Grayscale’s Dogecoin and XRP ETFs Set for NYSE Debut on November 24

Grayscale's new Dogecoin and XRP ETFs debut comes as the SEC, under Chairman Paul Atkins, shifts toward faster, disclosure-focused reviews of digital asset products.

Grayscale will introduce new exchange-traded fund products tied to Dogecoin and XRP on Nov. 24 after securing approval to list both vehicles on the New York Stock Exchange.

The Grayscale Dogecoin Trust ETF (GDOG) and the Grayscale XRP Trust ETF (GXRP) will debut as spot ETPs holding their respective underlying tokens.

Grayscale Expands ETF Lineup With Dogecoin and XRP

The firm is converting its existing private trusts into fully listed ETFs, a move that represents a major liquidity event for current investors.

GXRP will enter a market that already includes spot products from Canary Capital and Bitwise.

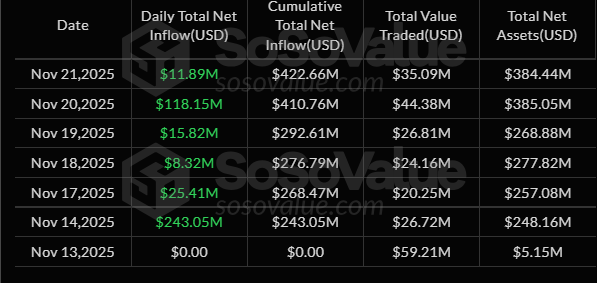

Those funds have drawn about $422 million in combined inflows during their first two weeks of trading, signaling early institutional interest in XRP-linked products.

XRP ETFs Daily Inflow Since Launch. Source:

SoSoValue

XRP ETFs Daily Inflow Since Launch. Source:

SoSoValue

On the other hand, GDOG will be one of the first Dogecoin ETF available to US investors.

Dogecoin, once a meme token, has grown into the ninth-largest cryptocurrency by market capitalization. Its deep retail following has made it one of the most frequently traded and discussed digital assets, a trend Grayscale expects will support ETF demand.

Considering this, Bloomberg Intelligence analyst Eric Balchunas said the product could attract as much as $11 million in volume on its first trading day.

Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday. $GLNK coming soon as well, week after I think

— Eric Balchunas (@EricBalchunas) November 21, 2025

GDOG and GXRP’s launch broadens the mix of crypto ETFs available in the US market, extending the industry’s expansion beyond Bitcoin and Ethereum products that dominated the initial wave of approvals.

Their arrival also reflects shifting regulatory conditions in Washington.

Both approvals are part of a broader acceleration in digital asset oversight under Securities and Exchange Commission (SEC) Chairman Paul Atkins.

Since taking office, Atkins has moved the agency away from a “regulation by enforcement” approach and toward a disclosure-focused framework.

Through his “Project Crypto” initiative, he has signaled that the SEC is open to reviewing compliant digital asset products, clearing the path for issuers seeking to list new ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u

Visa and AquaNow Upgrade Payment Infrastructure through Stablecoin Integration

- Visa partners with AquaNow to expand stablecoin settlement in CEMEA via USDC , aiming to cut costs and settlement times. - The initiative builds on a $2.5B annualized pilot program, leveraging stablecoins to modernize payment infrastructure. - Visa's multicoin strategy aligns with industry trends, as regulators and competitors like Mastercard also explore stablecoin integration. - Regulatory progress in Canada and risks like volatility highlight evolving opportunities and challenges in digital asset adop

Bitcoin Updates: Large Holder Liquidations and Retail Investor Anxiety Lead to a Delicate Equilibrium in the Crypto Market

- A long-dormant crypto whale sold 200 BTC after a 3-year hibernation, intensifying market scrutiny over investor sentiment and liquidity shifts. - Bitcoin struggles above $92,000 amid weak technical indicators, mixed ETF flows ($74M inflow for BTC vs. $37M ETH outflow), and diverging institutional/retail behaviors. - Whale activity highlights fragile market balance: large holders accumulate BTC while retail investors liquidate, with over $557M in BTC moved from Coinbase to unknown wallets. - Technical bea