Aster Price Dips 8% But This Secret Ingredient Is Keeping Its Uptrend Alive

Aster has slipped 8% in the past 24 hours, yet the altcoin continues to maintain a broader uptrend that has held firm for nearly three weeks. Despite bearish pressure from the wider crypto market, Aster is benefiting from unique structural advantages that are helping it resist deeper declines. Aster Has The Key To A Safe

Aster has slipped 8% in the past 24 hours, yet the altcoin continues to maintain a broader uptrend that has held firm for nearly three weeks.

Despite bearish pressure from the wider crypto market, Aster is benefiting from unique structural advantages that are helping it resist deeper declines.

Aster Has The Key To A Safe Rally

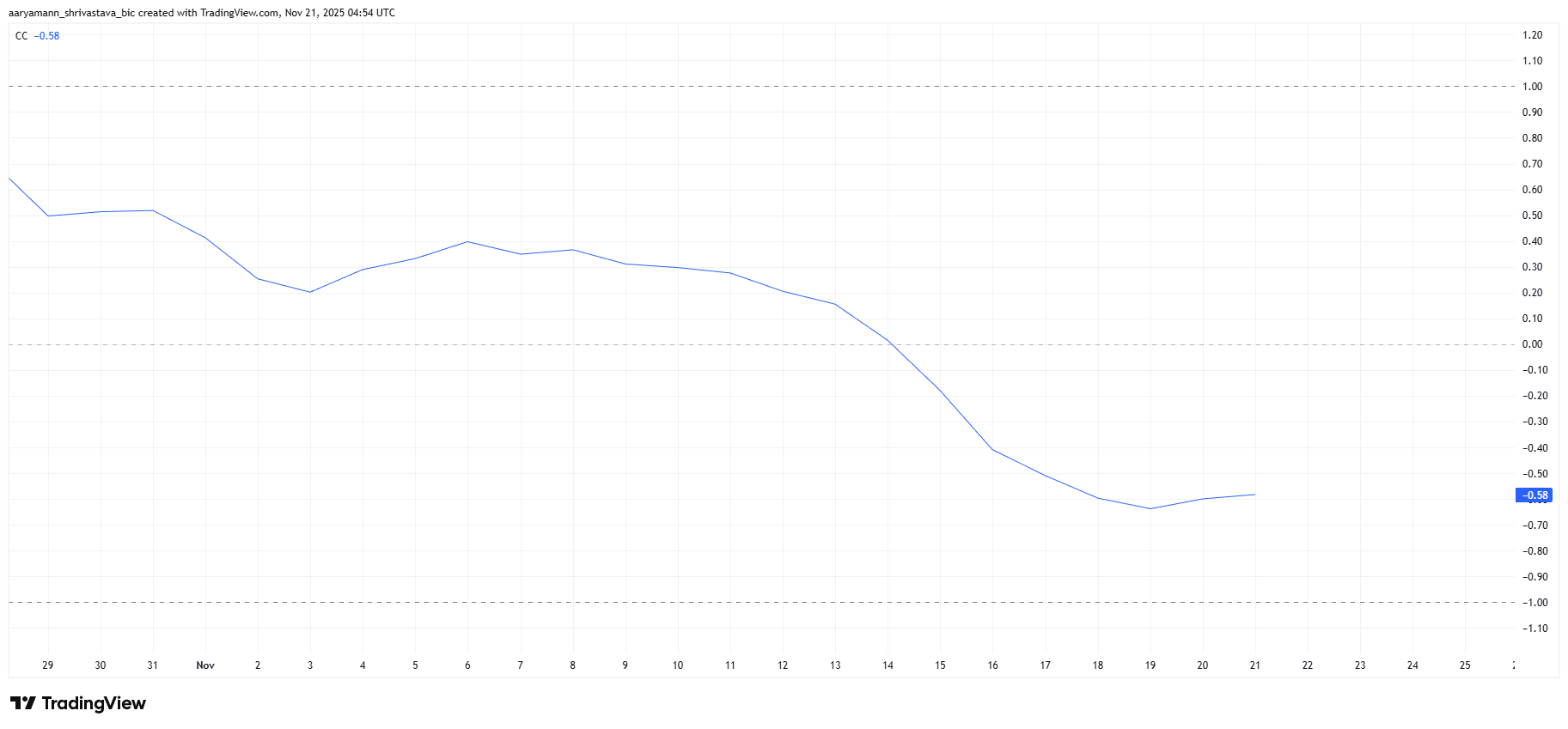

Aster’s negative correlation with Bitcoin is strengthening its position. At the time of writing, the correlation coefficient between Aster and BTC sits at -0.58, indicating that the two assets are moving in opposite directions. With Bitcoin continuing to decline on the daily chart, this negative relationship gives Aster room to rise even as the market weakens.

This dynamic has turned into one of Aster’s biggest advantages. As Bitcoin retreats, Aster’s price structure gains support from its divergence, allowing buyers to step in without the usual pressure tied to BTC’s volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ASTER Correlation To Bitcoin. Source:

ASTER Correlation To Bitcoin. Source:

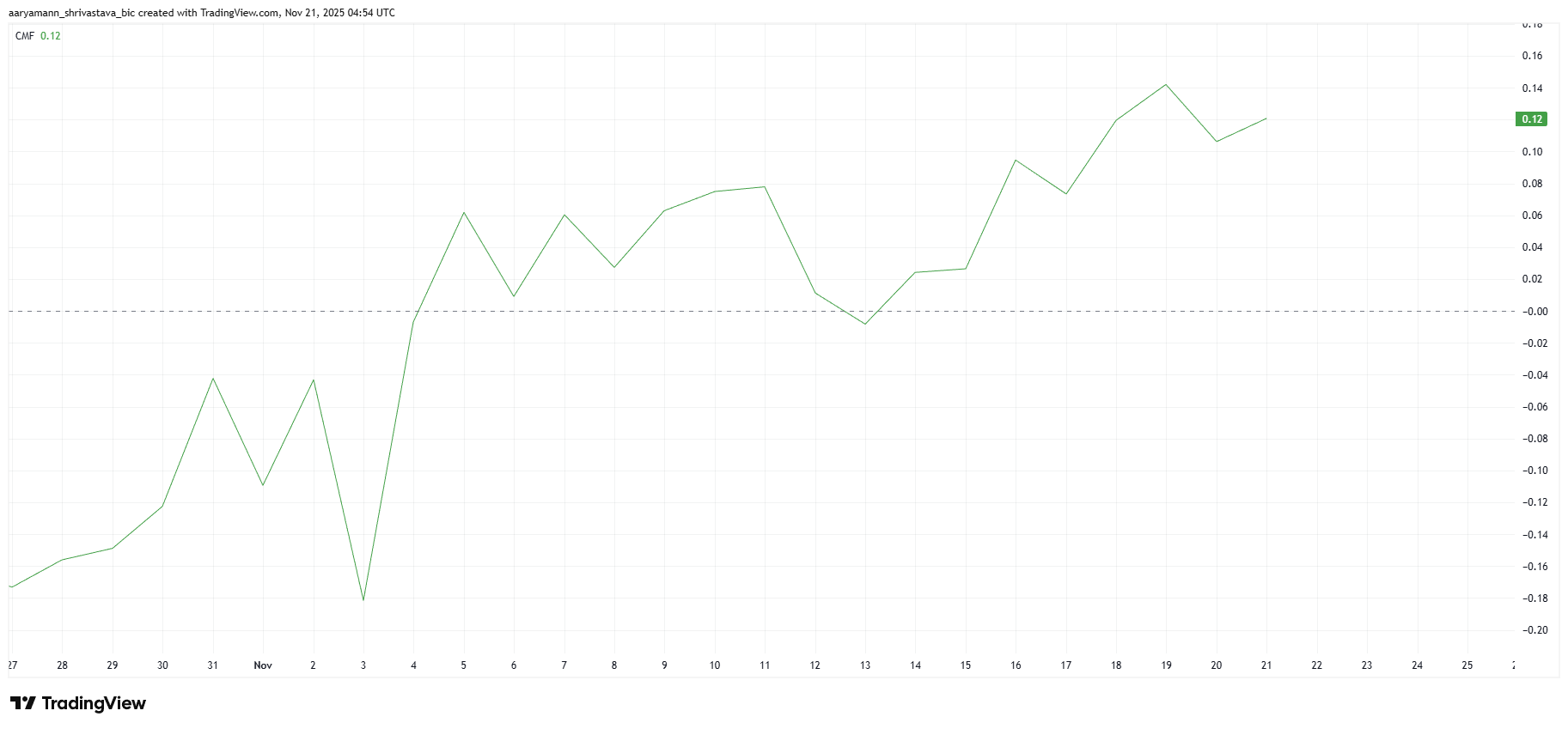

Macro momentum indicators are also pointing toward strengthening inflows. The Chaikin Money Flow is showing a sharp uptick, signaling rising capital entering the asset. Sustained positive CMF readings often indicate renewed investor confidence and provide essential backing for continued rallies.

Investor support plays a crucial role in maintaining price momentum, and Aster is benefiting from consistent accumulation. If these inflows continue, the altcoin could gain enough strength to push toward the $1.50 mark.

ASTER CMF. Source:

ASTER CMF. Source:

ASTER Price Will Continue Its Rise

Aster trades at $1.25 while holding above the key $1.20 support level, sitting just below the $1.28 resistance. Its current position suggests that the altcoin may continue rising as long as broader momentum and negative correlation with Bitcoin remain supportive.

Based on the current indicators, Aster’s nearly three-week-long uptrend appears likely to extend further. Even with the recent 8% drop, bullish conditions could drive the price toward $1.39. A breakout above that level would open the path to $1.50, reinforcing the strength of the ongoing rally.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if investors decide to lock in profits, Aster could lose its $1.20 support. A breakdown below that threshold may push the price to $1.07. This would invalidate the bullish thesis and signal a shift in sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin surges to $90K—Is this a sign of a new cycle or an early warning of another downturn?

- Bitcoin surged past $90,000 amid November's 29% drop from its October $126,000 peak, signaling a tentative recovery. - Ethereum , Solana , and other major cryptos rose 3-5%, while the Crypto Fear & Greed Index improved slightly to 15. - Technical indicators show Bitcoin testing critical levels, with analysts divided on whether $90,000 marks a cyclical bottom or temporary respite. - Institutional flows and on-chain data reveal mixed sentiment, as Fed policy uncertainty and bearish structures persist. - Lo

The Iceberg Phenomenon: Unseen Dangers of AI’s Labor Force Surface Across the Country

- MIT's Iceberg Index reveals AI could replace 11.7% of U.S. jobs ($1.2T in wages), impacting sectors like finance and healthcare beyond tech hubs. - The tool maps 151M workers across 923 occupations, highlighting hidden risks in routine roles (e.g., HR, logistics) versus visible tech layoffs. - States like Tennessee and Utah use the index for reskilling strategies, while C3.ai partners with Microsoft to expand enterprise AI solutions. - Despite C3.ai's market expansion, its stock faces volatility, reflect

Where Saving Animals and Supporting People Come Together: The Gentle Barn's Comprehensive Approach

- The Gentle Barn, a California-Tennessee sanctuary, merges animal rescue with human emotional healing through acupuncture, mobility aids, and therapeutic interactions. - Its volunteer programs and $75 season passes support financial sustainability while fostering compassion between humans and rescued animals like turkeys and hoofless goats. - The nonprofit's holistic model attracts attention as a case study in combining veterinary care with mental health initiatives, despite scalability challenges in nonp

XRP News Today: With Tether and USDC under examination, RLUSD from the UAE stands out as a regulatory-compliant stablecoin option.

- Ripple's RLUSD stablecoin received ADGM approval as a regulated fiat-referenced token in Abu Dhabi, enabling institutional use in payments and treasury management. - Pegged 1:1 to the USD with NYDFS oversight, RLUSD ($1.2B market cap) offers compliance-driven alternatives to USDT/USDC amid global regulatory scrutiny. - UAE's ADGM-DIFC regulatory framework positions the region as a crypto innovation hub, with Ripple expanding partnerships through Zand Bank and Mamo fintech . - The approval aligns with UAE