Date: Wed, Nov 26, 2025 | 03:20 PM GMT

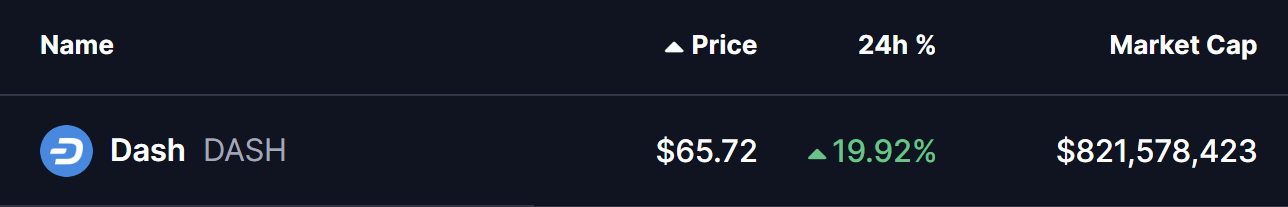

The broader cryptocurrency market continues its steady rebound after last week’s sharp volatility, which dragged Ethereum (ETH) to a low of $2,622 before recovering toward $2,925. This improving sentiment is now helping several altcoins regain momentum — and Dash (DASH) is one of the standout performers today.

DASH has surged 19% in today’s session, but beyond the price jump, its current market structure is attracting even more attention. A key technical pattern now forming on the chart may be signaling a much larger move ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge in Play

On the 4H timeframe, DASH is trading inside a falling wedge, a pattern widely recognized as a bullish reversal signal. This structure reflects weakening seller control and often precedes a strong upside breakout once price escapes the narrowing range.

After several weeks of consistent sell pressure, DASH finally tapped the wedge’s lower boundary near $52.61, where buyers stepped in with strong defense. This buying reaction pushed the token back toward $66.01, placing DASH directly beneath its upper wedge resistance — and just under the 200 moving average ($72.23), which is also acting as dynamic resistance.

Dash (DASH) 4H Chart/Coinsprobe (Source: Tradingview)

Dash (DASH) 4H Chart/Coinsprobe (Source: Tradingview)

This combination of tightening structure and renewed buyer interest suggests that DASH may be gearing up for an imminent breakout attempt.

What’s Next for DASH?

If DASH successfully pushes above the wedge resistance and reclaims the 200 MA, it could trigger a powerful continuation rally. Based on the wedge’s measured move projection, the next major upside target sits near $145.00, representing more than 123% potential upside from current levels.

However, if the breakout fails to materialize, DASH may retest the $58 support region, which now serves as the critical short-term demand zone. Buyers must hold this level to sustain the bullish structure. A breakdown below it could delay or weaken the current recovery momentum.

For now, all eyes remain on whether DASH can gather enough momentum to break above the wedge and potentially kickstart a new bullish leg in the coming days.