Hashed’s Simon Kim Says Ethereum Is 57% Undervalued

Simon Kim, founder of venture capital firm Hashed, has introduced a real-time dashboard that estimates Ethereum’s fair value at $4,747.4. With Ethereum trading at $3,022.3, the tool suggests an undervaluation of 56.9%. The dashboard updates every two minutes and uses eight distinct valuation models.

The Ethereum Valuation Dashboard combines methods from traditional finance and crypto-native analysis. Kim aims to provide a rigorous valuation approach, reflecting broader institutional interest in fundamental analysis in crypto markets.

Dashboard Combines Traditional and Crypto-Native Valuation Methods

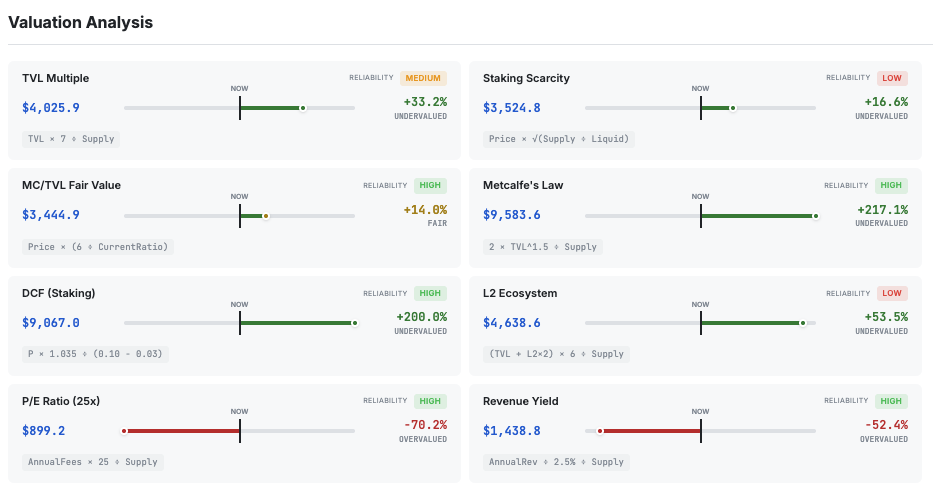

Kim’s dashboard incorporates eight models to assess Ethereum’s intrinsic value. Traditional finance methods include Discounted Cash Flow (DCF), which relies on staking yields, a Price-to-Earnings (P/E) ratio set at 25x, and Revenue Yield analysis. Institutional investors have long used these tools to evaluate equities and bonds.

The dashboard also uses crypto-specific metrics designed to capture blockchain dynamics. These include Total Value Locked (TVL) Multiple, Staking Scarcity, Market Cap to TVL Fair Value, Metcalfe’s Law, and Layer 2 ecosystem valuation. 21Shares research notes that network-based models are gaining popularity as institutions seek to quantify blockchain adoption and its effects.

Metcalfe’s Law, which holds that network value grows with the square of the user base, yielded the highest valuation of $9,583.6 and indicated that Ethereum was 217.1% undervalued. The DCF model arrived at $9,067.8—a 200% undervaluation. Yet the P/E Ratio model suggested Ethereum is 70.2% overvalued at $899.2, and Revenue Yield indicated a 52.4% overvaluation at $1,438.8.

The composite fair value of $4,747.4 is calculated by weighting each model by reliability—high-reliability models are 9 times more influential, medium 5 times, and low 2 times. These scores yielded five buy signals, one hold, and two sell signals across the eight models.

High reliability models include MC/TVL Fair Value, Metcalfe’s Law, DCF (Staking Yield), P/E Ratio, and Revenue Yield. TVL Multiple is rated medium reliability, while Staking Scarcity and Layer 2 Ecosystem models rank as low reliability.

This approach highlights the difficulty of valuing cryptocurrencies. While traditional metrics like P/E ratios and revenue multiples offer proven methodologies, they may miss crucial network dynamics. Crypto-native tools such as Metcalfe’s Law propose frameworks rooted in blockchain adoption, though accurately gauging user activity remains a hurdle.

Market Data Reveals Shifting Ethereum Fundamentals

Current market data shows Ethereum priced at $3,022.3 with a market cap of $365.4 billion and a 24-hour volume of $21 billion. The price remains 38.8% below the all-time high of $4,946.1. Ethereum’s market dominance is 16%, and the ETH/BTC ratio has dropped 24.7% year-over-year to 0.03243. The dashboard also shows Ethereum’s circulating supply and exchange reserves, as well as on-chain activity, including TVL and the staked amount of ETH.

What is ETH actually worth?

— Simon Kim (@simonkim_nft) November 26, 2025

The crypto industry deserves better than price speculation.

I built a dashboard to think about ETH's intrinsic value with 8 models:

Far from perfect and open to feedback.

If you like this initiative, please share it 🙏

Kim, CEO and Managing Partner of Hashed, has positioned the firm as a leader in blockchain venture capital. His credentials include speaking at major industry events, such as the AI Crypto Summit 2025 and KOOM 2025, where he represents Hashed’s technology-driven investment focus.

Recent price moves reinforce the need for robust analysis. ZebPay technical analysis reports that Ethereum broke free from a $2,350 to $2,750 trading range in late November 2024, surging almost 25% to $3,442 before finding support at $3,015. Key resistance sits at $3,750, while $3,000 acts as crucial support.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH drops 7.15% in a day as several top executives offload shares through scheduled selling plans

- DoorDash (DASH) fell 7.15% on Nov 26, 2025, but rose 71.59% year-to-date amid insider sales by executives via Rule 10b5-1 plans. - CFO Ravi Inukonda and President Prabir Adarkar sold $2.7M and $4.6M of shares respectively, while analysts raised price targets to $260. - Institutional buyers like XTX Topco Ltd and Summit Global Investments added shares, reflecting ongoing confidence in DoorDash's international expansion and DashPass strategy. - Upcoming Q4 2025 earnings on Feb 10, 2026, will test market se

XRP News Update: XRP ETFs See Inflows Soar While Prices Drop: The $628 Million Inflow Mystery

- XRP ETF inflows hit $164M daily as Bitwise, Grayscale, and Franklin Templeton drive institutional adoption, surpassing $628M total assets. - Ripple's 2025 SEC settlement and RLUSD stablecoin boosted confidence, but XRP's price fell below $2 amid whale sales of 200M tokens. - CME's XRP futures and NYSE Arca's ETF approvals signal growing institutional infrastructure, though 41.5% of XRP supply remains in loss positions. - XRP outperformed Bitcoin (+89% vs 3.6%) due to DeFi upgrades and cross-border utilit

India’s legal framework poses significant obstacles to the enforcement of U.S. court judgments.

- U.S. courts face enforcement challenges in India as Byju Raveendran's $1.07B default judgment clashes with India's strict foreign judgment recognition rules under Section 13. - TCS must appeal a $194M trade secrets ruling from the U.S. Fifth Circuit, highlighting cross-border IP disputes' complexity in the global IT sector . - Binance refunds Alpha Points after a technical error in a token airdrop, emphasizing operational risks in blockchain-based reward systems. - Amber International reports 69.8% YoY a

Bitcoin News Update: Bitcoin's Divergence from MAG7 Highlights a Shift Toward Scarcity-Focused Identity

- Bitcoin’s recent price drop and volatility warnings highlight market fragility amid diverging MAG7 correlations. - A historic $19B liquidation on October 10 marked Bitcoin’s decoupling from MAG7 tech stocks, reclassifying it as a scarcity-based hedge. - Low institutional adoption and 5% odds for MAG7 firms to hold Bitcoin in 2025 underscore limited macro support. - Trump’s growth forecasts lack Bitcoin tailwinds; CleanSpark’s AI pivot highlights crypto diversification. - Bitcoin’s future hinges on macroe