CITES and Instant DNA Technology Aim to Uncover Covert Shark Trade and Prevent Species Disappearance

- CITES CoP20 in Uzbekistan proposes historic protections for 12 shark/ray species via Appendix I listings and stricter Appendix II monitoring. - Genetic testing reveals illegal shark trade volumes exceed official records by 10-70x, with Hong Kong as a key trafficking hub despite zero-export claims. - Portable DNA tools now enable real-time identification of 38 CITES-listed species, aiding enforcement in Indonesia, Ecuador, and other source countries. - Experts stress CITES is critical to prevent extinctio

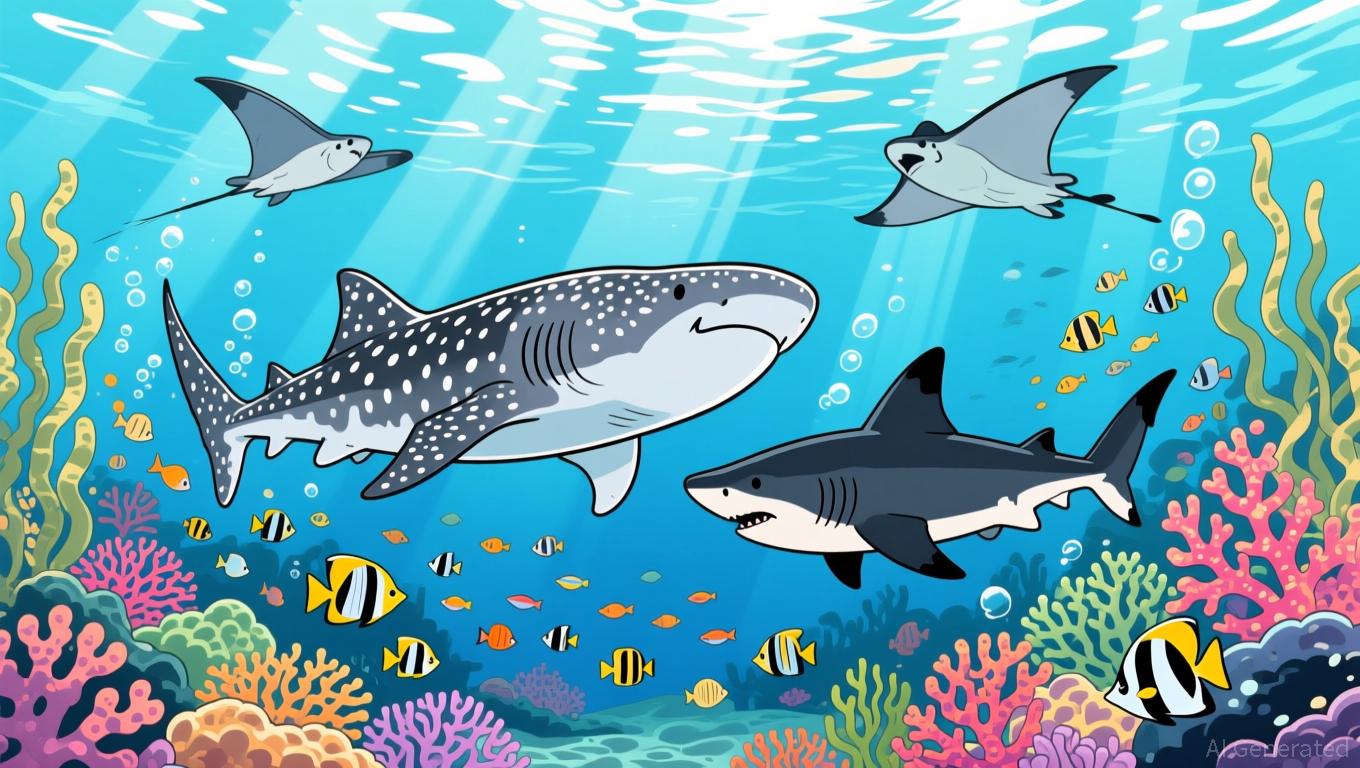

At the 20th Conference of the Parties to the Convention on International Trade in Endangered Species (CITES CoP20), held in Samarkand, Uzbekistan, government representatives are at a crucial crossroads to prevent the disappearance of whale sharks, manta rays, and other highly threatened marine animals. Currently, more than 37% of shark and ray species are at risk of extinction, with pelagic shark numbers having dropped by over 70% in the past five decades and

The measures being discussed at CoP20—with backing from over 50 nations—would provide the most extensive protections for sharks and rays ever seen under CITES. These proposals include moving the oceanic whitetip shark, all manta and devil rays, and whale sharks to Appendix I, effectively banning international commercial trade. Zero export quotas are suggested for wedgefish and giant guitarfish, while species such as gulper sharks and smoothhound sharks would be added to Appendix II, requiring tighter oversight

The need for immediate action is highlighted by a recent Science Advances study, which discovered that fins from species listed under CITES, such as oceanic whitetip and hammerhead sharks, are found in markets at rates 10 to 70 times higher than what is officially reported. For instance, 81% of countries exporting shark fins claimed no exports of threatened species, even though DNA evidence traced the fins back to their waters. Hong Kong continues to be a major trade center, with many source countries failing to report the quantities uncovered by genetic testing.

To address this, marine biologist Diego Cardeñosa from Florida International University has created a portable DNA testing device that can instantly identify protected shark and ray species. The tool, tested on 55 species—including 38 listed by CITES—can detect unknown species and provide immediate proof for authorities. Cardeñosa points out that without fast identification methods, illegal shipments often go unnoticed, weakening global conservation efforts. The technology, which can also be used for turtles and mammals, is now being used in countries such as Indonesia and Ecuador to help stop trafficking.

Luke Warwick, who leads the Wildlife Conservation Society's (WCS) shark and ray initiative, emphasized that "CITES remains the most powerful international mechanism to ensure that wildlife trade does not push species to extinction." Dr. Susan Lieberman of WCS further noted that the proposed listings "align CITES with other international commitments and clearly demonstrate the global intent to safeguard these species before it is too late"

The outcomes of CoP20 may decide the fate of these vital species. As top predators and key ecosystem engineers, sharks and rays are essential for maintaining marine biodiversity and the stability of fisheries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Law Firms Take Action Against Corporations Amid Rising Investor Lawsuits

- U.S. law firms like Schall and Gross are leading class-action lawsuits against corporations for alleged investor misrepresentations across sectors. - Cases involve DexCom , MoonLake , Beyond Meat , and Stride , accusing them of concealing risks, overstating drug efficacy, and inflating enrollment figures. - Legal actions highlight SEC's intensified focus on biotech disclosures and edtech compliance, with deadlines set for investor claims by late 2025-2026. - These lawsuits emphasize corporate accountabil

Solana News Update: Solana ETFs Attract $476M While Death Cross and $120 Support Level Approach

- Solana ETFs attract $476M in 19 days, driven by Bitwise's 0.20% fee BSOL ETF with $424M inflows. - Technical indicators show a death cross and $120-$123 support test, with RSI at oversold 33 amid stagnant price action. - Institutional confidence grows via Franklin Templeton's fee-waiver strategy, contrasting Bitcoin/Ethereum ETF outflows of $5.34B. - Whale accumulation and on-chain growth hint at long-term buying, but $140 resistance remains unbroken despite ETF inflows.

XRP News Today: ADGM's Authorization of RLUSD Establishes International Standard for Institutional Stablecoin Compliance

- Ripple's RLUSD stablecoin gains FSRA approval for institutional use in Abu Dhabi's ADGM, effective November 27, 2025. - The $1.2B market-cap stablecoin features 1:1 USD reserves, third-party audits, and compliance with ADGM's transparency standards. - ADGM's approval aligns with its strategy to position Abu Dhabi as a global digital asset hub through regulated fiat-referenced tokens. - Ripple's Middle East expansion includes partnerships with UAE banks and regulatory licenses in Dubai, Bahrain, and Afric

Pi Network Boosts Web3 Gaming Innovation Through New Strategic Partnership