JPMorgan Offers Capped Upside Notes Tied to Bitcoin ETF Performance

Quick breakdown:

- JPMorgan’s new structured notes link returns to BlackRock’s iShares Bitcoin Trust IBIT, offering at least 16% if the ETF clears preset levels in a year and up to 1.5x BTC upside by 2028.

- Gains are capped, principal is only protected to about a 30% drawdown, and investors take on JPMorgan credit and liquidity risk.

- Buyers are exposed to JPMorgan’s issuer credit risk since the instruments are unsecured obligations, and secondary liquidity is typically limited to over-the-counter dealing.

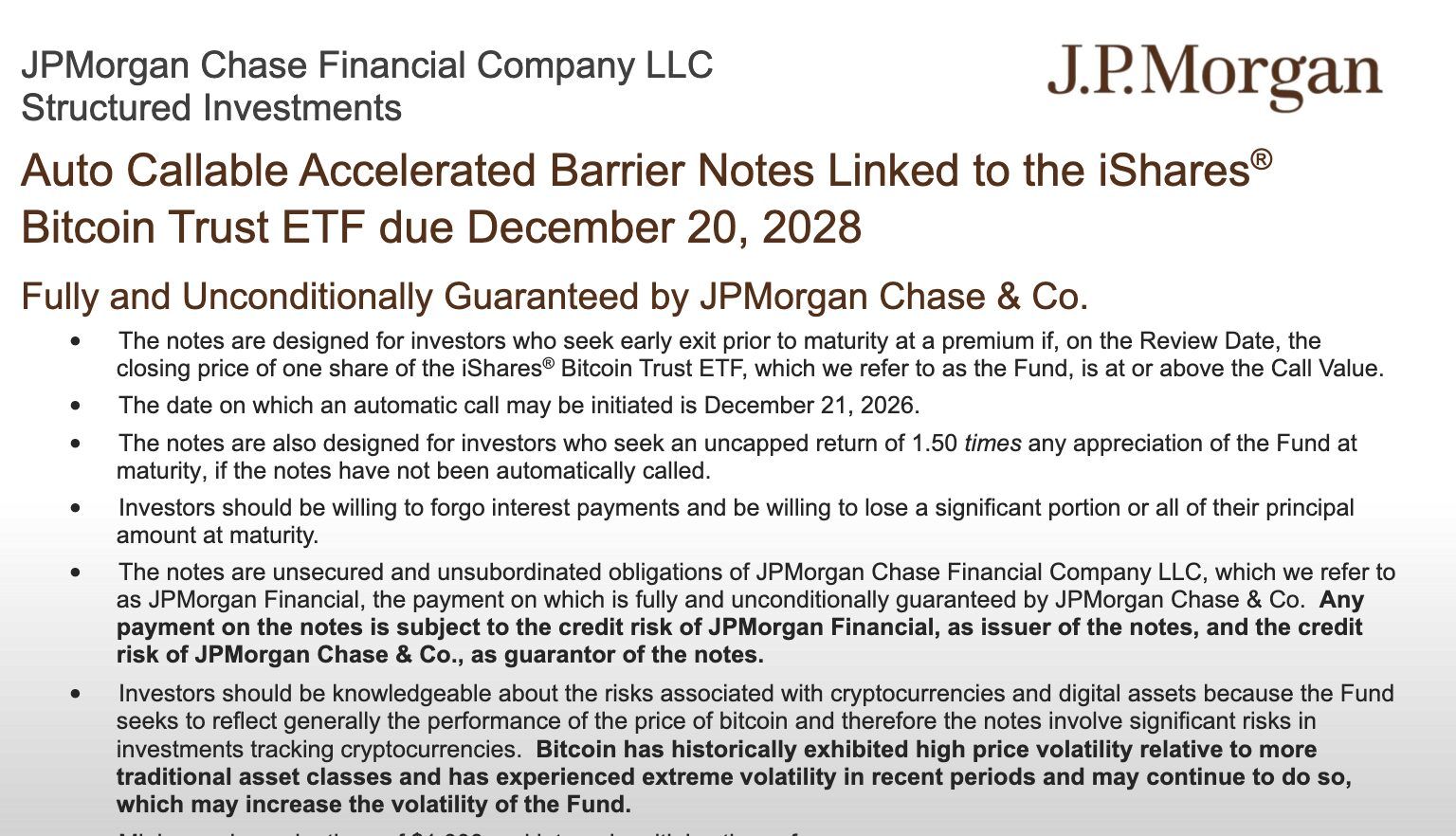

JPMorgan has structured a new batch of Bitcoin-linked notes that could deliver amplified returns if BTC and IBIT rally into 2028, while exposing investors to capped upside, conditional protection, and the bank’s own credit profile. The issuance underscores Wall Street’s push to package Bitcoin exposure into familiar securities instead of direct spot holdings.

The notes tie their performance to BlackRock’s iShares Bitcoin Trust IBIT, a spot Bitcoin ETF that already holds tens of billions of dollars in assets under management. Investors buy the notes at a fixed price and receive payouts based on IBIT’s level at specific dates rather than traditional coupons.

Source

:

SEC

Source

:

SEC

How the Bitcoin-linked notes work

According to term sheets, the structure typically combines an auto-call feature after about one year with a final maturity in 2028, creating two key decision points for returns.

If IBIT trades at or above a set threshold on the early observation date, the notes get called, and investors receive a mid-teens return, usually around 16% on their principal. If IBIT finishes below that mark, the notes stay in place until 2028 and then track the ETF with an enhanced upside, typically about 1.5x, up to a maximum cap. On the downside, principal is generally protected only as long as IBIT doesn’t drop more than about 30% from its starting level. If it falls beyond that, investors begin taking losses and could see a substantial hit to their capital.

Because the instruments are unsecured obligations, buyers also rely on JPMorgan’s ability to honour payments at maturity, adding issuer credit risk to Bitcoin’s price volatility. Secondary liquidity is typically limited to over-the-counter dealing, which can make exiting the position before maturity difficult or costly.

Who these products target and why they matter

The notes are aimed at investors who expect Bitcoin to grind higher over the next few years but prefer a packaged security linked to a regulated ETF rather than direct crypto custody or derivatives trading. They can fit mandates that allow exposure to bank notes and listed ETFs while still providing a defined payoff profile tied to BTC performance.

At the same time, the design converts a simple asset into a complex payoff that blends options, barriers, and credit, requiring investors to understand scenarios across 2026 and 2028 before allocating capital. The launch adds to a broader shift in which banks use ETF-linked notes to intermediate Bitcoin exposure, signalling that BTC is being treated as a strategic reference asset inside traditional fixed-income and structured-product desks rather than a fringe speculation.

Meanwhile, JPMorgan’s Kinexys unit is piloting JPMD, a permissioned deposit token on the Base Layer 2 network, for institutional clients. This digital representation of commercial bank money offers a regulated, efficient 24/7 on-chain payment alternative to stablecoins. This move signals JPMorgan’s belief that regulated deposit products will be central to the future of digital finance.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Recent Rise in Astar (ASTR) Value: Unveiling the Driving Forces Behind the Latest Surge

- Astar (ASTR) price surge driven by institutional adoption, robust on-chain metrics, and cross-chain innovation, with TVL rising to $2.38M in Q3 2025. - Astar 2.0's 150,000 TPS throughput and dynamic tokenomics (4.32% inflation) attract institutional investors seeking scalable, stable blockchain solutions. - Partnerships with Sony , Toyota , and others validate Astar's enterprise-grade infrastructure, aligning with crypto-traditional finance convergence trends. - Projected $0.80–$1.20 price target by 2030

Hayes Focuses on High-Yield DeFi Initiatives Amid Growing Institutional Interest

- Arthur Hayes acquired 2.01M ENA , 218K PENDLE, and 33K ETHFI tokens via Cumberland, totaling $1.42M in DeFi projects focused on yield optimization and automated market-making. - The purchases highlight growing institutional interest in DeFi protocols offering structured products and tokenized derivatives, with ENA and PENDLE leading in governance and yield strategies. - Hayes's strategy aligns with leveraging on-chain data to target undervalued assets, potentially amplifying market sentiment but exposing

Bitcoin Updates: Major Institutions Propel Bitcoin Beyond $90K Amid Expanding ETF Investments

- Institutional investors drove Bitcoin above $90,000 in November 2025 through strategic ETF allocations, including Texas's $10M initiative and Harvard's $443M IBIT stake. - ETF flows showed $238M inflows into spot Bitcoin ETFs despite prior $3.5B outflows, reflecting maturing institutional diversification and crypto-friendly government frameworks. - Texas's planned self-custodied Bitcoin transition and Mubadala's tripled IBIT holdings highlighted growing acceptance of Bitcoin as a strategic reserve asset.

Solana News Update: CHOG Soars by $10M—Meme Coin Frenzy Faces Analyst Cautions Over Market Fluctuations

- CHOG, a Monad ecosystem meme coin, briefly hit $10M market cap on Nov 27, driven by $17.9M 24-hour trading volume. - Monad's mainnet launch (Nov 24) raised $269M via a 1.43x oversubscribed Coinbase ICO, attracting 85,000 participants. - Analysts warn meme coins like CHOG face volatility risks due to social media-driven hype and lack of fundamentals. - Meme coin market reached $47.1B in Q4 2025, with DOGE and SHIB leading despite emerging Solana/Monad projects gaining traction. - Institutional investors r