YFI Value Increases by 1.18% During Market Fluctuations

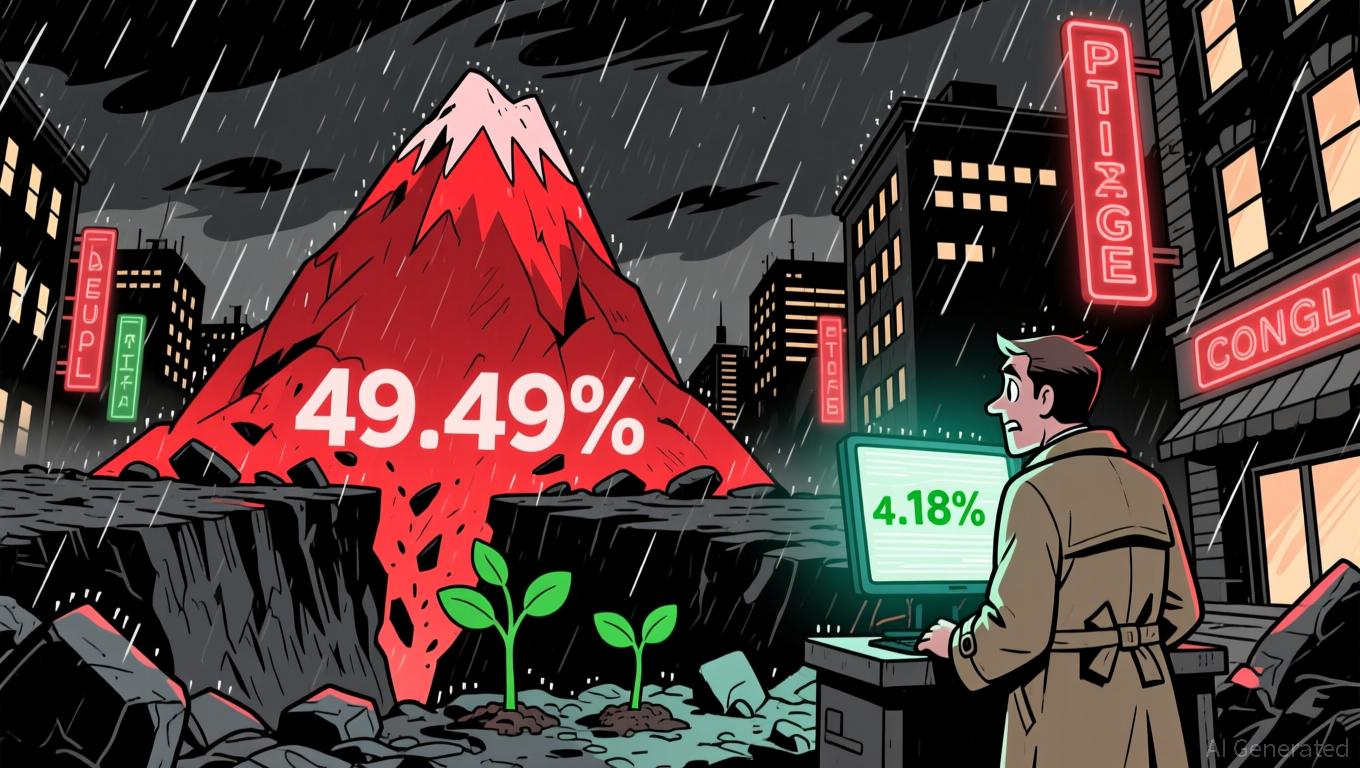

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

On November 24, 2025, YFI (yearly interest factor) saw its value climb by 1.18% in the past 24 hours, bringing its price to $4,036. Despite this brief upward movement, the overall trend remains negative: in the last seven days, YFI has fallen by 9.16%, and over the previous 30 days, it has lost 14.24%. Most notably, the asset has suffered a 49.49% decrease over the past year, highlighting a persistent bearish pattern even with the recent short-term rise.

This activity highlights the continued instability within the

The recent changes in YFI’s price mirror the broader sense of unpredictability in the market. Short-lived gains can often be attributed to shifts in liquidity, economic indicators, or speculative trades. However, since there have been no notable news or events linked to YFI, this movement likely stems from general market forces. Traders are watching closely for any signs of stabilization, but the prevailing downward trend continues to dominate.

Given the asset’s performance over the past year, investors should approach with caution, as it remains highly responsive to economic shifts and changing market sentiment. While the latest increase is encouraging, it does not necessarily signal a reversal of the broader trend. Uncertainty is still being factored into the market, and only a sustained period of growth could indicate a potential change in direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Law Firms Take Action Against Corporations Amid Rising Investor Lawsuits

- U.S. law firms like Schall and Gross are leading class-action lawsuits against corporations for alleged investor misrepresentations across sectors. - Cases involve DexCom , MoonLake , Beyond Meat , and Stride , accusing them of concealing risks, overstating drug efficacy, and inflating enrollment figures. - Legal actions highlight SEC's intensified focus on biotech disclosures and edtech compliance, with deadlines set for investor claims by late 2025-2026. - These lawsuits emphasize corporate accountabil

Solana News Update: Solana ETFs Attract $476M While Death Cross and $120 Support Level Approach

- Solana ETFs attract $476M in 19 days, driven by Bitwise's 0.20% fee BSOL ETF with $424M inflows. - Technical indicators show a death cross and $120-$123 support test, with RSI at oversold 33 amid stagnant price action. - Institutional confidence grows via Franklin Templeton's fee-waiver strategy, contrasting Bitcoin/Ethereum ETF outflows of $5.34B. - Whale accumulation and on-chain growth hint at long-term buying, but $140 resistance remains unbroken despite ETF inflows.

Pi Network Boosts Web3 Gaming Innovation Through New Strategic Partnership

The Inability of Regulatory Systems to Curb Cryptocurrency Price Fluctuations

- Global crypto regulations advanced in 2024-2025, with 70% of jurisdictions improving policies, yet markets faced 2025 liquidity crises exposing structural fragility. - U.S. SEC's Project Crypto and EU/UK frameworks aimed to clarify rules, but fragmented enforcement gaps and 25% higher 2024 crypto hacks highlighted systemic vulnerabilities. - Institutional investors increased crypto holdings to 55% in 2025, adopting tokenized funds and liquidity strategies amid evolving disclosure requirements and unstabl