SEC Begins Privacy Debate With Zcash-Led Roundtable

Industry voices say the SEC's privacy session signals a rare opportunity to shape oversight while preserving civil-liberty protections.

The US Securities and Exchange Commission (SEC) will hold its delayed roundtable on financial surveillance and privacy on December 15.

This sets the stage for one of the agency’s most direct engagements yet with the builders of privacy-focused crypto systems.

SEC Opens Door to Privacy Tech

The SEC said the session will examine how privacy-preserving technologies work. It will also explore how those tools intersect with existing surveillance expectations in financial markets.

The SEC's Crypto Task Force is holding a roundtable on financial surveillance and privacy on Dec. 15.See agenda, panelists, and registration details:

— U.S. Securities and Exchange Commission (@SECGov)

Zooko Wilcox, founder of Zcash, is expected to present at the event. Other participants include Aleo Network Foundation CEO Alex Pruden, Predicate CEO Nikhil Raghuveera, and SpruceID founder Wayne Chang.

Meanwhile, their involvement underscores the agency’s attempt to gather input from teams building zero-knowledge proofs, identity systems, and private computation frameworks.

Moreover, Hester Peirce, who leads the SEC’s crypto task force, said the agency wants a clearer view of the tools that shape modern digital transactions. She added that fresh insight could help the financial agency rethink its oversight approach without constraining civil liberties.

“New technologies give us a fresh opportunity to recalibrate financial surveillance measures to ensure the protection of our nation and the liberties that make America unique,” she stated.

Her comments mark one of the clearest signals that the agency is weighing how privacy infrastructure fits into broader digital-asset policy.

Interest in Privacy Token Spikes

Craig Salm, Chief Legal Officer at Grayscale, said the roundtable is also an opportunity for the industry to demonstrate that privacy protocols can coexist with regulatory goals.

Salm said active engagement with policymakers is essential for teams that worry about existential regulatory risk. He added that this type of forum gives real meaning to the long-standing call for crypto firms to “come in and talk to us.”

Interest in privacy tools has surged this year as regulators in multiple regions expand monitoring requirements. The trend has prompted many crypto users to adopt systems that conceal transaction details or restrict data exposure.

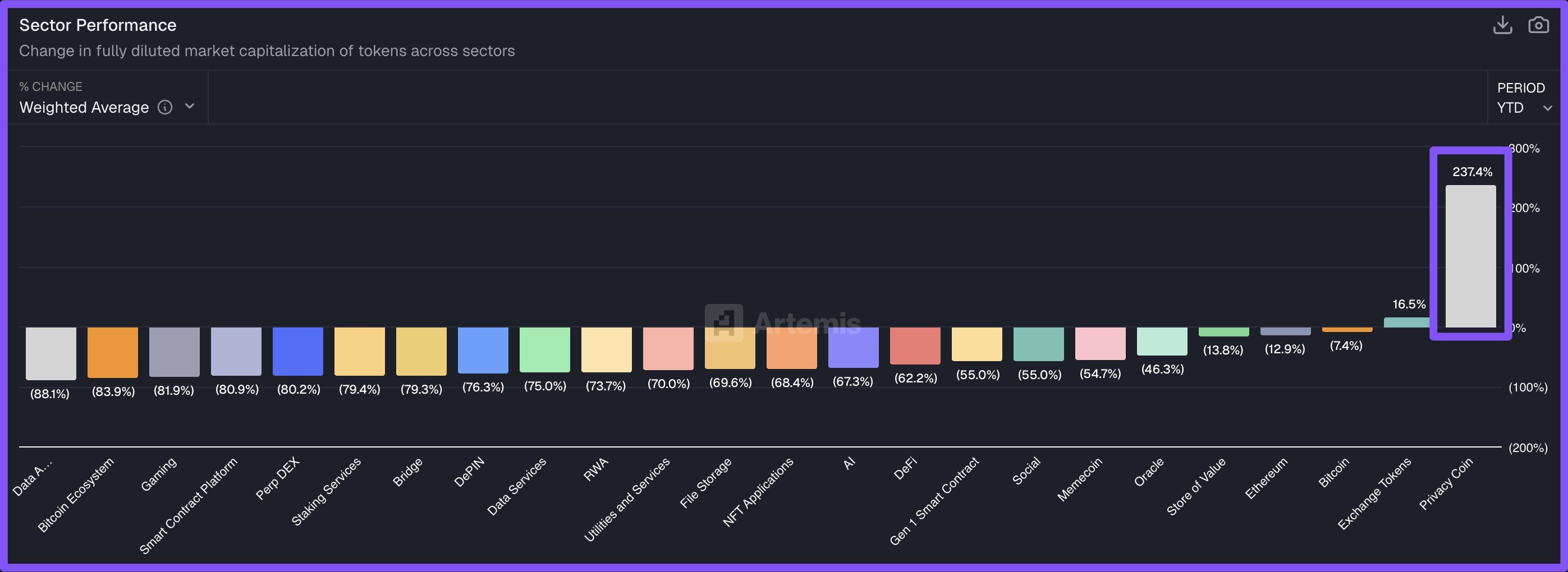

That shift is visible in market performance.

Artemis data shows that privacy-focused tokens have climbed more than 237% in 2025. The gains are driven in part by strong rallies in Zcash, Monero, and other projects at the center of the debate.

Privacy Tokens Outperform Crypto Market. Source:

Privacy Tokens Outperform Crypto Market. Source:

The roundtable signals that the SEC now recognizes privacy technologies as a central part of the crypto market structure. It also shows that policy decisions made today will shape how those systems scale in the years ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timeless Investment Strategies: Why Insights from 1927 Continue to Shape Today’s Investors

- McNeel's 1927 "Beating the Market" prefigured Buffett's value investing and modern behavioral finance principles. - He advocated emotional discipline and long-term faith in U.S. economic resilience, echoed by Buffett's "margin of safety" strategy. - Modern behavioral finance (2020–2025) validates these insights, showing disciplined investors outperforming during crises like 2008 and 2020. - Algorithmic trading and meme stocks highlight the enduring relevance of McNeel's principles in countering speculati

ICP Network Expansion and Its Impact on Web3 Infrastructure Investments

- ICP Protocol's 2025 growth highlights its role as a hybrid cloud/Web3 infrastructure leader through cross-chain integration and enterprise partnerships. - Unverified 10M node claims contrast with 1.2M wallets, creating transparency concerns for investors assessing network legitimacy. - 22.5% TVL growth and 2,000 new developers signal institutional confidence, yet Q3 dApp usage fell 22.4%, exposing adoption gaps. - Regulatory risks and Web3's user experience challenges question ICP's long-term viability d

SOL Price Forecast and Solana's Market Strength in Late 2025: A Two-Factor Assessment

- Solana (SOL) faces pivotal 2025 juncture with Fed easing and blockchain upgrades driving price resilience. - Fed rate cuts and $421M institutional inflows via ETFs (e.g., REX-Osprey) boost crypto adoption amid low yields. - Firedancer/Alpenglow upgrades cut validator costs by 80%, enabling 100-150ms finality and $10.2B DeFi TVL growth. - $133 support level and bullish TD Sequential signals suggest $150-$165 target by year-end despite inflation risks.

The Federal Reserve's Change in Policy and Its Effects on Rapidly Growing Cryptocurrencies Such as Solana

- Fed's 2025 rate cut and QT halt injected $72.35B liquidity, briefly boosting crypto markets and Solana (+3.01%) amid easing monetary policy. - Prolonged US government shutdown and $19B October liquidation event exposed crypto's liquidity risks, despite Fed support for speculative assets. - Solana saw $3.65B trading volume but 6.1% price drop in November, with TVL falling 4.7% as regulatory pressures and macro volatility offset institutional inflows. - SIMD-0411 proposal aims to reduce Solana issuance by