BTC Market Pulse: Week 50

Bitcoin rebounded from the mid-$80K region and stabilised near $91K, setting a cautiously constructive tone after last week’s drawdown. Buyers were active at the lows, though broader conviction remains uneven across on-chain, derivatives, and ETF signals.

Overview

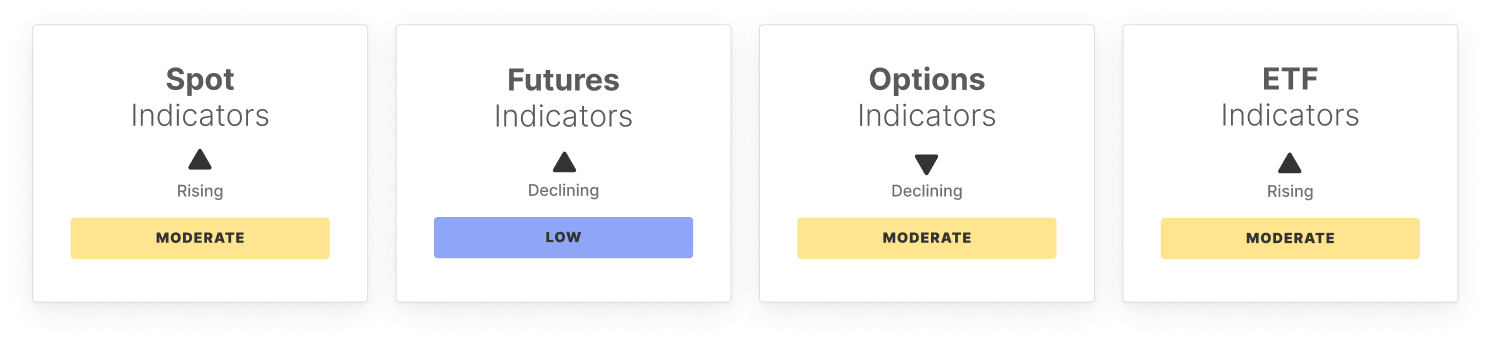

Momentum firmed as the 14-day RSI climbed from 38.6 to 58.2, while spot volume rose 13.2 percent to $11.1B. However, Spot CVD weakened from -$40.8M to -$111.7M, pointing to stronger underlying sell pressure.

Derivatives remained cautious. Futures open interest fell to $30.6B, perpetual CVD improved slightly, and funding turned more supportive with long-side payments up to $522.7K. Options showed mixed sentiment: steady OI at $46.3B, a sharply negative volatility spread at -14.6 percent, and a high 25-delta skew at 12.88 percent, indicating demand for downside protection.

ETF flows added a clear headwind. Netflows flipped from a $134.2M inflow to a $707.3M outflow, signalling profit-taking or softer institutional interest. Yet ETF trade volume rose 21.33 percent to $22.6B, and ETF MVRV increased to 1.67, pointing to higher holder profitability and some potential for distribution.

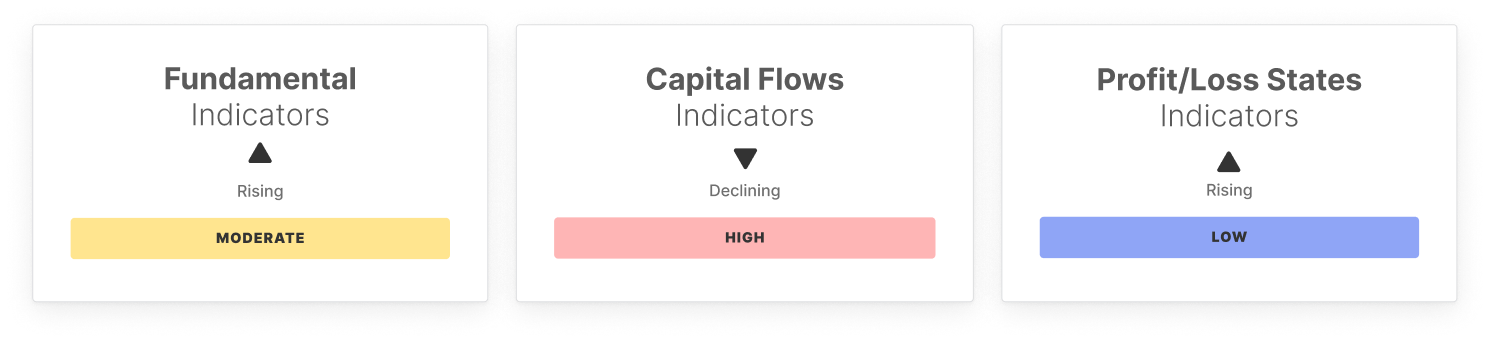

On-chain activity showed mild stabilisation. Active addresses rose slightly to 693,035, sitting near the low band. Entity-adjusted transfer volume increased 17.1 percent to $8.9B, suggesting healthier throughput. Fee volume dipped 2.9 percent to $256K, reflecting lighter block-space demand.

Supply dynamics remain cautious. Realised Cap Change fell to 0.7 percent, well below its low band, signalling softer capital inflows. The STH-to-LTH ratio rose to 18.5 percent, and Hot Capital Share stayed elevated at 39.9 percent, indicating a market still dominated by short-term participants. Percent Supply in Profit increased modestly to 67.3 percent, consistent with early-stage recovery. NUPL improved to -14.6 percent but remains deeply negative, while Realised Profit to Loss slipped to -0.3, signalling ongoing loss-realisation.

Overall, Bitcoin shows early signs of recovery momentum, yet sentiment and positioning remain cautious, highlighting a market still rebuilding confidence after recent volatility.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.