Date: Mon, Dec 08, 2025 | 09:15 AM GMT

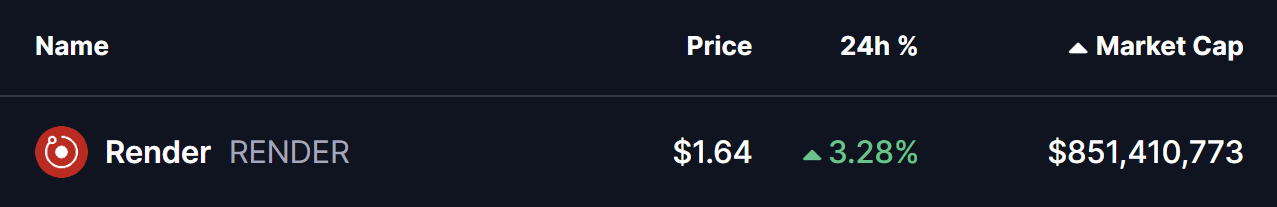

The broader crypto market is showing signs of relief after a volatile weekend, with Bitcoin (BTC) and Ethereum (ETH) both gaining over to 3% today. This improvement is helping several altcoins stabilize, including AI-focused Render (RENDER), which is now displaying a technical setup that could mark the beginning of a short-term upside phase.

Source: Coinmarketcap

Source: Coinmarketcap

Double Bottom Pattern Taking Shape

On the 4-hour chart, RENDER is forming a classic double-bottom structure — a well-known reversal pattern that often signals exhaustion in selling pressure followed by an upside shift.

The decline began when RENDER once again failed to break above the neckline resistance near $1.791. That rejection led to a sharp sell-off, pushing price down more than 14% and testing the $1.53 support level for a second time. This area has now proven itself as a strong defense zone, with buyers repeatedly stepping in to absorb selling volume.

Render (RENDER) 4H Chart/Coinsprobe (Source: Tradingview)

Render (RENDER) 4H Chart/Coinsprobe (Source: Tradingview)

Price has since rebounded toward $1.648, indicating that bearish pressure is beginning to fade while demand slowly re-enters the market. This second bottom not only marks the completion of the double-bottom structure but also reflects renewed accumulation interest at lower price zones.

Adding to this technical momentum is the positioning of the 50-period moving average, currently hovering near $1.715. This moving average intersects directly with the neckline resistance, making it the most critical breakout level for confirming a trend reversal.

What’s Next for RENDER?

A successful breakout above and consolidation beyond $1.715 would be the key trigger for bullish continuation. If confirmed, RENDER could revisit the neckline at $1.791 — an area that, if finally broken, opens the door for a stronger upside extension. Such a move would not only validate the double-bottom formation but could also launch the token into the next recovery phase.

If momentum strengthens further after clearing the neckline zone, the move could potentially expand beyond initial resistance levels, transforming current recovery into a broader uptrend.

However, the bullish scenario hinges on maintaining support. A decisive breakdown below $1.53 would invalidate the pattern, resetting expectations and putting RENDER at risk of deeper retracement before any meaningful rebound attempt returns.