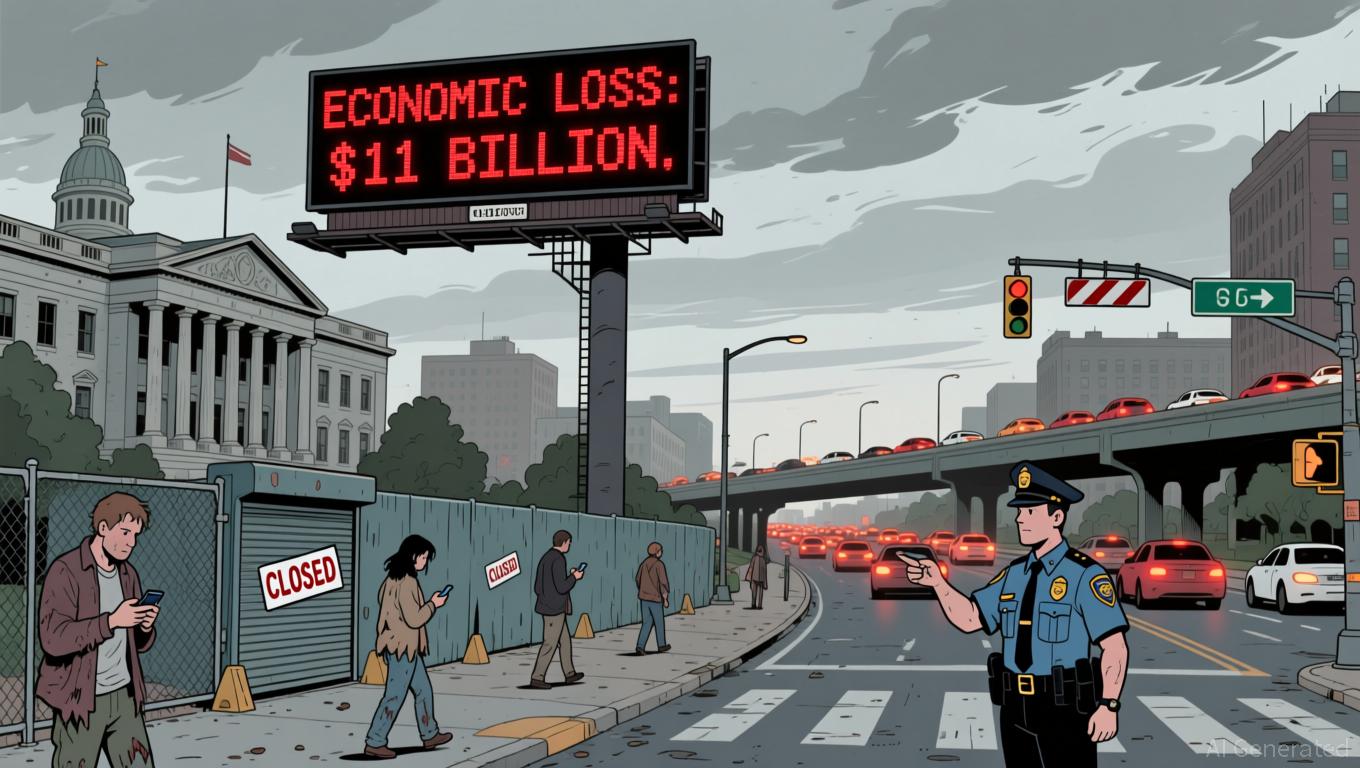

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

The United States experienced a government shutdown spanning 43 days at the end of 2025

The BLS

Despite these obstacles, the administration remains optimistic about the nation’s economic direction.

The economic consequences of the shutdown have strengthened demands for legislative change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Law Firms Take Action Against Corporations Amid Rising Investor Lawsuits

- U.S. law firms like Schall and Gross are leading class-action lawsuits against corporations for alleged investor misrepresentations across sectors. - Cases involve DexCom , MoonLake , Beyond Meat , and Stride , accusing them of concealing risks, overstating drug efficacy, and inflating enrollment figures. - Legal actions highlight SEC's intensified focus on biotech disclosures and edtech compliance, with deadlines set for investor claims by late 2025-2026. - These lawsuits emphasize corporate accountabil

Solana News Update: Solana ETFs Attract $476M While Death Cross and $120 Support Level Approach

- Solana ETFs attract $476M in 19 days, driven by Bitwise's 0.20% fee BSOL ETF with $424M inflows. - Technical indicators show a death cross and $120-$123 support test, with RSI at oversold 33 amid stagnant price action. - Institutional confidence grows via Franklin Templeton's fee-waiver strategy, contrasting Bitcoin/Ethereum ETF outflows of $5.34B. - Whale accumulation and on-chain growth hint at long-term buying, but $140 resistance remains unbroken despite ETF inflows.

Pi Network Boosts Web3 Gaming Innovation Through New Strategic Partnership

The Inability of Regulatory Systems to Curb Cryptocurrency Price Fluctuations

- Global crypto regulations advanced in 2024-2025, with 70% of jurisdictions improving policies, yet markets faced 2025 liquidity crises exposing structural fragility. - U.S. SEC's Project Crypto and EU/UK frameworks aimed to clarify rules, but fragmented enforcement gaps and 25% higher 2024 crypto hacks highlighted systemic vulnerabilities. - Institutional investors increased crypto holdings to 55% in 2025, adopting tokenized funds and liquidity strategies amid evolving disclosure requirements and unstabl