HyperLiquid ecosystem leader Kinetiq TGE tonight, what price is suitable to enter?

When in doubt, check Polymarket first.

When in doubt, check Polymarket first.

Written by: Eric, Foresight News

At 20:00 (UTC+8) on November 27 in the East 8th time zone, Kinetiq, the largest DeFi protocol on HyperLiquid and also the HYPE LST protocol, will conduct its TGE.

The Kinetiq team members are currently anonymous, so their real identities cannot be confirmed. However, based on community discussions, it appears that all protocol members are deeply involved in HyperLiquid and focus on its ecosystem. Kinetiq did not raise funds when it was launched, but instead operated for several months with its own funds and resources. Later, at the end of 2024, the $1.75 million financing was almost entirely aimed at participants within the HyperLiquid ecosystem, including validator node operators, market makers, and more than 30 HyperLiquid OGs.

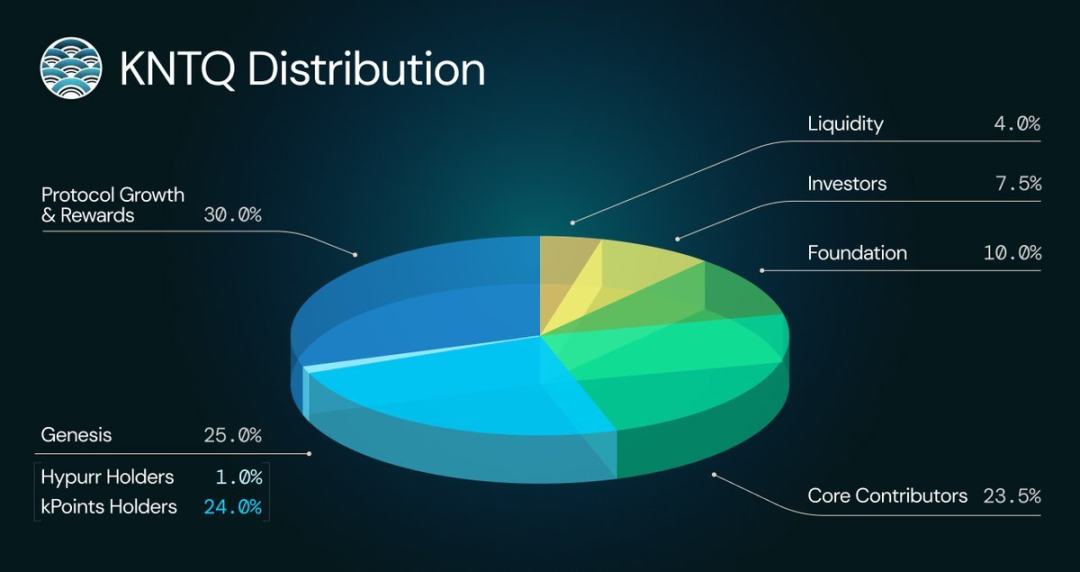

Kinetiq's token KNTQ has a total supply of 1 billion, with an initial circulating supply of 29%, including 25% for airdrops and 4% for providing initial liquidity. Kinetiq will directly establish a trading pair of KNTQ and USDH on the HyperLiquid spot market for initial liquidity provision. For those who want to rush in, remember to prepare your funds in advance.

Kinetiq's LST business does not have much to elaborate on; the core is that it allows users to stake HYPE to generate the LST kHYPE. At the same time, users holding kHYPE can also choose to continue staking kHYPE in the protocol to obtain vkHYPE. The protocol will invest the staked kHYPE into other DeFi protocols within the HyperLiquid ecosystem to generate additional yields. Currently, the annualized yield for staking HYPE and staking kHYPE is both below 3%.

According to Kinetiq's official website, the protocol's current TVL is about $1.11 billion, including about 27.97 million HYPE, 1.735 million kHYPE, and 1.58 million HYPE. The HYPE staked in this protocol accounts for about 8.8% of HYPE's current circulating supply. In mid-October, the amount of HYPE staked was still about 36 million, so it seems that the recent drop in HYPE's price has also had a significant impact.

From the perspective of an LST protocol alone, Kinetiq is a fairly standard project, and the returns that the HYPE token itself can bring are indeed relatively small. However, after HyperLiquid passed HIP-3, Kinetiq plans to leverage its own advantages to launch a launch platform, which may bring significant qualitative changes. This platform can provide teams wishing to launch contract platforms based on HIP-3 with 500,000 HYPE, and later bring higher returns to HYPE stakers through revenue sharing from the new platform.

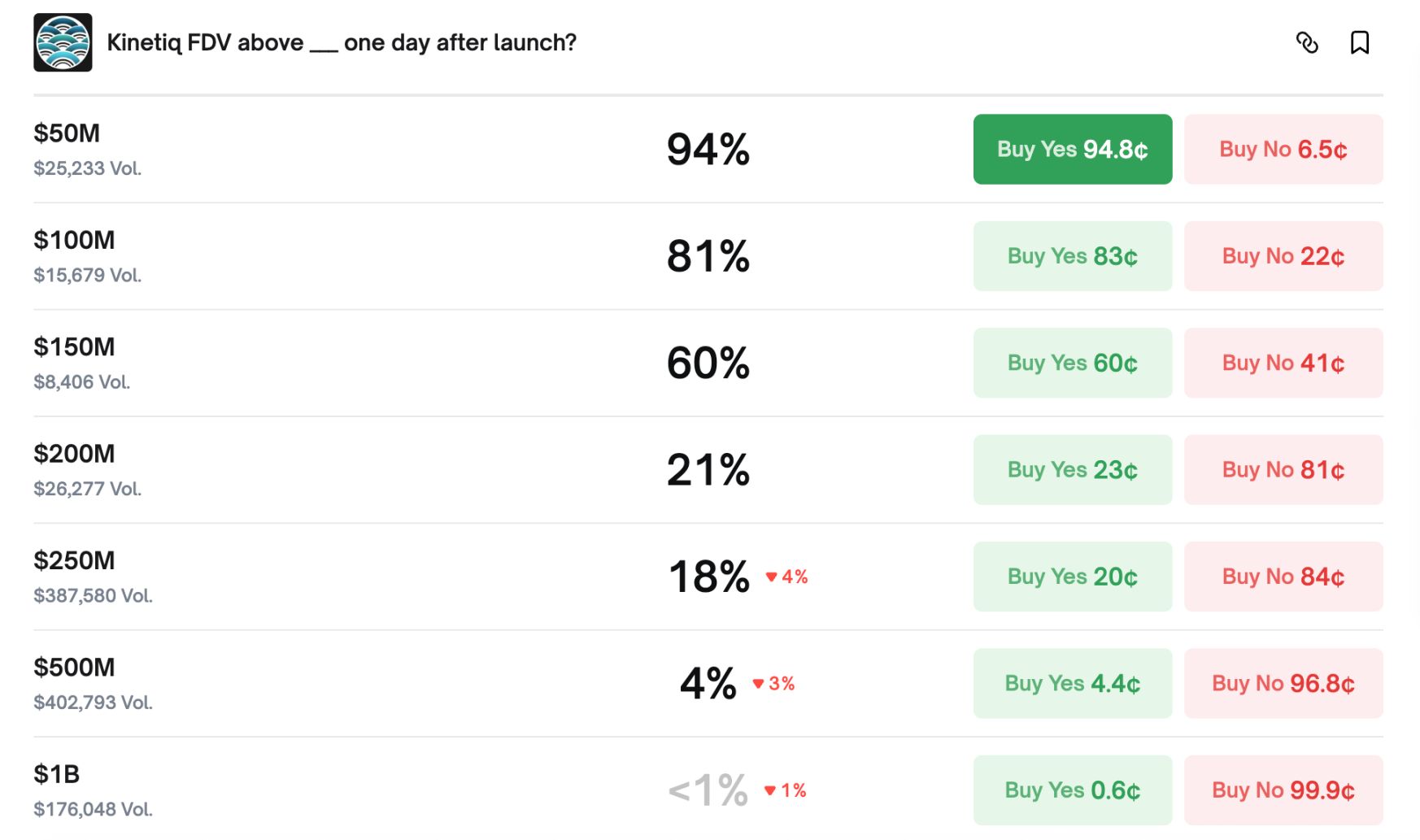

It can be said that the core of Kinetiq's imagination lies in how much revenue the launch platform can bring after its launch. Obviously, with such strong expectations and an unquantifiable income outlook, it is difficult to calculate Kinetiq's actual value under the "dream ratio" using TVL and income valuation parameters from other LST protocols. In this case, the best place to reflect market sentiment in protocol valuation is Polymarket.

According to Polymarket voting, Kinetiq's reasonable FDV is roughly between $100 million and $150 million, corresponding to a KNTQ price of about $0.1 to $0.15. However, it is worth noting that most of the funds in this prediction market are bet on the market cap not reaching $250 million or more, so this can only be used as a reference.

Recently, HyperLiquid's popularity has actually declined quite a bit, and many teams that have rushed to establish contract markets through HIP-3 rules have not led to better performance for HYPE. However, the author believes that HYPE's actual value can be fully referenced to CEXs, and it is currently just in a recovery period after the first wave of hype has subsided.

Given this, it is hard to say whether KNTQ will have a short-term explosive performance after its launch; short-term traders will have to rely on their own skills. But for long-term investors, under the premise that overall market sentiment recovers, the key points to watch are whether HyperLiquid's fundamental data can continue to improve and whether Kinetiq's launch platform will have enough demand after its launch. If both conditions are met and KNTQ's valuation is still less than $100 million or even $50 million at that time, it should be a good opportunity to make a move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Market Liquidity Rebounds, Paving Way for Potential Year-End Crypto Rally

Bedrock Elevates Bitcoin DeFi Security with Chainlink Integration

Ripple’s USD Stablecoin RLUSD Gains Regulatory Approval for Use Inside Abu Dhabi’s ADGM

Nasdaq Expands IBIT Bitcoin ETF Options Limits, Boosting Market Liquidity and Institutional Access