Lowest Rating! Why Doesn’t S&P Recognize USDT?

S&P warns that Tether's bitcoin exposure has breached safety limits. Tether CEO responds defiantly: "We take pride in your disdain."

S&P warns that Tether's Bitcoin exposure has breached the safety threshold. Tether CEO hits back: "We take pride in your disdain."

Written by: KarenZ, Foresight News

On the evening of November 26, S&P Global Ratings released its stablecoin stability assessment report on Tether, downgrading Tether (USDT) from level 4 (restricted) to level 5 (weak).

This rating is the lowest in S&P's 1-5 rating system, marking a new height in concerns about the security of this stablecoin, which has a circulation of over 180 billions USD.

Why the downgrade?

S&P's downgrade is not unfounded, but is based on multiple hidden risks in Tether's reserve asset structure and information disclosure.

1. Bitcoin exposure exceeds safety buffer

The core issue lies in the uncontrolled growth of Bitcoin exposure. As of September 30, 2025, the value of Bitcoin held by Tether accounted for 5.6% of USDT in circulation, exceeding the 3.9% excess collateral margin implied by its 103.9% collateralization ratio.

This comparison is particularly thought-provoking: a year earlier, on September 30, 2024, the same indicator was only 4%, below the 5.1% excess margin implied by the then 105.1% collateralization ratio. In other words, Tether's safety buffer is being eroded year by year.

When Bitcoin experienced significant monthly declines in October and November, this risk shifted from a theoretical threat to a real hazard. If Bitcoin continues to fall further, the value of Tether's reserves may fall below the total value of USDT issued, resulting in under-collateralization. For S&P, this is no longer a hypothetical scenario, but a real risk that needs objective assessment.

2. Surge in high-risk asset proportion

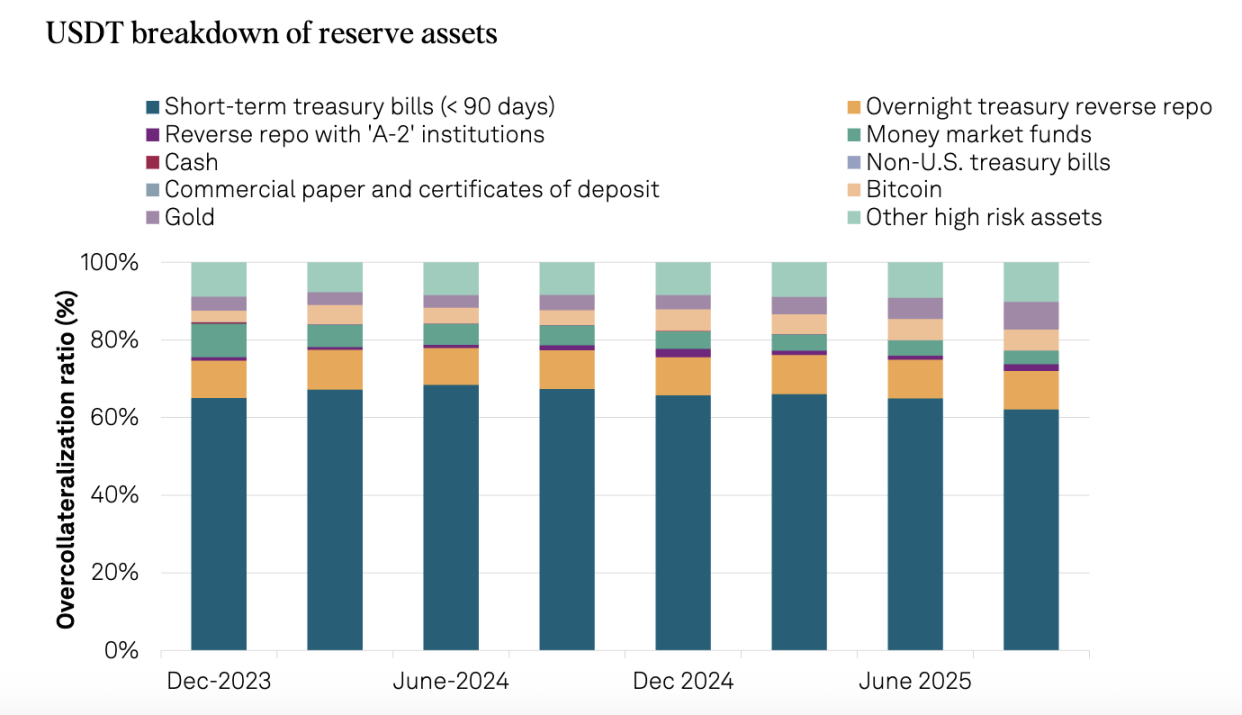

From September 30, 2024 to September 30, 2025, the proportion of high-risk assets in Tether's reserves soared from 17% to 24%. These high-risk assets include corporate bonds, precious metals, Bitcoin, secured loans, and other investments, all of which face credit, market, interest rate, and foreign exchange risks, while related disclosures remain limited.

Meanwhile, low-risk assets (short-term U.S. Treasury bills and overnight reverse repos) fell from 81% to 75%, while high-risk assets expanded accordingly. This directly reflects the significant increase in Tether's reserve portfolio's sensitivity to market volatility.

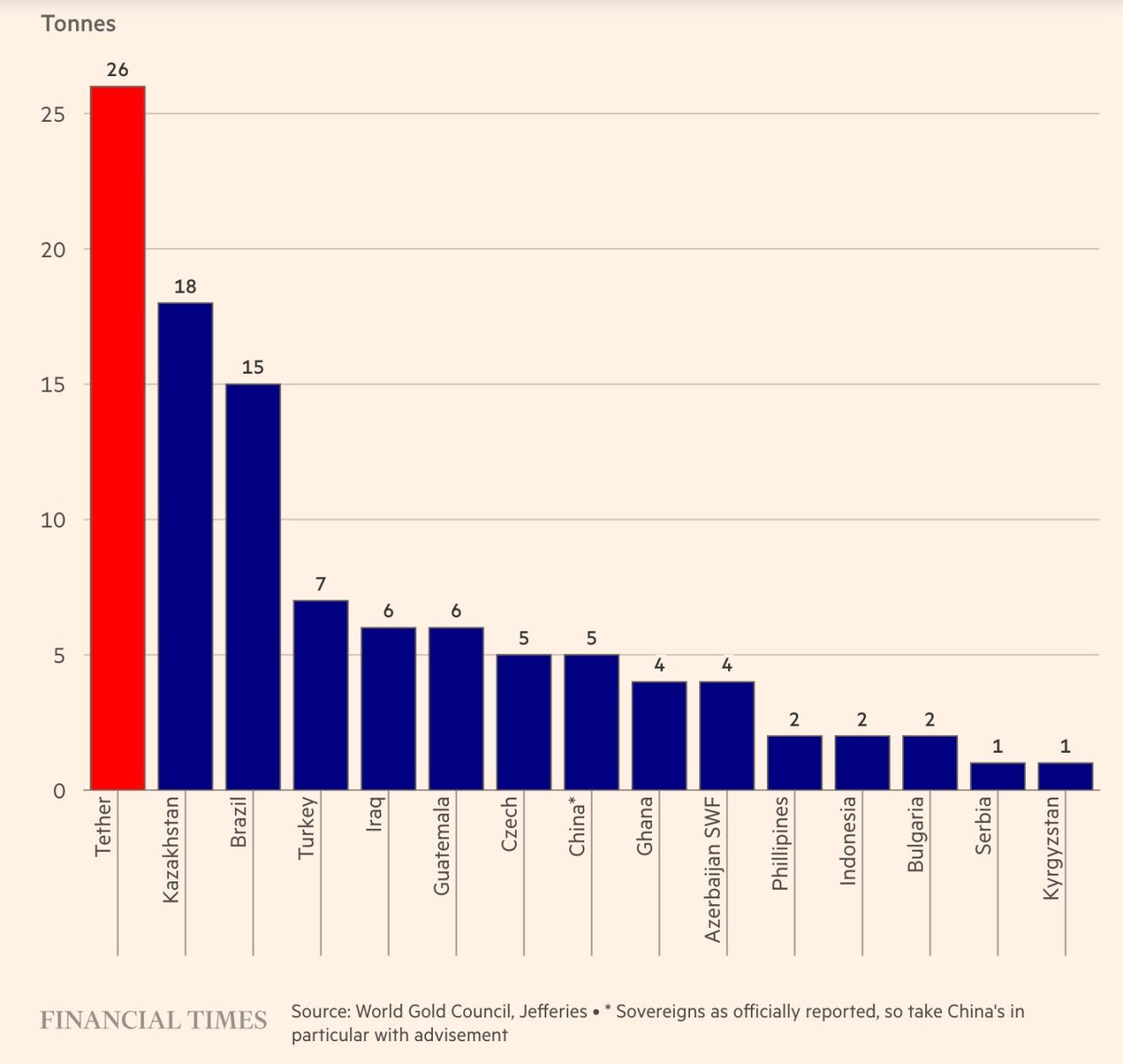

It is worth noting that Tether's enthusiasm for gold is particularly noteworthy. The company purchased 26 tons of gold in Q3 2025, bringing its total holdings to about 116 tons as of the end of September. Surprisingly, gold reserves (12.9 billions USD) have surpassed Bitcoin reserves (9.9 billions USD), making it the largest non-U.S. Treasury asset. Behind this rapid expansion is Tether's strategic intent to hedge against fiat devaluation and seek value preservation and appreciation.

Source: Financial Times

3. Relatively weak regulatory framework

After moving from the British Virgin Islands to El Salvador, Tether is now regulated by El Salvador's National Digital Assets Commission (CNAD). Although CNAD requires a minimum 1:1 reserve ratio, S&P believes this framework has key flaws.

First, the rules are too broadly defined. CNAD allows relatively high-risk instruments such as loans and Bitcoin, as well as highly volatile gold, to be included in reserve assets. Second, there is no requirement for segregation of reserve assets.

4. Opaque management and lack of information disclosure

S&P once again emphasized the long-standing issues:

- Lack of credit rating information on custodians, counterparties, and bank account providers.

- Limited transparency in reserve management and risk appetite.

- After the company expanded into finance, data, energy, and education, there is limited public disclosure on group-level governance, internal controls, and the segregation of these activities.

- No public information on USDT asset segregation.

Tether CEO's Counterattack

In response to the downgrade, Tether CEO Paolo Ardoino displayed his usual "fighting stance," with his core argument being: S&P's rating model is designed for the broken traditional financial system.

He pointed out, "We take your disdain as an honor. The classic rating models designed for old-fashioned financial institutions have historically misled private and institutional investors into putting their wealth into companies—companies that, though rated investment grade, ultimately collapsed. This situation has forced global regulators to question these models and the independence and objectivity of all major rating agencies. Tether has built the first over-capitalized company in financial history, and still maintains extremely high profitability. Tether is living proof—the traditional financial system is so broken that it terrifies those hypocritical rulers."

This rebuttal is not entirely without merit. In the past, Tether has survived every FUD event. In the first three quarters of 2025, Tether's net profit reached 10 billions USD, and Tether has become one of the world's largest holders of U.S. Treasuries, holding over 135 billions USD in U.S. Treasuries—this scale itself is a form of credit endorsement.

Deeper Reflections

What are stablecoins stabilizing?

Tether's strategy of increasing exposure to Bitcoin and gold is essentially a bet on "fiat devaluation." If the U.S. dollar experiences runaway inflation in the future, this diversified reserve structure may actually provide more purchasing power stability than a stablecoin backed purely by U.S. Treasuries.

But under the current dollar-anchored accounting standards, this approach is destined to be labeled "high risk." This exposes a fundamental question: what exactly should stablecoins stabilize? The face value of the currency, or actual purchasing power?

The traditional rating system chooses the former, while Tether pursues the latter. The evaluation criteria of the two are inherently misaligned.

Role confusion between private enterprises and central banks

When a private company tries to play the role of a central bank, it inevitably faces the dilemmas central banks face. Tether needs to maintain reserve safety while also pursuing profitability.

Tether's hoarding of Bitcoin and gold is both a rational choice to hedge fiat risk and a commercial consideration to increase company asset value. But this mixed motivation contradicts the stablecoin promise of "ensuring principal safety."

Parallel worlds of institutions and retail investors

For retail investors, S&P's rating may be just another brief FUD; but for traditional institutions, it could be an insurmountable compliance red line.

Large funds and banks seeking compliance may turn to USDC or PYUSD, as the latter's assets are mainly composed of cash and short-term U.S. Treasuries, fitting traditional risk control models. S&P's criticism of USDT aligns closely with the requirements of the emerging U.S. stablecoin regulatory framework. This difference in standards is directly reflected in the rating difference: in December 2024, S&P gave a "strong" (level 2) rating.

Generational differences in rating standards

The crypto world values "liquidity and network effects"—this is the logic of 21st-century digital finance. USDT has already demonstrated the resilience of its network effect through 10 years of operation. But whether a rating system more suited to the characteristics of crypto-native assets will emerge is an open question worth exploring.

Summary

S&P's downgrade of Tether is a warning about Tether's future risks. As the "liquidity pillar" of the crypto market, if USDT faces risk exposure, it not only concerns its own survival, but also affects the healthy development of the entire industry.

However, this will not bring down Tether in the short term, as its massive network effect has already formed a moat. But it also plants a long-term concern for the market: when a private company tries to support a global value-anchored tool with too many risky assets, can it still absolutely guarantee the principal safety of its holders?

This question not only concerns Tether's future, but also the sustainability of the entire stablecoin ecosystem. Only time will tell the answer.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Market Liquidity Rebounds, Paving Way for Potential Year-End Crypto Rally

Bedrock Elevates Bitcoin DeFi Security with Chainlink Integration

Ripple’s USD Stablecoin RLUSD Gains Regulatory Approval for Use Inside Abu Dhabi’s ADGM

Nasdaq Expands IBIT Bitcoin ETF Options Limits, Boosting Market Liquidity and Institutional Access