This Is How Aster Whales Can Save Price From Its First Bearish Crossover

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses. However, whale behavior suggests that a full breakdown may still be avoided if their support continues. Aster Whales Stand Firm Aster’s

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses.

However, whale behavior suggests that a full breakdown may still be avoided if their support continues.

Aster Whales Stand Firm

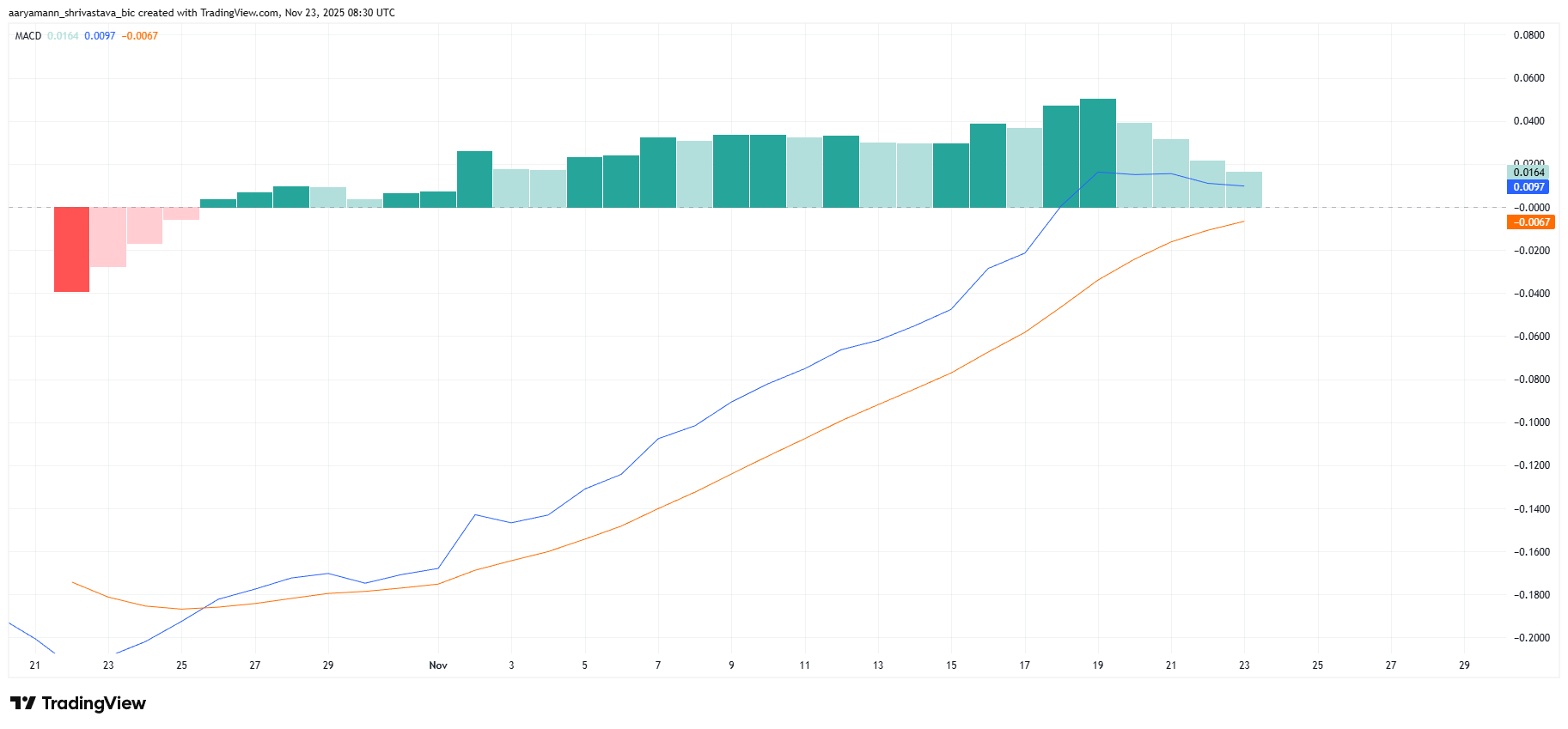

Aster’s MACD indicator is signaling a potential shift in momentum.

For the first time, the altcoin is nearing a bearish crossover as the signal line edges closer to moving above the MACD line. This alignment typically marks a transition from bullish to bearish momentum and raises caution among traders.

The histogram reinforces this warning with shrinking bars that indicate fading bullish strength.

As momentum recedes, investor sentiment may shift, making Aster more vulnerable to additional declines. The potential crossover could be Aster’s first major momentum reversal since the uptrend began.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER MACD. Source:

ASTER MACD. Source:

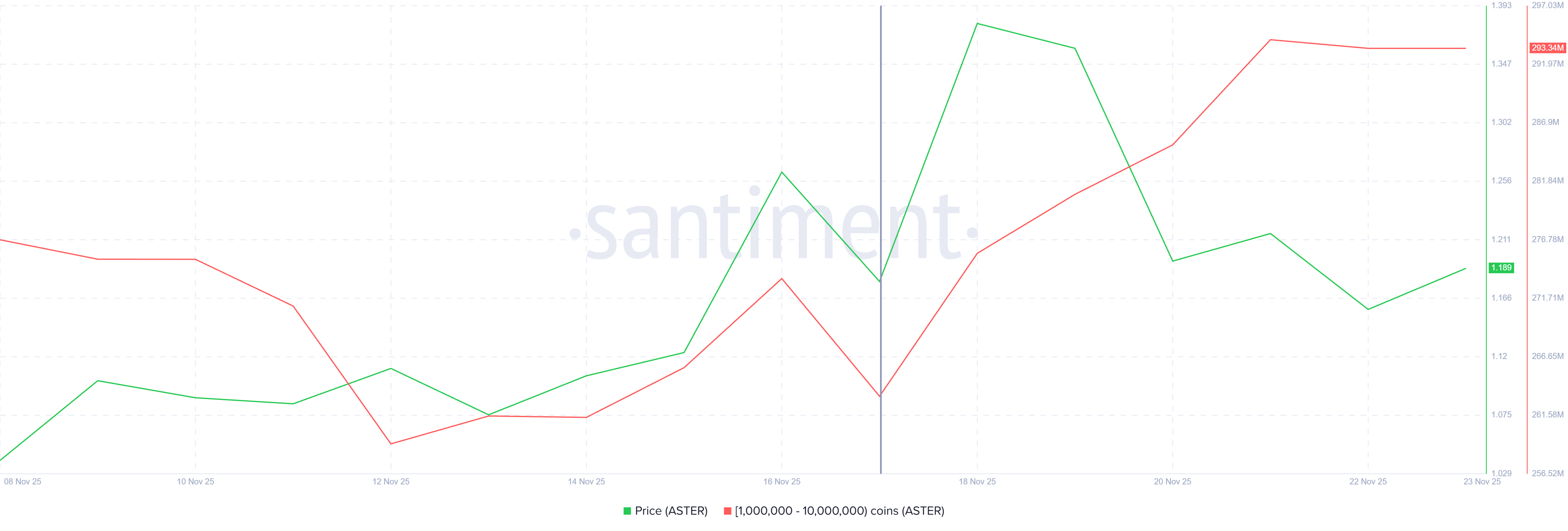

Despite weakening indicators, whale activity has remained surprisingly supportive. Over the past week, addresses holding between 1 million and 10 million ASTER accumulated 30 million tokens, worth more than $35 million. This consistent buying helped stabilize price action during earlier volatility.

Although whale accumulation has paused, these holders have not shifted to selling. Their willingness to hold despite market turbulence provides a critical cushion against sharper losses.

If whales maintain their positions, Aster may avoid a deeper decline, even if market conditions deteriorate further.

Aster Whale Holding. Source:

Aster Whale Holding. Source:

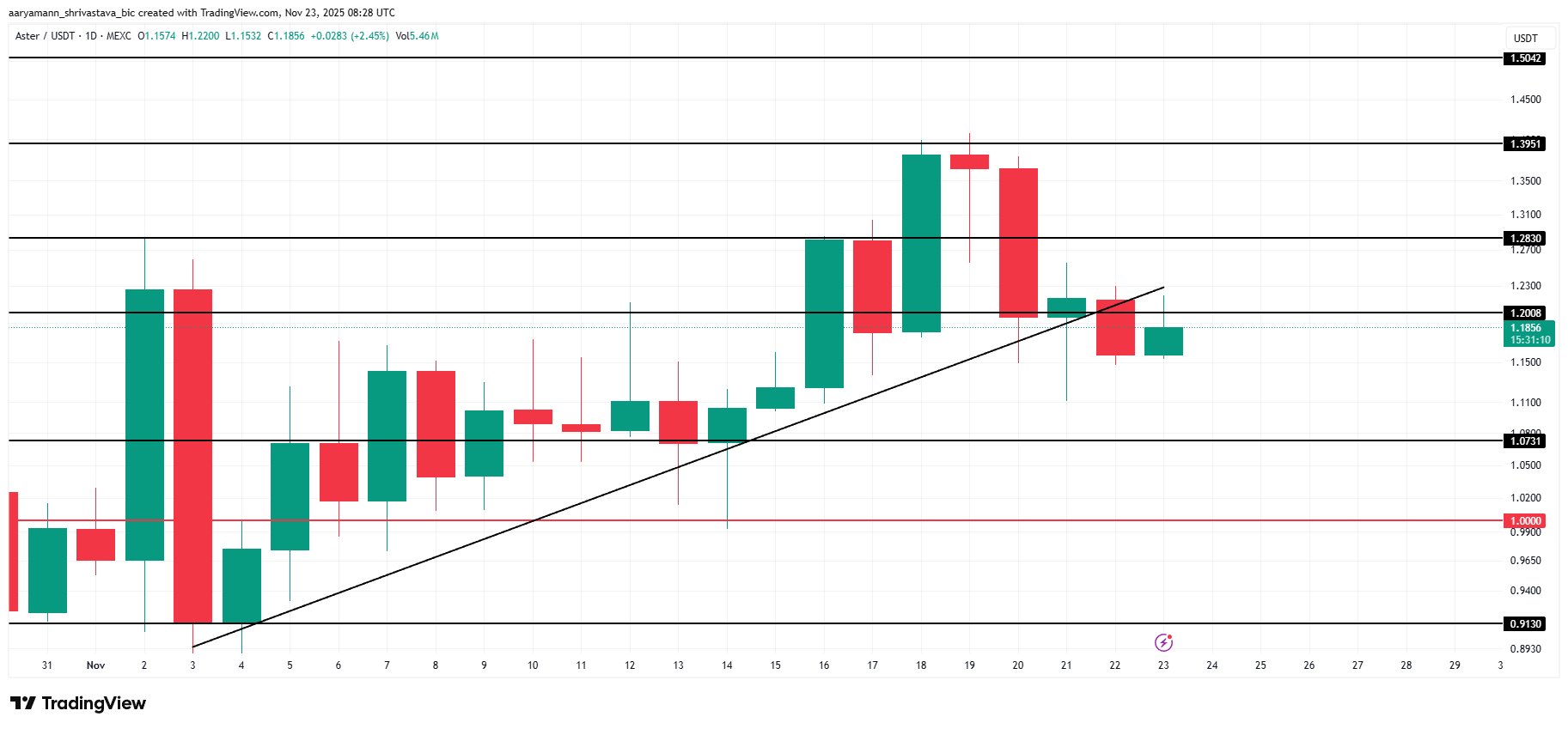

Aster trades at $1.18, sitting just below the $1.20 resistance level. The altcoin’s nearly three-week uptrend broke in the last 24 hours, creating uncertainity about the trajectory ahead.

Given the current indicators, Aster could reclaim $1.20 as support and either consolidate below $1.28 or climb toward $1.39. This outlook relies heavily on bullish stability and continued backing from accumulation-heavy investors.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if whales reverse course and begin to sell, Aster’s price could fall to $1.07. Losing that level would invalidate the bullish thesis.

This would confirm that bearish momentum has taken control, potentially leading to a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: With Tether and USDC under examination, RLUSD from the UAE stands out as a regulatory-compliant stablecoin option.

- Ripple's RLUSD stablecoin received ADGM approval as a regulated fiat-referenced token in Abu Dhabi, enabling institutional use in payments and treasury management. - Pegged 1:1 to the USD with NYDFS oversight, RLUSD ($1.2B market cap) offers compliance-driven alternatives to USDT/USDC amid global regulatory scrutiny. - UAE's ADGM-DIFC regulatory framework positions the region as a crypto innovation hub, with Ripple expanding partnerships through Zand Bank and Mamo fintech . - The approval aligns with UAE

ZK Atlas Enhancement: Driving Institutional Embrace Amid the Blockchain Scalability Competition

- ZKsync's Atlas Upgrade solves throughput bottlenecks with Airbender RISC-V zkVM, enabling 15,000+ TPS at $0.0001 per transaction. - Modular ZKsync OS reduces gas fees by 70% since 2023, enabling real-time financial applications while maintaining regulatory compliance. - Deutsche Bank and UBS test ZKsync for asset tokenization, highlighting its institutional appeal through privacy-preserving ZK features and sub-second finality. - Upcoming Fusaka upgrade aims to push TPS to 30,000 by December 2025, but reg

Bitcoin Updates: Bitcoin Receives Major-Cap Status as Nasdaq Increases Options Limits Fourfold

- Nasdaq seeks SEC approval to quadruple IBIT options limits from 250,000 to 1 million contracts, aligning Bitcoin ETF with high-liquidity assets like EEM and GLD . - The proposal cites IBIT's $86.2B market cap, 44.6M daily shares traded, and industry support for addressing institutional demand amid Bitcoin's rapid financial instrument maturation. - Experts argue higher limits will reduce spreads, enable sophisticated hedging, and treat Bitcoin as a "mega-cap asset," while Nasdaq also seeks unlimited FLEX

XRP Update: ADGM's Green Light for RLUSD Strengthens UAE's Pursuit of Digital Financial Growth

- Ripple's RLUSD stablecoin secured ADGM approval as an institutional fiat-backed token in November 2025, following DIFC's June 2025 greenlight. - The UAE's dual regulatory endorsements position RLUSD for cross-border settlements, with $1.2B market cap driven by institutional demand for collateral and treasury tools. - ADGM's stringent oversight framework requires full reserve backing and AML compliance, aligning RLUSD with global standards under NYDFS charter . - XRP prices surged 24% in late 2025 amid $1