$41M Pours Into First LINK ETF: Will Chainlink Finally Break Its ATH?

The Grayscale Chainlink Trust ETF ($GLNK) launched on Tuesday, attracting approximately $41.5 million in its first day and marking a milestone for altcoin ETFs in the U.S. Institutional demand for cryptocurrency exposure is expanding beyond Bitcoin and Ethereum. As a result, many investors are now watching to see if LINK can reach new all-time highs.

The Grayscale Chainlink Trust ETF ($GLNK) launched on Tuesday, attracting approximately $41.5 million in its first day and marking a milestone for altcoin ETFs in the U.S.

Institutional demand for cryptocurrency exposure is expanding beyond Bitcoin and Ethereum. As a result, many investors are now watching to see if LINK can reach new all-time highs.

ETF Launch Reflects Rising Institutional Interest

The Grayscale Chainlink Trust ETF, trading under the ticker $GLNK on NYSE Arca, is the first spot Chainlink ETF for US investors. According to SoSoValue data, as of Dec 3, it saw $40.90 million in net inflows on its debut, with total net assets reaching $67.55 million and $8.45 million in volume. The ETF closed up 7.74% at $12.81 per share.

Grayscale converted its existing Chainlink Trust, first launched in February 2021, into this ETF. This move aligns with the company’s broader strategy and provides institutions with direct exposure to LINK through traditional accounts. At the time of reporting, LINK, Chainlink’s native token, was priced at $14.66.

Grayscale CEO noted the launch was “a clear signal of broader market demand for Chainlink exposure,” pointing to increased institutional interest in oracle network tokens. With its strong first day, $GLNK has become one of the top-performing new crypto ETFs, launching amid rising market activity and regulatory changes.

LINK Technical Breakout and Whale Activity

Technical analysts have seen a critical pattern shift in LINK’s price structure as the ETF debuted. The token broke out of a month-long downward channel. Many observers now believe this could help drive LINK past 2021 highs, as institutional flows through $GLNK may be a catalyst for new records.

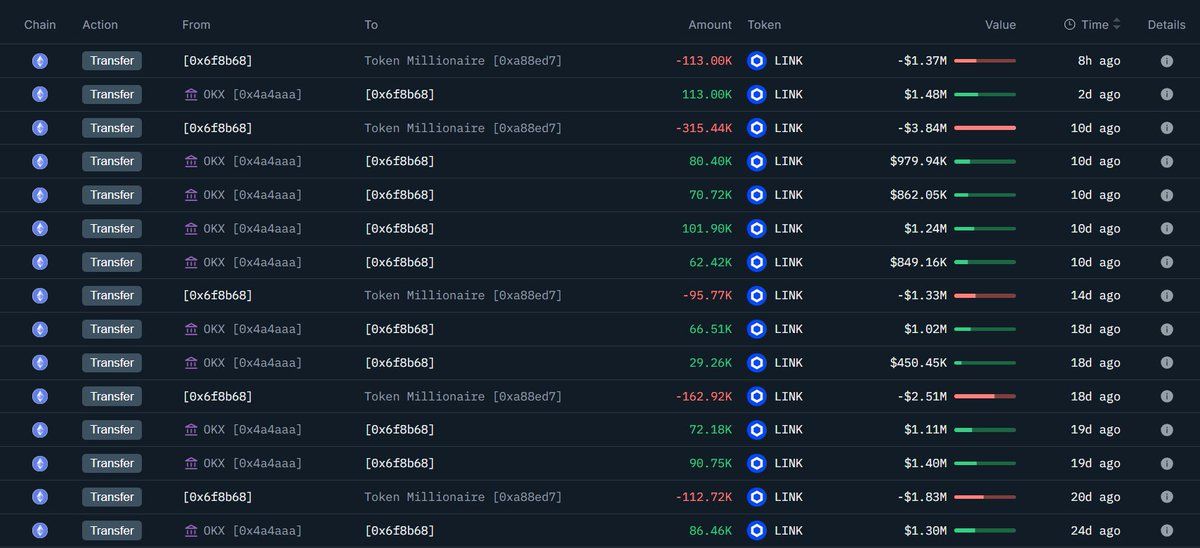

On-chain data highlights major whale accumulation before and after the ETF launch. Lookonchain reported that 39 new wallets withdrew 9.94 million LINK, worth $188 million, from Binance since October’s market correction. This behavior underscores confidence among large holders, despite recent volatility.

Whale accumulation of LINK since October 11. Source: Lookonchain

Whale accumulation of LINK since October 11. Source: Lookonchain

Yet not all large investors have benefited. OnchainLens identified one address that acquired 2.33 million LINK over six months for $38.86 million. This whale now faces an unrealized loss of $10.5 million, with the position valued at $28.38 million. The case highlights the risks and volatility in LINK accumulation, especially for early purchasers at higher prices.

Individual whale accumulation pattern showing unrealized losses. Source: OnchainLens/Nansen

Individual whale accumulation pattern showing unrealized losses. Source: OnchainLens/Nansen

Market Dynamics and Potential Risks

Open Interest data presents a nuanced view after the ETF launch. Open Interest has risen to around $7 million, following a prior dip. This trend signals renewed trader engagement and greater confidence in LINK’s potential. A simultaneous price increase and Open Interest typically points to bullish momentum and active derivatives trading.

However, analysts caution that whales who accumulated LINK before the ETF launch may soon approach break-even or profit targets. If these holders sell, selling pressure could limit short-term gains despite strong institutional inflows. Traders are closely watching as LINK tests resistance, weighing optimism against possible reversals while awaiting further momentum.

The ETF’s outlook depends on whether institutional demand meets potential whale selling and continues to attract capital. As technical breakouts, whale accumulation, and Open Interest rise alongside record ETF inflows, both breakout and correction remain possible. Market participants are watching to see if LINK sustains its upward momentum or if profit-taking will drive a correction before new highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ZK Transformation: Evaluating How Zero-Knowledge Technology Influences the Future Development of Blockchain

- ZK-rollups scale blockchain networks by bundling transactions, achieving 43,000 TPS and 30% lower gas fees, attracting institutions like Goldman Sachs and JPMorgan . - ZK technology resolves privacy-scalability paradox by enabling verifiable transactions without data exposure, adopted by EU regulators and enterprises like Nike and Sony . - Challenges persist: ZK-SNARKs require heavy computation, trusted setup risks exist, and privacy conflicts with AML regulations in some jurisdictions. - $725M+ VC inves

The Influence of Vitalik Buterin's Support for ZKsync on the Advancement of Scalable Blockchain Technologies: Evaluating the Prospects for Long-Term Investment in Pr

- Vitalik Buterin's 2025 endorsement of ZKsync accelerated its rise as a scalable Ethereum Layer-2 solution with 30,000 TPS and $3.3B TVL. - ZKsync's EVM compatibility and institutional partnerships contrast with StarkNet's quantum-resistant STARK proofs and Aztec's privacy-first architecture. - Analysts project ZK token prices at $0.40–$0.60 by 2025, while StarkNet faces adoption barriers and Aztec navigates regulatory challenges in privacy-focused DeFi. - The $7.59B ZKP market (2033 forecast) hinges on b

ZK Atlas Enhancement: Transforming Blockchain Scalability and Paving the Way for Institutional Integration

- ZKsync’s 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001/transaction costs, boosting blockchain scalability for institutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for tokenized assets and privacy-driven transactions, citing compliance and efficiency gains. - Market forecasts predict 60.7% CAGR for ZK Layer-2 solutions through 2031, with Fusaka upgrade targeting 30,000 TPS to solidify ZKsync’s leadership.

Hinge’s latest AI tool assists singles in skipping dull introductory conversations