Bitcoin Update: Federal Reserve Postponements and $1.2 Billion ETF Withdrawals Trigger 26% Drop in Bitcoin Value

- Bitcoin falls 26% to $83,000 amid Fed's delayed rate-cut timeline and $1.2B ETF outflows, marking its longest losing streak since 2024. - Analysts warn of structural risks, with Bloomberg's Mike McGlone projecting a potential $10,000 drop and Cathie Wood revising bullish 2030 forecasts. - Market volatility intensifies as JPMorgan's index exclusion proposal sparks crypto sector backlash and S&P 500 defensive sector shifts highlight interconnected risks. - Fed's December rate-cut speculation and upcoming i

Bitcoin is experiencing its lengthiest downturn of 2024, as shifting signals from the Federal Reserve inspire cautious hope for a possible recovery. The digital asset has dropped 26% since late October and is currently hovering near $83,000,

The main factor behind the sell-off has been the Fed’s decision to push back its rate-cut schedule. After failing to meet its October employment goal, the central bank indicated a more restrained stance on easing,

The

This wave of selling has affected the wider financial landscape.

Across the broader market, the S&P 500’s performance in November has signaled a move toward more defensive industries,

Looking forward, investors are set to monitor inflation figures and manufacturing data closely,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Grayscale Files for First US Spot Zcash ETF

Web3 is Helping AI Agents Reshape Digital Payments

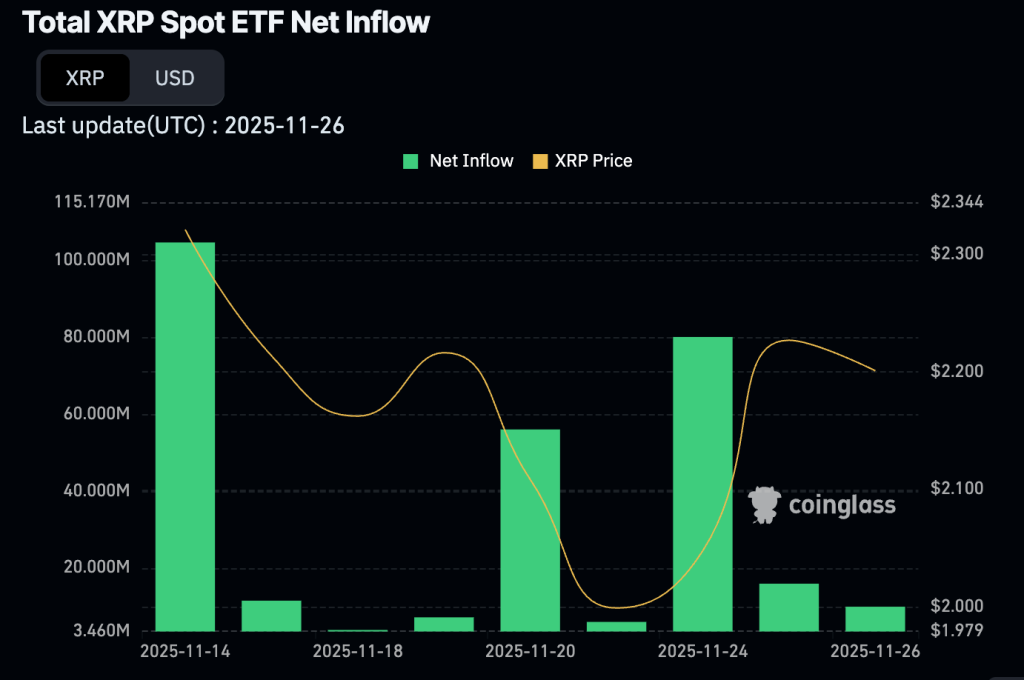

Ripple News : XRP ETFs Could Pull In $7–$10B Annually as Demand Accelerates

Justin Sun Details New Progress in $456M TUSD Fraud After Worldwide Asset Freeze