XRP Jumps 8% as Crypto Whales Scoop Up $1.3 Billion

XRP is attempting a strong recovery after last week’s decline, with the altcoin posting an 8% rise in the past 24 hours. The broader market’s positive shift is helping XRP regain momentum, but the real catalyst appears to be renewed confidence from large investors. This surge in whale activity could position XRP for a retest

XRP is attempting a strong recovery after last week’s decline, with the altcoin posting an 8% rise in the past 24 hours.

The broader market’s positive shift is helping XRP regain momentum, but the real catalyst appears to be renewed confidence from large investors. This surge in whale activity could position XRP for a retest of multi-week highs.

XRP Whales Rescue The Altcoin

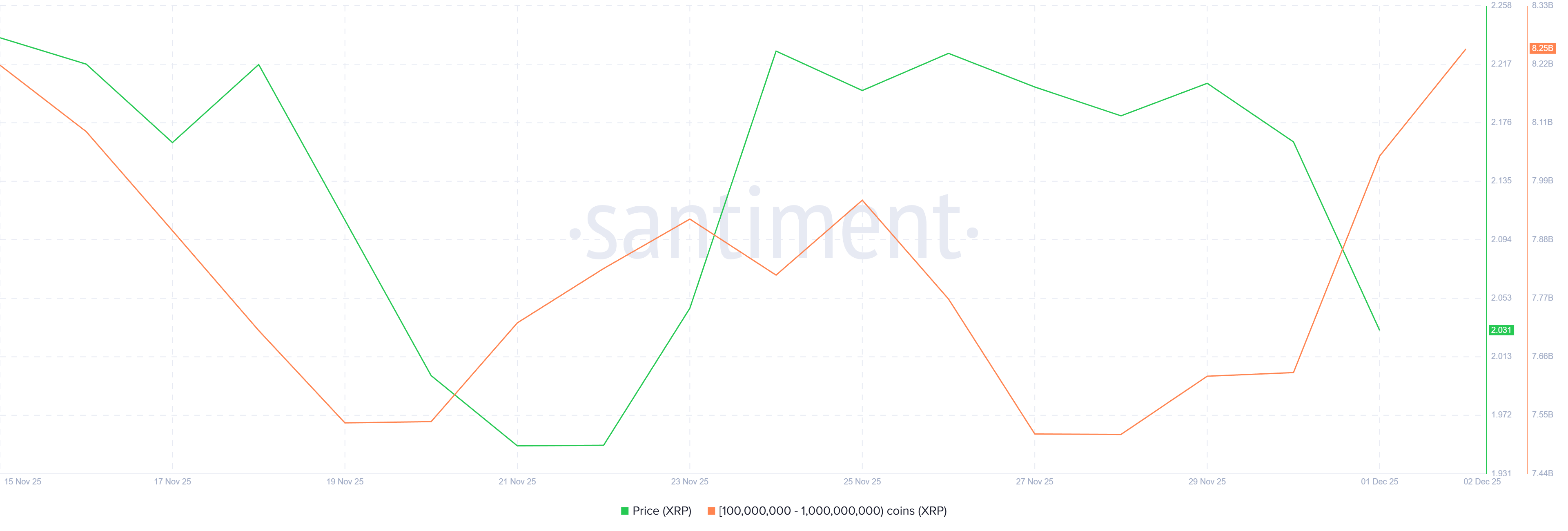

Whale buying has intensified as XRP approached the $2.00 psychological level earlier this week. On-chain data shows that wallets holding between 100 million and 1 billion XRP collectively accumulated 620 million XRP in just a few days. At current prices, this accumulation is worth more than $1.36 billion.

Such aggressive buying at discounted levels indicates that whales are positioning for a potential rebound and view the recent dip as a buying opportunity rather than a trend reversal. Their renewed confidence signals that the upside potential outweighs the short-term volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum Whale Holding. Source:

Ethereum Whale Holding. Source:

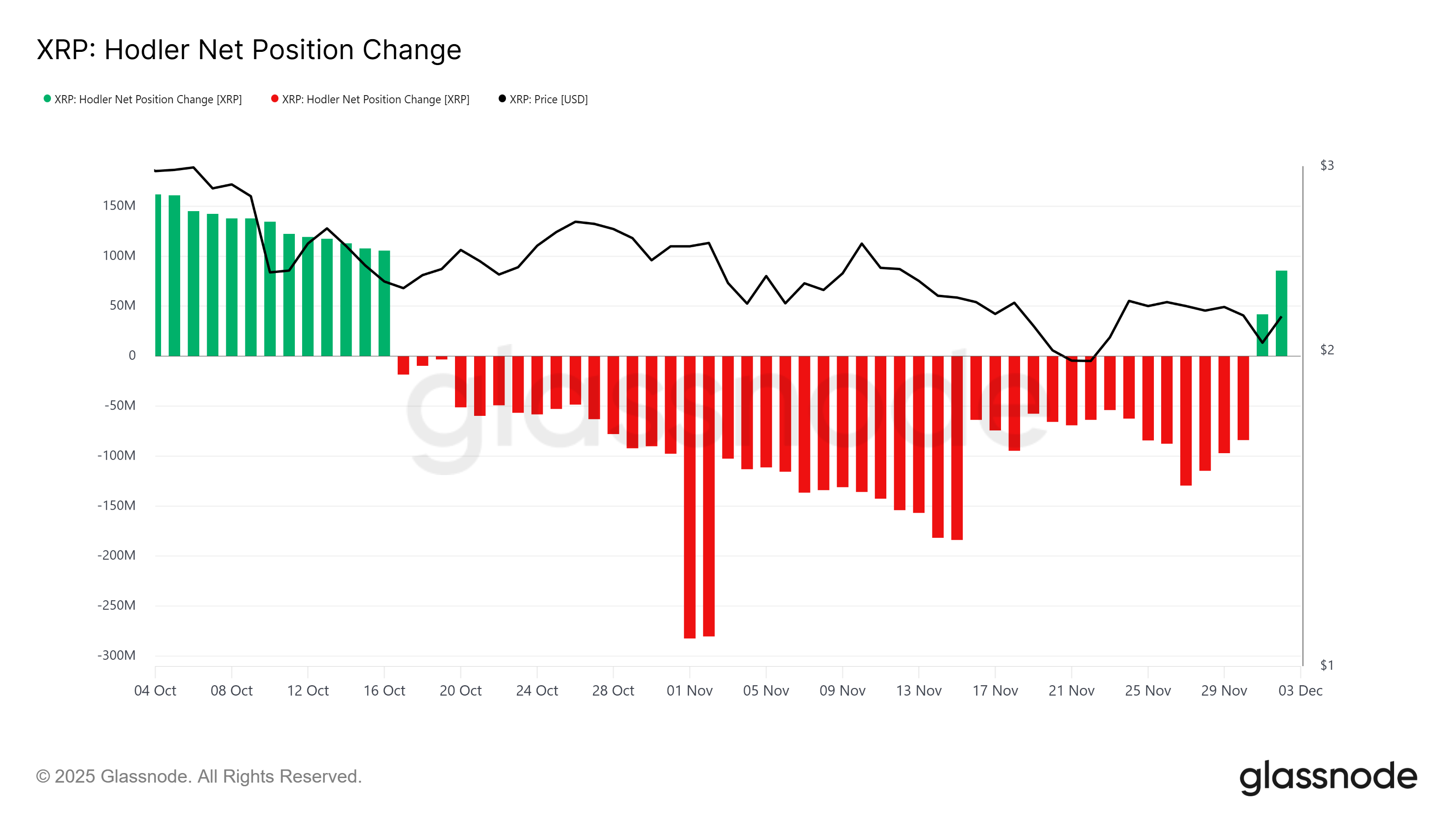

The macro backdrop for XRP is also showing marked improvement. The HODLer Net Position Change — an indicator tracking movements among long-term holders — is flashing bullish for the first time since mid-October. The metric has shifted back into positive territory, signaling that LTHs have stopped selling and are once again accumulating.

Support from long-term holders is critical for maintaining price floors during periods of market uncertainty. Their return provides XRP with a more stable base and reduces the likelihood of major downside moves, priming the asset for sustained recovery should broader market conditions remain favorable.

XRP HODLer Net Position Change. Source:

XRP HODLer Net Position Change. Source:

XRP Price Has A Shot At Recovery

XRP is trading at $2.20 at the time of writing, up 8% in 24 hours after bouncing cleanly from the $2.00 intra-day low. The rebound from this key psychological level reinforces bullish sentiment and aligns with heavy whale accumulation.

Holding $2.20 as support places XRP in a strong position to target $2.36 next. If XRP manages to break this resistance, the altcoin could climb toward $2.50 and log its highest price in three weeks. Whale buying and LTH support make this scenario increasingly realistic.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

However, failure to maintain investor confidence could still introduce downside risk. If selling pressure increases, XRP may slip back to the $2.02 support level. This would invalidate the bullish setup and erase recent gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The CFTC-Authorized Clean Energy Marketplace: An Innovative Gateway for Institutional Investors

- REsurety’s CleanTrade platform, CFTC-approved as a SEF, addresses clean energy market illiquidity and opacity by centralizing VPPAs, PPAs, and RECs. - Within two months of its 2025 launch, it attracted $16B in notional value, enabling institutional investors to streamline transactions and reduce counterparty risk. - By aggregating market data and automating compliance, CleanTrade enhances transparency, aligning with ESG priorities and regulatory certainty for institutional portfolios. - It democratizes a

SOL Drops 50%: Is This a Healthy Market Adjustment or the Onset of a Major Sell-Off?

- Solana's 50% price drop sparks debate over whether it signals a bear market correction or deeper structural selloff. - On-chain metrics show liquidity contraction and reduced exchange supply, but ETF inflows and validator activity suggest structural resilience. - Corporate transfers and the Upbit hack highlight volatility risks, while Solana's alignment with Bitcoin's trend underscores macroeconomic influence. - Key watchpoints include liquidity recovery timelines, ETF inflow sustainability, and potentia

Key Bitcoin price levels to watch ahead of 2025’s last FOMC meeting

Navigating the Fluctuations of Bitcoin in Late 2025: Adaptive Risk Management Approaches for an Evolving Cryptocurrency Landscape

- Bitcoin's November 2025 price swung between $80,553 and $91,000, eroding 25% of value amid macroeconomic and regulatory pressures. - Volatility stemmed from technical breakdowns, leveraged liquidations, and market makers' gamma exposure shifts below $85,000. - U.S. GENIUS Act and EU MiCA framework provided regulatory clarity, boosting institutional adoption through compliant ETPs and stablecoins. - Investors adopted risk-rebalance strategies: options hedging, macro-adjusted DCA, and diversified crypto tr