HBAR Price Needs A Near 40% Rally To Recover November Losses

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation. However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation.

However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is not helping its case.

Hedera Traders Are Placing Shorts

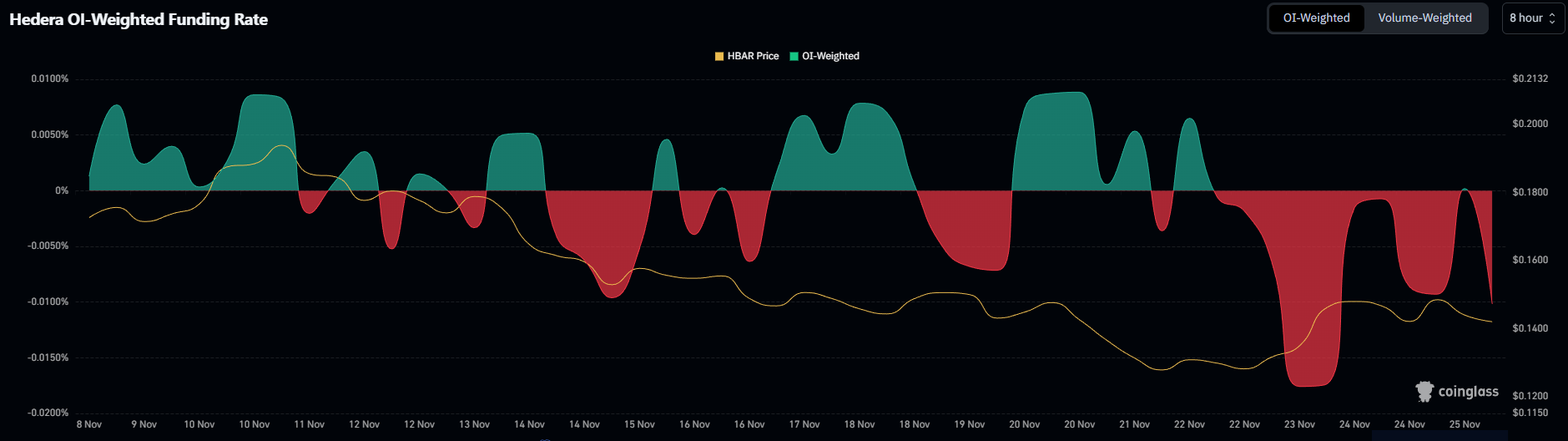

Funding rates across major exchanges indicate that traders remain hesitant. The current negative funding rate suggests that market participants expect more downside and are opening short positions to profit from a potential decline. This type of sentiment often emerges during extended consolidation phases, where traders lose confidence in the asset’s ability to rebound.

However, funding rates are highly reactive and can shift quickly. Their frequent fluctuations signal volatility and uncertainty rather than a firmly bearish trend. If sentiment flips and traders begin to unwind shorts, HBAR could benefit from a sudden surge in buying pressure, helping it regain lost ground.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

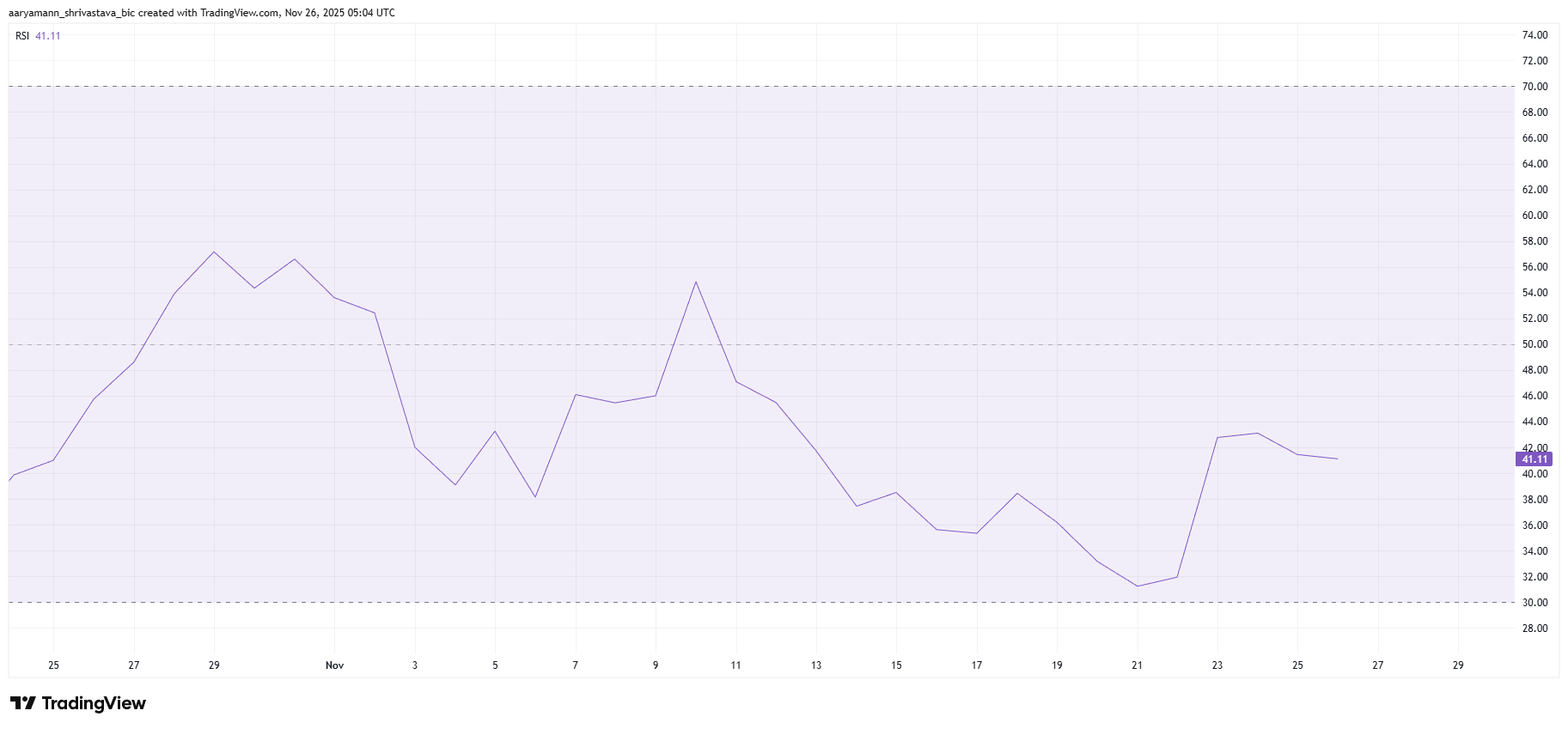

The broader momentum picture remains weak. Hedera’s relative strength index is sitting below the neutral 50.0 level, firmly in bearish territory. This positioning reflects ongoing market pressure and a lack of strong bullish conviction. When the RSI holds in the negative zone, price action often struggles to form higher highs or generate sustainable rallies.

The persistent market-wide caution also weighs on HBAR’s ability to mount a recovery. Unless momentum indicators shift upward, the altcoin could remain stuck in its current range.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price Has A Long Way To Go

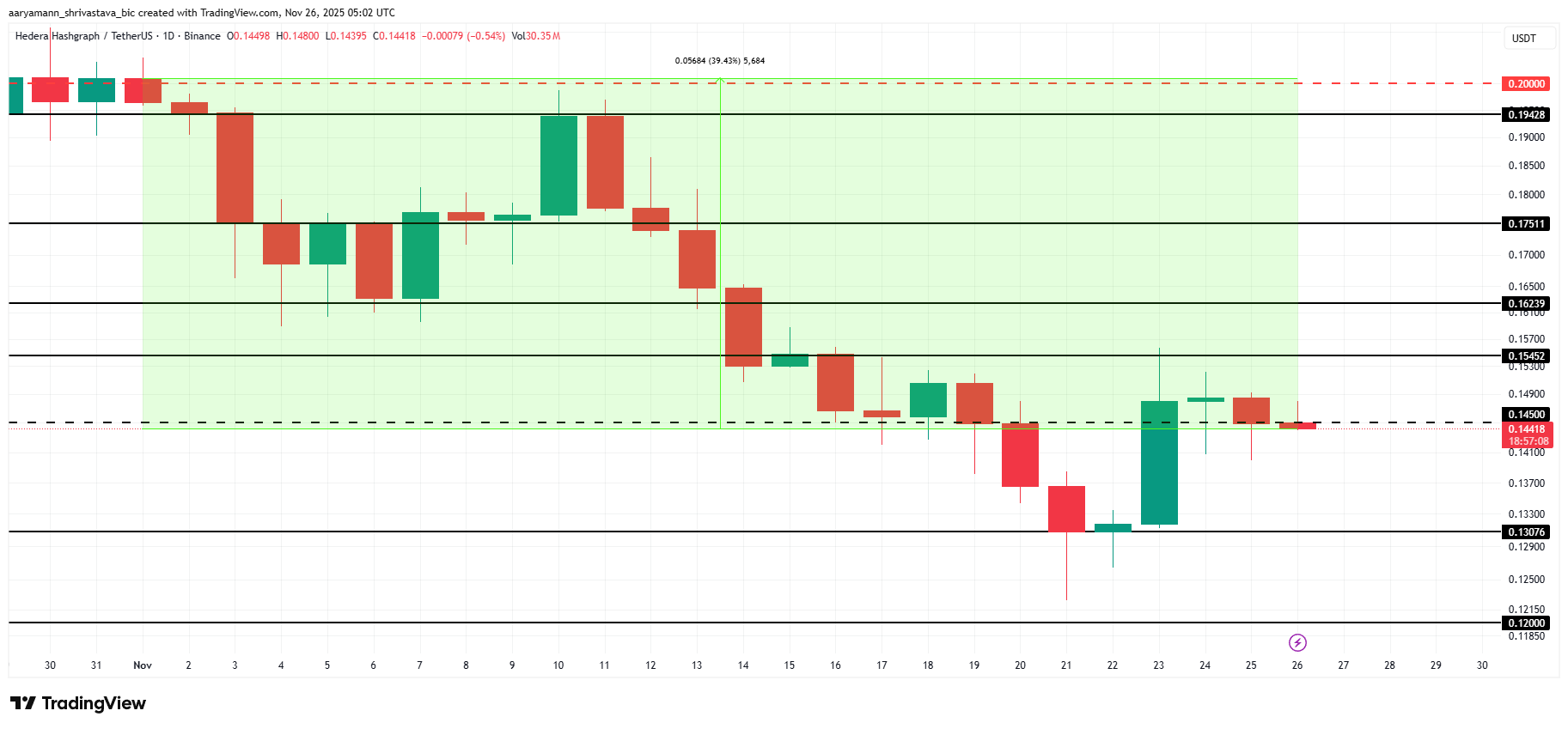

HBAR is trading at $0.144, sitting just under the important $0.145 resistance level. To begin a meaningful climb, the altcoin must flip this resistance into support. This would allow it to move toward $0.154 — a level that has previously acted as a ceiling.

Based on current indicators, HBAR may continue consolidating between $0.154 and $0.130. Bearish sentiment and weak macro signals suggest the altcoin could remain trapped in this zone unless a strong catalyst emerges.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

To recover its November losses, HBAR needs roughly a 40% rally, pushing it toward the $0.200 region. This requires breaking through several resistance levels, starting with $0.154. If HBAR can reclaim that barrier, a move to $0.162 and higher becomes possible, giving the altcoin a chance to invalidate the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Ripple Gains Abu Dhabi Approval, Igniting a Blockchain Healthcare Transformation

- Ripple's RLUSD stablecoin gains ADGM approval as a regulated fiat-referenced token, boosting institutional adoption in the Middle East. - XRP Healthcare launches HIPAA-grade XRPH Wallet in U.S. and East Africa, targeting $595B healthcare markets with real-time XRP/RLUSD payments. - Wallet enables 3-5 second settlements at <$0.001 fees, aiming to capture 3-5% of a $595B market through blockchain-driven pharmacy networks. - Low-cost cross-border settlements and open-source design position RLUSD and XRPL as

UK's aspirations in artificial intelligence face obstacles as tax regulations stifle the expansion of the crypto sector

- UK Autumn Budget by Chancellor Rachel Reeves sparks mixed reactions, with crypto industry concerned over tax hikes and gilt sales impacting competitiveness. - Playtech highlights increased Remote Gaming Duty and Betting Rate, projecting up to €15M EBITDA reduction in 2026 due to higher taxes. - Government unveils £10B AI Growth Zone in Wales and £100M startup funding to boost tech leadership, despite fiscal challenges. - Sustainable mobility sector welcomes untouched Cycle to Work scheme, aiding affordab

DASH Aster DEX: Transforming DeFi Liquidity and Driving Institutional Integration in 2025

- DASH Aster DEX's hybrid AMM-CEX model combines transparency with efficiency, achieving $27.7B daily volume and $1.399B TVL in Q3 2025. - Cross-chain interoperability across BNB Chain, Ethereum , and Solana enables seamless transfers, while Aster Chain's ZKP technology processes 10,000 TPS. - Institutional adoption accelerates through privacy tools (77% transaction masking) and governance upgrades, highlighted by Binance CZ's $2M DASH purchase. - Strategic advantages include 40% lower slippage for liquidi

Bitcoin News Today: Bitcoin surges to $90K—Is this a sign of a new cycle or an early warning of another downturn?

- Bitcoin surged past $90,000 amid November's 29% drop from its October $126,000 peak, signaling a tentative recovery. - Ethereum , Solana , and other major cryptos rose 3-5%, while the Crypto Fear & Greed Index improved slightly to 15. - Technical indicators show Bitcoin testing critical levels, with analysts divided on whether $90,000 marks a cyclical bottom or temporary respite. - Institutional flows and on-chain data reveal mixed sentiment, as Fed policy uncertainty and bearish structures persist. - Lo