apps Session and SimpleX Chat, emphasizing decentralized metadata protection and user-friendly access. - Recent 1,009 ETH transfer to Railgun protocol sparked speculation about asset reallocation, though control remains with Buterin amid mixed Ethereum price trends. - Buterin warns of existential risks: 10.4% institutional Ether ownership and quantum computing threats by 2028, advocating layered security for Ethereum's desi