Trillion-Dollar Bank Handing $33,000,000 To Customers After Lawsuit Accuses Lender of Knowingly Assisting Alleged Fraudsters

One of the biggest banks in the US has agreed to pay $33 million to resolve a class action lawsuit accusing the bank of knowingly helping alleged fraudsters move millions of dollars tied to deceptive subscription schemes.

Court documents show Wells Fargo has reached a “global settlement” with both the Class Plaintiffs and a court-appointed Receiver, who brought parallel accusations against Wells Fargo in related actions.

The settlement, which just received preliminary approval , states that Wells Fargo will make a lump-sum payment of exactly $33,000,000 to “fully, finally, and forever” settle all claims, dismiss the actions with prejudice and resolve the allegations raised over the last several years.

The payout will be primarily sent to eligible class members, who are customers enrolled in recurring billing programs by the Tarr Entities, Triangle Entities or Apex Entities from 2009 to the present.

Both sets of plaintiffs allege Wells Fargo provided knowing assistance to the three companies, which allegedly ran deceptive online subscription operations involving nutraceutical and other consumer products.

The plaintiffs also allege the companies relied on Wells Fargo to keep the operation running, claiming the bank “knowingly assisted” their activities by opening business deposit accounts for dozens of companies tied to the alleged scheme. The complaint also alleges Wells Fargo transferred millions of dollars into “third-party bank accounts,” enabling the entities to move and launder funds collected from consumers.

The lawsuit stems from two coordinated cases filed on July 9, 2021 in federal court in the Southern District of California.

Following more than three years of litigation, the newly filed agreement says both the Class Plaintiffs and the Receiver have agreed to settle all claims in exchange for the $33 million payment.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

'Bitcoin Has Failed'-Crypto Influencer Questions Entire BTC Thesis After 12 Years

Reliance: Q4 Financial Results Overview

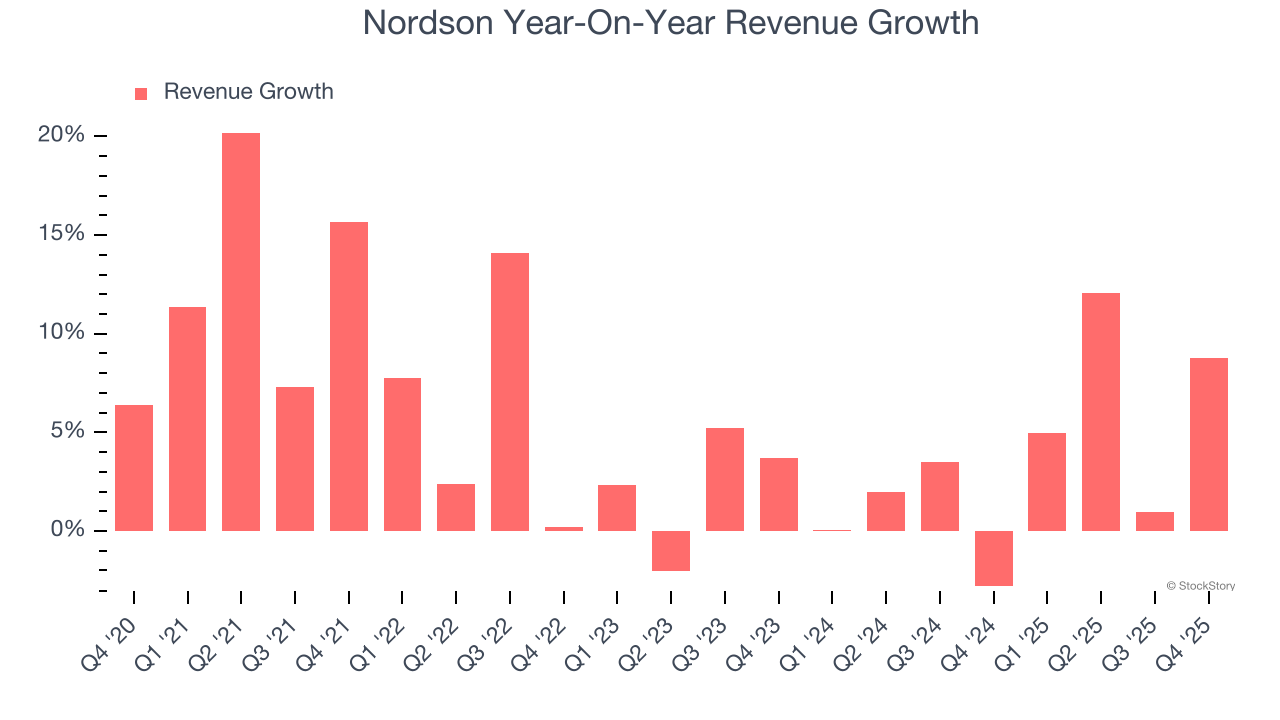

Nordson (NASDAQ:NDSN) Exceeds Q4 CY2025 Expectations