JPMorgan Closed His Accounts, But You Don’t Throw Out a Bitcoin CEO by Accident

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why. The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms. Mallers Says

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why.

The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms.

Mallers Says JPMorgan Gave No Reason: “We Aren’t Allowed to Tell You”

In a series of posts on X (Twitter), Mallers revealed that Last month, JPMorgan Chase threw him out of the bank, citing a bizarre incident that disregarded his family’s three-decade-long relationship with the bank.

Allegedly, each time he asked for an explanation, the bank reportedly repeated the same line: “We aren’t allowed to tell you.”

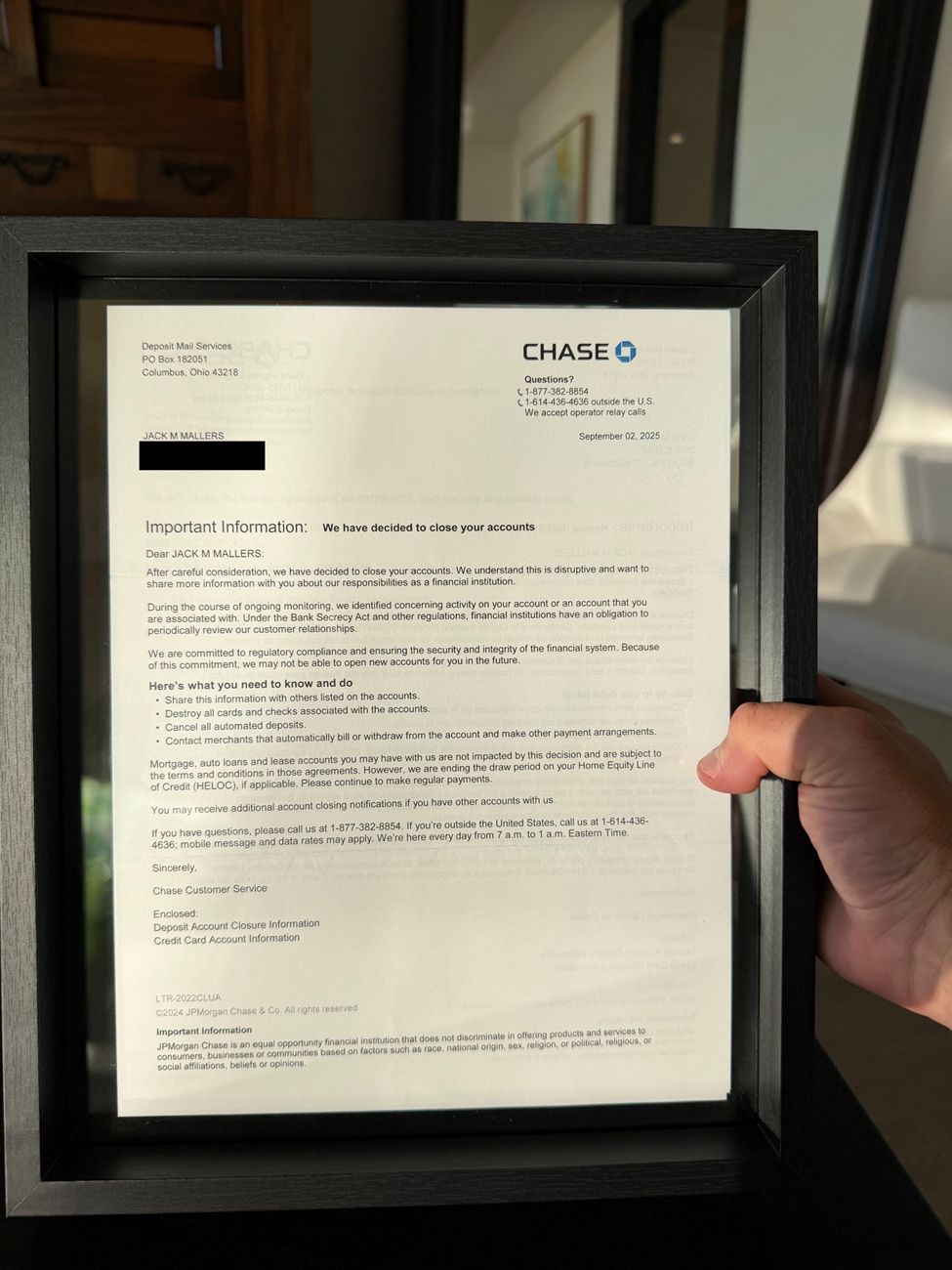

Mallers also shared an image of a letter he claims came from JPMorgan, stating that the bank had identified “concerning activity” and warning that it may not open new accounts for him in the future.

Alleged letter from JPMorgan to Jack Mallers. Source:

Alleged letter from JPMorgan to Jack Mallers. Source:

The incident has since triggered speculation online, with many users suggesting that “Operation Chokepoint 2.0” may still be active. Notably, this rhetoric suggests that banks are under quiet pressure to sever ties with cryptocurrency businesses.

According to Tether CEO Paolo Ardoino, the move was likely for the best, with Mallers advocating for freedom from centralized entities.

His comments added fuel to the broader debate about whether traditional banks can coexist with Bitcoin-native leaders who view decentralization as a form of resistance, not disruption.

Debanking Flashpoint Comes as JPMorgan Faces MicroStrategy Fallout

The timing of Mallers’ account closure is notable. JPMorgan is currently under scrutiny for its research surrounding a potential MSCI reclassification that could result in MicroStrategy being expelled from major equity indexes.

MSCI is considering a rule that excludes companies whose digital assets comprise more than 50% of total assets, placing MicroStrategy, which holds 649,870 BTC at an average price of $74,430, directly in its crosshairs.

JPMorgan analysts estimate this could trigger $2.8 billion in passive fund outflows tied to MSCI alone, and up to $8.8 billion if other index providers adopt similar criteria.

The backlash intensified following new Senate findings showing JPMorgan under-reported suspicious Jeffrey Epstein transactions for years. Senator Ron Wyden accused the bank of enabling Epstein’s crimes, renewing calls for criminal investigation.

For critics, Mallers’ treatment fits into a pattern of questionable judgment and selective enforcement. It also reflects the reality that when Bitcoin CEOs are pushed out of banks without explanation, the implications extend far beyond a single closed account.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving and Its Effects on the Dynamics of the Cryptocurrency Market

- Zcash's halving mechanism reduces block rewards every four years, enhancing scarcity and mimicking Bitcoin's deflationary model while offering optional privacy features. - Historical halvings (2020, 2024) triggered sharp price swings, with Zcash surging 1,172% post-2024's NU5 upgrade and institutional adoption via Grayscale Zcash Trust. - Next halving projected for late 2028 faces risks from regulatory scrutiny of shielded transactions and competition from privacy coins like Monero. - Long-term investors

Bitcoin News Today: Has Bitcoin's Drop to $87K Signaled a Temporary Pullback or the Onset of a More Significant Decline?

- Bitcoin fell below $87,000 amid ETF outflows, whale selling, and macroeconomic pressures, marking its largest correction since spot ETFs launched. - Institutional withdrawals, including $151M in ETF outflows and BlackRock's $2.47B IBIT losses, reflect waning confidence and profit-taking amid tightening monetary policies. - On-chain data shows mixed signals: mid-sized wallets accumulate Bitcoin while whales offload, while regulatory uncertainties in the U.S. and EU amplify selling pressure. - Technical in

Stellar News Update: Technology-Fueled Commodity Markets Grow Through Stellar and Abaxx Collaboration

- Stellar Trading Systems partners with Abaxx Exchange to expand global commodity trading access via Singapore-based USD gold futures. - Intralot S.A. reports EUR 548M revenue in Q3 2025 but faces UK 40% remote gaming tax hike threatening pro forma EUR 1B revenue goals. - Strive Asset Management and Polymarket advance crypto adoption through institutional BTC treasury models and CFTC-approved prediction markets. - Market developments highlight evolving interplay between digitized commodity infrastructure a

Bitcoin News Update: Bitcoin's Value Drops in Parallel with Declining Political Clout of Trump

- Bitcoin maintains market dominance with Altcoin Season Index at 24, indicating most altcoins lag behind. - Bitcoin’s price decline correlates with waning Trump support, as highlighted by economist Paul Krugman. - BlackRock’s IBIT ETF sees $3.2B unrealized gains as Bitcoin rebounds to $90,000. - Technical indicators show mixed near-term prospects, while a few altcoins like Aster surged over 1,200%. - Analysts suggest regulatory clarity or tech breakthroughs could trigger next altcoin season after prolonge